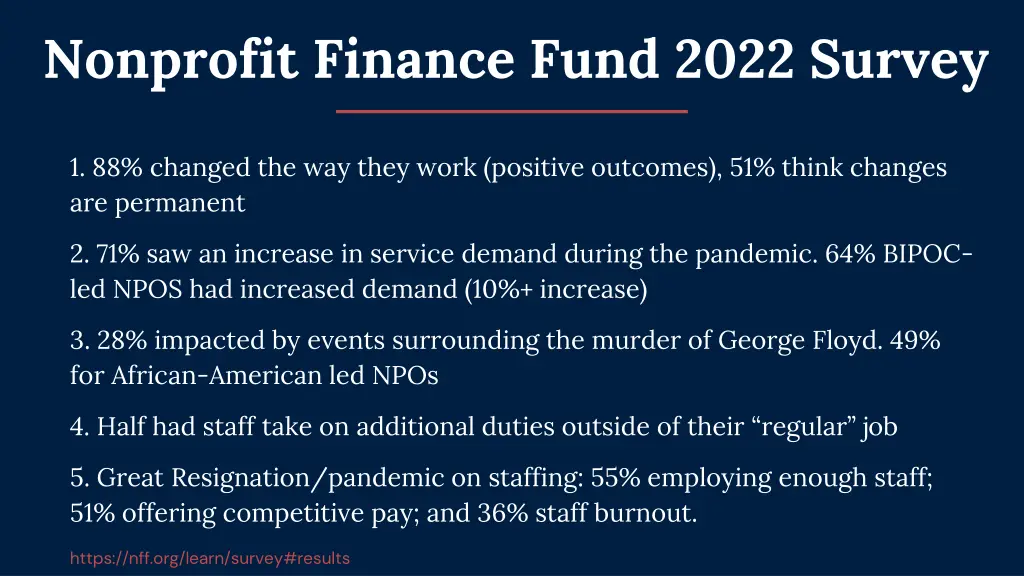

Nonprofit Finance Fund 2022 Survey Insights

Explore key findings from the Nonprofit Finance Fund 2022 Survey, revealing shifts in nonprofit operations, increased service demand during the pandemic, effects of the Great Resignation, and impact investing initiatives. Discover how organizations are adapting to meet community needs.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Nonprofit Finance Fund 2022 Survey 1. 88% changed the way they work (positive outcomes), 51% think changes are permanent 2. 71% saw an increase in service demand during the pandemic. 64% BIPOC- led NPOS had increased demand (10%+ increase) 3. 28% impacted by events surrounding the murder of George Floyd. 49% for African-American led NPOs 4. Half had staff take on additional duties outside of their regular job 5. Great Resignation/pandemic on staffing: 55% employing enough staff; 51% offering competitive pay; and 36% staff burnout. https://nff.org/learn/survey#results

Intro and Grant Making Jessie Ball duPont Fund October 11, 2022.

Jessies Will Grantmaking is governed by the Last Will and Testament of Jessie Ball duPont: Organizations that received funding from Mrs. duPont between 1960 and 1964 (~318 today); and 1. 2. Organizations supporting the temporary relief of people in need in the states where Mrs. duPont lived - Virginia, Delaware and Florida

5% payout By law, private nonoperating foundations must distribute 5% of the value of their net investment assets each year either through grants or eligible administrative expenses (those other than investment management fees and expenses and Federal Excise Taxes) The rule was created to prevent foundations from receiving assets but never actually making charitable distributions with them.

Endowment Endowment size ranges = $300M-$400M Carve-out of $50M dedicated to for impact Annual payout range= $15M-$20M

Impact Investing Impact investing = identifying investments designed to yield positive social, economic and environmental outcomes together with a financial return Major projects focus on expanding access to affordable capital, small business support, affordable housing projects

Mission Our mission is to serve the communities that Jessie Ball duPont knew and loved. Wilmington, DE | Jacksonville, FL Port St. Joe, FL | Northern Neck of Virginia We envision a world in which every member of those communities feels they belong.

Values With belonging comes power. Listen, act, learn. Repeat. Do better. Always. In it together.

The Funds Foci Committed to building communities of belonging in the places that Jessie knew and loved Equity (access to .) Placemaking

Grantmaking Program staff manage proactive, reactive and small grants. a. Proactive grants are highly aligned with the Fund s strategies and are invited by staff for review. b. Reactive grants are highly aligned with the Fund s strategies but are initiated by grantees, not staff. c. Small grants are highly aligned with the Fund s strategies, reactive, and are $15K or less.

Organizational Effectiveness and Resiliency (OER) Programs For our grantmaking work to have impact, it is critical for our grantees to be effective and resilient 15 years+ of capacity building grants. Shifted in last 3 years to an evolving portfolio of activities and programs, including : digital fundraising, feedback, diversifying boards

Proposal Flow Process structured to mirror natural human decision-making: 1. What s the problem / opportunity? (data/evidence) 2. What s the proposed solution? Does it make sense? 3. What are the anticipated changes / results? How will you know if you re successful? (measurement)

What I Pay Attention to in a Proposal Sound strategy Does the ask meet the need? Does the budget align with activities? Experience with issue and/or innovation Leadership Executive competency Board reflect community / population served Organizational capacity to do the proposed work Partnerships Diverse revenue streams

Relying on 15 Years+ of Capacity Building JBdF provided millions in reactive capacity building grants over 15 years+ to our universe of grantees. Capacity Building = 40% of grantmaking. So, what was the outcome? a. Many organizations still struggled with the challenges of staffing and sustainability b. Individuals increased capacity, and they turn over c. Most effective were focused initiatives that included cohorts (ex. digital fundraising, feedback)

Multi-Year Funding JBdF provides multi-year grants for high-alignment grantees. a. Unrestricted operating support and program grants w/ verbal annual check-ins and the potential to course correct as needed b. Runway can oftentimes be too long for programmatic grants beyond two years (~90% unexpended or had challenges) c. KEY: Commitment to long-term change and revenue diversification

Options & Considerations Standard grant seeking: -Grants.gov -Community & local foundations (Community Foundation Locator) Build relationships / make introductions Review websites / seek RFP schedules -Candid (Foundation Center / GuideStar merged) Your NPO should seek platinum status! -Grantwatch (ex. 224 listings for FL NPOs seeking BIPOC grants) -GrantStation (membership) -Community Development Financial Institutions (CDFIs) re: TA -Leverage your board (networks) -NPO-serving organizations (some warehouse grant info)

Options & Considerations Outside the box: -Connect with wealth managers/CPAs/etc. re: Donor-Advised Funds (WIIFM - it can help them, too!) -Become a resource for policymakers (WIIFM) -Crowdfunding (e.g., Kickstarter) -Request funders support for digital fundraising capacity (e.g., Lightful) -Debt and debt-like Recoverable grants (structured that if successful NPO repays) Program-related investment (financing, cash-flow loans) FinTech online lenders (e.g., Honeycomb Credit)

What I Pay Attention to in a Proposal NOTE: Recession & market volatility affects amounts funders may give. Invites more scrutiny on the ask. Sound strategy Does the ask meet the need? Does the budget align with activities? Experience with issue and/or innovation Leadership Executive competency Board reflect community / population served Organizational capacity to do the proposed work Partnerships Diverse revenue streams Are you using data and evidence effectively to support your case (e.g., need and solution)? Measurement matters. How will you know if you re successful. Recreating the wheel? Make sure funders know where you fit in the ecosystem and your value.