Policy Rules and Economic Performance Analysis

Explore the relationship between policy rules and economic performance, delving into constrained discretion, Taylor rules, inflation targeting, dual mandate, and simulations with implications for current policy decisions and future perspectives.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

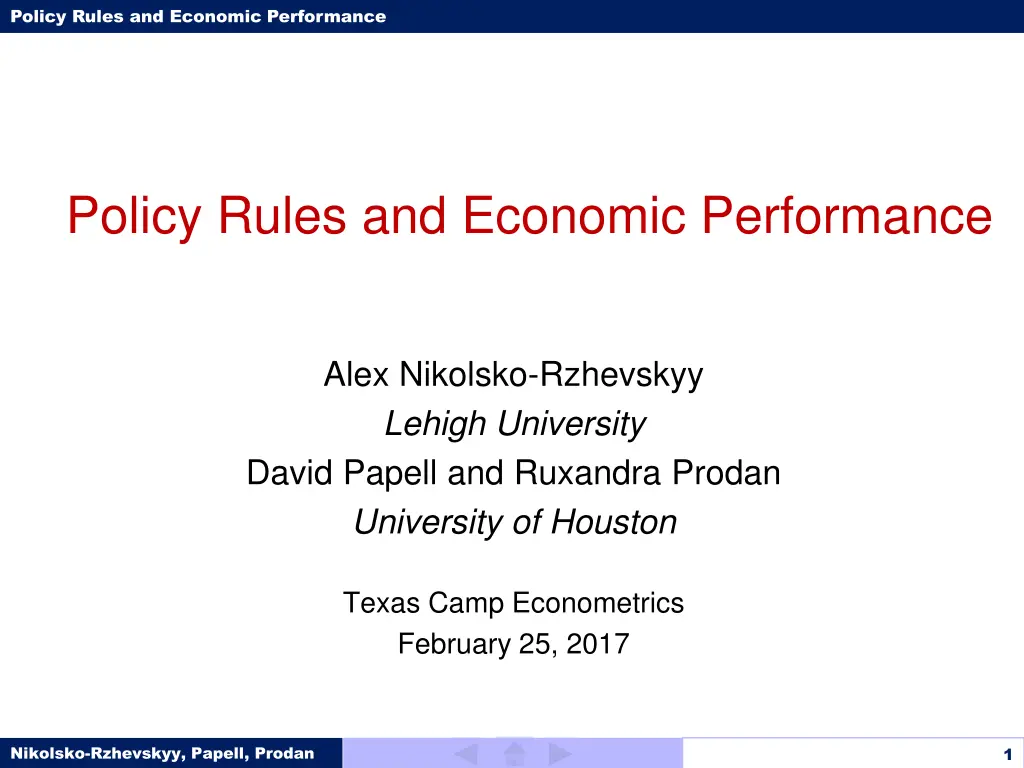

Policy Rules and Economic Performance Policy Rules and Economic Performance Alex Nikolsko-Rzhevskyy Lehigh University David Papell and Ruxandra Prodan University of Houston Texas Camp Econometrics February 25, 2017 Nikolsko-Rzhevskyy, Papell, Prodan 1 1 1

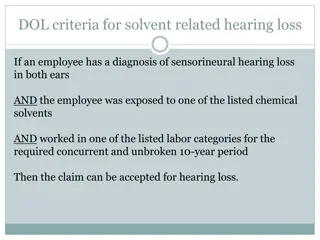

Policy Rules and Economic Performance Policy Rules and Constrained Discretion Monetary Policy Rules Friedman (1959) Sargent and Wallace (1975) Rules versus Discretion Kydland and Prescott (1977) Taylor Rule Taylor (1993) Constrained Discretion Bernanke (2003) Nikolsko-Rzhevskyy, Papell, Prodan 2

Policy Rules and Economic Performance Outline of the Paper Taylor Rules and Constrained Discretion Policy Evaluation with Quadratic Loss Ratios Perspectives Implications for Current Policy Conclusions Nikolsko-Rzhevskyy, Papell, Prodan 3

Policy Rules and Economic Performance Taylor Rules Balanced Coefficients - Taylor (1993) it = t + 0.5 ( t 2.0) + 0.5 yt + 2.0 (or R*t) Output Gap Tilting - Yellen (2012) it = t + 0.5 ( t 2.0) + 1.0 yt + 2.0 (or R*t) Inflation Gap Tilting it = t + 1.0 ( t 2.0) + 0.5 yt + 2.0 (or R*t) Nikolsko-Rzhevskyy, Papell, Prodan 4

Policy Rules and Economic Performance Taylor Rules and Constrained Discretion Constrained Discretion as a Subset of Taylor Rules it = t + ( t ) + yt + R* it = + t + yt Constrained Discretion Inflation Target Taylor Principle > 0 so that > 1 Dual Mandate Nikolsko-Rzhevskyy, Papell, Prodan 5

Policy Rules and Economic Performance Taylor Rules and Constrained Discretion Minimum Coefficients > 0 (Taylor Principle) and (Dual Mandate) Maximum Coefficients Theory: and Infinite if No Uncertainty About and y Ball (1994) and Boehm and House (2014) Simulations - Need to Include Variance of Interest Rate Changes to Avoid Extreme Values of and Nikolsko-Rzhevskyy, Papell, Prodan 6

Policy Rules and Economic Performance Taylor Rules and Constrained Discretion Tension Between Theory, Simulation, and Estimation Optimal and in Taylor and Wieland (2012) 1.04 and 0.26 in Smets and Wouters (2007) higher in CEE (2005) and Taylor (1993) Models Optimal and in Tetlow (2015) 0.53 and 1.17 for FRB-US Model (October 2007) Estimated and 0.53 and 0.77 in Taylor (1989) 0.39 and 0.92 in Rudebusch (2006) Nikolsko-Rzhevskyy, Papell, Prodan 7

Policy Rules and Economic Performance Rules and Fed Policy Real-Time Data Available to FOMC Philadelphia Fed RTDSM: 1965:Q4 2015:Q4 GDP (GNP) and GDP (GNP) Deflator Inflation Quadratic Detrended Output Gaps (Shadow) Federal Funds Rate after 2008 Equilibrium Real Interest Rates Trend Growth Laubach and Williams (2003, 2015) Holston, Laubach, and Williams (2016) Nikolsko-Rzhevskyy, Papell, Prodan 8

Policy Rules and Economic Performance Correspondence Between Rules and Fed Policy Consider all Rules with and between 0 and 2 Step Size Equals 0.1 * = R* = 2 Low Deviations < 2.0 High Deviations > 2.0 2.0 Based on Structural Change Tests Calculate Share of Time in the Rules-Based Regime Nikolsko-Rzhevskyy, Papell, Prodan 9

Policy Rules and Economic Performance Share in Time : 400 Policy Rules, Threshold = 2% and R*=2% 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 2.0 0.39 0.41 0.38 0.39 0.41 0.42 0.40 0.38 0.39 0.37 0.36 0.30 0.29 0.27 0.25 0.28 0.28 0.28 0.28 0.26 2.0 2.0 0.39 0.41 0.39 0.41 0.43 0.43 0.42 0.39 0.39 0.38 0.36 0.31 0.29 0.27 0.28 0.29 0.29 0.29 0.29 0.27 1.9 1.9 0.41 0.41 0.41 0.44 0.44 0.42 0.42 0.42 0.41 0.39 0.38 0.32 0.30 0.30 0.30 0.29 0.30 0.31 0.29 0.27 1.8 1.8 0.43 0.43 0.43 0.45 0.45 0.42 0.41 0.43 0.41 0.41 0.39 0.33 0.32 0.32 0.31 0.30 0.31 0.30 0.31 0.30 1.7 1.7 0.43 0.44 0.43 0.45 0.48 0.45 0.43 0.43 0.42 0.42 0.41 0.36 0.34 0.32 0.32 0.32 0.32 0.34 0.32 0.30 1.6 1.6 0.45 0.45 0.47 0.47 0.48 0.47 0.46 0.46 0.44 0.43 0.42 0.38 0.36 0.35 0.36 0.33 0.34 0.33 0.31 0.28 1.5 1.5 Inflation gap coefficient, 0.46 0.46 0.48 0.48 0.51 0.49 0.49 0.49 0.46 0.44 0.45 0.40 0.38 0.36 0.35 0.34 0.34 0.34 0.30 0.28 1.4 1.4 0.49 0.49 0.49 0.49 0.53 0.52 0.51 0.50 0.47 0.47 0.47 0.42 0.38 0.38 0.36 0.35 0.34 0.33 0.30 0.28 1.3 1.3 0.51 0.51 0.50 0.51 0.55 0.54 0.53 0.51 0.50 0.49 0.48 0.42 0.41 0.39 0.37 0.35 0.34 0.32 0.30 0.28 1.2 1.2 0.51 0.55 0.53 0.53 0.56 0.56 0.54 0.53 0.52 0.51 0.48 0.45 0.42 0.39 0.38 0.36 0.35 0.34 0.31 0.28 1.1 1.1 0.55 0.56 0.54 0.55 0.57 0.58 0.54 0.54 0.52 0.51 0.52 0.45 0.44 0.42 0.38 0.36 0.35 0.32 0.30 0.29 1.0 1.0 0.56 0.56 0.56 0.56 0.58 0.57 0.57 0.55 0.53 0.53 0.53 0.48 0.45 0.42 0.38 0.36 0.34 0.30 0.31 0.28 0.9 0.9 0.55 0.58 0.58 0.56 0.59 0.59 0.57 0.57 0.57 0.55 0.54 0.51 0.46 0.43 0.41 0.38 0.33 0.30 0.29 0.28 0.8 0.8 0.55 0.59 0.61 0.58 0.58 0.60 0.59 0.61 0.59 0.58 0.55 0.51 0.46 0.44 0.42 0.36 0.32 0.29 0.28 0.27 0.7 0.7 0.55 0.58 0.61 0.57 0.58 0.60 0.61 0.61 0.59 0.57 0.54 0.50 0.46 0.43 0.39 0.35 0.32 0.30 0.29 0.27 0.6 0.6 0.56 0.59 0.59 0.58 0.59 0.62 0.63 0.62 0.59 0.60 0.55 0.51 0.46 0.43 0.37 0.35 0.32 0.30 0.27 0.26 0.5 0.5 0.56 0.59 0.61 0.61 0.62 0.63 0.65 0.63 0.62 0.58 0.56 0.50 0.46 0.41 0.37 0.35 0.32 0.29 0.28 0.26 0.4 0.4 0.58 0.60 0.63 0.64 0.63 0.65 0.65 0.64 0.62 0.59 0.58 0.51 0.45 0.41 0.36 0.34 0.32 0.30 0.27 0.26 0.3 0.3 0.58 0.61 0.65 0.68 0.68 0.71 0.68 0.65 0.63 0.60 0.56 0.52 0.43 0.39 0.36 0.33 0.31 0.29 0.27 0.27 0.2 0.2 0.56 0.62 0.64 0.69 0.67 0.69 0.67 0.63 0.62 0.56 0.54 0.49 0.42 0.38 0.36 0.33 0.32 0.30 0.27 0.27 0.1 0.1 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 2.0 Output gap coefficient, Nikolsko-Rzhevskyy, Papell, Prodan 10

Policy Rules and Economic Performance Taylor Rules and Constrained Discretion Plausible Policy Rules for Constrained Discretion 0 < 1, 0 < 1 Accords with Estimates Share in Time Smets and Wouters (2007) Policy Discussion in Yellen (2012) Nikolsko-Rzhevskyy, Papell, Prodan 11

Policy Rules and Economic Performance Policy Evaluation with Quadratic Loss Ratios Quadratic Loss Functions Loss = (( *)2 + (U U*)2) Different Weights on Inflation and Unemployment Loss Loss Independent of Policy Rule Loss Ratios for Each Policy Rule Loss in High Deviations Periods Divided by Loss in Low Deviations Periods Greater than One for a Good Rule Metric to Evaluate Policy Rules Higher Loss Ratio is Better Nikolsko-Rzhevskyy, Papell, Prodan 12

Policy Rules and Economic Performance Quadratic Loss Ratios Consider Plausible Rules with and between 0 and 1 Step Size Equals 0.1 Calculate Loss Ratios for High and Low Deviations Periods Benchmark Equal Weights on Inflation and Unemployment Loss * = R* = 2 Threshold for Deviations = 2.0 Policy Lag of 6 Quarters Robustness Nikolsko-Rzhevskyy, Papell, Prodan 13

Policy Rules and Economic Performance Discretion to Rules Loss Ratios 1:1 Weights, Threshold=2%, R*=2% and *=2%, 6-Quarter Lag Nikolsko-Rzhevskyy, Papell, Prodan 14

Policy Rules and Economic Performance Discretion-to-Rules Relative Loss Ratios for R*=2 Large Coefficient/ Small Coefficient Rules Inflation Gap Tilting/Output Gap Tilting Rules Higher Quadrant/Lower Quadrant Rules Equal Weights on Inflation and Unemployment Loss, Threshold = 2% Policy Lag = 6 quarters (Benchmark) Policy Lag = 4 quarters Policy Lag = 8 quarters 1.50*** 1.49*** 1.72*** 1.26*** 1.33*** 1.28*** 1.90*** 1.94*** 2.29*** Equal weights on Inflation and Unemployment Loss, Policy Lag = 6 quarters Threshold = 2.5% Threshold = 1.5% 1.79*** 1.24*** 1.31*** 1.17** 2.26*** 1.46*** Threshold = 2%, Policy Lag = 6 quarters 1.25:0.75 Inflation and Unemployment Loss Weights 1.5:0.5 Inflation and Unemployment Loss Weights 0.75:1.25 Inflation and Unemployment Loss Weights 0.5:1.5 Inflation and Unemployment Loss Weights 1.64*** 1.75*** 1.34*** 1.15** 1.30*** 1.32*** 1.22*** 1.17** 2.12*** 2.33*** 1.64*** 1.34*** Nikolsko-Rzhevskyy, Papell, Prodan 15

Policy Rules and Economic Performance Discretion to Rules Loss Ratios 1:1 Weights, Threshold=2%, R*=Trend Growth and *=2, 6-Quarter Lag Nikolsko-Rzhevskyy, Papell, Prodan 16

Policy Rules and Economic Performance Discretion-to-Rules Relative Loss Ratios for R*=Trend Growth Large Coefficient/ Small Coefficient Rules Inflation Gap Tilting/Output Gap Tilting Rules Higher Quadrant/Lower Quadrant Rules Equal Weights on Inflation and Unemployment Loss, Threshold = 2% Policy Lag = 6 quarters (Benchmark) Policy Lag = 4 quarters Policy Lag = 8 quarters 1.45*** 1.41*** 1.55*** 1.40*** 1.43*** 1.38*** 1.99*** 1.99*** 2.08*** Equal weights on Inflation and Unemployment Loss, Policy Lag = 6 quarters Threshold = 2.5% Threshold = 1.5% 1.77*** 1.23** 1.34*** 1.74*** 2.40*** 2.07*** Threshold = 2%, Policy Lag = 6 quarters 1.25:0.75 Inflation and Unemployment Loss Weights 1.5:0.5 Inflation and Unemployment Loss Weights 0.75:1.25 Inflation and Unemployment Loss Weights 0.5:1.5 Inflation and Unemployment Loss Weights 1.60*** 1.73*** 1.29*** 1.11*** 1.52*** 1.63*** 1.28*** 1.15*** 2.34*** 2.69*** 1.64*** 1.27*** Nikolsko-Rzhevskyy, Papell, Prodan 17

Policy Rules and Economic Performance Discretion to Rules Loss Ratios 1:1 Weights, Threshold=2%, R*=LW and *=2, 6-Quarter Lag 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.0 2.64 2.60 2.86 2.88 2.77 2.99 2.83 3.46 2.95 2.53 1.0 0.9 2.65 2.68 2.66 2.83 2.57 3.09 2.75 2.35 2.07 2.87 0.9 0.8 2.63 2.73 2.54 2.47 2.51 2.38 2.71 2.50 2.43 2.14 0.8 Inflation gap coefficient, 0.7 2.42 2.43 2.42 2.17 2.18 2.24 2.07 2.27 2.25 1.96 0.7 0.6 2.09 2.16 2.36 2.35 2.26 2.15 2.29 2.54 2.46 2.12 0.6 0.5 1.94 2.02 2.30 2.20 2.12 1.86 1.75 1.69 1.63 1.56 0.5 0.4 1.66 1.73 1.83 1.96 1.86 1.81 1.73 1.57 1.37 1.35 0.4 0.3 1.62 1.79 1.80 1.82 1.82 1.74 1.69 1.43 1.16 1.04 0.3 0.2 1.63 1.83 1.94 1.95 1.80 1.57 1.47 1.13 0.85 0.80 0.2 0.1 1.45 1.53 1.66 1.74 1.71 1.53 1.35 1.12 0.95 0.86 0.1 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 Output gap coefficient, Nikolsko-Rzhevskyy, Papell, Prodan 18

Policy Rules and Economic Performance Discretion-to-Rules Relative Loss Ratios for R*=LW Large Coefficient/ Small Coefficient Rules Inflation Gap Tilting/Output Gap Tilting Rules Higher Quadrant/Lower Quadrant Rules Equal Weights on Inflation and Unemployment Loss, Threshold = 2% Policy Lag = 6 quarters (Benchmark) Policy Lag = 4 quarters Policy Lag = 8 quarters 1.44*** 1.39*** 1.47*** 1.22*** 1.22*** 1.19*** 1.68*** 1.64*** 1.66*** Equal weights on Inflation and Unemployment Loss, Policy Lag = 6 quarters Threshold = 2.5% Threshold = 1.5% 1.79*** 1.22*** 1.01 1.42*** 1.74*** 1.68*** Threshold = 2%, Policy Lag = 6 quarters 1.25:0.75 Inflation and Unemployment Loss Weights 1.5:0.5 Inflation and Unemployment Loss Weights 0.75:1.25 Inflation and Unemployment Loss Weights 0.5:1.5 Inflation and Unemployment Loss Weights 1.56*** 1.67*** 1.30*** 1.14*** 1.30*** 1.39*** 1.14*** 1.06** 1.93*** 2.19*** 1.44*** 1.20*** Nikolsko-Rzhevskyy, Papell, Prodan 19

Policy Rules and Economic Performance Discretion to Rules Loss Ratios 1:1 Weights, Threshold=2%, R*=HLW and *=2, 6-Quarter Lag Nikolsko-Rzhevskyy, Papell, Prodan 20

Policy Rules and Economic Performance Discretion-to-Rules Relative Loss Ratios for R*=HLW Large Coefficient/ Small Coefficient Rules Inflation Gap Tilting/Output Gap Tilting Rules Higher Quadrant/Lower Quadrant Rules Equal Weights on Inflation and Unemployment Loss, Threshold = 2% Policy Lag = 6 quarters (Benchmark) Policy Lag = 4 quarters Policy Lag = 8 quarters 1.49*** 1.44*** 1.54*** 1.03 1.18*** 0.88 1.47*** 1.64*** 1.31*** Equal weights on Inflation and Unemployment Loss, Policy Lag = 6 quarters Threshold = 2.5% Threshold = 1.5% 1.78*** 1.33*** 1.11 1.13** 1.98*** 1.45*** Threshold = 2%, Policy Lag = 6 quarters 1.25:0.75 Inflation and Unemployment Loss Weights 1.5:0.5 Inflation and Unemployment Loss Weights 0.75:1.25 Inflation and Unemployment Loss Weights 0.5:1.5 Inflation and Unemployment Loss Weights 1.63*** 1.75*** 1.32*** 1.13*** 1.05 1.07 1.01 0.98 1.62*** 1.76*** 1.29*** 1.09*** Nikolsko-Rzhevskyy, Papell, Prodan 21

Policy Rules and Economic Performance Discretion to Rules Loss Ratios 1:1 Weights, Threshold=2%, R*=2% and *=2, 6-Quarter Lag, Unemployment-based output gap Nikolsko-Rzhevskyy, Papell, Prodan 22

Policy Rules and Economic Performance Discretion-to-Rules Relative Loss Ratios for the Unemployment Gap Inflation Gap Tilting/ Unemployment Gap Tilting Rules Large Coefficient/ Small Coefficient Rules Higher Quadrant/Lower Quadrant Rules Equal Weights on Inflation and Unemployment Loss, Threshold = 2%, R*=2% Policy Lag = 6 quarters (Benchmark) Policy Lag = 4 quarters Policy Lag = 8 quarters Equal weights on Inflation and Unemployment Loss, Policy Lag = 6 quarters, R*=2% Threshold = 2.5% Threshold = 1.5% Threshold = 2%, Policy Lag = 6 quarters, R*=2% 1.25:0.75 Inflation and Unemployment Loss Weights 1.5:0.5 Inflation and Unemployment Loss Weights 0.75:1.25 Inflation and Unemployment Loss Weights 0.5:1.5 Inflation and Unemployment Loss Weights 1.46*** 1.33*** 1.82*** 1.32*** 1.49*** 1.33*** 1.89*** 1.93*** 2.41*** 1.64*** 1.32*** 1.26*** 1.32*** 1.93*** 1.75*** 1.61*** 1.74*** 1.29*** 1.10*** 1.35*** 1.37*** 1.29*** 1.24*** 2.11*** 2.31*** 1.64*** 1.36*** Equal Weights on Inflation and Unemployment Loss, Threshold = 2%, Policy Lag = 6 quarters R* = Trend Growth R* = LW R* = HLW 1.81*** 1.63*** 1.61*** 1.35*** 1.22*** 1.35*** 2.51*** 1.94*** 2.12*** Nikolsko-Rzhevskyy, Papell, Prodan 23

Policy Rules and Economic Performance Perspectives Rules with Higher Weight on Inflation Produce Better Outcomes than Rules with Higher Weight on the Output Gap Theory Woodford (2003) Optimal Taylor Rule Depends on All Parameters Particular Specification (Page 531) Coefficient on > Coefficient on y in Taylor Rule iff Coefficient on Expected > Coefficient on y in NKPC Accords with Mavroeidis, Plagborg-Moller and Stock (2014) Survey of NKPC Estimates Nikolsko-Rzhevskyy, Papell, Prodan 24

Policy Rules and Economic Performance Perspectives More Theory Boehm and House (2014) Optimal Taylor Rules Results when and y Observed with Error = 1.0 and = 0.61 for Baseline Calibration Close to our Baseline Maximum Loss Ratio = 1.0 and = 0.7 Result that > is Robust to Different Parameters Contrast with Ball (1999) Old Keynesian Model with Backward-Looking PC Fed Should Put Higher Weight on y than on Nikolsko-Rzhevskyy, Papell, Prodan 25

Policy Rules and Economic Performance Perspectives Laubach and Williams (2015) Estimates of Equilibrium R* and Output Gap Large Uncertainty Taylor Rule R* Affects Intercept Point-for-Point Place Less Weight on Uncertain Intercept and Output Gap Higher Coefficient on the Inflation Gap Accords with our Results Nikolsko-Rzhevskyy, Papell, Prodan 26

Policy Rules and Economic Performance Perspectives Simulation of Smets and Wouters (2007) Optimal in Plausible Range Optimal in Taylor (1999) and CEE (2005) too Large Calculate Loss Functions for Policy Rules ???? = ??? ? + ??? y + ??? ? and between 0.1 and 1.0 Equal Weight on Variance of , y, and i in Loss Function Lower Loss with > in Policy Rule Nikolsko-Rzhevskyy, Papell, Prodan 27

Policy Rules and Economic Performance Smets and Wouters (2007) model 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 1 29.97 29.45 29.40 29.76 30.46 31.45 32.69 34.15 35.80 37.61 1 0.9 29.94 29.48 29.58 30.14 31.08 32.36 33.91 35.70 37.68 39.84 0.9 0.8 29.95 29.60 29.89 30.72 32.00 33.64 35.59 37.79 40.20 42.78 0.8 Inflation gap coefficient, 0.7 30.03 29.83 30.41 31.62 33.34 35.47 37.94 40.67 43.62 46.73 0.7 0.6 30.23 30.27 31.28 33.02 35.36 38.16 41.31 44.74 48.38 52.18 0.6 0.5 30.62 31.07 32.72 35.27 38.49 42.22 46.32 50.68 55.23 59.90 0.5 0.4 31.38 32.56 35.26 39.05 43.59 48.66 54.07 59.69 65.44 71.23 0.4 0.3 32.95 35.51 40.06 45.87 52.45 59.49 66.76 74.10 81.41 88.62 0.3 0.2 36.69 42.21 50.23 59.51 69.35 79.32 89.17 98.76 107.99 116.84 0.2 0.1 48.82 61.39 76.24 91.45 106.16 120.02 132.92 144.85 155.85 165.99 0.1 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 Output gap coefficient, Nikolsko-Rzhevskyy, Papell, Prodan 28

Policy Rules and Economic Performance Fed Policy Consider Plausible Rules with and between 0 and 1 * = R* = 2 Rules-Based if Deviations < 2.0 Discretionary if Deviations > 2.0 Calculate Share of Time in the Rules-Based Regime Fed Policy Tilted Towards Output Gap Stabilization Nikolsko-Rzhevskyy, Papell, Prodan 29

Policy Rules and Economic Performance Share in Time: 100 Policy Rules, Threshold = 2% and R* = 2% Nikolsko-Rzhevskyy, Papell, Prodan 30

Policy Rules and Economic Performance Fed Policy Does Not Respond Strongly to Inflation Share in Time with R* = 2 Top Quintile 12 of 21 Policy Rules Have = 0.1 or 0.2 Economic Performance Worse in Low Deviations Periods Similar for R* = Trend Growth Don t Calculate for R* = LW or HLW because Rates Revised Nikolsko-Rzhevskyy, Papell, Prodan 31

Policy Rules and Economic Performance FRB-US Model Current Vintage of FRB-US Model Calculate Loss Functions with and between 0 and 1 Zero and No Zero Lower Bound Fixed and Time-Varying Equilibrium Real Interest Rate Nikolsko-Rzhevskyy, Papell, Prodan 32

Policy Rules and Economic Performance FRB-US Model: Zero bound on the nominal interest rate and R*=2% 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 1 70.54 68.39 66.60 65.14 63.97 63.05 62.36 61.88 61.57 61.44 1 0.9 70.04 67.86 66.05 64.58 63.40 62.49 61.80 61.33 61.04 60.92 0.9 0.8 69.57 67.36 65.52 64.04 62.85 61.95 61.27 60.81 60.53 60.42 0.8 Inflation gap coefficient, 0.7 69.13 66.88 65.02 63.52 62.33 61.43 60.76 60.31 60.04 59.95 0.7 0.6 68.72 66.42 64.53 63.02 61.83 60.93 60.28 59.83 59.58 59.50 0.6 0.5 68.34 65.99 64.08 62.55 61.36 60.46 59.82 59.39 59.15 59.09 0.5 0.4 67.99 65.59 63.65 62.10 60.91 60.02 59.39 58.97 58.75 58.70 0.4 0.3 67.67 65.22 63.25 61.69 60.50 59.61 58.98 58.58 58.37 58.33 0.3 0.2 67.39 64.88 62.88 61.31 60.11 59.23 58.61 58.22 58.02 58.00 0.2 0.1 67.14 64.58 62.54 60.96 59.76 58.88 58.27 57.89 57.71 57.69 0.1 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 Output gap coefficient, Nikolsko-Rzhevskyy, Papell, Prodan 33

Policy Rules and Economic Performance Current Policy Suppose the Fed Rule were to Adopt a Policy Rule Legislated or Voluntary Benchmark to Explain Deviations Yellen 2012 and 2015 Speeches One of the 400 Policy Rules in the Paper 100 Rules Times 4 Equilibrium Real Interest Rates Which Rule Should the Fed Choose? Look at Rules Discussed in Policy Circles Not Trying to Pick an Optimal Rule Nikolsko-Rzhevskyy, Papell, Prodan 34

Policy Rules and Economic Performance Current Policy Three Criteria Produce Good Economic Performance Inflation Gap Tilting Rather than Output Gap Tilting Eliminates Yellen (2012) Rule Consistent with Fed Policy Since Financial Crisis Eliminates Taylor (1993) Consistent with Fed Policy Going Forward Eliminates Taylor (1993) and Yellen (2012) Yellen (2015) Consistent with (2) and (3) Yellen (2015) with Inflation Tilting Consistent with all Criteria Nikolsko-Rzhevskyy, Papell, Prodan 35

Policy Rules and Economic Performance Conclusions Monetary Policy Evaluation with Taylor Rules We Propose Outcomes-Based Measure of Rules Economic Performance after 1 2 Years Rules Consistent with Constrained Discretion Higher Coefficient on Inflation than Output Gap Produces Better Results Accords with Theory and Model Simulations The Fed Should Constrain Constrained Discretion Nikolsko-Rzhevskyy, Papell, Prodan 36