Recent Developments in Electronic IPO Implementation

Learn about the latest developments from the 2018 Capital Market Committee meeting regarding the formation of the e-IPO Committee, recommendations for full automation of the IPO process, regulatory considerations, and more. Dive into the discussions aimed at improving the electronic Initial Public Offering system in the capital market.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

2018 CAPITAL MARKET COMMITTEE MEETING

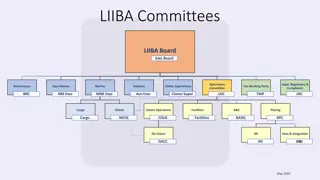

RECENT DEVELOPMENTS FROM LAST CMC MEETING The electronic Initial Public Offering (e-IPO) Committee was constituted on April 25, 2018; The Committee under the Leadership of Mr. Seyi Owoturo comprises representatives from the following stakeholder groups: Association of Stockbroking Houses of Nigeria (ASHON) Association of Issuing Houses of Nigeria (AIHN) Fund Managers Association of Nigeria (FMAN) Institute of Capital Market Registrars (ICMR) Capital Market Solicitors Association (CMSA) Nigeria Inter-bank Settlement System (NIBSS) Nigeria Stock Exchange (NSE) Central Securities Clearing System (CSCS) Securities and Exchange Commission (SEC)

RECENT DEVELOPMENTS FROM LAST CMC MEETING The Committee has covered its Terms of Reference (see Report) which include: Collation of the various stakeholders positions/recommendations on e-IPO; Preparation of an e-IPO blueprint; Review of the current SEC Rules and Regulations and/or propose new Rules for the operation of e-IPO; Recommendation of modalities for implementation. The Committee observed that Section 55 of the Investments and Securities Act 2007 and SEC Rule 345 provide basis for the implementation of e-IPO; However, impediments and made recommendations that should ensure the success of the e-IPO regime. the Committee identified some regulatory

RECENT DEVELOPMENTS FROM LAST CMC MEETING The Committee recommends the following - Full automation of the IPO process (from subscription to listing); Review of the SEC Rules 296(1); 300; 302; and 303 on timing (opening of subscription lists and pre-offer waiting period), costs (processing fee on applications) and KYC documentation (use of BVN information in place of signatures); The e-IPO platform should be self-regulated (by the relevant exchange) but supervised by the SEC; There should be disclaimers on restrictions/disclaimers on e-IPO platforms as contained on offer prospectuses; Prospectuses issued for securities to be offered through electronic platforms should utilize simple, easy to understand language to enable prospective investors to have better informed understanding and judgement on the decisions they are being solicited to take. For Rights Issues executed through an e-IPO platform, all provisional rights allocations should be credited to the CSCS under a different ticker to allow seamless trading; Regulation should provide for the establishment of multiple platforms and thus SEC should provide guidelines/standards for setting up e-IPO platforms; their registration and operations. selling restrictions and similar

FACTORS RESPONSIBLE FOR DEVELOPMENTS Global adoption of e-IPO; Ease securities offering process in line with the government s ease of doing business initiative; Reduce time to market (similar to timing for processing bank loans); Reduce cost and complexity of securities offering; Increase retail participation; Encourage increased listings.

CHALLENGES / NEXT STEP - Adoption of Committee report - SEC to set up guidelines for e-IPO process and registration/operations of e-IPO platforms ; - Engage CBN and Heads of Banking Operations on third party access to BVN information.

ISSUES FOR CMC DELIBRATION Participation of minors in e-IPO using BVN of sponsor Layers of cost in e-IPO process parties responsible for costs of payment services Implementation of the Report Set definitive timeline to go live