Online Cryptography Course: Fast One-Time Signatures with Special Properties

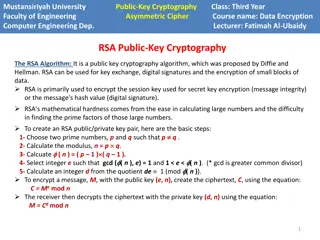

This online cryptography course by Dan Boneh explores the construction of fast one-time signatures with special properties. It covers topics such as defining one-time signatures, authenticating streams, and verifying signatures in a secure manner. The course also delves into practical applications like authenticating video streams and signing streams efficiently. Gain insights into the complexities of packet verification, packet loss, and out-of-order delivery, along with solutions like using TESLA for stream authentication.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Financials as at December 31, 2018 Partial Board PRESENTATION

Chairmans letter Beirut, June 11 2019 Key Financial Data. Written premium grew 4.7% to $18,128,000, and premium revenue for the year increased 2.7% to $17,075,000. Net profits dropped to $1,815,000 below target of 2.2 million dollars and significantly below 2017 profits of $2,668,000. A $340,000 difference of exchange headwind (from a positive $214,000 to a negative $125,000 swing), and weaker than forecast technical income led to this shortfall. Shareholder s Equity reached a record $27,313,000. Hence, the return on equity was below target for 2018 and lower than the average returns of the past fifteen years, we will remedy this by organic growth and by reducing the equity base thru increased dividends distribution. Technical highlights. Technical income increased 7.1% to $4,585,600, this recovery is lackluster and below our forecast of $4,970,000 and our past peak technical income of almost 5.5M$. It is the continuous weakness in Marine and deterioration in Motor that resulted in our shortfall, tainting what were otherwise, impressive results in Property and the remaining classes of business. It is still early to paint 2019 with any brush, but both Motor and Marine are performing better.

Financial highlights. UCA financial income was flat in 2018 at $1,300,000. Interest served on deposits in Lebanon rose sharply especially towards the end of 2018, UCA benefited also from a share dividend paid by UIC Syria slightly offset by lower disbursements from our investment in Real Berlin. Both SarwaInsurance and Sarwa Life in Egypt, commenced operations and we own 15% of each. Operating highlights. We are now operating from premises that are state of the art in terms of IT, security, provide a comfortable and efficient environment for productivity and ample room for growth. UCA is now refreshing its dated website and adding a payment gateway for premium settlement. This will pave the way for online policy issuance whenever legally authorized. Outlook. UCA is not immune to economic slowdown or competitive pricing, but we built our landmark Hazmieh HQ to position the company for the long term. To paraphrase our general contractor, the UCA building is designed to age very well . Moreover, I have commissioned Kameel Hawa to create a unique sculpture to complement this building and commemorate our move. He has called his creation Random . Ours is a profession of risk and hazard and probabilities, yet there is nothing Random about UCA s performance for two decades running. We have produced a consistent and predictable performance that has rewarded our shareholders and associates alike. We will be responsive to this drop in profitability and work tirelessly to restore better returns to our stakeholders. Sincerely, Jacques G. Sacy Chairman of the Board & Managing Director

Shareholders Equity-Dividend distributed during the Year 30,000 27,320 26,438 Shareholder Equity End of Year Dividend Distributed during the Year 24,706 25,000 23,171 21,197 19,266 20,000 17,325 15,092 15,000 13,564 11,632 9,764 9,261 10,000 5,000 1,318 995 995 995 750 737 737 730 663 663 498 498 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Net Profit 3,500 3,329 2,979 3,000 2,792 2,757 2,688 2,666 2,588 2,510 2,500 2,294 2,000 1,815 1,768 1,468 1,500 1,000 500 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

NET PROFIT AS A % OF EQUITY 18.81% 17.57% 13.92% 10.45% 9.99% 6.12% 2013 2014 2015 2016 2017 2018

Written Premiums (in Thousand $) 20,000 18,654 18,600 18,128 17,847 17,832 17,315 17,736 18,000 16,403 16,000 14,572 14,523 14,000 11,374 12,000 10,393 10,000 8,000 6,000 4,000 2,000 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Written premium by line of business 2018 Life 5% Others 8% Motor 34% Medical 10% Marine 11% Fire 32%

Premium Revenue (in Thousand $) 20,000 18,526 18,303 17,971 17,943 17,585 18,000 17,075 16,632 15,368 16,000 13,674 14,000 11,568 12,000 10,542 10,269 10,000 8,000 6,000 4,000 2,000 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Net Profit (Projected) 3,500 3,329 2,979 3,000 2,792 2,757 2,730 2,688 2,672 2,666 2,588 2,512 2,510 2,500 2,380 2,300 2,294 2,220 1,815 2,000 1,768 1,468 1,500 1,000 500 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 OF 2018 2019 OF 2019 NF 2020 OF 2020 NF 2021 F