Preparation of Profit and Loss Account for Business Analysis

Learn how to prepare a profit and loss account to determine the net profit or loss of a business for a specific accounting period. Follow the detailed steps and understand the different categories of expenses and revenue involved in creating a comprehensive profit and loss statement.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

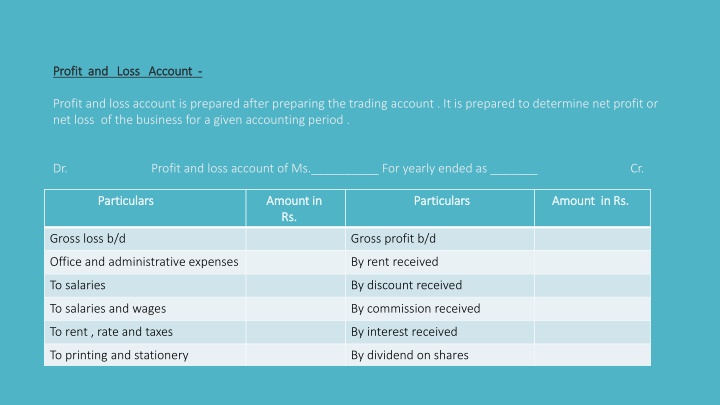

Profit and Loss Account Profit and Loss Account - - Profit and loss account is prepared after preparing the trading account . It is prepared to determine net profit or net loss of the business for a given accounting period . Dr. Profit and loss account of Ms.__________ For yearly ended as _______ Cr. Particulars Particulars Amount in Amount in Rs. Rs. Particulars Particulars Amount in Rs. Amount in Rs. Gross loss b/d Gross profit b/d Office and administrative expenses By rent received To salaries By discount received To salaries and wages By commission received To rent , rate and taxes By interest received To printing and stationery By dividend on shares

Particulars Particulars Amount in Rs. Amount in Rs. Particulars Particulars Amount in Rs. Amount in Rs. To unproductive wages By apprentice premium To postage By bad debts recovered To lightening , office lightening By profit on sale of assets To audit fees By interest on drawings To legal charges By miscellaneous receipt To telephone , mobile internet expenses By income from other sources To insurance premium By Net loss if any transferred to or deducted from capital account To travelling expenses To establishment expenses To trade expenses To General expenses

Particulars Particulars Amount in Rs. Amount in Rs. Particulars Particulars Amount in Rs. Amount in Rs. Selling and Distribution Expenses To carriage outward or carriage on sales To freight outward To advertisement To commission paid To export duty To packing charges To bad debts To delivery wan expenses To GST To Godown rent

Particulars Particulars Amount in Rs. Amount in Rs. Particulars Particulars Amount in Rs. Amount in Rs. Miscellaneous Expenses To Discount allowed To entertainment expenses To repair and renewal To depreciation To interest paid To convenience To donation and charity To Bank charges To loss on sale of fixed assets To loss by theft or fire To interest on capital To interest on loan To Net profit transferred to or added to capital account