Overcoming Life Insurance Lapse Bad Faith Practices by Samuel Bruchey

Learn about life insurance lapse, the consequences of insufficient premiums, sample policy language, lapse rates, and how to litigate against lapse situations. Discover the legal aspects of benefits due and bad faith claims in the insurance industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Life Insurance Lapse Bad Faith Practices Undermining Coverage and How to Overcome Them Samuel Bruchey The Rutter Group October 21, 2016

What is a Lapse When insufficient premiums are paid to cover monthly Cost of Insurance fees Policy enters 60-day Grace Period If premiums not paid during Grace Period Insurer terminates coverage and keeps all premiums

Sample Policy Language If on a monthly anniversary day the cash surrender value is insufficient to cover the monthly cost of insurance, the monthly expense charge and any applicable monthly face amount change(s), then this policy will terminate for no value.. A grace period of 60 days will then begin. The grace period allows for the payment of an amount sufficient to keep the policy from terminating without value at the end of the grace period. Notice of the amount due will be mailed at least 30 days before the end of the grace period to your last known address and the last known address of any assignee of record.

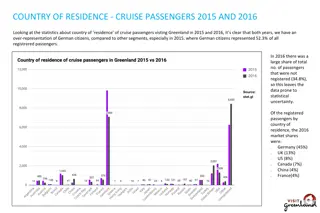

Lapse Rates Hundreds of millions of dollars worth of life insurance lapses annually Less than 1% of term life insurance policies pay out Only 15% - 20% whole life policies pay out Seniors especially vulnerable Insurance Code statutes enacted in 2013

Litigating Against Lapse Individual UCL claim (insured alive) unlawful/unfair business practice Restore coverage Recover attorney fees Individual bad faith claim (insured dead) Recover unpaid death benefits Consequential and tort damages Punitive damages Class actions

No benefits due = No bad faith? GFFD limited to assuring compliance with the express terms of the contract. (Racine & Laramie, Ltd. v. Cal. Dep t of Parks & Recreation, (1993) 11 Cal.App.4th1026, 1033) GFFD developed in contract arena and is aimed at making effective the agreement s promises. (Foley v. Interactive Data Corp., (1988) 47 Cal.3d 654, 683) No bad faith where no benefits due. (Progressive W. Ins. Co. v. Sup. Ct. (2005) 135 Cal.App.4th263, 279; Waller v. Truck Ins. Exchange, Inc., (1995) 11 Cal. 4th1, 36)

No benefits due = No bad faith? The conclusion that a bad faith claim cannot be maintained unless policy benefits are due is in accord with the policy in which the duty of good faith is [firmly] rooted. (Love v. Fire Ins. Exchange (1990) 221 Cal.App.3d 1136, 1151) Thus, there are at least two separate requirements to establish breach of the implied covenant: (1) benefits due under the policy must have been withheld; and (2) the reasons for withholding benefits must have been unreasonable or without proper cause. Waller v. Truck Ins. Exchange, Inc. (1995) 11 Cal.4th1, 36)

Bad Faith Failure to Communicate The essence of the implied covenant of good faith and fair dealing is that the insurer must refrain from doing anything that will injure the right of the insured to receive the benefits of the insurance agreement. (Brandwein v. Butler (2013) 218 Cal.App.4th1485, 1514-1515.) The precise nature and extent of the duty imposed by the implied covenant depends on the nature and purpose of the underlying contract and the legitimate expectations of the parties arising from the contract. (Jonathan Neil & Assocs., Inc. v. Jones (2004) 33 Cal.4th917, 937.)

Bad Faith Failure to Communicate Failure to communicate adequately with the insured is evidence of bad faith. Indeed, together with other improper conduct, it may provide sufficient evidence to support an award of punitive damages. (Delgado v. Heritage Life Ins. Co. (1984) 157 Cal.App.3d 262, 278.) Arrogance or hostility by insurance personnel (particularly in combination with other evidence of unreasonable insurer conduct) is also evidence of bad faith. (Egan v. Mutual of Omaha Ins. Co. (1979) 23 Cal.3rd 809, 819)

Evidence of Bad Faith Letters to carrier regarding premiums Recorded telephone calls Owner v. Insured (follow the money) Inconsistent privacy guidelines Unreasonable reliance on Ins. Cd. 791.13 File claim if insured dies after lapse

Lapse Protection Statutes Ins. Cd. 10113.71 Obligation to provide 60 day grace period Notice of lapse must be given; to owner and designee; within 30 days after premium due Ins. Cd. 10113.72 Must be given right to designate third party to receive lapse notice Effective January 1, 2013

What Insurers Will Argue Statutes do not apply retroactively It is an established canon of interpretation that statutes are not to be given a retrospective operation unless it is clearly made to appear that such was the legislative intent. (Aetna Casualty & Surety Co. v. Industrial Acc. Com., 30 Cal.2d 388, 393 (1947)

Policy Renewal Renewal Privilege: This policy may be renewed for successive one-year periods until the expiration date shown on page 3. Current renewal premiums are subject to premiums redetermination after the twentieth policy year as described in the Premium Redetermination provision, but will never exceed the guaranteed maximum premiums.

Renewal Principle Automatic renewal when premiums are paid annually Each renewal incorporates any changes in the law that occurred prior to the renewal. (Modglin v. State Farm Mut. Auto. Ins. Co., 273 Cal.App.2d 693, 700 (1969) Renewal principle not in conflict with rule that statutes do not apply retroactively.

Reinstatement The overwhelming weight of authority is to the effect that an agreement to reinstate an insurance policy upon satisfactory evidence of insurability does not give the insurer the power to act arbitrarily or capriciously, but that evidence which would be satisfactory to a reasonable insured is all that is require. Kennedy v. Occidental Life Insurance Company 18 Cal.2d 627, 635 (1941).

Reinstatement Under Kennedy the insurer does not retain absolute discretion to disapprove application for reinstatement; so long as an applicant s insurability would be satisfactory to a reasonable insured, reinstatement cannot be denied. The insurer could only require that the applicant furnish evidence demonstrating his insurability on an objective rather than subjective basis. (Ryman v. American National Insurance Company 5 Cal.3d 620, 635 (1971))

Reinstatement Reinstatement does not involve the formation of a new contract, rather during the period in which reinstatement is possible the policy is not void but merely suspended. Ryman, supra, 5 Cal.3d at 631. Reinstatement is a valuable contractual right, and the insurer has no arbitrary or discretionary right to refuse reinstatement. Id. When objective proof of insurability is provided, the original policy is revived and the insurer having received all he bargained for in that policy, should be liable for any loss thereafter occurring to the same extent as if the policy had never lapsed. Kennedy, supra, 18 Cal.2d at 634

End Samuel Bruchey T: 310-246-1764 sbruchey@shernoff.com