Proposed Operating Budget for FY24 - Key Updates and Impacts

Explore the FY24 proposed operating budget with key updates on funding sources, service level changes, COVID-19 service reductions, and budget impacts. Learn about the latest developments affecting urban transit services and potential budget implications for the upcoming fiscal year.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

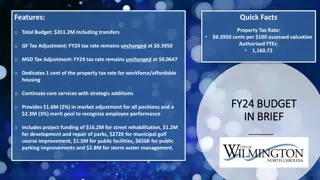

FY24 PROPOSED OPERATING BUDGET December 15th, 2022 1

Level VTRANS Federal Funding (Urban + Rural) Barre Urban Federal Funding = ARPA + Formula MicroTransit/Capstone Funding Not Included Current Service Levels Budgeted Rural System deficit funded with reserves Urban Fare Revenue FY24 KEY ITEMS 2

URBAN SERVICE LEVEL UPDATE 3

Service Change Timeline Date February 2020 Update The GMT Board approved going out to public process for service modifications on the #1 Williston, #2 Essex Junction, #6 Shelburne and #7 North Ave. routes. Temporary COVID-19 service reductions implemented The GMT Board approved service modifications on the #1 Williston, #2 Essex Junction, #6 Shelburne and #7 North Ave. routes (5,737.5 annual service hrs). Service modifications went into effect 20-minute midday service returns on the #1 Williston and #2 Essex Junction due to crowding concerns (4,000+ hrs.) March 2020 April 2020 June 2020 February 2021 June 2021 Remove color naming/interlining and transfer of Middlebury LINK Express COVID-19 suspended commuter and LINK Express service returns COVID-19 related service reductions on local and commuter/LINK Express routes go back into effect August 2021 March 2022 4

Remaining COVID-19 Service Reductions Combo #4 Essex Center and #10 Williston/Essex with 75-minute headways #1 Williston, #2 Essex Junction, #6 Shelburne, #7 North Avenue reduced service after 7PM from 30-minute headways to 60-minute headways (Monday-Friday), and 75-minute headways on Saturdays #9 Riverside/Winooski reduction of two evening trips #11 Airport (College Street) reduced headways from 30-minutes to 45-minute headways from 6AM-7:30PM, and 45-minute headways to 75-minute headways 7:30PM-10:45PM Barre LINK Express 5

Service Hours & Budget Impacts Budget impact estimated at $301.3K if service level was resumed 2 addition urban drivers would need to be added to current workforce 6

FEDERAL, STATE, & LOCAL FUNDING 8

Federal, State, and Local Revenues Urban 23% Local Match Budgeted Urban Local, $3,588,438 , 23% Budget includes $351.4K of ARPA Funds $2.3M of State Operating Funds budgeted Fed., State, and Local represents 87% of total urban budget Federal, State, $2,313,513 , 15% $9,613,177 , 62% Federal State Local 9

Urban Federal Grants Mix 5307 figure includes 5311 Flex Funds and allocation to ADA CMAQ allocation is based on $105 transit rate PM (Preventative Maintenance) includes additional 5307 programming of funds 10

Urban State & Local Grants Mix State Operating guidance represents a $100K reduction over FY23 FY24 Assessments raised an additional $226.8K 50% funding of ADA program remains a long- term fiscal challenge 11

URBAN 5307 FEDERAL GRANT BUDGET/OUTLOOK 12

Federal, State, and Local Revenues Rural Local funds represent 6% of total budget Fund balance figure results in a 4% budget deficit Fund Balance of $1.46M (as of FY21) available to support deficit 13

Federal & State Grants Mix Rural MyRide and Stowe Expansion routes shifted to CMAQ E&D returning to traditional 80/20 split State funding provided to support nonfederal match for 5311, CMAQ, and other Federal grants 14

OPERATING REVENUES 15

OPERATING REVENUE ADJ.S Programming of both fixed route and paratransit fare revenue represents largest change $369K of fare revenue forecasted from Unlimited Access Rural special trips revenue adjusted downward based on actuals 16

OPERATING EXPENSES 17

Salary & Fringe Driver and Maintenance compensation matches approved CBA s; seasonal service pay rates adjusted upward to account for mix of FT vs. Seasonal drivers Admin pay increases budgeted at 5% to account for inflationary environment and for retention; GM position budgeted; Admin headcount = 48 FTE s 18 Assist. GM position replacing Director of Transportation/I.T. Manager position removed Vacancy savings of 2% -3% budgeted for admin and maintenance workgroup Medical insurance budgeted to increase at historical growth rates

General & Admin Growth in Admin supplies tied to reinstatement of fares (cash- count expenses/credit card fees) 19 Computer Services increase due to 3rd party I.T. contract Insurance premiums expected to grow by 6% (ex. Flood insurance = 10%)

Operations & Planning No change in base allocation over FY23 Planning expenses includes local match for an Americorp Vista 20 CCRPC Planning Expense represents base amount for outsourced planning projects

Vehicle/BuildingMaintenance Urban Fuel budgeted at $4.25 per gallon (Diesel) Rural Fuel budgeted at $3.60 Rural parts expense normalized 21 Source: EIA

Contract, Marketing, & Other ADA expense growth tied to program demand and cost growth Reduction in Other Transportation from removal of Capstone funding Bus Tickets/Fare Media adjusted to account for reinstatement of fares Capital match expense matches approved FY24 Capital Budget 22

GMT Expense Profiles Urban Rural Marketing, $62,320 , 0% Contractors , $1,758,839 , 10% Marketing, $28,000 , 0% Salaries & Wages, $7,774,103 , 44% Other, $445,235 , 3% Other, $331,235 , 4% Salaries & Wages, $3,707,215 , 45% Contractors , $1,338,635 , 16% Vehicle & Building Maintenance , $2,627,247 , 15% Vehicle & Building Maintenance , $941,585 , 11% Planning, $104,200 , 1% Planning, $26,800 , 0% Operations, $36,300 , 0% Operations, $27,400 , 0% Personnel Taxes & Benefits, $3,408,496 , 19% Personnel Taxes & Benefits, $1,172,100 , 14% General & Administrative , $1,567,372 , 9% 23 General & Administrative , $748,605 , 9%

FY25 CHALLENGES Salary/Wage Pressures CBA s 5307 Overspending Run-off of COVID Relief Funds Medicaid (NEMT) Program Profitability Decreases in Operating Revenues (Fares) State Operating Funding Levels Capital Investment Health Insurance Inflation Demand for Local Funds ADA Cost Pressures Fuel Price Volatility 24

Questions? 25