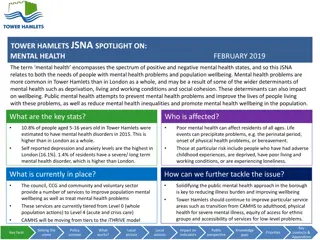

Protecting Civil Rights of Individuals with Mental Health Disabilities

The Bazelon Center for Mental Health Law works to safeguard the civil rights of adults and children with mental health and developmental disabilities. Through advocacy and legal action, they aim to address disparities in the treatment of individuals with mental health conditions, highlighting the need for community-based support over criminal enforcement. Learn about their mission, impactful initiatives, and solutions offered to enhance the well-being of those affected by mental health challenges.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Housing Markets: Setting the Scene Prakash Loungani International Monetary Fund Presentation at European Commission November 30, 2016 VIEWS EXPRESSED ARE THOSE OF THE PRESENTER AND SHOULD NOT BE ASCRIBED TO THE IMF.

Global House Price Index: Almost back to pre-crisis level 2

Time to worry again? Answer: A guarded no for five reasons Lack of synchronicity 1) 2) Not a synchronized global boom across countries Booms localized to a few cities in many countries Not an excessive credit -driven boom 3) 4) Some booms due to supply constraints Low interest rates driving some of the appreciation No more benign neglect 5) Active use of macroprudential policies to tame booms 3

Three-track recovery Real House Price Index 2010Q1=100 Gloom Bust and Boom Boom 140 130 120 110 100 90 80 70 60 2000q1 2004q1 2008q1 2012q1 2016q1 Source: Bank for International Settlements, European Central Bank, Federal Reserve Bank of Dallas, Savills, and national sources 5

Countries in each cluster Bust and Boom Gloom Boom Bulgaria, Denmark, Estonia, Germany, Hungary, Iceland, Indonesia, Ireland, Japan, Latvia, Lithuania, Malta, New Zealand, Portugal, South Africa, Thailand, United Kingdom, and United States. Australia, Austria, Belgium, Canada, Chile, Colombia, Czech Republic, Hong Kong SAR, India, Israel, Kazakhstan, Korea, Malaysia, Mexico, Norway, Peru, Philippines, Slovak Republic, Sweden, Switzerland, and Taiwan POC. Brazil, China, Croatia, Cyprus, Finland, France, Greece, Italy, Macedonia, Morocco, Netherlands, Poland, Russia, Serbia, Singapore, Slovenia, Spain, and Ukraine. 6

Incidence of financial crisis Percent of countries experiencing a financial crisis: 2007-12 Average Output Loss: 2007-12, In percent 50 55 45 40 50 35 45 30 25 40 20 35 15 30 10 5 25 0 20 Gloom Bust and Boom Boom Gloom Bust and Boom Boom Output losses are computed as the cumulative sum of the differences between actual and trend real GDP over the period [T, T+3], expressed as a percentage of trend real GDP, with T the starting year of the crisis. Note: Financial crisis includes: systemic banking crisis, currency crisis, sovereign debt crisis, and sovereign debt restructuring Source: "Systemic Banking Crises Database: An Update" by Luc Laeven and Fabian Valencia (2012) Source: "Systemic Banking Crises Database: An Update" by Luc Laeven and Fabian Valencia (2012) 7

BOOMS LOCALIZED TO A FEW CITIES IN MANY CASES 8

China: boom or gloom? A long upward march Land prices, major drivers of house prices, have increased steadily over the past 15 years. 7 6 Index (2004Q1=1) 5 4 3 2 1 0 2004q1 2004q4 2005q3 2006q2 2007q1 2007q4 2008q3 2009q2 2010q1 2010q4 2011q3 2012q2 2013q1 2013q4 2014q3 2015q2 2016q1 Source: Deng Yongheng, Joe Gyourko, and Jin Wu (2015), "Chinese Housing Market: What We Know and What We Need to Know" 9

Booms in other cities Austria Netherlands Norway 240 120 250 Netherlands Amsterdam Norway Oslo Austria Vienna 220 230 110 200 210 100 180 190 160 90 170 140 150 80 120 130 70 100 110 80 60 90 2008.Q1 2010.Q1 2012.Q1 2014.Q1 2008.Q1 2010.Q1 2012.Q1 2014.Q1 2009.Q3 2012.Q3 2015.Q3 2000.Q1 2001.Q1 2002.Q1 2003.Q1 2004.Q1 2005.Q1 2006.Q1 2007.Q1 2009.Q1 2011.Q1 2013.Q1 2015.Q1 2016.Q1 2000.Q1 2001.Q1 2002.Q1 2003.Q1 2004.Q1 2005.Q1 2006.Q1 2007.Q1 2009.Q1 2011.Q1 2013.Q1 2015.Q1 2016.Q1 2005.Q1 2005.Q4 2006.Q3 2007.Q2 2008.Q1 2008.Q4 2010.Q2 2011.Q1 2011.Q4 2013.Q2 2014.Q1 2014.Q4 2016.Q2 Source: Haver Analytics Source: Haver Analytics Source: Haver Analytics 10

RICS Commercial Property Monitor for Cities 13

SOME BOOMS DUE TO SUPPLY CONSTRAINTS 14

Housing permits in each cluster Residential Building Permits Index, 2010Q1=100 390 Gloom Bust and Boom Boom 340 290 240 190 140 90 40 2000Q1 2004Q1 2008Q1 2012Q1 2016Q1 Source: Eurostat, Haver Analytics, and OECD 15

IMF references to supply constraints: Denmark (billions of Australian dollars) Supply conditions matter for house price developments. The analysis ( ) highlights the often-underestimated role of housing supply constraints in shaping local house prices in Danish cities. Cities such as Copenhagen where the stock of housing is relatively inflexible and responds slowly to changes in housing demand could see higher price growth ( ). 16

IMF references to supply constraints: Sweden House price booms in Sweden, as in many other countries, are a big city phenomenon ( ) Differences in housing supply conditions across cities contribute to such price divergences. Immigration inflows, rapid urbanization, and income growth have put pressures on the demand for housing in large cities. But the housing stock has also not expanded at a pace commensurate with that demand. 17

IMF references to supply constraints: Ireland Boosting the housing supply would help mitigate property price and rent pressures. The sluggish construction activity in recent years reflects the sector s downsizing after the bursting of the property market bubble in 2008-09 and the ensuing limited access to finance for companies. High construction costs due to strict planning requirements have also been a factor. 18

IMF references to supply constraints: Australia, Canada, France Australia: Housing supply does seem to have grown significantly slower than demand, reducing (but not eliminating) concerns about overvaluation. Canada: Montreal and Ottawa registered near zero [house price] growth over the last four quarters. Home sales have not been particularly strong suggesting that price increases may be due to supply constraints rather than demand factors. France: More could be done to alleviate structural rigidities in the housing market. Residential construction has fallen by 14 percent, and real house prices by 11 percent, since the peak in 2007. While this decline is partly cyclical, a succession of laws introducing regulatory and tax changes may also have contributed. (July 2015) 19

IMF references to supply constraints: Germany, Netherlands, Norway Germany: The strength of markets in the center of the largest cities, where supply restrictions are the tightest, also points to an important role of housing supply factors. (July 2014) Netherlands: Zoning regulations have constrained supply and contribute to its low price elasticity. In addition, tight zoning and other regulations have held back new developments. (December 2014) Norway: [IMF] staff would welcome new measures that could take some of the pressure off of housing prices by relaxing unneeded supply restrictions. 20

IMF references to supply constraints: United Kingdom Housing construction: ( ) rapid price increases reflect the impact of serious supply constraints Residential investment in the UK as a share of GDP is among the lowest across the OECD economies. The sluggish response of residential investment to a strong demand for housing is attributed to supply-side constraints restrictive planning regulations, in combination with inadequate incentives for local authorities to grant building permits (July 2014) House prices: House price increases in the UK stand out among the OECD economies. Over the past 30 years, real house prices have increased the most in the UK when compared with other OECD economies. Indeed, over this period, annual house price increases have averaged 3 percent in real terms, compared with 1 percent for the OECD as a whole. (July 2014) 21

Some perceptions about the role of foreign investors in real estate markets My fix for the [London] housing crisis: ban ownership by foreign non-residents Zoe Williams in The Guardian (June 22, 2015) What we have seen over three decades is a rise in house prices far beyond what people can afford. 75% of inner London housing is never shown on the UK market, going straight to mainly Asian investors. It has become so normal for housing to be sold abroad that to complain about it sounds old-fashioned, almost racist. However, when anybody from anywhere can buy a flat in your city, sooner or later the people who live and work in it won t be able to afford to. The solution could not be easier: we could ban the ownership of housing by foreign non-residents, as they do in Norway and Australia. 22

Top Foreign Buyers of U.S. Real Estate, by Type of Financing (percent of total) Type of Financing by Top 5 Buyers 90 All cash 80 With mortgage financing 70 60 50 40 30 20 10 0 Canada China United Kingdom Mexico India Source: National Association of Realtors 23

Chinese Purchases of Australian Residential Property (billions of Australian dollars) Source: Foreign Investment Review Board, Australian Department of Immigration, Australian Bureau of Statistics, Credit Suisse 24

LOW INTEREST RATES AND HOUSE PRICE APPRECIATION 25

House Prices and GDP Panel A Real GDP Growth and Real House Prices Growth 2000-2006 2010-2015 60 QAT 20 UKR Real House Price Growth in Percent Real House Price Growth in Percent LTU PER EST 40 HKG KAZ 10 IND MYS EST ISR TWN COL TUR ARE SWE LVA RUS NZL USA PHL AUT DEU JPN NOR CHE KAZ ISL THA GBR LVA MLT CANCHL LTU LUX MEX ZAF AUS KOR SVK BRA DNK TTO 20 ZAF IDN 0 BEL CZE FIN FRA PRT SVN ESP MAR SGP HUN CHN ESP EGY MKD IRL POL BGR FRA NLD SRB GBR CYP GRC SVK NZL DNK MLT NLD ITA SWE USA ISL IRL CYP AUS CAN FIN MKD CHE HRV NOR ROU BEL MEX HRV KOR MYS ITA GRC RUS VNM CHN BRA ISR THA COL HKG IDN PER 0 DEU JPN AUT SGP -10 SRB MAR UKR 0 5 10 15 -5 0 RGDP Growth 5 10 RGDP Growth Correlation: .56 Correlation: .56 26

House Prices and Credit Panel B Real Credit Growth and Real House Prices Growth 2000-2006 2010-2015 60 20 UKR Real House Price Growth in Percent Real House Price Growth in Percent LTU 40 HKG IND 10 MYS EST ISR SWE COL TUR RUS NZLNOR USA PHL AUT DEU JPNKOR ZAF CHE ISL LVA CAN THA GBR LUX MLT AUS BRA MEX SGP 20 ZAF IDN 0 BEL FRA FIN CHN SVK ESP IRL SVN ESP PRT FRA NZL SWE USA NLD GBR DNK ITA IRL ISL GRC NOR CYP AUS FIN ITA KOR MYSMEX SGP HRV GRC BEL CAN NLD CHE THA HRV RUS CHN BRA COL IDN HKG 0 DEU JPN AUT ISR -10 UKR 0 20 40 60 80 100 -10 0 10 20 30 Real Credit Growth Real Credit Growth Correlation: .81. Correlation: .37. 27

House Prices and Fiscal Balances Panel C Change in Fiscal Stance and Real House Prices Growth 2000-2006 2010-2015 60 20 Real House Price Growth in Percent Real House Price Growth in Percent LTU PER EST 40 HKG 10 IND MYS EST SWE ISR TUR COL PHL THA RUS NZL USA AUT CAN LVA LUX MLT MEX MAR ZAF NOR CHE KAZ ISL CHL IDN KOR AUS DEU JPN GBR LTU BRA 20 ZAF DNK 0 BEL FIN HUN CZE FRA SGP CHN SVK EGY ESP IRL BGR ITA PRT POL SVN FRA NLD SRB GBR SVK DNK SWE IRL ITA ISL MLT GRC AUS NOR HRV ESP CAN KOR NLD ROU BEL CHE FIN RUS GRC VNM MEX CHN COL MYS THA 0 DEU AUT SGP ISR JPN -10 PER MAR UKR -10 -5 0 5 -10 -5 0 5 10 General Government Primary Balance Change in % of GDP Correlation: -.05. General Government Primary Balance Change in % of GDP Correlation: -.34. 28

House Prices and Real Interest Rate Panel D Average Real IR and Real House Prices Growth 2000-2006 2010-2015 60 20 Real House Price Growth in Percent Real House Price Growth in Percent 40 HKG KAZ 10 IND MYS TUR ISR SWE TWN RUS NZL PHL AUT MLT GBR KAZ CHE THA NOR ISL CAN DEU USA CHL AUS IDN LUX BRA 20 MEX ZAF DNK KOR ZAF JPN 0 BEL EGY ITA CZE SVK FINFRA MAR CHN SGP HUN POL ESP IRL PRT FRA SWE NLD CYP DNK MLT USA NZL GBR SVK SVN ISL IRL SRB GRC CYP AUS FIN KOR MYS SGP HRV ESP NOR BEL CAN NLD CHE THA HRV ITA RUS GRC CHN MEX BRA HKG IDN MAR 0 AUT DEU ISR JPN -10 UKR -10 -5 0 5 10 -4 -2 0 2 4 Average Real Interest Rate Correlation: -.36. Average Real Interest Rate Correlation: -.11. 29

Drivers of house prices Independent Variable (1) (2) (3) Real GDP (growth) Working age population (growth) 0.3 0.1 0.2 0.1 0.1 Short-term interest rate House Price-to-income ratio (lagged) -0.4 -0.1 -0.5 -0.1 -0.6 -0.3 Credit (growth) Equity prices (growth) Fiscal balance (change) 0.1 0.06 0.1 0.00 -0.1 Constant 1.1 2.3 1.5 R-square Number of observations 0.28 3519 0.30 3148 0.39 2291 30

ACTIVE USE OF MACROPRUDENTIAL POLICIES 31

Use of macroprudential policies Number of macroprudential policies implemented and any subsequent tightening: 2007-16 25 Gloom Bust and Boom Boom 20 15 10 5 0 Limits on loan-to-value ratios Caps on debt-service- to-income ratios Sectoral capital requirements Source: International Monetary Fund 32

Denmark: Macroprudential Policy In view of the emerging risks, macroprudential policies need to play a primary role in safeguarding financial stability. ( ) As the Danish economy is still recovering from the last crisis, new measures must be carefully calibrated to balance the benefits of reduced financial stability risks against any negative short-run impact on growth. 33

Ireland: Macroprudential Policy Residential real estate (RRE) prices and rents continued to increase. Nevertheless, following the abolishment of tax exemptions on capital gains in December 2014 and the introduction of new macroprudential loan-to-value (LTV) and loan-to-income (LTI) limits in February 2015 ( ), the market somewhat cooled off: RRE price growth decelerated in late 2015 and the number of mortgage approvals temporarily declined 34

United Arab Emirates: Macroprudential Policy Real estate prices have continued to decline, but the quality of the real estate loan portfolio has remained resilient. Structural measures taken in 2014, such as the tightening of industry self-regulation, higher real estate fees, and tighter macroprudential regulation for mortgage lending, have helped contain speculative demand for real estate and led to declining prices. 36

United Kingdom: Macroprudential Policy Housing and mortgage markets have re-accelerated since mid-2015 ( ) However, the recent acceleration in housing markets could partly be a temporary response to tax changes ( ) Macroprudential policies will need to be tightened later this year if the acceleration does not prove temporary ( ) 37

Acknowledgments I am grateful to Hites Ahir for helping me put together this presentation, to Nathalie Gonzalez- Prieto for the empirical work on the drivers of global housing prices, and to Erlend Nier for providing the data on macroprudential policies. This presentation draws on work by the IMF s Global Housing Watch team at the IMF, which also includes Richard Koss, Grace Li and Alessandro Rebucci (Johns Hopkins University). I am grateful to the IMF Housing Markets group for their review of this document. 38