Outsourced R&D and GDP Growth: Insights on Research and Development

This research paper by Anne Marie Knott explores the relationship between outsourced R&D and GDP growth. It delves into the impact of R&D practices on effectiveness, firm IQ measurement, and the theory linking R&D to economic growth. The paper examines possible explanations for declining GDP growth despite increased scientific labor, testing theories and identifying sources of declining R&D productivity. It also speculates on reasons for firms persisting with declining R&D productivity.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

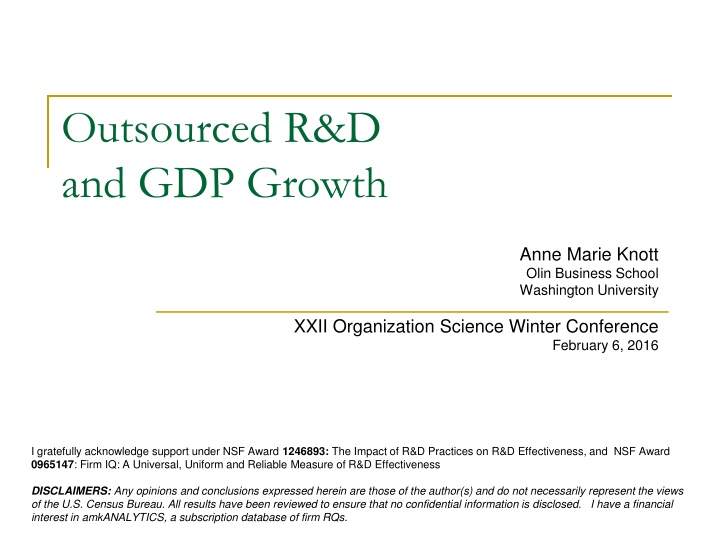

Outsourced R&D and GDP Growth Anne Marie Knott Olin Business School Washington University XXII Organization Science Winter Conference February 6, 2016 I gratefully acknowledge support under NSF Award 1246893: The Impact of R&D Practices on R&D Effectiveness, and NSF Award 0965147: Firm IQ: A Universal, Uniform and Reliable Measure of R&D Effectiveness DISCLAIMERS: Any opinions and conclusions expressed herein are those of the author(s) and do not necessarily represent the views of the U.S. Census Bureau. All results have been reviewed to ensure that no confidential information is disclosed. I have a financial interest in amkANALYTICS, a subscription database of firm RQs.

Romer (1990) provides first formal theory linking R&D to growth Finished goods production function: Y=K (ALY)1- Imbedded in that is the knowledge production function: A = ALA Where: A = knowledge/technology = research productivity LA= research labor Combining: Y=K ((A+ ALA)*LY)1- Most important conclusions: Growth in steady state: gA=gY=A /A=( ALA)/A= LA Testable proposition: doubling LA doubles g (Scale effects)

The puzzle Scientific labor (LA) has increased 2.5x GDP growth declining 0.03% per year

Two explanations for the disconnect* Jones (1995) explanation R&D has gotten harder Eliminates scale effects prediction, by adding Fishing out effect, , - probability of finding new idea is declining in the stock of ideas Diminishing returns to scientific labor, , -due to higher likelihood of duplicate efforts Revision: Implication: growth converges to 0 Alternative explanation Firms have become worse at R&D Scientific labor productivity, , has declined Leave Romer intact Implication: Steady state growth Scale effects l-1Aq g=dLA Third explanation is extension of first

Paper tests the two explanations Characterize firms R&D productivity (RQ) Conduct semi-critical test of two explanations Identify source of declining RQ Demonstrate sufficient to account for decline Rule out alternative explanations linking source to declining RQ Speculate why it causes decline in RQ Speculate why firms persist with it 1. 2. 3. 4. 5. 6. 7.

RQ is most intuitive measure you could construct for R&D productivity Derived from production function: Y = K L Expand it to include intangibles: Outputit = Capitalit *Laborit * R&Dit-1 * Spilloversit-1 * Advertisingit Matches most common approach to measuring R&D productivity (Hall, Mairesse, Mohnen 2010) Make all exponents firm-specific: Outputit = Capitalit *Laborit * R&Dit-1 * Spilloversit-1 * Advertisingit RQ is the exponent, , on R&D Exact definition: firm-specific output elasticity of R&D % output increase from 1% R&D increase

Important properties of RQ Universal: Can estimate for all firms doing R&D (only 50% of R&D firms patent) Uniform: It s essentially a ratio of inputs to outputs, so interpretation is same across firms Patents are apples and oranges:10% of patents comprise 85% of total value of all patents (Scherer and Harhoff 2000) Reliable: Consistent with propositions from endogenous growth theory (tested over 47 years)*: R&D investment, market value (MV) and firm growth increase with RQ Patents fail MV and growth props; TFP fails growth prop Knott and Vieregger 2015, An Empirical Test of Endogenous Growth

2a. Test of firms getting worse at R&D 1 2 OLS RQ FE RQ Dependent variable Year -0.0014 0.0000 -0.0009 0.0000 firm effects yes Constant 2.8637 0.0853 1.9233 0.0660 R-squared within between adjusted R-sq 0.0134 0.0134 0.0206 0.0019 0.0134 observations groups (firms) 55957 55957 6217 RQ has declined 65% over 30 years!

2b. Test of R&D getting harder If R&D has gotten harder, maximum RQ should decline over time Maximum RQ is actually increasing Though the increase comes from new industries Max RQ is declining within industries 1 2 3 4 5 OLS FE FE FE FE sic1yr RQmax sic2yr RQmax sic3yr RQmax sic4yr RQmax Dependent variable yearRQmax Year 0.007^ 0.004 0.000 0.000 0.002 0.001 -0.001 0.000 -0.001 0.000 Industry effects included included included included Constant -13.900 8.731 0.126 0.449 -4.245 1.514 1.961 0.206 2.138 0.161 R-squared within between adjusted R-sq 0.067 0.011 0.023 0.289 0.000 0.000 0.012 0.010 0.013 0.000 0.012 0.016 0.001 0.043 observations groups (sic) 41 6197 235 402 10 1938 9627 367 65

3. Identify source of declining RQ using NSF Survey of Industrial R&D (SIRD) Annual survey of US firms conducting R&D 1957 to 2007 Replaced by BRDIS in 2008 Sample intended to represent all for-profit R&D-performing companies The data includes: domestic sales domestic employment number of scientists/engineers total domestic R&D expenditures by source of funding (Federal R&D versus company R&D funds) horizon (basic research, applied research, and development) location (internal, outsourced within US, foreign entities). 20.1x rise in R&D outsourcing versus 2.4x for R&D labor

4a. Demonstrate outsourcing can account for RQ decline Treat three sources of R&D (internal, outsource in US, foreign) as separate inputs Estimate contributions of each to firm production function: Outputit = Capitalit *Laborit * RDintit-1 * RDoutit-1 * RDforit-1 * Spilloversit-1

4b. Results: Outsourced R&D unproductive for funding firm Elasticity of outsourced R&D 0.001 Versus 0.13 for internal R&D robust to exclusion of spillovers No evidence R&D has gotten harder: Elasticities for each R&D form are equivalent (3)vs(5) (1) (2) (3) (4) (5) Random coefficients estimation Dependent variable: ln(Revenues)Yit 1983-2000 1983-2000 1983-1988 1989-1994 1995-2000 ln(employees) (Lit) 0.841 0.006 0.128 0.004 0.001 0.002 0.008 0.002 0.004 0.001 4.872 0.049 0.843 0.006 0.126 0.004 0.002 0.002 0.007 0.002 0.885 0.018 0.114 0.015 0.008 0.003 0.003 0.004 0.003 0.002 4.487 0.147 0.867 0.015 0.094 0.010 0.006 0.003 0.004 0.004 -0.005 0.002 5.210 0.113 0.921 0.023 0.108 0.011 0.009 0.004 0.000 0.003 -0.008 0.002 4.931 0.123 ln(internalR&D) (Rit-1) ln(outsource R&D) (Ot-1) ln(foreignR&D) (Fit-1) ln(spillovers) (Sit-1) Constant 4.915 0.047 Log-likelihood Wald chi2 prob>chi2 -25911 23438 -26195 24022 -2094 3939 -5019 5649 -3902 8292 0 0 0 0 0 Observations Firms Obs and firms rounded to nearest 500 Std errors below coefficients Coefficients in bold significant at 0.05 28500 3500 28500 3500 2500 500 5000 1000 5000 1000

5. Rule out selection effects A. Do lower quality firms outsource? Treatment regression If lower quality firms outsource should affect both internal and aggregate RQ B. Do firms outsource less productive projects? What happens to internal RQ pre/post outsource If firms outsource lower quality projects, internal RQ should increase following first outsourcing

5a. Test of firm quality suggests productivity problem lies elsewhere (1) (2) Treatment regression Dependent variable: Two stage treatment model: First stage models p(outsource): neverout Second stage models treatment effects of neverout on R&D productivity If firm quality is driving outsourcing: Treatment effect (neverout) should be same for internal and aggregate RQ Results: No treatment effect on internal RQ Positive effect on aggregate RQ (significant at 10%) Internal RQ Aggregate RQ ln(employees) 0.000 0.000 0.006 0.001 0.000 0.000 0.000 0.001 0.093 0.001 40.46 -0.004 0.000 0.012 0.002 0.000 0.000 0.015 0.008 0.087 0.007 484.5 Scientist ratio (dns/dne) Scientist cost (totcost/dns) Neverout Constant wald chi2 prob>chi2 stage 1 neverout 0 0 Basic percent (brtot/rdtotown) 0.511 0.122 -0.186 0.124 -1.330 0.215 0.194 0.164 0.857 0.078 0.030 -4.548 0.030 0.010 0.000 0.690 0.508 0.117 -0.291 0.118 -1.451 0.194 0.098 0.180 0.870 0.073 -0.242 -3.676 -0.237 0.025 -0.006 0.026 Applied percent (ardtot/rdtotown) Foreign percent (outforeign/RDtrue) Federal percent (fedtot/Rdtrue) Constant /ath rho /lnsigma rho sigma lambda prob>chi2 observations firms Obs and firms rounded to nearest 500 Std errors below coefficients Coefficients in bold significant at 0.05 6000 500 6500 500

5b. Test of project selection suggests productivity problem lies elsewhere If firms outsource their less productive projects should see internal RQ increase post-outsourcing Characterize internal RQ in window of first outsource Create 7 year moving estimates of firm s internal RQ Create dummies for years around first outsource RQit= i + t(dummies)+ it Results: No significant effect Mean coefficient: 0.0006 pre-outsource 0.0000 post-outsource 0.120? 0.100? 0.080? 0.060? InternalRQ? Intercept? 0.040? 0.020? 0.000? out-5? out-4? out-3? out-2? out-1? first? out? out+1? out+2? out+3? out+4? out+5? -0.020?

6. Speculate why outsourcing has no impact on revenues Loss of internal spillovers Benefits of knowledge from abandoned projects accrue to outsourcing firm rather than funding firm Raises rivals Lost internal opportunity (Hughes ion beam propulsion) Lower ability to exploit research outcomes (Frank s absorptive capacity in reverse ) Key technical resources lie outside the firm Exploitation less likely and/or more costly Firms who outsource IT integration less able to develop new applications (Weigelt 2009)

7. Speculate why firms persist given outsourcing is unproductive Firms don t know their R&D productivity Need for better R&D measures top concern for IRI members (Schwartz, Miller, Plummer, Fusfeld 2011) Evidence Fewer than 5% of firms R&D investment within +10% of optimum level (Knott 2012) 70% of surveyed CIOs and CEOs believe outsourcing innovation improves financial performance (Osteria and Kotlarsky 2011) Susceptible to information cascades (Bikhchandani et al 1992) Information cascade occurs when it is optimal for actors to ignore private information in favor of following prior actors Relevant cascade is open innovation trend Note outsourcing is only subset of open innovation Other forms: alliances, joint ventures and external technology sourcing External technology sourcing seems to benefit firms (Cassiman & Veugulers 2006; Arora, Cohen, Walsh 2014)

Summary Proposed and tested an alternative to Jones for the broken link between R&D and growth No evidence R&D getting harder Rather it appears firms have become worse at it--their R&D productivity, RQ, has declined. Fortunately the decline in RQ appears to stem from increased use of outsourced R&D No decline in firms internal RQ. Implications Preserves model with growth in steady state (and scale effects) vs Jones expectation of convergence toward 0 growth Since outsourcing is fairly easily reversed, may restore firm RQs as well as US GDP growth.