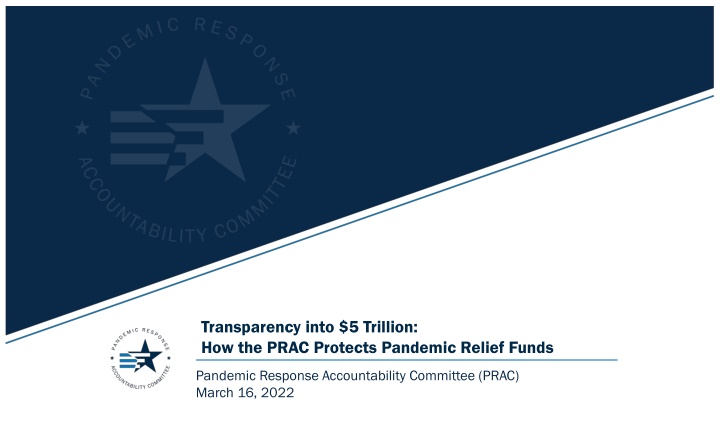

Protecting Pandemic Relief Funds: How the PRAC Ensures Transparency in Handling $5 Trillion

Discover how the Pandemic Response Accountability Committee (PRAC) oversees and safeguard $5 trillion in pandemic relief funds to protect against fraud and ensure accountability. Learn about the legislation, oversight measures, and tracking methods put in place to combat pandemic-related fraud and provide transparency.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Transparency into $5 Trillion: How the PRAC Protects Pandemic Relief Funds Pandemic Response Accountability Committee (PRAC) March 16, 2022

The PRAC oversees $5 trillion in pandemic relief $15.4B $7.8B The Families First Coronavirus Response Act Signed into law on March 18, 2020, the FFCR Act provided paid sick leave, tax credits, and free COVID-19 testing, while also expanding food assistance and unemployment benefits. The Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 Signed into law on March 6, 2020, the Act provided emergency funding to Health and Human Services, the State Department, and the Small Business Administration. $5+ Trillion $2.1T $1.9T The Coronavirus Aid, Relief, and Economic Security Act American Rescue Plan Act of 2021 Signed into law on March 11, 2021, this legislation includes direct payments, unemployment benefits, and tax provisions as well as support for small businesses and schools. Signed into law on March 27, 2020, the CARES Act created the Paycheck Protection Program, provided tax rebates to individuals, and provided relief to federal agencies. $900B $483B The Coronavirus Response and Relief Supplemental Appropriations Act, 2021 Paycheck Protection Program and Health Care Enhancement Act Signed into law on April 24, 2020, the Act added funds to the Paycheck Protection Program (PPP) and other SBA programs. Signed into law on December 27, 2020, this legislation extended federal unemployment benefits, provided direct payments to individuals, and started a second round of PPP loans. 2 PANDEMIC RESPONSE ACCOUNTABILITY COMMITTEE

U.S. pandemic relief spending in context 2009 0.861 Recovery Act FY19 4.45 Total Spending 2020-2021 Pandemic 5 $ in Trillions 3 PANDEMIC RESPONSE ACCOUNTABILITY COMMITTEE

Tracking the money on PandemicOversight.gov 4 PANDEMIC RESPONSE ACCOUNTABILITY COMMITTEE

Fighting pandemic-related fraud Pandemic Analytics Pandemic Analytics Center of Excellence Center of Excellence (PACE) (PACE) Identity Fraud Reduction Identity Fraud Reduction & Redress Working Group & Redress Working Group Fraud Task Force Fraud Task Force 1272 949 Arrests 455 Indictments Convictions 5 PANDEMIC RESPONSE ACCOUNTABILITY COMMITTEE

Connecting federal, state, and local oversight entities Regular listening posts meet monthly Participants include: o PRAC o State Auditors o Local Auditors o NASACT o GAO o Federal OIG Staffs o AICPA o OMB o Auditors for Tribes Discuss key issues or areas of priority Single Audit Requirements OMB Guidance Fraud Alerts and Early Warnings 6 PANDEMIC RESPONSE ACCOUNTABILITY COMMITTEE

Connecting with State Auditors: State Auditor-in-Residence WHAT: 6- to 12-month detail with the PRAC Work on cross-cutting projects Network with federal OIG staff Participate in subcommittee and other coordination meetings WHO: Piloting with 1 or 2 mid-level or senior auditor staff from state auditors offices on rotation 7 PANDEMIC RESPONSE ACCOUNTABILITY COMMITTEE

Identifying lessons learned and risks that cross agency and program boundaries The PRAC and its members have issued 360+ oversight reports. We've covered a lot and recommended a lot. Our new report breaks it all down to five basics. Our new report breaks it all down to five basics. 1. Verify eligibility before sending money 2. Give underserved communities better access to relief funds 3. Use existing data to prevent fraud 4. Get guidance out quickly and accurately 5. Let the public see who got grants and loans 8 PANDEMIC RESPONSE ACCOUNTABILITY COMMITTEE

Resources: Stakeholder Listening Sessions Did pandemic relief reach the underserved? You can watch video recaps of 9+ events at PandemicOversight.gov PandemicOversight.gov Receive invites right in your inbox by signing up for our email newsletters 9 PANDEMIC RESPONSE ACCOUNTABILITY COMMITTEE

Connect with the PRAC | Newsletter and Social Media Sign up for our emails and follow us on Twitter Subscribe example@website.com 10 PANDEMIC RESPONSE ACCOUNTABILITY COMMITTEE