Purpose and Business Entities

Explore the intersection of purpose and business entities, including nonprofit entities, members, beneficiaries, and economic outcomes. Delve into the trend towards purpose hybridization, balancing selfless and selfish entities, legal variations, and protection of third-party trust. Understand fundamental models, differences, and the focus on foundations as entrepreneurial tools, addressing challenges with oversight, public trust, and organizational autonomy.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

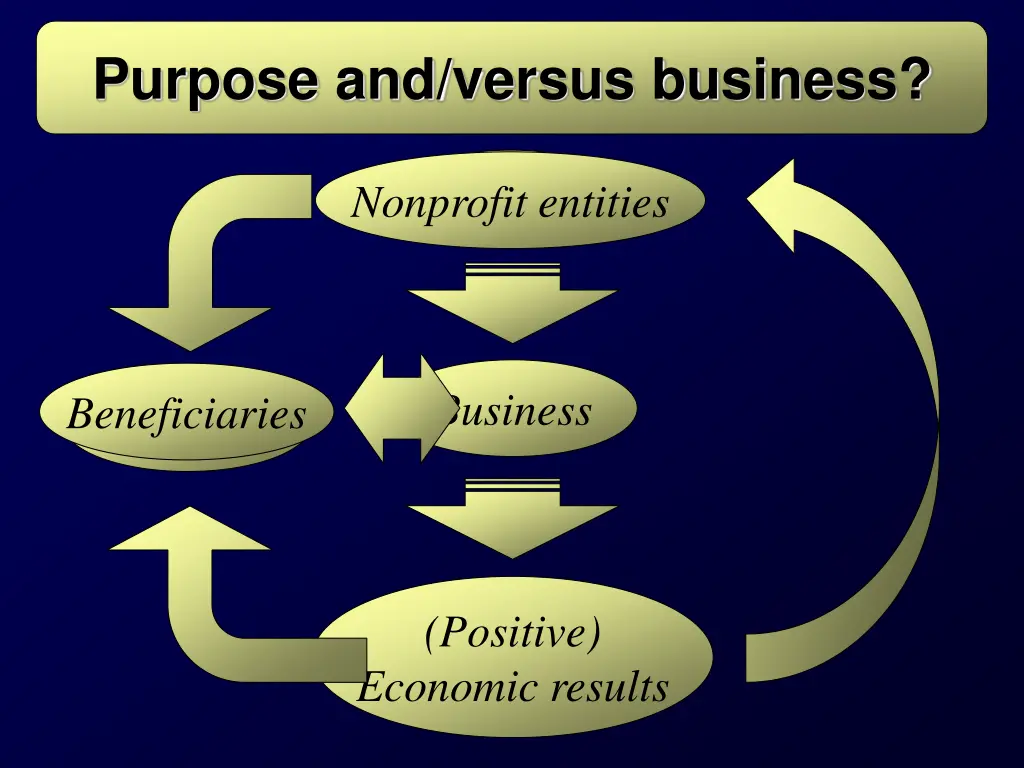

Purpose and/versus business? Entities Nonprofit entities Business Members Beneficiaries (Positive) Economic results

The trend towards purpose hybridization Selfless entities Selfish entities Hybrids Associations Foundations Charitable trusts Companies Corporations Partnerships Cooperatives Nonprofit Corporations Public benefit/L3 corporations Benefit corporations Social enterprises Community interest companies Social cooperatives More legal variations than actual application?

Non profitability Non distribution constraint Collective distributions Final Individual distributions distributions Indirect distributions Inaccurately prevents only one possible conflict of interest How to protect third parties trust?

Fundamental models and differences Paradigmatic nonprofit entities Associations Foundations Foundations are intrinsically form, asset and purpose-locked Possibility/Impossibility of endogenous fundamental changes or dissolution of the entity Public intervention and horizontal subsidiarity Label issues

A focus on foundations as entrepreneurial tools Foundations Business Widespread lack of general rules Interference of conflicting special regimes (especially tax law) Inadequate/poorly or seldom used oversight powers Public trust / Trust of the public Room for organizational autonomy Urgent need to coordinate substantive and tax law Create single point of contact with dedicated officers and adequate powers Through genuine horizonal subsidiarity: Sufficient flexibility Preservation of purpose and assets

Thank you for your attention! mail: aldo.laudonio@unicz.it