Profit Shifting & the Erosion of Tax & Wage in South Africa

The Lonmin example highlights the impact of profit shifting on tax revenues and local investments in South Africa. Through questionable practices like sales commissions and management fees, companies are able to reduce their taxable income, depriving the government of much-needed revenue. This erodes the tax base, impacting public services and economic development. The problem is larger than just tax evasion, affecting wages and local investments, ultimately hindering sustainable growth and development.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Profit Shifting & the erosion of the tax, wage, and local investment base in South Africa Dick Forslund, dick@aidc.org.za 1. 1

The Lonmin example shows the importance of questioning substance Shares Office with law firm, Appleby Services Western Metal Sales; Bermuda (Subsidiary of Lonmin Plc) Western Platinum Limited (Subsidiary of Lonmin Plc) ~R250mn/annum sales commissions But this is only 2% of revenue... Lonmin Management Services (Subsidiary of Lonmin Plc) ~R250mn/annum management fees Significant group- wide marketing fees paid to external providers Insurance (R?) to Lonmin Insurance Ltd Acquisition of worthless asset UK Head office 3

An owner of Samancor Chrome in South Africa (Superyatchfan.com) 4

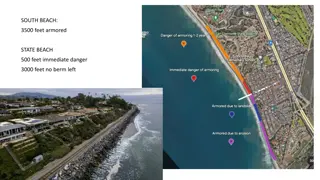

The problem is bigger than tax 1 2 At a corporate tax rate of 28%, you save R28mn . by removing revenue of R100mn 100 100 100 80 80 R28mn saved in tax; R100mn removed from the bargaining table and investment 60 60 R(mn) R(mn) 40 40 28 20 20 0 0 Tax Revenue Back 6