Recent AGT Opportunities from PD Services: Small Scale to Large Scale Qualifications

This content provides an overview of recent opportunities in the field of Advanced Gene Therapies (AGT) from PD Services, featuring completed and ongoing small-scale to large-scale qualifications with various pharmaceutical companies. It also includes insights into specific projects and developments within the industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

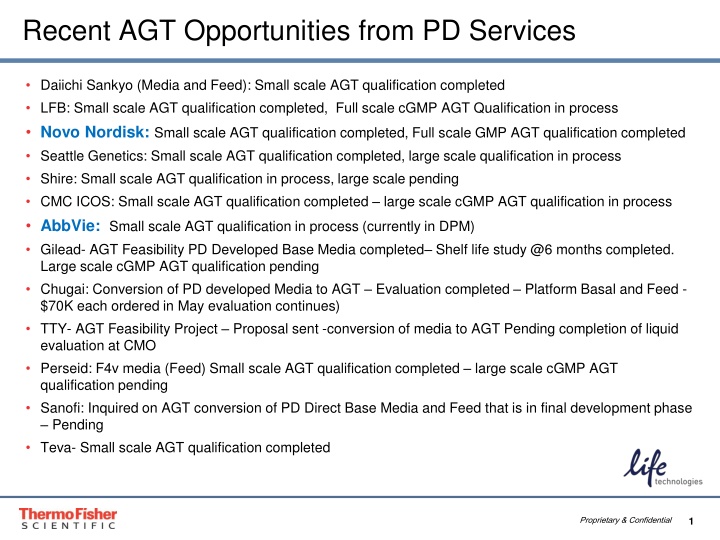

Recent AGT Opportunities from PD Services Daiichi Sankyo (Media and Feed): Small scale AGT qualification completed LFB: Small scale AGT qualification completed, Full scale cGMP AGT Qualification in process Novo Nordisk: Small scale AGT qualification completed, Full scale GMP AGT qualification completed Seattle Genetics: Small scale AGT qualification completed, large scale qualification in process Shire: Small scale AGT qualification in process, large scale pending CMC ICOS: Small scale AGT qualification completed large scale cGMP AGT qualification in process AbbVie: Small scale AGT qualification in process (currently in DPM) Gilead- AGT Feasibility PD Developed Base Media completed Shelf life study @6 months completed. Large scale cGMP AGT qualification pending Chugai: Conversion of PD developed Media to AGT Evaluation completed Platform Basal and Feed - $70K each ordered in May evaluation continues) TTY- AGT Feasibility Project Proposal sent -conversion of media to AGT Pending completion of liquid evaluation at CMO Perseid: F4v media (Feed) Small scale AGT qualification completed large scale cGMP AGT qualification pending Sanofi: Inquired on AGT conversion of PD Direct Base Media and Feed that is in final development phase Pending Teva- Small scale AGT qualification completed Proprietary & Confidential 1

2015 Current Pipeline for Media Projects 70% Likely Shire Gema (Argentina) Merck P1 Merck P2 Merck P3 Abbvie Novo GSK P1 GSK P2 Genzyme Assay Novo MabXience Bayer Kirin (KHK) $53,000 $52,600 $109,345 $241,800 $255,000 $43,000 $25,000 $141,980 $170,614 $125,200 $20,000 $109,000 $191,000 $79,000 $1,445,925 Proprietary & Confidential 2

2015 Current Pipeline for CLD Projects 70% Likely Syntimmune Aggamin Selexys Project 2 Genzyme RFP- CLD Genzyme RFP MCB Kadamon (Mat Gen) Kadamon Jinan U 319,300 185,500 289,000 408,000 267,000 27,000 221,000 328,840 2,045,640 Proprietary & Confidential 3

AbbVie Case: The Opportunity: Develop a Platform Media and Feed for all Abbott (ABV) CHO Cell Produced Molecules. Target was to increase titers from current 3g/L to >4g/L The Result The Project First engagement Platform media and feed developed producing titers between 4-6g/L Customer VOC: Gary Welch: Internal work would have been longer, cost more, and not been as successful. Abbvie realizes that it's better to use experts such as PD Direct. Project paid for itself in under 2 years Project 1 (12 months) 2008- 2009: Developed Platform Media and Feed Project 2 (6 months) 2010- 2011: Optimize JCL-5 Feed Project 3 (1 Month) 2012: Provide feed panel to AbbVie targeting improved product quality Project 4: GIA1 GME AGT assessment initiated First engaged Oct 2008 Three projects total: Liquid Platform media and Feed development and optimization - $465K Project Revenue Pull thru to date is $1.3M still in early phases with multiple molecules Proprietary & Confidential 4

Novo Nordisk Case: The goal of this project was to develop a feed medium platform for the production of IgG from GS-CHO cells that is AOF, CD and has Equivalent Titers to Lonza Feed V6 (3g/L titer) http://www.novonordisk.com/ui/images/apis.png The Result The Project First engagement 2009 Developed Platform Feed within the scheduled 40 week time frame. The initial feed produced at between 4-5g/L 2010: Further Feed optimization achieved 5-8g/L (customer pleased) 2013 Converted to AGT and maintained 5-8g/L (GME) 2014 Large scale AGT GMP qualification just successfully completed Three projects total since 2009: Liquid Feed development, optimization and conversion to AGT - $352K Project Revenue Pull thru to date is $213K still in early phases with multiple molecules (first revenue was 2014) September 2014 VOC: Ann Merete: The feeds combined with the developed process have shown good performance with all the tested cell lines so far and therefore, it was decided in the end of August to use this setup for all future antibody projects in NN Proprietary & Confidential 5

NV013: Feed Development and AGT Conversion Cell Line/Control Process Multiple CHO Cell Lines Proprietary feed/process Desired Outcome Improved titer AGT Conversion for medium and feed Titer improvement for each cell line in AGT format Reached 5-8g/L AGT performance equal to liquid Potentially displaced competitor feeds Proprietary & Confidential 6

H1 and YTD Revenue By Region vs. AOP 2014 Americas EMEA IPAC Japan Greater China Total PDD variance H1 AOP H1 Actual * Variance $741,608 $286,548 $197,850 $4,000 $87,974 $1,317,980 $700,281 $235,464 $209,082 $70,720 $37,276 $1,252,823 $41,327 $51,084 -$11,232 -$66,720 $50,698 $65,157 5% $65,157 *June 30, 2014 2014 Americas EMEA IPAC Japan Greater China Total PDD variance YTD AOP YTD Actual* Variance $1,334,000 $300,000 $332,000 $27,000 $120,000 $1,046,214 $358,694 $285,010 $115,562 $103,029 $1,908,509 $287,786 -$58,694 $46,990 -$88,562 $16,971 $204,491 $2,113,000 11% $204,491 *Sept 25 2014 Proprietary & Confidential 7

PD-Direct Revenue by Year (through Q2 2014) New SKU's generated from Projects # of Projects initiated Media Pull Thru Revenue (from Freedom Kit sales) # of Projects initiated Revenue from CLD projects Revenue from projects Pull Thru Revenue CLD Media 2005 8 $ 380,733 2 $72,717 2006 14 $ 191,658 0 $229,497 2007 7 $ 550,237 2007 9 $ 1,373,661 0 $225,762 2008 7 $ 1,646,871 2008 7 $ 1,269,376 15 $539,742 2009 2 $ 787,393 2009 17 $ 1,990,195 21 $1,214,544 2010 2 $ 1,068,325 2010 14 $ 1,499,580 10 $2,827,778 2011 4 $ 1,057,248 2011 9 $ 1,852,467 7 $2,442,352 $128,168 2012 4 $ 1,582,530 2012 13 $ 1,777,273 13 $3,350,197 $486,699 2013 6 $ 742,817 2013 6 $ 1,235,379 5 $4,161,066 YTD 2014 $ 727,552 $241,890 2014 3 $ 590,429 1 $2,169,810 2015 2015 Total 99 $ 12,160,752 70 $17,233,464 Total 32 $ 8,162,973 $ 614,867 Proprietary & Confidential 8

PD-Direct Media Development Summary 99 Media Project Initiations since 2005 4 assay development projects, 3 Media Panel 63 customers Total Booked Revenue from media projects and MAS over 9.5 years: $12.2 M Avg annual media project revenue: $1.28 M Total Pull Thru Revenue over 9 years: $17.2 M Total SKU s tracked in pull thru : ~90 total Total Customers tracked in pull thru : ~20 Large customers account for 80% ($5.1M of $6.4M) of total pull thru Proprietary & Confidential 9

PD-Direct Cell Line Services and Freedom Kits 32 CLD Projects since 2007 29 Customers Total Booked Revenue for CLD: $8.16 M (FY07-YTD 2014) Avg annual CLD project revenue: $1.1 M Freedom Kit Total Freedom kits sold Since launch: Total kit revenue since launch: Total licenses since launch: Total Licenses revenue since launch: Media pull through since launch: $614,867 Proprietary & Confidential 10

Summary PD-Direct Revenue 4500000 4000000 3500000 3000000 CLD Projects 2500000 Media Dev Projects Media Pull Through 2000000 Media Pull Through from Kit Sales 1500000 1000000 500000 0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD Proprietary & Confidential 11

Media Development Top Accounts Crucell/ Amgen/ Leinco (CD17/F17) CMC- ICOS Abbott/ Abbvie Client: Roche LFB GSK Project Revenue (USD): $0.104M $0.208M $0.25M $0.18M $0.32M Proj 1 2009 Proj 2 2011 Proj 3 2012 Initiation of Project: Proj 1 2006 Proj 2 2011 2007 2007 2008 2005 Follow on Project Revenue (USD): $126K 1 project $525K 5 projects $60.5K 1 project $188K 2 projects $145.9K 2 projects Project Pull- through Media Revenue (USD): $0.68M $1.8M $0.31M $1.23M $1.3M $10.4M Licensing Revenue (USD): TBD $1.9M TBD TBD TBD TBD Total Revenue (USD): $0.91M $4.4M $0.62M $1.6M $1.8M $10.4M Proprietary & Confidential 12