Quality System Maturity Model Update

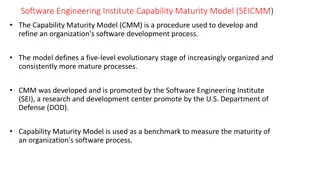

MDIC Open Forum Quality System Maturity Model Update by George Serafin from Deloitte & Touche LLP. Background, objectives, key milestones, project timeline, and the approach for adapting CMMI process framework for medical devices are discussed in detail.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Making Sense of U.S. Renewables Policy & Markets Rusty Haynes DSIRE Project Manager N.C. Solar Center / N.C. State University Italian Trade Commission New York, NY 27 September 2012

DSIRE Overview Created in 1995 Funded by U.S. DOE / NREL Managed by NCSC / NCSU Scope = government & utility incentives & policies that promote RE/EE ~ 2,740 total summaries ~175,000 users per month DSIRE Solar: dsireusa.org/solar DSIRE data services for businesses: dsireusa.org/services

Why is the U.S. market challenging? Regulatory Regimes Electric Utilities Investor-owned (210) Public utilities (2,009) Electric co-ops (883) Federal (9) Federal (1) States, territories, DC (~65) Counties (3,143) Municipalities (~30,000)

U.S. Electric Industry Average Revenue, per kWh (Source: U.S. DOE, March 2012)

States encourage or require RE via: Utility rates & revenue policies Interconnection standards Financial incentives RPS polices / mandates 3rd-party ownership FITs Examples of incentives & policies included in DSIRE: Industry recruitment Tax incentives (corporate, personal, property, sales) Performance-based incentives Grant programs Loan programs Rebate programs RPS policies EE resource standards Interconnection standards Net metering policies Solar/Wind access policies Public benefits funds

RPS Policies (Source: DSIRE, September 2012) 29 states,+ DC have RPS policies

RPS Policies with Solar/DG Provisions . (Source: DSIRE, September 2012) 16 states,+ DC have an RPS with solar/DG provisions RPS with solar / DG provision RE goal with solar / DG provision Solar water heating counts toward solar / DG provision Fuel cells qualify for solar carve-out

3rd-Party PV Power Purchase Agreements (PPAs) (Source: DSIRE, August 2012) UT: limited to certain sectors VA: see notes AZ: limited to certain sectors At least 22 states + DC & PR authorize or allow 3rd-party PV PPAs Authorized by state or otherwise currently in use, at least in certain jurisdictions within in the state Apparently disallowed by state or otherwise restricted by legal barriers Puerto Rico Status unclear or unknown

CALIFORNIA The Golden State AVG electric rates (R/C/I): 16.1 / 15.5 / 11.5 per kWh Installed PV/wind capacity (MW): 1,564 (#1) / 4,425 (#3) Net metering / interconnection standards: A / A RPS: 33% by 2020 CSI incentives: $2.167B budget / 1,940MW goal Renewable Auction Mechanism: RE systems < 20MW; 1,000MW in 2 years FIT (revisions IP): long-term contracts for RE < 3MW; floor of ~$89/MWh Self-Generation Incentive Program: rebates for non-solar RE < 3MW Property tax incentive (solar) Strong muni & local solar incentives (LADWP, SMUD, Palo Alto)

ARIZONA AVG electric rates (R/C/I): 11.9 / 10.1 / 7.0 per kWh Installed PV/wind capacity: 398 (#3) / 238 Net metering / interconnection standards: A / ? RPS: 15% by 2025 (30% DG) Non-residential solar/wind tax credit (corporate, personal) RE production tax credit (corporate, personal) RE business tax incentives (tax credits, property tax incentives) Residential solar/wind tax credit RE property tax exemption & special assessment (utilities) Solar/Wind sales tax exemption Utility solar rebate programs (DG) The Copper State

FLORIDA The Sunshine State AVG electric rates (R/C/I): 11.7 / 9.8 / 8.6 per kWh Installed PV/wind capacity (MW): 95 (#9) / 0 Net metering / interconnection standards: B / D RPS: none Solar/Wind corporate tax credit ($0.01/kWh) Solar sales tax exemption Solar PTE repealed in 2008 Muni solar incentives (GRU, OUC) progressive but small Utility solar rebate programs (DG)

Key Points & Take-Aways Each state is basically its own market. Markets are driven by state policy, rates, RE resource availability. Federal policy is a wildcard. Industry focuses on states and state policy. Dominance of 3PO model -- profitable, easy. Clarification needed in many states. Long-term perspective -- a decade of overwhelmingly solid state policy progress, with little backtracking. Increasing policy complexity. Implications?

Contact Info Rusty Haynes DSIRE Project Manager N.C. Solar Center / NCSU rusty_haynes@ncsu.edu 919.513.0445 13