Pan-European Personal Pension Product for Infrastructure Investment

This presentation explores the Pan-European Personal Pension Product (PEIPP) as an opportunity to promote investment in infrastructure projects within the EU. It covers the aim of the study, PEIPP characteristics, nature and diversity of infrastructure investments, as well as potential risks associated with such investments. The PEIPP aims to enhance pension options for individuals, particularly mobile workers, and complement existing pension schemes at the EU level. It focuses on stimulating voluntary pension investments accessible at an EU level, emphasizing long-term investment in infrastructure projects and other suitable assets.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

PAN-EUROPEAN PERSONAL PENSION PRODUCT AS AN OPPORTUNITY TO PROMOTE INVESTMENT IN INFRASTRUCTURE PROJECTS Chief Assit. Ptof. RalitzaPandurska, PhD, University of national and world economy rpandurska@unwe.com

Structure of the presentation 1. Aim of the study 2. PEIPP main characteristics 3. Infrastructure investments nature and diversity 4. Difficulties of the infrastructure investments 5. Potential risks of the investments in infrastructure projects

1. Aim of the study This study publication aims to present the possibilities for investing PEIPP funds in infrastructure projects. That will accelerate the achievement of a capital markets union and to make better use of targeted pension savings. The capital markets union (CMU) is a plan to create a single market for capital. The aim is to get money investments and savings flowing across the EU. That it can benefit consumers, investors and companies, regardless of where they are located.

2. PEIPP main characteristics The main objective of PEIPP is to enrich the individuals and especially mobile workers choice for pension payments. PEIPP are basic schemes but they will only complement existing ones at the local level. They should stimulate the creation of a functioning market for voluntary pension investments that are accessible and managed at EU level. PEIPP will complement existing occupational schemes in the countries without replacing them They will satisfying people who seek to achieve a higher retirement income. This could partially offset the demographic challenges facing EU countries, as well as provide long-term investment funds.

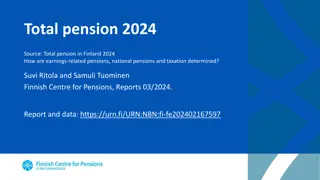

3. Infrastructure investments nature and diversity According to EU legislation long-term return on investment means non- transferable securities that do not have access to liquidity in secondary markets. The instruments suitable for long-term investment are: - infrastructure projects, - growth-seeking companies whose securities are not admitted to trading on a regulated market, - investments in real estate or other real assets that could be suitable for long-term investment. - Green infrastructure projects using low carbon emissions, - climate-neutral and socially responsible investments, - investments in energy efficiency, transport, healthcare, renewable energy, etc.

S Infrastructure investments Economic Social ENERGY AND SOCIAL TRANSPORT UTILITIES - Gas distribution and storage - Hospitals COMMUNICATIONS - Toll roads -Electricity distribution, - Schools - Bridges Transmission and generation -Cable networks - Tunnels - Social institutions (incl. Subsidized housing -Renewable energy - Satellite networks - Ports - Water treatment and -Mobile phone towers - Airports - Courts distribution - Railways - Prisons -Waste - Ferries - Stadiums management Source: ISSA

Big service costs infrastructure investments Long-lived physical assets Characteristics of Stable and predictable High entry barrears Inflationlinked cash flows Inelastic demand

4. Potential risks of the investments in infrastructure projects