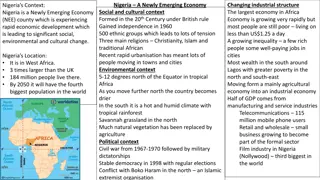

Overview of NIPC Activities and Nigeria's Business Environment

Highlighting the strategic role of the Nigerian Investment Promotion Commission (NIPC) in promoting investments, national investment laws, and challenges and opportunities in Nigeria's business climate. Discusses the NIPC's functions, incentives, and support services for investors.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

UPDATES ON THE ACTIVITIES OF NIPC YEWANDE SADIKU EXECUTIVE SECRETARY/CEO NIGERIAN INVESTMENT PROMOTION COMMISSION (NIPC) ABUJA | 09 MAY 2017 Private and Confidential

Nigerias Business Climate Widening Income Gaps and Wealth Distribution Dependence on Oil Revenue Overdependence on Imports Huge Infrastructure deficit Security Concerns High Cost of Doing Business Incidences of Corruption Inadequate Fund to Finance Long-term Investment 1

National investment laws To ensure a sustainable and conducive business environment Corporate and Allied Matters Act of 1990 All enterprises must be registered with the Corporate Affairs Commission (CAC) The Nigerian Investment Promotion Commission Act 16 of 1995 Allows foreigners to invest and participate in the operation of any Nigerian enterprise without restrictions Allows 100% ownership assured except investments: listed under the negative lists or covered by the Nigerian Content and Cabotage Acts Protects against expropriation of investment: NIPC Act guarantees no enterprise shall be nationalized expropriated by any government of the Federation Special Incentives: The Act empowered the NIPC (Nigeria IPA) to negotiate, in consultation with appropriate Government agencies, special incentives for strategic or major investments The Foreign Exchange (Monitoring & Miscellaneous Provisions) Act 17 of 1995 Allows repatriation of Profit: investors are free to repatriate their profits and dividends net of taxes through any authorized dealer in freely convertible currency 2

Strategic Role of NIPC in the Nigerian Economy Strategic Roles Established by the Nigerian Investment Promotion Commission Act to: Promote, co-ordinate and monitor all investments in Nigeria Initiate measures to enhance investment climate Assist incoming and existing investors by providing support services Collect and share information on investment opportunities and sources of capital Services Provision of investment information Matchmaking investors with opportunities and partners One-Stop Investment Centre Connected to 27 agencies to facilitate investments and reduce time required to commence business operations Provide assistance with company incorporation processes Process regulatory approvals and permits Support with issuance of visas on arrival Administration / processing of Pioneer Status Incentive 3

Business entry scenarios at NIPCs One-Stop Investment Centre (OSIC) Generic Agencies Type of Business Specific/Sector Agencies NBS Software development and creative industry NCC NOTAP CAC FIRS Power Generation NIPC NERC ICRC FMI NAFDAC NIS NEPC MAN Drug Manufacturing for Export NCS PCN SON 4

Nigeria is considered a difficult place to do business Benchmarking metrics Ranking out of 189 (2016) 181 169 Overall: Ease of doing business 114 108 73 62 24 Key insights 151 141 139 120 111 Starting a business 102 Nigeria moved up one place from in the Ease of Doing Business in 2016 but still ranks 36 out of 47 in sub- Saharan Africa Sub-components of Ease of Doing Business: 6 182 168 166 127 121 Getting electricity 118 Drastic, fast-paced business reforms must be conducted simultaneously to improve the business environment and attract foreign investors 62 181 Getting credit Reforms must be adopted within the next 12 months to reflect in the 2018 Ease of Doing Business report (out October 2017) 59 59 42 28 7 2 185 143 127 119 Enforcing contracts 116 102 13 Nigeria Ghana South Africa Kenya Angola Rwanda Georgia SOURCE: World Bank ease of doing business index 5

Nigerias overall performance Nigeria s overall performance relative to best relative to best- -in in- -class across indicators class across indicators Results on individual indicators 100 Starting a business 90 Protecting minority investors Getting credit 80 Dealing with construction permits 70 Enforcing contracts 60 Registering property 50 Resolving insolvency 40 Nigeria scored 44.63 points in Distance to Frontier in the World Bank s Doing Business 2017, giving it a ranking of 169thoverall, out of 190 countries Getting electricity 30 Paying taxes 20 Trading across borders 10 0 20 40 60 80 100 0 DTF score 6

Strong correlation between Ease of Doing Business and economic prosperity SOURCE: World Bank Doing Business report; Lit. Search 7

Major sources of foreign capital inflows into Africa Top investing countries in Africa in 2015 Global FDI flow 600 541 504 468 500 2013 2014 2015 Italy , 11% 431 429 400 323 United States , 10% Others , 35% 306 UK 300 238 168 176 170 165 200 France , 9% 85 USA 100 58 56 54 52 35 0 United Developing Asia Europe North America Latin America Africa Transition Economies Kingdom , 7% Finland , 3% Morocco, 5% & Caribbean United Arab Emirate , 6% Bahrain , 6% China, 3% Germany , 4% % Share of top 5 FDI destinations, 2011 2015 (US$, bn) Business Services, Sales, Marketing & Support and Manufacturing were the top three business activities for FDI projects into Africa in 2015 Nigeria 11% Switzerland South Africa 9% Extraction projects remained the fastest growing business activity by capital investment accounting for 23% in 2015 (joint top with Electricity) Mozambique 9% Others 57% Infrastructure-related business activities such as Electricity, Construction and ICT & Internet Infrastructure made up 13% of all projects into Africa and accounted for 44% of capital invested Egypt 8% Ghana 6% 8 Source: FDi Markets, World Investment Report 2016 (UNCTAD Report)

Top recipients of FDI in Africa Top 5 FDI destinations in Africa, 2011 2015 (US$,bn) 10,000 8.9 8.3 8,000 7.1 6.9 6.0 6.2 5.8 5.6 5.6 6,000 4.6 4.6 4.9 4.7 4.3 4.2 3.2 3.2 3.2 3.7 3.6 4,000 3.4 3.3 3.1 1.8 2,000 5.9 4.9 4.8 4.2 3.3 - Nigeria South Africa Mozambique Egypt Ghana (483) (2,000) 2011 2012 2013 2014 2015 9 Sources: World Investment Report 2016 (UNCTAD)

Despite the challenges, Nigeria is a key strategic market in Africa Increasingly friendly business environment Southern Africa Within Southern Africa: South Africa ranks high in terms of ease-to-do-business , making the country a logical entry point for investment in Africa Second largest GDP on African continent, and 5th largest population (55 million) Emerging black middle class with increasing purchasing power Perceived favorably from a risk-return perspective by international investors in search for emerging market yield South Africa typically offers itself as the doorstep-to-Africa to new investors to the continent Within East Africa: Kenya is the trade and finance hub for East Africa Highest ease-of-doing-business in the East African hub Natural entry point to establish African presence from East Africa East Africa 0 West Africa 20 Note: Size of bubble reflects relative GDP of each country 40 60 South Africa Botswana 80 Ease of doing business (ranking) Kenya Zambia 100 Ghana Within West Africa: Nigeria s population is the largest on the African continent and eight largest in the world Largest GDP in Africa Large hydrocarbon resources, the largest gas reserves and second largest oil reserves in Africa Nigeria is the emerging economic locomotive of the African continent Uganda 120 Tanzania 140 C te d'Ivoire Senegal Togo Ethiopia 160 Cameroon Nigeria Equatorial Guinea 180 Angola 200 0 20 40 60 80 100 120 140 160 180 200 Population (millions) Increasing population SOURCE: World Bank Doing Business 2017 10

Policy Thrust of Government The Change Agenda of Federal Government is predicated on: Rule of Law anchored on Good Governance and driven by uncommon sense of service Transparency Accountability Zero-Tolerance for corruption Security of lives and properties Firm support and productive partnership with Organized Private Sector / Investors Provide a predictable Macroeconomic Framework Facilitate a private sector driven economy Promote and attract value-added industrialization Attract export-oriented Non-oil Sector FDI Make FDI work for local the economy; i.e. job creation, supply-chain etc Develop a well integrated physical infrastructure 11

PEBEC Presidential Enabling Business Environment Council (PEBEC): The President approved the formation of the Presidential Enabling Business Environment Council (PEBEC) chaired by H.E. the Vice President and comprised of 10 Honourable Ministers, the Central Bank Governor, and the Head of Service PEBEC is supported by the Enabling Business Environment Secretariat (EBES), a small task force responsible for driving the reform agenda and ensuring implementation across MDAs 12

PEBEC: Scorecard PEBEC: Scorecard Done! Starting a Business: Fully operationalize online company name search FIRS e-payment/e-stamping solution integrated Entry & Exit of People: Simplify visa-on-arrival process, incl. e-submission Sign & issue new 2017 immigration regulations Consolidate arrival and departure forms Trading Across Borders Mandate use of pallets for imports to Nigeria NCS to schedule and coordinate export examinations Ongoing / Areas for engagement Entry & Exit of People: Eliminate manual baggage search with scanners Overhaul key traveler infrastructure at Lagos airport Starting a Business: CAC lawyers to handle statutory declaration of compliance Server colocation for 99% application portal uptime Trading Across Borders: Reduce documentation required for import/export Optimize pre-shipment process for exports 13

The Economic Recovery and Growth Plan is organized around 5 thematic areas and builds on the 2016 Strategic Implementation Plan Macro policies Revenue enhancement Cost optimization Monetary policy and banking system Governance & enablers Governance Security Subnational coordination Public service delivery Growth drivers Agriculture Manufacturing Solid minerals Services NERGP A E B National Economic Recovery and Growth Plan Objectives: Articulate medium- term economic policies to implement over 2016-20, and prioritize key turnaround interventions and enablers generate concrete, visible impact by 2017 Key actions will be articulated based on the SIP and other national reports National Economic Recovery Plan D C Investing in our people Job creation and inclusive growth Social safety net Public service delivery Competitiveness Business environment Infrastructure (transportation, power) 14

NIPC has a well articulated Strategy to promote significant investment to create job/wealth Strategic Pillars Key Performance Indicators Improve the image of Nigeria as an investment location Increasing DDI and FDI flows Increasing aftercare flows from expansion investment Champion investment climate reforms Number of jobs created Proactive investment promotion & facilitation in priority sectors with large scale job creation potential Doing Business ranking improves by >20 places in 2018 Number of priority sector reforms initiated Provide quality aftercare services to investors with expansion potential State IPAs engagements: all engaged by 2018 Support States to become more effective promoters of domestic and foreign investments Domestic Direct Investors database: 2 states per zone in 2017 15

Strategic Focus: 2017 Ongoing dialogue with investors to improve investment climate and resolve implementation challenges Investment Climate + product Investment Climate development Policy Input Low Cost-High Impact investment promotion activity for increasing FDI Image building & branding Fast-tracking the implementation of investment projects Aftercare / investor Development Investment Promotion Circle Identify and remove individual investor s constraints and challenges Targeting Strategy Increasing overall investor satisfaction leading to improved image of Nigeria Investor Servicing Increasing value of the investment to local economy (expansion and/or retention opportunities) Investment Generation Investor facilitation Ensure growth is not constrained Encourage investors to upgrade activities and add value 16

Strategic Focus: 2017 The strategic initiatives of NIPC to attract quality investment into the Nigerian economy are as follows: Pioneer Status review Investment incentives Direct Investor Summit Develop Domestic Direct Investors (DDI) Proactive Aftercare service One-Stop Investment Centre (OSIC) Focused FDI strategy Develop research capacity Empower zonal offices National Investment Certification Programme for States (NICPS) 17

THANK YOU Yewande Sadiku Executive Secretary/CEO NIGERIAN INVESTMENT PROMOTION COMMISSION Plot 1181 Aguiyi Ironsi Street Maitama District Abuja Mobile : +234 803 402 0099 Email: yewande.sadiku@nipc.gov.ng Website: www.nipc.gov.ng 18