Rational Expectations Hypothesis in Economic Decision-Making

The rational expectations hypothesis suggests that economic agents use all available information to form expectations about future economic variables, guiding their decision-making. This concept has applications in both microeconomics and macroeconomics, influencing government policies and individual behavior. By anticipating government actions and economic changes, individuals and firms adjust their plans accordingly, impacting outcomes such as inflation and unemployment.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Rational Expectations Hypothesis Dr.A.J.Haja Mohideen

Ratex hypothesis was first put forth by Johy Muth in 1961 His model dealt mainly with modelling price movements in markets -related to microeconomics. In early 1970s, Robert Lucas, Thomas Sargent and Neil Wallace applied the idea to problems of macroeconomic policy.

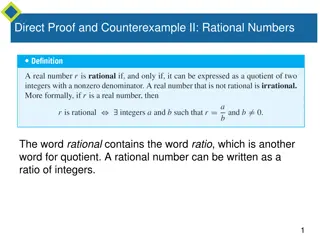

Economic agents form expectations of the future values of economic variables like prices, incomes, etc. by using all the economic information available to them. Economic agents have full and accurate information about future economic events. Individual economic agents use all available and relevant information in forming expectations in an intelligent fashion. This does not imply that consumers or firms have "perfect foresight" or that their expectations are always "correct". Agents reflect upon past errors and, if necessary, revise their expectational behaviour so as to eliminate regularities in these errors.

People form expectations about government monetary and fiscal policies and then refer to them in making economic decisions. Consumers and firms have accurate information about expected government actions- future economic events. Public learn from the past experience about the effects of the government policies. If the government is following any consistent monetary or fiscal policy, people know about it and adjust their plans accordingly. So when the government adopts the expected policy measure, it has been anticipated by the people who have already adjusted their plans.

By the time signs of government policies appear, the public has already acted upon them, thereby offsetting their effects. Government cannot fool the people and mere signs of such a policy in the economy create expectations of countercyclical action on the part of the public. The only policy moves that cause changes in people s economic behaviour are those that are not expected, the surprise moves by the government. Once the public acquires knowledge about a policy and expects it, it cannot change people's economic behaviour.

An expansionary fiscal policy (Increased government spending or reducing taxes to reduce unemployment) or Expansionary Monetary policy (increasing money supply to reduce unemployment) may reduce unemployment in the short run provided people do not anticipate that prices will rise. (Provided the policy effects on the economy are unanticipated) But when the government persists such expansionary policies, people expect the rate of inflation to rise. Firms raise the prices of their products to overcome the anticipated inflation (increased future costs) so that there is no effect on production.

Workers press for higher wages in anticipation of inflation and firms do not employ more workers (No effect on employment) As a result, both policies will become ineffective in the short-run. It may cause more unemployment and inflation in the long-run when the government tries to control inflation through such policies Ratex hypothesis holds that monetary and fiscal (stabilisation) policies are ineffective even in the short-run because it is not possible to anticipate accurately how expectations are formed during the short-run. This is called "policy impotence. Then the government policy becomes ineffective-policy impotence.

For such policies to be successful the government must be able to fool the people - they must be unanticipated by the people. But it is unlikely to happen all the time. People cannot be fooled for long. Once people anticipate these policies and make adjustments towards them, the economy reverts back to the natural rate of unemployment. Thus fiscal-monetary policies become ineffective in the short-run. According to the advocates of the Ratex hypothesis, inflation can be controlled without causing widespread unemployment, if the government announces fiscal and monetary measures and convinces the people about it and do not take them be surprise.