Optimizing Financial Planning for Canadian Housing Providers

Explore how Encasa offers tailored investment solutions for Canadian housing non-profits and co-ops, assisting them in strategically managing their funds to ensure long-term sustainability. Learn about their products, risk exposure, and the importance of financial planning in achieving organizational goals.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

NBNPHA Annual Conference May 24, 2024

Who is Encasa? Nous sommes: Our Clients: Nous offrons: Gestionnaire de fonds d investissement d di au secteur canadien du logement Canadian housing non- profits and co-ops Produits d investissement adapt s divers app tits pour le risque Crit res d investissement responsable Frais de gestion peu lev s 850+ organizations with more than $500M invested Propri t et fonctionnement du secteur Our goal: help housing providers best position their funds today, so they re equipped to operate for years to come.

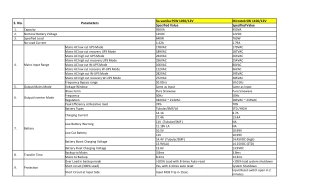

Products tailored to a range of time horizons and risk levels How much market risk can the funds be exposed to? Moderate Equity Fund Canadian Bond Fund Canadian Short-Term Bond Fund High Interest Savings Account How long until the funds will be needed / withdrawn? Low Long term (eg, 7+ years) Medium term (eg, 3-7 years) Short term (eg, 1-2 years)

What is Financial Planning? Process of matching your financial goals and objectives with the financial capital available. It describes the planned use of your resources to support upcoming projects, such as installing a roof or replacing windows in your building.

Financial Planning 101 Identify your investment objectives: What you need to get started: Identify your short and long-term capital investment requirements, including timing Identify the investment team within your organization Clarify Accountability Undertake contingency planning Promote Integration Identify your organization s risk tolerance Get familiar with your most recent BCA As for help if you need it

Financial Planning Cont Implementing Your Investment Strategy: Define how much money you need and when: Once you ve developed a solid investment plan, your focus should be on following it. Match the time horizon of large expenditures to the time horizon of your investments Expect significant volatilities from time to time Monitor and review Refine Your Investment Strategy: Help With Investment Planning: Portfolio Diversification don t put all your (investing) eggs in one basket! If you don t have an investment professional that your organizations works with, consider finding one you trust. Rebalancing regular monitoring is key.

How Encasa can help Free webinar Detailed Guide to Financial Planning June 20. Contact us experienced advisors ready to give unbiased advice, tailored to your organization. Visit encasa.ca for details

8 Questions? Contact us: 416-488-3077 information@encasa.ca www.encasa.ca

Legal disclosure This material is for general and educational purposes only and is based on the perspectives and opinions of the owners and writers. It is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering of tax, legal, accounting, financial or other professional advice. Investors should always consult an appropriate professional regarding their particular circumstances before acting on any of the information here. All information provided is believed to be accurate and reliable, however, we cannot guarantee its accuracy or completeness. Due to the possibility of human and mechanical error as well as other factors, including but not limited to technical or other inaccuracies or typographical errors or omissions, Worldsource Financial Management Inc. is not responsible for any errors or omissions contained herein. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Prospectus or the Fund Facts before investing. Mutual funds are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently and past performance may not be repeated. Encasa Financial Inc. is the fund manager and portfolio manager for all Encasa Funds. Worldsource Financial Management Inc. is the sponsoring mutual fund dealer.