North Korean Economic Challenges and Marketization Progress

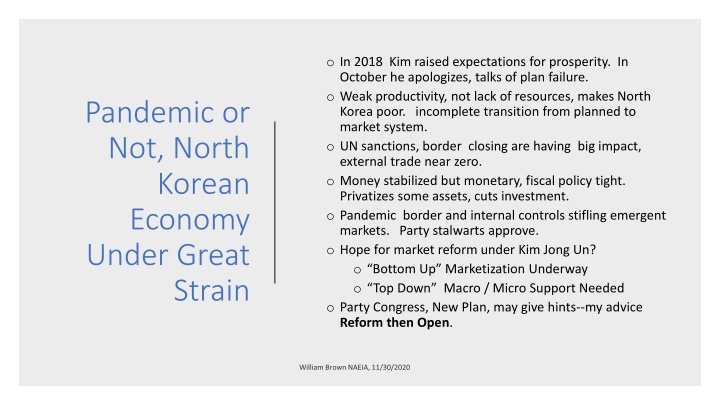

In 2018, Kim Jong Un raised hopes for prosperity in North Korea, but weak productivity and external sanctions have led to economic strain. The economy is undergoing marketization, but faces obstacles like border closures and low trade. The upcoming Party Congress and new plan could provide insights into the country's economic direction.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

o In 2018 Kim raised expectations for prosperity. In October he apologizes, talks of plan failure. o Weak productivity, not lack of resources, makes North Korea poor. incomplete transition from planned to market system. o UN sanctions, border closing are having big impact, external trade near zero. o Money stabilized but monetary, fiscal policy tight. Privatizes some assets, cuts investment. o Pandemic border and internal controls stifling emergent markets. Party stalwarts approve. o Hope for market reform under Kim Jong Un? o Bottom Up Marketization Underway o Top Down Macro / Micro Support Needed o Party Congress, New Plan, may give hints--my advice Reform then Open. Pandemic or Not, North Korean Economy Under Great Strain

o Border Closing and Internal Restrictions impacting markets. o Fewer Chinese consumer products o Traders losing money o Private employment endangered, no investment, decline in living standards. GDP plunging. o Government Benefits o Less outflow of foreign exchange o Less competition for state enterprises o Stronger population controls, especially movement. o But Economy now depends on markets o Plan needs imports, imports need exports o Budget needs dollars. o Kim has big decision move to market or reinforce plan. o Squeezing use of dollars/yuan, pushing up won. o New regs expanding money making teams but more state, party controls. Kim s Decision Point -- January Party Congress & New Plan

Marketization Underway, Not Finished What is a Market? Marketization: Much more than marketplaces Many buyers Many sellers Rules, Structure Time, currency, behavior Compete for best price Market clears with flex price Usually most efficient outcome Decentralized, Unplanned Law of One Price Goods Markets Services Markets Labor Markets Real Estate/Land Markets Capital/Finance Markets Foreign Exchange Markets William Brown NAEIA, 11/30/2020

China-North Korea Trade million dollars, as of October 2020, China Customs 400 350 300 250 200 150 100 50 0 01/2015 01/2016 01/2017 01/2018 01/2019 01/2020 ChX ChM William Brown NAEIA, 11/30/2020

Won jumps against Dollar and Yuan Won jumps against Dollar and Yuan Asia Press and Daily NK Dollar falls sharply against won But yuan falls even more Won per US Dollar As of 27 Nov, 2020 Won per PRC Yuan As of 27 Nov 2020 10,000 1,400 9,500 1,300 9,000 8,500 1,200 8,000 1,100 7,500 7,000 1,000 6,500 900 6,000 5,500 800 5,000 9/1/2020 12/1/2019 2/1/2020 4/1/2020 6/1/2020 8/1/2020 10/1/2020 700 9/1/2019 11/12019 1/1/2020 3/1/2020 5/1/2020 7/1/2020 9/1/2020 11/1/2020 William Brown NAEIA, 11/30/2020

China Yuan per US Dollar Asia Press, as of 27 Nov 2020 8.500 NK Cross Rate implies drop in yuan versus dollar unlike market rate which shows the opposite. 8.000 7.500 7.000 6.500 6.000 9/1/2019 11/12019 1/1/2020 3/1/2020 5/1/2020 7/1/2020 9/1/2020 11/1/2020 Cross Rate Market rate

Theory: Dollarization stopped inflation but requires tight monetary, fiscal policy to protect won. New Plan Requires Something Else? Pyongyang reduces won supply in parallel with loss of dollars. Gives up independence of monetary and fiscal policy. Little printing of new won cash. Few new net loans to state enterprises and agencies State firms allowed to privatize assets to make ends meet. Raise fees to raise funds. (no normal tax system). Allow workers to engage in private work. Halts inflation, and currency depreciation but kills investment Cost of stable won is thus a shrinking state sector. State has huge assets it can privatize so this can last a long time. Like China. By allowing hard currency to circulate, financial savings vehicle is available for the first time, allowing citizens to save. Reduces current demand. Advances basic human rights. William Brown NAEIA, 11/30/2020

Reform Then Open Chinese construct. Order is important. Reform then Open. What is meant by Reform? Unify price system Establish at least some private property rights Decollectivize agriculture Create new money and banking system Shrink huge bureaucracy and military Privatize some state assets Establish tax system and transparent budget This could put economy on moderate growth track, without foreign opening, even under sanctions. Reform incentivizes Opening, and massive engagement with rest of world. Much more secure than nukes. William Brown NAEIA, 11/30/2020