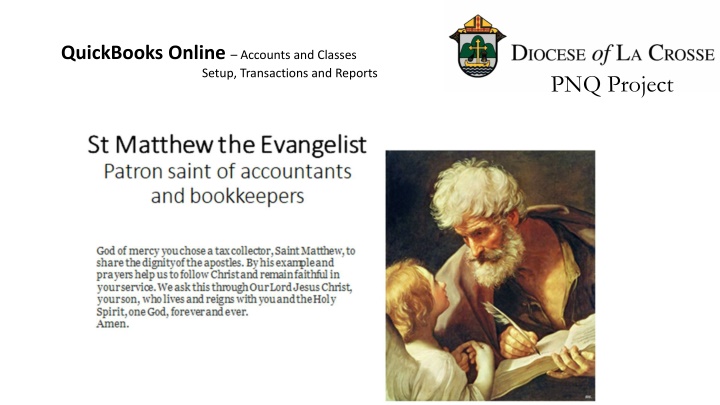

QuickBooks Online Accounts and Classes Setup, Transactions, and Reports

Learn about setting up QBO accounts and classes correctly, managing transactions, and analyzing reports in QuickBooks Online to optimize your financial accounting processes. Explore licensing limits, tools like Qvinci, chart of accounts details, and default account settings to enhance your bookkeeping experience efficiently.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

QuickBooks Online Accounts and Classes Setup, Transactions and Reports PNQ Project

QuickBooks Online Accounts and Classes Setup, Transactions and Reports PNQ Project Thank you! Thank you for logging into your QuickBooks Online license. Thank you for changing the Bill To . Our goal: Let s get your QBO accounts setup correctly. Things to accomplish today Learn about QuickBooks licensing limits Learn about QuickBooks and Qvinci Learn about QuickBooks Classes Classes in account setup Bank accounts All other accounts Classes in Transactions Classes in Reports This video and presentation will be posted on diolc.org/temporalities under the heading PNQ Accounting Project They will be titled QBO Accounts and Classes, March 19,2021

QuickBooks Online Accounts and Classes Setup, Transactions and Reports PNQ Project QuickBooks licensing limits $150/mo $14/mo

QuickBooks Online Accounts and Classes Setup, Transactions and Reports PNQ Project QuickBooks and Qvinci Qvinci is a reporting tool Assemble data across all QBO parishes Monitor and manage standard account and class usage Aggregate QBO parish data to combine with ParishSOFT parish data Important Notice! The pricing quoted for Qvinci, $5/month, was wrong. Actual pricing will be $16.95/month plus $1/Class used.

QuickBooks Online Accounts and Classes Setup, Transactions and Reports QuickBooks licensing limits PNQ Project Chart of accounts: Maximum of 250 accounts. QuickBooks adds Default Accounts that can t be deleted The following default accounts are created automatically. You can t delete them or use them for any other purpose. Undeposited Funds: This holds funds from payments to your company until you deposit them to your bank account. You can t delete this account as it s required to properly record payments before they are deposited. Note: If for any reason you ve created your own Undeposited Funds with an incorrect detail type, QuickBooks Online will not auto-generate the undeposited funds. Opening Balance Equity: This is the default account for adjustments. You can only edit the name of this account, if necessary. Retained Earnings: This account is for reporting retained earnings on the Balance Sheet report. You can change the name of the Retained Earnings account if, for example, you are a non-profit that prefers to use another name for retained earnings. But in all other cases, the name shouldn t be changed. Inventory/Stock Assets and Cost of Goods Sold/Cost of Sales: If you try to edit or delete these accounts, any edits to Products/Services will recreate them. Reconcile/Reconciliation Discrepancies: This is used to report when your transactions in QuickBooks Online don't match the transactions reported on your bank statement. Unapplied Cash Payment Income: This is used to report cash basis income from customer payments that were received but not applied to a sales form. Sales of Product Income: This is used to track sales for inventory items and can't be deleted. This account only appears when Inventory is enabled, and at least one inventory item under Sales is added. (Sales tax agency name) Payable: This is created when you set up sales tax and reports the sales tax for every transaction.

QuickBooks Online Accounts and Classes Setup, Transactions and Reports QuickBooks licensing limits PNQ Project Chart of accounts: Maximum of 250 accounts. QuickBooks adds Default Accounts that can t be deleted Number and Rename as DIOLC accounts QBO default account name Undeposited Funds Opening Balance Equity Retained Earnings Inventory/Stock Assets and Cost of Goods Sold/Cost of Sales Reconcile/Reconciliation Discrepancies Unapplied Cash Payment Income: Sales of Product Income: (Sales tax agency name) Payable Number and Rename to 3010 Opening Balance Equity 3040 Fund Balance - Parish

QuickBooks Online Accounts and Classes Setup, Transactions and Reports QuickBooks licensing limits PNQ Project Chart of accounts: Maximum of 250 accounts. default accounts from QBO approx. 16 DIOLC pre-loaded accounts 138 Most parishes use less than 100 accounts. 154, approx 100 remaining available Pre-loaded accounts Not loaded accounts Basic General Ledger accounts Less commonly used Subaccounts Commonly used Subaccounts Administrative or Parish accounts Departmental or Program accounts School accounts Hot Lunch Day Care Cemetery accounts Most Endowment accounts Catholic Education accounts Youth Ministry accounts We pre-loaded 13+ QBO Classes to handle these Administrative and Parish Headers Departmental and Program Header accounts

QuickBooks Online Accounts and Classes Setup, Transactions and Reports PNQ Project How Class allocations will affect Annual Report

QuickBooks Online Accounts and Classes Setup, Transactions and Reports PNQ Project Each Cemetery Class enables a separate Cemetery report

QuickBooks Online Accounts and Classes Setup, Transactions and Reports PNQ Project Each Endowment Class enables a separate Endowment report

QuickBooks Online Accounts and Classes Setup, Transactions and Reports PNQ Project How to use Accounts and Classes together: Expense is allocated to 2 separate Departments, Catholic Ed and Admin using Class. Notice that we did not need to add a separate account for 56203 Utilities Expense, Catholic Ed Class 030 records expense portion to Column C, Evangelization Class 000 records expense portion to Column A, Admin

QuickBooks Online Accounts and Classes Setup, Transactions and Reports PNQ Project How to use Bank Accounts and Classes together: Applies to each School, Cemetery and Endowment Need a distinct account for each reconciliation Does not apply to Catholic Ed, Sacred Worship, or Youth Ministry The key is to be consistent Asset 201 Cemetery1 Liability - 201 Cemetery1 Income 202 Cemetery2 Income - 201 Cemetery1 Expense - 201 Cemetery1

Filter by Class is available for Balance Sheet , or Profit and Loss Report Statements

QuickBooks Online Accounts and Classes Setup, Transactions and Reports PNQ Project Things we set out to accomplish today Learn about QuickBooks licensing limits Learn about QuickBooks and Qvinci Learn about QuickBooks Classes Classes in account setup Bank accounts All other accounts Classes in Transactions Classes in Reports Nick Lichter (608) 791-2681 nlichter@diolc.org Thank you! This video and presentation will be posted on diolc.org/temporalities under the heading PNQ Accounting Project They will be titled QBO Accounts and Classes, March 19,2021