Potential German Tax Liability Information

German Tax Authority guidelines for U.S. military and civilian personnel in Germany under the Status of Forces Agreement (SOFA). Topics include taxable income, double taxation risks, and individual tax situations. Residents must be aware of their tax obligations. Seek expert advice for effective tax planning.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

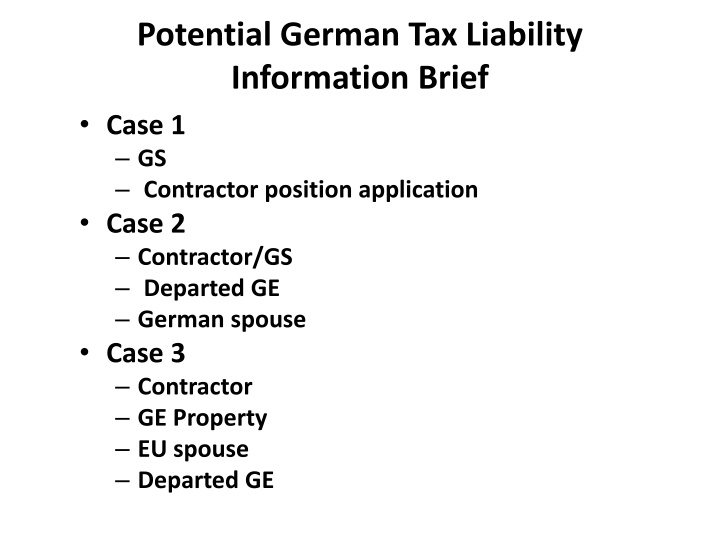

Potential German Tax Liability Information Brief Case 1 GS Contractor position application Case 2 Contractor/GS Departed GE German spouse Case 3 Contractor GE Property EU spouse Departed GE

U.S military and civilian support personnel and the German Tax Authority (GTA) Status of Forces Agreement (SOFA) applicability U.S. military personnel and immediate family Member of U.S. civilian support staff (e.g., GS/Contractors) Typically, these persons are not subject to German income tax if: They reside in Germany under SOFA They, during residency in Germany, can exhibit a permanent intention to leave Germany

U.S military and civilian support personnel and the German Tax Authority (GTA) If SOFA is applicable, wages are only taxable in U.S. Other German income may be taxable SOFA may NOT be applicable if: If personal circumstances change (e.g., personal relationships, residences etc.) GTA determines an individual has given up his/her Permanent Intention to leave Germany => unlimited tax liability in Germany all worldwide income sources are subject to unlimited tax liability in Germany

U.S military and civilian support personnel and the German Tax Authority (GTA) Double Taxation (secondary potential risk) U.S. IRS and GTA disagreement of SOFA application Potential tax liability in both states Resolution application of the double tax treatment 2007: wages normally are only taxable in the U.S. exception: if a person will reside for private reasons in Germany at the beginning of the work as a GS/contractor Germany is only allowed to tax the wages

Tax Situation in Germany Each case is individual Active Duty, GS, Contractors and Retirees need to understand their individual circumstances Seek expert advice and, if necessary, support when? Prior to making your decision to reside in Germany at the beginning of your work in Germany If you already reside in Germany and receive a notification from the German Tax Authority (e.g., Finanzamt) If you are a current GS or Contractor and receive a notification from the German Tax Authority

Tax Situation in Germany What about U.S. Government retirement payments?: Retirement payments from the U.S. Government are only taxable to the U.S. (exception: if the person has only worked in Germany and not in another country as a employee of the U.S. Government) Other income streams will have tax issues with the GTA e.g., Social Security, IRAs etc. In the case of marriage and German residence you will be required to submit German Common Tax Return to the GTA annually Retirement payments may influence German tax rates

Tax Assistance If you or others need advice or are being confronted with a tax issue we will provide a free confidential consultation to U.S. Personnel Contact information: Dr .Daiber & Partner Stuttgart mbB Florian Sch fer Eichwiesenring 11 70567 Stuttgart Tel. + 49 (0) 711 687 94 737 f.schaefer@daiberpartner.de

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)