Protecting Distributed Infrastructure: Humans and Behavioral Economics

Security of large-scale systems relies on human decisions, often influenced by behavioral economics. This research explores how human perceptions impact decision-making in protecting interconnected systems against attacks.

Uploaded on Mar 12, 2025 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Learning about Protecting Distributed Infrastructure from Behavioral Economists Saurabh Bagchi ECE & CS, Purdue University Joint work with: ECE: Shreyas Sundaram, Mustafa Abdallah Economics: Tim Cason, Daniel Woods Supported by NSF SaTC grant CNS-1718637 (2017-20) 1

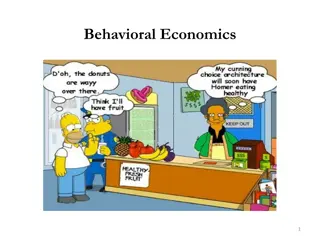

Security is Only Too Human Security of large-scale systems (such as the power grid, industrial plants, and communication and computer networks) depend critically on human decisions A few thousand papers on optimal decision making for protecting interconnected systems But relies on classical economic models of perfectly rational and optimal behavior for human decision- makers But behavioral economics shows humans are only partly rational and thus, consistently deviate from the above- mentioned classical models. 2

Behavioral Weighting Function Human perceptions of rewards and losses can differ substantially from their true values These perceptions can have a significant impact on the investments made to protect the systems that the individuals are managing. Humans overweight low attack probabilities and underweight large attack probabilities. Example: Prelec [1998] weighting function: ? ? = exp ln(?) where parameter 0,1 . 3

Whats Nobel Got to Do With It? Richard Thaler (2017 Economics Nobel Laureate): I discovered the presence of human life in a place not far, far away, where my fellow economists thought it did not exist: the economy. Daniel Kahneman (2002 Economics Nobel Laureate): Prospect theory as a model of decision making under risk, as a counterpoint to expected utility theory 4

Our Research Direction Game-theoretic framework involving attack graph models of large-scale interdependent systems and multiple defenders Each human defender misperceives the probabilities of successful attack in the attack graph We characterize impacts of such misperceptions on the security investments made by each defender Attacker A Defender 2 The cost of a defender ?? is: Defender 1 ??x ?? ?? ?? max ? ? ?(??,?(x)) ??,? ?? ?? ?? ??,?? ? Defender 3 5

Initial Observations Both games (vertex based and path based) have Convex cost function given a convex decreasing probability function Both games have a Pure Nash Equilibrium (PNE) state In each game, we can compute the best response by solving a convex optimization problem They have different investment decisions than standard security game which maximizes expected utility A rational player can benefit from a biased player Both players rational Player 2 biased 2.081 3 3 2 2 0 0 L2 = 200 0 L2 = 200 0 0 0 0 1 1 5 6 5 6 19.2 4 4 0 0 8.576 L1 = 200 L1 = 200 Overall Loss =18.1436 Overall Loss = 0.3616 6