Operating Performance Measures & Standard Costs Overview

Explore the essential aspects of standard costs, variance analysis, key performance indicators, and setting standards in managerial accounting. Learn how deviations from standards are managed and why using practical standards is beneficial in achieving efficient operations. The process of variance analysis and the PDCA cycle are also discussed in this informative content.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Standard Costs and Operating Performance Measures

Standard Costs Standards are benchmarks or norms for measuring performance. In managerial accounting, two types of standards are commonly used. Quantity standards specify how much of an input should be used to make a product or provide a service. Price standards specify how much should be paid for each unit of the input. Examples: Firestone, Sears, McDonald s, hospitals, construction and manufacturing companies.

Key performance indicators VS Actual performance KPI/Pre cost target Actual/Post cost Variance Direct material 10.00 per unit 5kg@2.00 per kg =10.00 11.00 1.00 (A) Direct labour 5.00 per unit 5.50 0.50(A) Variable overhead 2.00 per unit 1.50 0.50 (F) Fixed overhead 1.00 per unit 0.75 0.25(F) Full cost 18.00 per unit 18.50

Standard Costs Deviations from standards deemed significant are brought to the attention of management, a practice known as management by exception. Standard Amount Direct Material Direct Labor Manufacturing Overhead Type of Product Cost

Variance Analysis Cycle Take Identify questions Receive explanations corrective actions Conduct next period s operations Analyze variances Prepare standard cost performance report Begin

PDCA P=PLAN D=DO C=CHECK A=ACTION

Setting Standard Costs Accountants, engineers, purchasing agents, and production managers combine efforts to set standards that encourage efficient future operations.

Setting Standard Costs I recommend using practical standards that are currently attainable with reasonable and efficient effort. Should we use ideal standards that require employees to work at 100 percent peak efficiency? Engineer Managerial Accountant

Setting Direct Material Standards DM WOOD 20 LF@10.00 LF = Rs.200 Price Quantity Standards Standards Final, delivered cost of materials, net of discounts. Summarized in a Bill of Materials.

Setting Standards Six Sigma advocates have sought to eliminate all defects and waste, rather than continually build them into standards. As a result allowances for waste and spoilage that are built into standards should be reduced over time.

Setting Direct Labor Standards labour 16 Hrs@30.00= 480 Rate Time Standards Standards Often a single rate is used that reflects the mix of wages earned. Use time and motion studies for each labor operation.

Setting Variable Manufacturing Overhead Standards Rate Quantity Standards Standards The rate is the variable portion of the predetermined overhead rate. The quantity is the activity in the allocation base for predetermined overhead.

Price and Quantity Standards Price and quantity standards are determined separately for two reasons: The purchasing manager is responsible for raw material purchase prices and the production manager is responsible for the quantity of raw material used. The buying and using activities occur at different times. Raw material purchases may be held in inventory for a period of time before being used in production.

A General Model for Variance Analysis Variance Analysis Price Variance Quantity Variance Difference between actual price and standard price Difference between actual quantity and standard quantity

A General Model for Variance Analysis Variance Analysis Price Variance Quantity Variance Materials quantity variance Labor efficiency variance VOH efficiency variance Materials price variance Labor rate variance VOH rate variance

A General Model for Variance Analysis Actual Quantity Actual Quantity Actual Price Standard Price Standard Price Standard Quantity Price Variance Quantity Variance

Standard Cost Card Variable Production Cost A standard cost card for one unit of product might look like this: A B A x B Standard Cost per Unit Standard Quantity or Hours Standard Price or Rate Inputs Direct materials Direct labor Variable mfg. overhead Total standard unit cost 3 Kg 2.5 hours 2.5 hours 4.00 14.00 3.00 $ per kg per hour per hour Rs.12.00 Rs.54.50 35.00 7.50

Actual results for the month of March Actual production 5000 units Actual material used and purchased 17500Kg Actual material cost Rs. 66500.00 Labour hours produced 11250hours Labour cost incurred Rs.160312.5 Variable overhead Rs.28125.00 Calculate all possible variances from the pre cost standard

Variances Direct material variance DM Price variance Standard price per kg = 4.00 Actual price per kg = 3.80 Variance = 0.20 (F) Actual quantity = 17,500 Kg = 3500 (F) Total material variance = 6500(A) DM Usage variance Standard quantity = 15,000 Kg Actual quantity = 17,500 Kg Variance = 2500 Kg (A) Std price per Kg = 4.00 = 10,000 (A)

Labour cost variance Labour rate variance Standard labour rate per hour = 14.00 Actual labour rate per hour = 14.25 Variance = 0.25 (A) Actual hours = 11250 hours = 2812 (A) Total labour variance Labour efficiency variance Standard hours = 12500 hours Actual hours = 11250 hours Variance = 1250 hours ( F) Std rate per hour = 14.00 = 17500 (F)

Variable overhead Variance VOH rate variance Standard VOH rate per hour Rs.3.00 Actutal VOH rate per hour Rs.2.50 Variance Rs.0.50 (F) Actual hours 11250 hours 5625 (F) VOH efficiency variance Standard hours ( 2.5*5000) 12500 hours Actual hours 11250 hours 9375 (F) Variance 1250 (F) Standard rate per hour 3.00 Total 3750 (F)

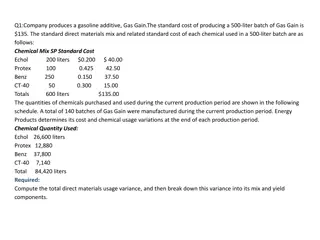

Variance analysis Ultra Shine Company Ultra Shine Company manufactures a cleaning solvent. The company employs both skilled and unskilled workers. The standard and actual material and labor information is presented below. Budgted production sales 60000 units. Standard: Material A: 3.25 gallons @ Rs.1.25 per gallon = Skilled Labor: 4 hours @ Rs. 12 per hour = 48.00 Variable production overhead 4 hours @ Rs. 3.00 per hour= 12.00 Fixed production overhead = 05.00 Full cost per unit = 102.80 Profit margin per unit = 40.00 Selling price = 142.80 Post order costing: Material A: 10,716 gallons purchased and used @ Rs.1.50 per gallon Skilled labor hours: 1,950 @ Rs.11.90 per hour Variable production cost Rs.7800.00 Fixed production overhead cost Rs.310,000.00 During the current month Ultra Shine Company manufactured 4000 units and total revenue earned Rs.7,508,250.00. 04.50 Calculate all possible variances

ABC ltd operates standard costing system for the product pricing and measuring the operational performance. Following pre costing is given product A. Direct material 0.5kg@4.00 per kg = 2.00 Direct labour 2hours@5.00 per hour = 10.00 Variable overhead 2 hours@0.30 per hour= 0.60 Fixed overhead = 7.40 Standard cost =20.00 Standard profit = 06.00 Standard selling price = 26.00 Budgeted output for the month of June was 5100 units. Actual results for June is as follows. Production 4850 units was manufactured and sold for Rs.124,280.00. Material consumed in production amounted 2300Kg at a cost of Rs.9800.00. Labour hours worked 8000 hours and paid Rs.42,000.00. Variable overhead amounted to Rs.2600.00. Fixed overhead paid amounted to Rs.Rs.42,300.00. You required to prepare a operating statement for the month of June.

Variances Direct material variance DM Price variance Standard price per kg = 4.00 Actual price per kg = 4.26 Variance = 0.26 (A) Actual quantity = 2300 kg = 598 (A) Total material variance = 98 (A) DM Usage variance Standard quantity = 2425 Kg Actual quantity = 2300 Kg Variance (Kg) = 125 Kg (F) Std price per Kg = 4.00 Variance = 500 (F)

Labour cost variance Labour rate variance Standard labour rate per hour = 5.00 Actual labour rate per hour = 5.25 Variance = 0.25 (A) Actual hours = 8000 HOURS = 2000 (A) Total labour variance 6500(F) Labour efficiency variance Standard hours = 9700 hours Actual hours = 8000 HOURS Variance = 1700 HOURS (F) Std rate per hour = 5.00 = 8500 (F)

Variable overhead Variance VOH rate variance Standard VOH rate per hour Rs.0.30 Actual VOH rate per hour Rs. 0.32 Variance Rs.0.02 (A) Actual hours 8000 hours 160 (A) VOH efficiency variance Standard hours ( 2*4850) 9700 hours Actual hours 8000 hours TVOH Variance 350(F) Variance 1700 (F) Standard VOH rate per hour 0.30 Total 510 (F)

Fixed overhead Variance FOH expenditure variance Budgeted fixed OH (7.40*5100) 37,740 Actual fixed OH 42,300 Variance 4560 (A) FOH volume variance Budgeted volume 5100 units Actual volume 4850 units TFOH Variance 6410 (A) Variance 250 (A) OAR 7.40 Total 1850 (A)

FOH OAR = Budgeted OH = 7.40 Budgeted activity Actual OAR = Actual OH = 42300 /4850 Actual activity = 8.70

Sales Variance Selling price variance Standard selling price 26.00 Actual selling price 25.60 Variance 0.40 (A) Actual sales 4850 units = 1940 (A) Sales volume profit variance Budgeted volume 5100 units Actual volume 4850 units Sales Variance 3440 (A) Variance 250 (A) Standard profit margin 6.00 Total 1500 (A)

Operating statements Budgeted profit 5100 units*6 Rs.30,600 Add: Selling price variance (A) ( 1940) Sales volume profit variance (A) (1500) Cost variance DM Price variance (A) (598) DM Usage variance (F) 500 DL Rate variance (A) (2000) DL efficiency variance (F) 8500 FOH expenditure variance (A) (4560) FOH volume variance (A) (1850) VOH rate variance (A) (160) VOH efficiency variance (F) 510 342 Actual profit Rs.27,502