Rationalization of Salaries Calculation for Seconded Staff Board of Governors

The document outlines the rationalization of calculating salaries for seconded staff by the Board of Governors, including interim calculations, proposed legal modifications, differential adjustments, and challenges faced in compliance and reimbursement processes.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Schola Europaea Rationalization of calculation of salaries of seconded staff Board of Governors April 2020

Remuneration Art. 49 The differential adjustment (AD) is calculated in two steps: 1 / interim calculation during the course of the year on the basis of the national tax withheld on the national salary slips; National Remuneration European Remuneration Basic salary Household allowance Dep. child allowance Health Insurance Accident insurance Temporary contribution -37,43 Europeen Tax (*) 3.704,38 250,10 769,20 -40,75 -3,70 Salary (Gross Pay - Social contrib.) National tax (*) 2.883,70 - 672,06 2.211,64 Total = 4.510,79 Total = 4.510,79 Seconded Staff Remuneration = 2.299,15 2.299,15 - 131,01 (*) Including an interim differential adjustment of 541,05 (672,06-131,01) This national tax is provisional! 2

1. Interim calculation The interim salary calculation, is done monthly and: Depends on systematic monthly transmission of national salary slips from national administrations (Article 49.2) 18 out of 28 Member States comply and 4 out of 28 partially comply Seconded staff also has the obligation to provide all documentation regarding rights, and updates (Article 19) Despite these, Schools accountants often do not receive documents and have to search, wasting valuable time 3

Proposed Legal modification (Art 49) Objectives: to rationalize the process by: 1. Clarifying the responsibility of providing the national salary slips and placing it exclusively on the seconded staff : 2. Calculation once a year and adjusting when necessary. Transmission once a year: salary slips applicable to August, and after modifications to the national salary slip Precautionary measures : Non-transmission of the salary slip applicable for the month of August After 3 months : National tax at zero After 6 months : suspension of payment of the European supplement Article 75 Non-transmission of any modification Retroactive correction Article 75 4

Second step: Differential Allowance Current situation after definite calculation: Reimbursement to the European Schools = 70% Repayment to the Seconded staff = 30% 5

Second step: Differential Allowance Frustration for 70% of the seconded staff members and subsequent lack of compliance An advance on the EU budget for an amount of around 1,2 mio Euro per year Administrative burden on schools to avoid financial loss. - - - - - - Many reminders to the seconded staff Withholding amounts from severance grants When they leave the system, letters and reminders Contacting lawyers Bringing files to Administrative Boards Administrative appeals and Complaints Board 6

Scenarios considered Investigation of three scenarios by working group to limit the financial loss for the system as well as the loss of monthly net salary of the seconded staff OBJECTIVE = KEEP ATTRACTIVNESS 1. National Tax at zero: put the interim National Tax at zero with a Tax advance 2. Lump-sum tax : put a lump-sum amount as interim National Tax 3. Proportional tax : put a proportional amount of 80% as interim National Tax 7

Scenario 1 National tax at 0 Taking into account of the National tax only at the time of submission of the tax document, then deferring a part of the payment. In practice : EU net without National tax during the current year Current position Proposition Seconded Staff Remuneration 1.627,09 x 12 = 19.525,08 Seconded Staff Remuneration 2.299,15 x 12 = 27.589,80 Income year Financial Regularization = + 2.100 Financial Regularization = - 5.964,72 Year of tax documents TOTAL = 21.625,08 (27.589,80 -5.964,72) = 21.625,08 (19.525,08 + 2.100) No financial impact for the seconded staff (only timing difference) 8

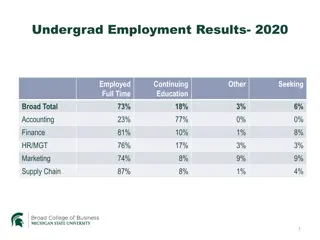

Alternative 1 National tax at 0 The following table summarizes the impact on the NET EU salary in the case the national tax is set at zero Total number of files Old StaffMonthly average New staff Net without AD % Nationality loss <0 3,50% 16 1.644 16 0 DE, DK, LU, BE 0 - 12.000 7,88% 36 1.258 34 2 BE, CZ, DE, GB, IE AT, BE, DE, DK, ES, FI, FR, GB, IE, IT, NL, SE 12.001 - 25.000 15,32% 70 979 62 8 AT, BE, DE, DK, EE, ES, FI, FR, GB, HU, IE, IT, LU, MT, NL, PL, PT, SE, SI. 25.001 - 50.000 36,76% 168 725 119 49 AT, BE, BG, CZ, DE, EE, ES, FI, FR, GB, GR, HU, IT, LT, NL, PL, PT, RO, SE, SI, SK. 50.001 - 75.000 26,26% 120 349 61 59 AT, BE, CZ, DE, ES, FR, GB, GR, HU, IT, LT, LV, MT, PL, PT, SK 75.001 - 100.000 8,97% 41 347 10 31 > 100.000 1,31% 6 336 0 6 CZ, GB, GR, IT, PT. 100,00% 457 302 155 Impact on attractiveness (loss of monthly net salary) 9

Scenario 2 Lump-sum Interim National Tax A lump-sum amount (average national tax) is put as interim National Tax. -3.870,78 -4.149,87 Creates huge imbalances due to non-harmonisation of taxation in Europe 26,000 24,000 22,000 20,000 -1.511,24 -1.407,40 18,000 -140,50 Average National Tax (from Pay Slip) 16,000 Does not rectify overall % of negative differential allowance 14,000 -553,76 -692,41 Average National Tax (from Tax Statement) 777,06 12,000 -470,82 10,000 TOTAL Annual Average -1.154,28 -1.632,10 -1.015,65 -68,24 8,000 149,47 6,000 -235,84 -494,00 -125,95 -1.198,08 -883,75 381,34 -503,50 -184,25 -113,92 4,000 -478,69 -1,02 -7,07 2,000 0 AT BG DE EE FI GB HU IT LU MT PL RO SI 10

Scenario 3 Proportional Interim Tax The interim National Tax is set at 80% of national tax during the year. This proportionality respects the different tax legislation. 11

Alternative 3 Proportional Interim Tax The following table summarizes the impact on the NET EU salary in the case a proportional amount is put as interim National Tax (Alternative 3) Net with Proportional Tax Total number of files Old StaffMonthly average New staff % Nationality loss 3 431 <0 0,66% 3 0 LU, DE LOW RANGE 12 203 0 - 12.000 2,63% 12 0 BE, DE, DK, IE AT, BE, CZ, DE, DK, ES, FI, FR, GB, IE, IT, NL 57 213 12.001 - 25.000 12,47% 55 2 AT, BE, DE, DK, EE, ES, FI, FR, GB, HU, IE, IT, LU, MT, NL, PL, PT, SE MIDDLE RANGE 176 152 25.001 - 50.000 38,51% 144 32 AT, BE, BG, CZ, DE, DK, EE, ES, FI, FR, GB, GR, HU, IE, IT, LT, NL, PL, PT, RO, SE, SI, SK 151 112 50.001 - 75.000 33,04% 72 79 HIGH RANGE AT, BE, CZ, DE, ES, FR, GB, GR, HU, IT, LT, LV, MT, PL, PT, SK 52 77 75.001 - 100.000 11,38% 16 36 6 67 > 100.000 1,31% 0 6 CZ, GB, GR, IT, LT, PT 100,00% 457 302 155 12

Overview of scenarios 13

Proposed Legal modification Scenario 3: Proportional Interim Tax Interim calculation of European complement by taking 80% of national tax in article 49.2 c) of Regulation for Seconded Staff Accompanying measures discussed at the Budget Committee Improved information to seconded staff about rights and obligations Shorter timeframe for final calculation Review after two years Entry into force September 2020 14

Alternative 2 Lump-sum Interim National Tax The following table summarizes the impact on the NET EU salary in the case a lump-sum amount is put as interim National Tax Net with Lump- sum Tax Total number of files Old StaffMonthly average New staff % Nationality loss <0 1,31% 6 1.452 6 0 BE, DE, DK, LU 0 - 12.000 3,72% 17 636 17 0 BE, DE, DK, IE 12.001 - 25.000 13,35% 61 466 58 3 AT, BE, CZ, DE, ES, FI, FR, GB, IE, IT, NL AT, BE, CZ, DE, DK, EE, ES, FI, FR, GB, IE, IT, LU, MT, NL, PT, SE 25.001 - 50.000 31,73% 145 123 113 32 AT, BE, CZ, DE, EE, ES, FI, FR, GB, GR, HU, IE, IT, LT, NL, PL, PT, RO, SE, SI, SK 50.001 - 75.000 33,04% 151 -240 87 64 AT, BE, BG, CZ, DE, ES, FR, GR, GB, HU, IT, LT, MT, PL, PT, SK 75.001 - 100.000 13,57% 62 -368 19 43 > 100.000 3,28% 15 -453 2 13 CZ, ES, FR, GB, GR, HU, IT, LT, LV, PT 100,00% 457 302 155 50% 16