Overview of School District of Athens & Skyward's ERP Implementation

Learn about the School District of Athens' upcoming ERP implementation with Skyward, including project timeline, benefits of using Skyward, implementation phases, costs involved, and the seamless experience it aims to create for district partners.

Uploaded on Apr 04, 2025 | 1 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

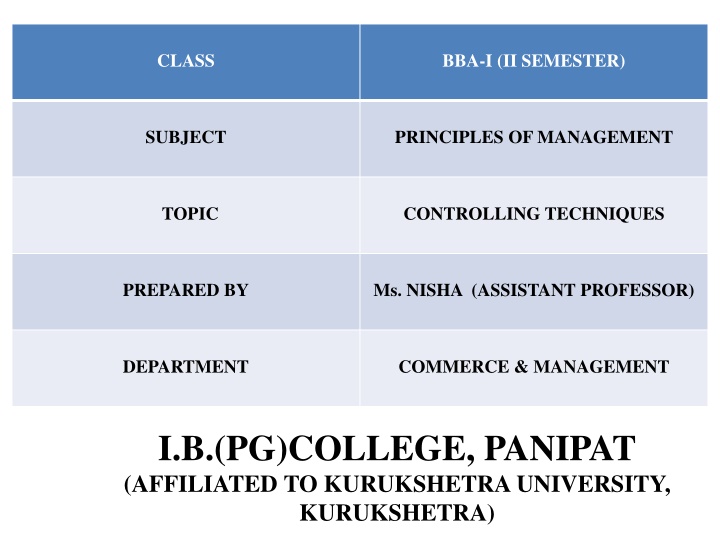

CLASS BBA-I (II SEMESTER) SUBJECT PRINCIPLES OF MANAGEMENT TOPIC CONTROLLING TECHNIQUES PREPARED BY Ms. NISHA (ASSISTANT PROFESSOR) DEPARTMENT COMMERCE & MANAGEMENT I.B.(PG)COLLEGE, PANIPAT (AFFILIATED TO KURUKSHETRA UNIVERSITY, KURUKSHETRA)

INTRODUCTION Controlling is that process and function of management which tells the companies about the gap between the standard performance and actual performance. information regarding particular action to be taken in case of deviations. It also provide Controlling techniques are the methods which helps in making the task of controlling successful.

TYPES OF CONTROLLING TECHNIQUES There are various techniques of controlling which are described below: CONTROLLING TECHNIQUES BUDGETARY CONTROL TECHNIQUES NON-BUDGETARY CONTROL TECHNIQUES (CONTROL DEVICES)

BUDGETARY CONTROL TECHNIQUES Budgetary control techniques includes two devices for controlling which are budgetary control and zero based budgeting. 1.BUDGETING CONTROL: Budgetary control are those methods of controlling in which budgets are used as a basis for the task of controlling. Budgets are the those quantitative plans which reflects the amount of money to be spent in the company in near future. In budgetary control techniques, the standard budgets are compared with actual budget and deviations are find out and performance is adjusted if needed.

FEATURES/CHARACTERISTICS OF BUDGETARY CONTROL Study of difference between standard and actual budget: This technique of controlling is a comparative study of standard and actual budget spend in the company. Finding out the deviations : Budgetary control after making comparative study, find out the deviations and their causes. Budget is made for all departments: Under this technique budget is made for all departments not for a single department. So, controlling covers whole company. Taking corrective action: Budgetary control not only find out the deviations but also suggest the corrective action for removing those deviations.

ADVANTAGES/IMPORTANCE OF BUDGETARY CONTROL Budgetary control provide number of benefits to the companies which are as follows: 1.)Financial planning for future: Budgetary control by studying the actual and standard performance in figures provide the important information regarding shortage or excess of money. On the basis of this, a company make financial planning for future. 2.) Help in price fixation: Budgetary control provide the information regarding cost of products and expenditure spent in the company which helps in price fixation. 3.) Sound decision: This technique helps in taking sound and balanced decision because controlling is based on budget of all departments.

Continued 4.) Successful planning: Budgets are based on plans and expected performance has communicated to the departmental mangers. These managers make their full efforts to achieve their targets. 5.) Profit maximization: Budgetary control helps in optimum utilization of resources, so helps in maximization of profits. 6.) Control on misuse of funds: This technique helps in checking on the misuse of funds by comparing the targeted and actual budget, because after comparison information regarding expenditure spent in departments are studied.

Continued.. 7.) Helps in motivating the employees: Budgetary control provide the reality of realization of targets. Under this technique goals for the employees are determined which motivates the employees. 8.) Clarity of authority and responsibility: The authority and responsibility of employees are fixed in budget manual due to which the supervisors do not have to issue orders again and again and it saves their time.

DISADVANTAGES/PROBLEMS OF BUDGETARY CONTROL Budgetary control has some limitations along with number of benefits which are as follows: 1.) Limitations of forcasting: Budgets are based on forecasting and forecasting is related to future. Future is uncertain, no one can predict the future with 100% surety. So, there can be wrong forecasting. 2.) More time and money required: Budgetary control is not a single step and it also requires appointment of controllers which demands for more time and money. 3.) Less flexible: Budgets happens to be inflexible because it is not possible to afford the changes.

ESSENTIALS FOR SUCCESSFUL BUDGETARY CONTROL Knowledge of company s objectives and policy by the controllers. Framing of budgetary committee and budgetary organization structure. Proper appointment of controller and required staff. Determination of budget period. Preparation of budget manual. Full participation from employees. Proper motivation and feedback system for the employees should be implemented.

STEPS IN BUDGETARY CONTROL PREPARATION OF BUDGET POLICY AND BUDGET MANUAL PREPARATION OF BUDGTS FINDING OUT VARIANCES AND THEIR CAUSES REPORTING OF VARIANCES FOLLOW UP AND REVIEW

Continued. 1.) Preparation of budget policy and budget manual: The first step in budgetary control is preparation of budgetary policy and budget manual. The budget policy provide the guidelines for making budgets and budget manual determines the authority and responsibility of employees and instructions to be followed in budgeting . 2.) Preparation of budgets: After making budget policy and budget manual, next step is preparation of budgets. This include the departmental budget and main master budget. Departmental budget include sales budget, production budget, cash budget etc.

Continued. 3.) Finding out the deviations and their causes: In this step the deviations are find out by making comparison between actual budget and standard budget. The deep study of deviations is made and their causes are find out. 4.) Reporting of variances: After finding out the variances, a report is made on this and communicated to supervisors. 5.) Follow up and review: Finding out deviations is not enough, strong actions should be taken for removing these deviation and for this purpose budget committee conducts meeting in intervals.

2.) ZERO BASED BUDGETING Second technique in budgetary control is zero based budgeting. Under this technique, previous year budget is not referred. Generally, budget is prepared after considering previous year budget and taking it as a base. In Zero Based Budgeting such base is not taken and new budget is prepared all together. This eliminates weakness of previous budget. Lets study this with an example, suppose a company prepared budget for manufacturing 1000 units in previous year. Target for this year is 1500, Instead of preparing budget of additional 500 units as done in traditional costing, budget for complete 1500 units will be prepared as per zero based budgeting.

NON BUDGETARY CONTROL TECHNIQUES Following are the non budgetary control techniques: Break-Even Point Analysis Statistical Data Special Reports Operational Audit Personal observation Responsibility Accounting Management Audit Management Information System- MIS Programme Network Analysis 1. Programme Evaluation and Review Technique-PERT 2. Critical Path Method-CPM

Break-Even point Analysis Break Even Point Analysis shows that level of production where there is no profit no loss for the businessman. It is a situation where cost of production and sale price are both equal. Formula for the same is mentioned below: Break Even Point: Fixed Cost/ Selling Price- Variable Cost

STATISTICAL DATA This method is based on past data. Under this method, figures of previous years are collected related to activities of which data is needed and then is analyzed. Statistics shown through pictorial representation are more effective and clear. They help in making forecast regarding the future and their importance can not be undermined.

SPECIAL REPORTS Special reports are prepared by Senior Management for some special purpose which is not served by statistical report. This can be better understood with an example. Let say, through statistical reports, management concludes that sales are increasing at healthy pace. Reason for the same could not be determined by statistical report and special report has to be prepared in such scenario. These reports contain detailed information about the causes and problems.

OPERATIONAL AUDIT Also known as internal audit, it is an important technique of control. It is performed by an internal auditor and same is employee of the organization. He makes an independent enquiry in to financial and other activities of the business. It is never ending process and report is submitted at various intervals. Employees remain alert as internal audit covers point related to various activities also.

PERSONAL OBSERVATION Personal observation is very important and unique technique of non budgetary control techniques. No other technique involves personal touch. To know whether employees are working dedicatedly, it is important to understand their behavior and other things and same is possible only through possible observation which no other technique could do. The manger should himself go to the place of work and check employees whether they are working with full enthusiasm and honesty or not.

RESPONSIBILITY ACCOUNTING In responsibility accounting, activities of the company are divided in to various groups and responsibility of each group is assigned to a person, thus responsibility accounting. In this way, account of the responsibilities of the people are kept. Responsibility centers are made and failure or success of each centre is attributed to managers to whom centers are assigned. Product cost accounting and responsibility accounting are two parts. In product cost accounting, accounts of cost of product is kept. In responsibility accounting, account of responsibilities of people are kept. To ascertain progress of managers, cost is divided in to two parts controllable and non- controllable cost. Efforts are made to minimize controllable cost. Uncontrollable cost are those in respect of which manager has no authority.

Continued Process of Responsibility Accounting: Establishment of Responsibility Centre: This is the first step in which activities are divided in to various group and each group is known as responsibility centre and manager is assigned to every responsibility centre. Further, responsibility centers are of three types: Cost or expense centre: It is that unit of enterprise on which expenses are incurred but its output cannot be measure in monetary terms. Profit Centre: It is that unit of enterprise whose objective is determined in the form of profit.

Continued. Investment centre: It is that centre in which managers are held responsible for effect use of the asset of the department along with income ad expenditure of the department. Development of accounting system: After establishing responsibility center, the next step is to recording of accounts for each responsibility center. Determination of goal: After recording of accounts for each center, the goals for all departments are determined.

Continued. Measurement of cost: Next step in responsibility accounting process is to measure the controllable and non controllable cost for each department. Necessary actions taken in case of deviations: After calculation of cost, actual performance or accounts are checked and compared and communicate to the supervisors. In case of any deviation necessary actions are taken and it is ensured that such deviations should not be repeated in future.

MANAGEMENT AUDIT Management audit check the overall performance of the management of the companies. This technique aims at reviewing the efficiency and effectiveness of management and improving its future performance. The main purpose of this technique is identify the deficiencies in the performance of management functions.

MANAGEMENT INFORMATION SYSTEM Management information system is the use of technology, people and business processes to record, store and process data to produce information that decision makers can use to make day to day decisions. Its main purpose is to extract data from various sources and derive insights that drive business growth. Management information system should consist of following characteristics: ACCURATE COMPLETE COST EFFECTIVE UP TO DATE USER FOCUSED

PROGRAMME NETWORK ANALYSIS PERT(programmed evaluation & review technique) & CPM(critical path method) are important techniques useful in planning & controlling. These techniques helps in performing various functions like planning; scheduling & implementing time- bound projects involving the performance of variety of complex, diverse and interrelated activities. These techniques are so interrelated and deal with such factors as time scheduling & resource allocation for these activities.

CONCLUSION Controlling helps in assessing the work and performance of the companies by comparing actual and standard performance and after finding deviations , it also suggest the necessary actions to be taken. So, in order to make the task of controlling successful various budgetary control and non-budgetary control techniques are used. Budgetary control techniques uses budgets as a basis for controlling and non-budgetary techniques used various techniques other than budgets. Controlling technique help in providing the basis and criteria for controlling to the person who is performing the task of control.