Recent Changes in SEBI Regulations and COVID-Induced Concessions

SEBI has introduced various concessions and extensions to address challenges arising from the pandemic, including the extension of timelines for AGMs and filings. These changes aim to ease compliance procedures and ensure the smooth functioning of businesses. Stay informed about the key modifications to SEBI regulations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

RECENT CHANGES IN SEBI REGULATIONS & SEBI Consultative Paper RAMASWAMI KALIDAS SEPTEMBER,18, 2020 WIRC, PUNE

COVID INDUCED CHANGES Concessions transitory to tide over difficulties caused by the Pandemic and hence not forming part of Regulations. Ease of Procedure through circulars. SEBI has been pro-active like the MCA. Benefits unlikely to extend beyond Month - end

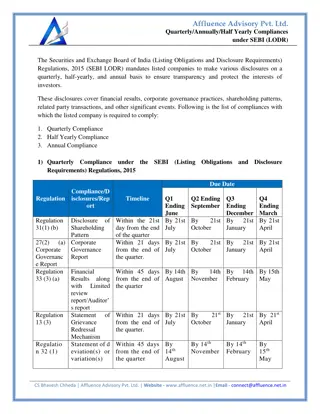

Run-down on major concessions Extension of time for holding AGMs companies with FY other than March 31-from 5 months for top 100 companies to Nine months ending September 30. Not to be construed as violation. Extended timelines for filings Reg7(3)-Compliance Certificate for Share transfer facility-Half yearly-Due date extended by one month

Slew of concessions Reg.13(3)-Statement of investor complaints Due date -21 days from end of quarter .Extension 3 weeks May 15, 20. Reg. 24A-Secretarial compliance Report Due-60 days from close of FY-Extension- 1 month June 30. Reg.27(2)-Quarterly CG Report -15 days from quarter end Extension 1 month Reg 31-Shareholding pattern-Due-31 days from Quarter end-Extension Three weeks

Further Concessions Reg.33-Quarterly/Annual Financial results- 45 days from end of Quarter-Extended by 45 days Annual-60 days of FY-Extension- I month Time lag between two meetings of Board and Audit Committee Relaxation initially between December 1 2019 to June 30, 2020.Since extended to September 30. Minimum 4 meetings to be ensured.

Reg-40(9)-Certificate from PCS regards issue of share certificates Due- 1 month from close of half year extension one month Holding of meetings of stakeholder/NRC and RMC Due by March 31-Extension 3 months Reg.47-Relaxation in publication of advertisements in newspapers till May 15. Timeline for holding AGM for companies with FY March Extended to September 30, 2020.

Benefits continue Reg-29-Prior intimations relating to Board meetings-Relaxed to issue of two days prior notice. Reg.39(3)-Intimation reg loss of share certificates- time line extended beyond two days For intimations between March 1 to May 31. Use of digital signatures for all intimations-till June 30, 2020-Since allowed till December 31, 20. Consequential circulars in sync with MCA concessions reg. AGMs through Video conferencing

Consultative Paper on LODR recommendations Major proposals-Responses elicited Compliances specific to top 100/500/1000 companies based on market cap to continue even if they fall off. Requirements relating to CG for companies with paid up capital of ten crores or net worth -25 crores to continue if their thresholds drop. Reg-24(5)-Special resolution for disposal of investments in material subsidiary if sale leads to drop below 50%.Now required even if holding drops to 50%- Exception where disposal through scheme of Arrangement or where there is an insolvency scheme.

No delay in intimating results Reg.30(4)-Financial results to be intimated to Exchanges within 30 mts. of Board approval. Dividend distribution policy to apply to top 1000 companies against 500 of now. Reg7(3)-Compliance certificate relating to timely share transfers etc. proposed to be annual requirement than bi annual as at present.

Extended timelines for certain compliances Requirement of sending Div. warrants for value higher than 1500 to go. Time line for intimating loss of share certificates eased.To report once a quarter within 21 days from Quarter end. Change in name of company. Requirement of Reg.45(1) with CA certificate to be provided in Explanatory statement while seeking approval for change.

Ease of compliance No need for newspaper Advt .reg meeting of board for consideration of financials and for explaining deviations in results. Instead to only upload in website. However statement of results(summary) to be published. Definition of working days-Refers to working days of stock exchanges. Clarified only in FAQs. Amendment in definition of ID in line with changes in Section 149(6)-thresholds to be lower

Further disclosures Reg.24A-Secretarial Audit Secretarial Compliance Report to be provided to members along with Audit Report. To provide Report to Exchanges-60 days of close of FY. Reg.36(3)-Appointment of new director- disclosure reg functional areas of specialization and holding in company including as beneficial owner.

Revised time lines Reg.27(2)(a)-Quarterly report on CG-Timelines for submission 21 days instead of 14 days from end of Quarter. Reg.29-Prior intimation regarding bonus proposal to be considered by board. Reg.44(3)-Provision of voting results to exchange-before conclusion of two working days instead of 48 hours from conclusion of meeting.

Subsidiary financial results-Overseas Reg 46(2)(s)-Standalone results of overseas subsidiary to be uploaded 21 days prior to meeting. Where Audit is not compulsion in country of origin unaudited results fine. If results in language other than English, English version to be provided. Hosting of Annual Return on website in sync with amendment to Section 92(3).

Legitimate look-in for RMC Disclosure-CG Report Details regarding composition ,terms of reference of RMC Details of members Number of meetings. Recommendations of Committee, steps taken for risk mitigation etc.