Quality Uncertainty in Markets: The Market for Lemons

Explore the concept of quality uncertainty in markets through George Akerlof's seminal work on "The Market for Lemons." This paper delves into the implications of information asymmetry, adverse selection, and the impact on market mechanisms.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

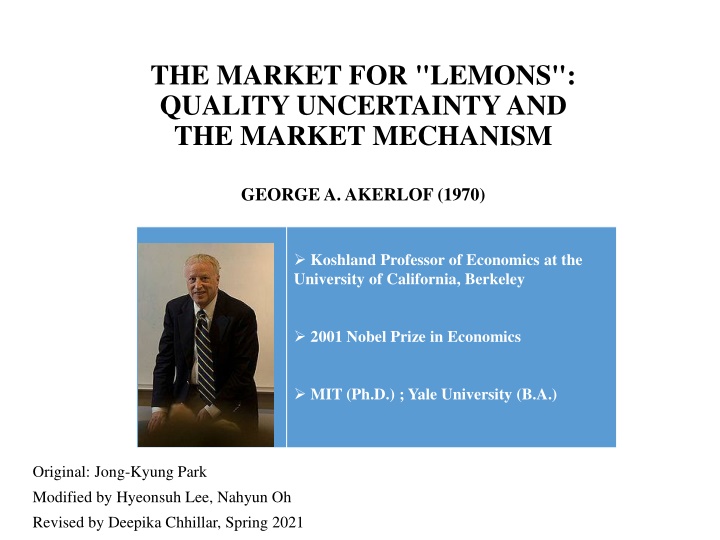

THE MARKET FOR "LEMONS": QUALITY UNCERTAINTY AND THE MARKET MECHANISM GEORGE A. AKERLOF (1970) Koshland Professor of Economics at the University of California, Berkeley 2001 Nobel Prize in Economics MIT (Ph.D.) ; Yale University (B.A.) Original: Jong-Kyung Park Modified by Hyeonsuh Lee, Nahyun Oh Revised by Deepika Chhillar, Spring 2021

The need for research Microeconomic theory models in the 1960s were characterized by their generic nature in which they dealt with perfect competition and general equilibrium. Situational and specific considerations were left out (such as information asymmetries). The existence of goods of many grades poses interesting and important problems for the theory of markets.

Research Purpose The paper relates quality and uncertainty. Investigates the adverse selection problem. Explores the interaction of quality differences and uncertainty in explaining important institutions of the labor market. Gives structure to the statement: Business in under-developed countries is difficult. Determines the economic costs of dishonesty.

Buyer Seller Incentive to market poor quality goods. Judge quality based on market statistics. Reduction in the average quality of good and size of the market. Social and private returns differ. Sometimes, government intervention increases the welfare of parties.

The Automobile Market Large price difference between new cars and those that have just left the showroom. After owning a specific car for a length of time, the car owner can form a good idea of its quality. An asymmetry in available information has developed: for the sellers now have more knowledge about the quality of a car than the buyers.

Greshams law Bad money drives out good. For most cars traded will be the lemons, and good cars may not be traded at all. Bad cars tend to drive out the good. Because bad cars sell at the same prices as good cars. It is impossible for a buyer to tell the difference between a good car and a bad car; only the seller knows. Information asymmetry exists. CIRCULATION COIN COIN CIRCULATION COMPOSED OF CHEAPER METAL COMPOSED OF EXPENSIVE METAL The exchange rate is even. Both buyers and sellers know the difference between good and bad money.

Illustrative Example of Upcoming Model Imagine that owners of lemons (bad cars) are willing to sell for $1000 and owners of plums (good cars) are willing to sell for $2000. Imagine that purchasers are willing to pay up to $1200 for a lemon and up to $2400 for a plum. Assume that sellers know what kind of car they have, but buyers can't tell. All buyers know is that half of all used cars are lemons. Therefore, based on the expected probability that a given car is a lemon, they will pay only up to $1800 for any car (1/2*1200 + 1/2*2400).

Illustrative Example of Upcoming Model I am uncertain about the quality of cars , so I will not pay a premium But plum owners aren't willing to sell for only $1800, so only lemon owners will sell. The logical conclusion is that only the lemons will be sold The mere presence of inferior goods destroys the market for quality goods when information is imperfect/asymmetric Plum owners need some way of signalling their car's quality.

Lemon Market Model Where: M is the consumption of goods other than automobiles, xi is the quality of the ith automobile, and n is the number of automobiles.

Model with Information Asymmetry Demand-Supply for group 1 Demand-Supply for group 2 Demand Curve Supply Curve

Model with Information Asymmetry Table : Demand and Supply in Asymmetric Case Price and Average quality Demand Supply Equilibrium Group 1 Group 2 ?1 ? ?2 ? ?? 2 p < ? - ?2 ? ?? 2 ? < p < 3 - 2? p > 3 0 0 N - 2? The average quality of cars is only a half of the offering price. The buyer is uncertain about the quality of cars Group 1 only wants to pay at P/2, while group 2 only wants to pay at 3/4p. No cars will be sold at price p. The price would go down, which further drives some sellers out of the market and further lowers down the average quality of cars, leading to the shrinking of the market.

Model with Information Symmetry Supply Demand Table : Demand and Supply in Asymmetric Case Price Demand Supply Equillirium Group 1 Group2 0 0 N - 0 N 0 N P=1 N P<1 0 -

Model with Information Symmetry Equilibrium of Supply and Demand in Symmetric Case There is no equilibrium when price is above 3/2, because group 1 is willing to sell their car, but no group is willing to buy, since the reservation price of group 2 is only 3/2 and group 1 is only 1. When price is 3/2, only group 2 wants to buy the car, because price is still above the reservation price of group 1 When price falls below 1, the equilibrium doesn't exist since group 1 doesn't want to supply/ sell their cars.

Insurance - Adverse Selection Problem Similar phenomenon -> very little market (if any) for insurance of those over 65. Under information asymmetry, insurance providers cannot discern between types of applicants (the healthy vs. Unhealthy) Why doesn't the price rise to match the risk? As the price level rises, the people who insure themselves will be those who are increasingly certain that they will need the insurance Healthy term insurance policy holders may decide to terminate their covera ge when they become older and premiums mount This action could leave an insurer with an undue proportion of below avera ge risks and claims might be higher than anticipated Average health condition deteriorates Incentive of insurance providers hurts Attract high risk applicants Insurance market shrinks Price rises

Insurance - Adverse Selection Problem One possible solution is Group Insurance but again, it is available only to those fit enough to be employed Argues in favor of Medicare programs (e.g., Obamacare) At the same time this means that medical insurance is least available to those who need it most

Employment of Minorities Race may serve as a good statistic for the applicant's social background, quality of schooling, and general job capabilities. The fact that some demographic groups are preferred to others is because employers make judgments about the average behavior of an observable group of people. Quality schooling may be a substitute for this statistic. Workers with high ability have lower costs of pursuing attainment of education at higher levels, which can act as a signal of their productive capacity.

Cost of Dishonesty In the example for the used car market, there is an incentive for the sellers to offer lemons at the market price Lowers the expected quality of a good from the perspective of consumers Drives legitimate goods out of business. Dishonest dealings tend to drive honest dealings out of the market The cost of dishonesty resides not only in the amount by which the purchaser is cheated but also the cost of loss incurred from driving legitimate business out of existence

Credit Market in Underdeveloped Countries In India a major fraction of industrial enterprise is controlled by managing agencies. Promoter would turn to the agency because of its reputation, which would encourage confidence in the venture and stimulate investment. If there were symmetric information, investors would immediately know whether or not a venture was worth investing in, and there would be no need for additional spending on a managing agency to draw in more investment. The local moneylender charges extortionate rates to his clients, leading to landlessness Cooperative Movement: setting up banks to compete with local money lender Central Bank has easy means of enforcing the contract & Local moneylender has knowledge of the borrower s character Anyone else in the middle captures all the high-risk borrowers (lemons) and will make losses Creates a barrier for entry in the market.

Counteracting Institutions Institutions arise to counteract the effects of quality uncertainty Guarantees Guarantees of a good's average quality helps reduce buyer uncertainty regarding quality. The risk is borne by the seller rather than by the buyer. Brand names Brand names serve as an indicator of quality and allow for consumer retal iation (no longer purchasing that brand) in the case that the true quality of a good fails to reflect the expected quality of the good. Chains Similar to brand names. (e.g., the chain restaurants on interurban highways : provide non-local customers with trustworthy restaurant options) Licensing Licensing for skilled workers signal to market participants that those poss essing licenses have reached a certain level of education, training or skill. ( e.g., doctors, lawyers, barbers, etc.)

Conclusion Informal unwritten guarantees are preconditions for trade and production. Where these guarantees are indefinite, business will suffer as indicated by generalized Gresham's law. The difficulty of distinguishing good quality from bad is inherent in the business world. Institutions emerge to mitigate this uncertainty.

Discussion A used-car salesperson may work to maintain his reputation rather than pass off a "lemon." Reputation is usually a good asset if one intends to continue business in the market. Thus, a temporal dimension is important to consider. In my view, this problem is a variant of common goods problem- > (Collective) Cost of (Individual) Dishonesty. Would you agree/disagree? Let s discuss.