Processing of Taxpayer Identification Number (TIN) Application Under BIR Regulations

This content outlines the detailed process for verification and issuance of TIN, online application procedures, and approval steps under the eONETT System, providing a comprehensive guide for taxpayers and officials alike.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

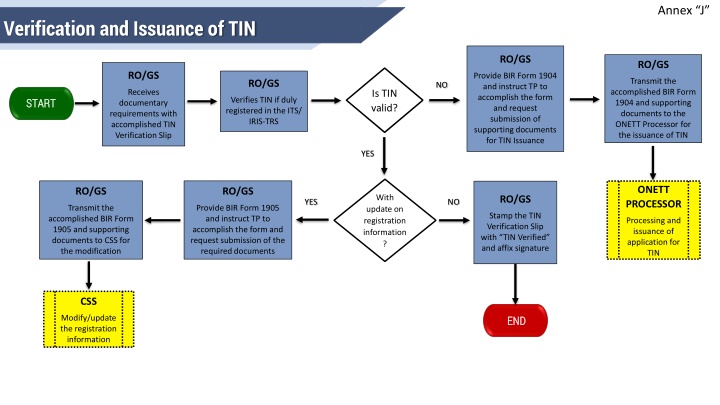

Annex J Verification and Issuance of TIN RO/GS RO/GS RO/GS Provide BIR Form 1904 and instruct TP to accomplish the form and request submission of supporting documents for TIN Issuance Transmit the accomplished BIR Form 1904 and supporting documents to the ONETT Processor for the issuance of TIN RO/GS NO Receives documentary requirements with accomplished TIN Verification Slip Is TIN valid? START START Verifies TIN if duly registered in the ITS/ IRIS-TRS YES ONETT PROCESSOR RO/GS RO/GS With update on registration information ? RO/GS YES NO Transmit the accomplished BIR Form 1905 and supporting documents to CSS for the modification Provide BIR Form 1905 and instruct TP to accomplish the form and request submission of the required documents Stamp the TIN Verification Slip with TIN Verified and affix signature Processing and issuance of application for TIN CSS END END Modify/update the registration information 1

Annex K Processing Of ONETT Under the eONETT System (Review of Application) Taxpayer A Fills out applicable information and accomplishes the Online Application Form Taxpayer Reads and agrees with Disclaimer by clicking the checkboxes START START Submits application Uploads/attach documentary requirements B System RO/GS Automatically computes tax and penalties Validates TIN and other pertinent information Forwards the application to the dashboard of the RO/GS Reviews the online OCS and documents submitted by TP RO/GS RO/GS Are documents complete and computation correct? No Forwards application to RDO/ARDO/CAS for approval by clicking the Submit button Yes 2 Returns application to TP for Compliance by clicking the Return to TP button 2

Annex K Processing Of ONETT Under the eONETT System (Approval of Application) TAXPAYER 2 Pays the tax due to any accredited payment channels of the BIR CAS/ARDO/RDO Are documents complete and computation correct? CAS/ARDO/RDO Yes Update status by clicking the Approve button Review/evaluate application Pays the convenience thru the available payment channels in the System Uploads and submits proof of payment No System System CAS/ARDO/RDO Generates Claim Slip for eCAR notifies TP generates OCS and applicable BIR Return Returns application to RO/GS for re-evaluation clicking the Return to RO/GS button &/or advise the same to return to TP for Compliance if needed Forwards application to the dashboard of the Collection Section for payment verification B COLLECTION SECTION Checks correctness of payment details and the uploaded proof of payment COLLECTION SECTION Returns application to TP for compliance A Are information correct and documents complete? Yes 3 or No COLLECTION SECTION 3 B Returns application to RO/GS for re-evaluation

Annex K Processing Of ONETT Under the eONETT System (Issuance of eCAR) TAXPAYER 3 Proceed to the RDO on the date indicated in the system-generated claim slip COLLECTION SECTION RO/GS RO/GS System Reviews/validates the original documents presented by TP if it matches the uploaded documents in the System Prints eCAR the system-generated eCAR Validate payment of tax due and updates status by clicking the Verified Payment button Generates eCAR for printing of BIR Users Present the claim slip together with the original and photocopies of uploaded documents to the RO/GS for validation RO/GS ONETT RELEASING/ CUSTODIAN Stamp the word USED in and indicate the eCAR Number in the proof of payment Are CAS/ARDO/RDO Yes documents correct and complete? END END Provide the Customer Satisfaction Survey Form/ Link/ QR Code to TP Affix signature in the printed eCAR Stamp/print the annotation (eCAR Number Issued, Date of Issuance and Name of Signatory) at the back of the transfer documents Release the eCAR to TP No RO/GS Require TP to submit the correct/complete documents or A 4 Refer to immediate Supervisor for evaluation

Processing of ONETT for Walk-in Taxpayers (ONETT Computation Sheet) Annex L a Officer-of-the-Day YES a Creates New OTS Transaction in the ONETT Tracking System Taxpayer Officer-of-the-Day Receives documentary requirements and verifies TIN if duly registered in the ITS/IRIS System Submits documentary requirements for OCS Officer-of-the-Day Is TIN valid? Accomplishes Checklist of Documentary Requirements (CDR) in the ONETT Tracking System indicating the requirements that have been complied with ONETT TIN Issuer Processing of Application for TIN NO Officer-of-the-Day Sets OCS Status to Pending for Submission of Requirements and print CDR indicating the required documents and inform TP to submit lacking requirement/s. Give printed CDR and submitted documents to TP Are the requirements complete? NO YES Officer-of-the-Day Officer-of-the-Day Sets OCS Status to CDR Complete and print CDR indicating the requirements that have been complied with. Officer-of-the-Day Gives printed CDR and OCS claim slip to TP YES b Sets OCS Status to For Computation of Tax Due Accomplish Routing Slip and attach to the docket Keeps photocopies of the submitted documents and stamp with VERIFIED FROM THE ORIGINAL 5

Processing of ONETT for Walk-in Taxpayers (ONETT Computation Sheet) Annex L b b ONETT Approver Officer-of-the- Day ONETT Approver b Sets OCS Status to For Ocular Inspection Sets OCS Status to For Recomputation Conduct Ocular Inspection Officer-of-the-Day YES YES Officer-of-the-Day Update Routing Slip and log sheet Computes Tax Due using the ONETT Computation Sheet (OCS) in the OTS. NO NO Need ocular inspection? RDO/ARDO/CAS Need additional requirements? For Forwards the complete documents together with CDR to ONETT Approver for review/approval/ updating of status recomputation of tax due? Reviews the CDR and OCS Sets Status to Review OCS after saving OCS YES ONETT Approver NO Sets OCS Status to For Additional Requirements a ONETT Approver Officer-of-the-Day Taxpayer Officer-of-the- Day Signs approved OCS. Release duplicate copy of approved OCS and Tax Return to the TP and inform TP to file using eBIRForms. Officer-of-the-Day Receives approved OCS and Tax Return. File thru eBIRForms before paying the computed tax due, CF and loose Doc. Stamp to any of the authorized payment channels of the BIR. Sets OCS Status in the system to Approved OCS . Instructs the taxpayer to accomplish the ONETT Customer Satisfaction Survey Form (CSSF) before the release of OCS Sets Status to Released OCS Require TP to pay Certification fee (CF) and loose Documentary Stamp to any of the following: AAB, RCO, and other payment channels Update routing slip and log sheet Update routing slip and forwards docket to Officer-of-the-Day. 6 END

Processing of ONETT for Walk-in Taxpayers (Electronic Certificate Authorizing Registration) Annex L Officer-of-the-Day Processing of ONETT Computation Sheet Sets eCAR Status to For Recomputation of Tax Due with Penalties NO Taxpayer Officer-of-the-Day Paid within the set due date? Officer-of-the-Day Submits documentary requirements for eCAR Retrieves OTS Transaction Info and fill-out eCAR Applications fields in ONETT Tracking System Receives documentary requirements Officer-of-the-Day Accomplishes Checklist of Documentary Requirements (CDR) in the ONETT Tracking System indicating the requirements that have been complied with YES Officer-of-the-Day Sets eCAR Status to Pending for Submission of Requirements and print CDR indicating the required documents and inform TP to submit lacking requirement/s. Give printed CDR and submitted documents to TP Are the requirements complete? NO YES Officer-of-the-Day Officer-of-the-Day Officer-of-the-Day Officer-of-the-Day Sets eCAR Status to CDR Complete Print CDR indicating the requirements that have been complied with. Give printed CDR and eCAR claim slip to TP Sets status to Issued Claim Clip . Sets Status to For Verification of Payment Update routing slip 2 Validates the submitted Approved ONETT Computation Sheet (OCS) Forwards docket to to Collection Section 7

Processing of ONETT for Walk-in Taxpayers (Electronic Certificate Authorizing Registration) Annex L 2 ONETT Encoder ONETT Payment Verifier ONETT Encoder ONETT Encoder Receives docket from Collection Section. ONETT Encoder Processing and Generation of eCAR using the eCAR System Sets status to For Processing of eCAR in the ONETT Tracking System Encodes Transaction and eCAR Number in the OTS Accomplish routing slip and log sheet Verification of Payment ONETT Approver ONETT Encoder ONETT Encoder ONETT Encoder ONETT Approver Sets Status to Approved eCAR Stamps the transfer documents to indicate the eCAR Number/s issued and date of issuance Write the eCAR Number under the stamp USED in the proof of payment Review/ sign/ approve the eCAR Sets Status to eCAR for Signature Forwards docket to Encoder ONETT Encoder ONETT Encoder Releases eCAR to TP upon presentation of CS and filling-up of ONETT Survey Form before the release of eCAR Set status to Released eCAR Taxpayer END Receives eCAR Update routing slip and logsheet 8

Annex M Processing of ONETT Payment Verification O O N N L L I I N N E E eONETT System System will forward the application to the dashboard of the Collection Section for payment verification Check correctness of payment details and the uploaded documents in the proof of payment page/screen Update status by clicking Verified Payment Button END END Validate payment details based on the process provided in Item No. II.F. ONETT Tracking System W W A A L L K K - - I I N N Fill out the payment details in OCS Affix signature in the OCS Stamp the return with Payment Verified Stamp Used and affix signature on all copies of Proof of Payment Print and attach Proof of Payment verification in the docket Encode payment details and update the status in the OTS Update the Routing Slip by affixing initial, indicating the date of receipt and release Receive Docket from RO/GS 9 Forward the docket to ONETT Processor END END

Annex N Reissuance of Manual CAR/Reprinting of eCAR RO/GS Taxpayer RO/GS Are the requirements complete? START Verify if it is issued thru eCAR or eONETT System Submits documentary requirements as listed in Item II.G. 2.1 to 2.7 START Receives and checks completeness of documentary requirements YES NO Is it issued thru eCAR System? RO/GS YES Instruct TP to submit lacking requirement/s NO RO/GS ONETT Encoder Print the eCAR using the eONETT System Encodes and prints the eCAR in the eCAR System ONETT Encoder/ RO/GS ONETT Encoder RO/GS Taxpayer RDO/ARDO/CAS Forwards the complete documents together to the CAS/ARDO/RDO for approval Provides the Customer Satisfaction Survey Form/ Link/ QR Code before releasing the eCAR to TP END END Receives the eCAR Sign the printed eCAR 10