Redemption and Overbid Process in Real Estate Foreclosure

Explore the intricacies of redemption and overbid scenarios in real estate foreclosures, presented by Holly Ryan, Esq., Chief Deputy Public Trustee of Douglas County, Colorado. Learn about key statutes, redemption figures, allowable expenses, and the roles of junior lienholders in the redemption process.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

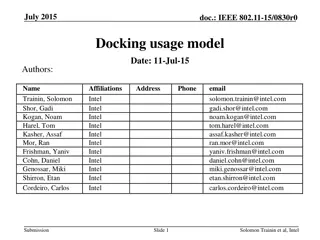

Presented by Holly Ryan, Esq. Chief Deputy Public Trustee Douglas County, Colorado SUMMER CONFERENCE 2024 REDEMPTION & OVERBID 1

REDEMPTIONS C.R.S 38-38-302

Any holder of a junior lien that is recorded PRIOR to the recording of the NED WHO CAN REDEEM An HOA A Junior Deed of Trust Judgement Holder IRS 3

2 INTENTS TO REDEEM FILED BID at PT Sale $225,000.00 Property Sold at PT Sale to THE CASH COW, LLC in the amount of $565,000.00 Overbid in the amount of $340,000.00 1. REDEMPTION FIGURES DUE BY 13THBUSINESS DAY AFTER 1. Moola Mortgage (1st lienholder SALE FROM THE CASH COW, LLC AND IF NOT RECEIVED PT CALCULATES AND PROVIDES BY 14THBUSINESS DAY AFTER 15-19 business days after FC Sale) noon on 19th day SALE. 2. REDEMPTION FIGURES DUE TO 2NDLIENHOLDER (JOE JUDGMENT) BY END OF 19THBUSINESS DAY FROM 2. Joe Judgment (2nd lienholder REDEEMING PARTY (MOOLA MORTGAGE) AND IF 20-24 business days after FC NOT RECEIVED PT CALCULATES AND PROVIDES BY THE START OF THE 20THBUSINESS DAY. Sale) noon on the 24th day IT IS NOT RECOMMENDED THAT YOU GIVE ALL REDEMPTION AMOUNTS TO ALL JUNIOR LIENHOLDERS AT START OF 1STREDEMPTION DATE. WHY? 4

MOOLA MORTGAGE DEBT: $250,000.00 ALLOWABLE: $1,017.75, INTEREST: $967.75 INTENT FEE: $50.00 ALLOWABLE ALLOWABLE TOTAL TOTAL $1,017.75 $1,017.75 5

JOE JUDGEMENT DEBT: $16,000.00 ALLOWABLE: $937.68 INTEREST: $937.68 6

EXAMPLE 2 INTENTS TO REDEEM BID at PT Sale $225,000.00 Property Sold at PT Sale to THE CASH COW, LLC in the amount of $565,000.00 Overbid in the amount of $340,000.00 1. Moola Mortgage would pay Purchaser $565,000.00 1. Moola Mortgage (1st lienholder 15-19 business days after FC Sale) plus per diem interest (interest rate on BID at time of FC sale) plus per diem allowable costs for a total of $569,818.40 2. Joe Judgment would Pay what Moola Mortgage paid 2. Joe Judgment (2nd lienholder 20-24 business days after FC Sale) $569,818.40 PLUS the debt owed Moola Mortgage in the amount of $250,000.00 plus per diem interest and allowable costs for a total of $820,836.15. 7

Allowable Expenses Lien Amount Due Redemption EXAMPLE EXPLAINED Purchaser $565,000.00 $4,818.40 0 Moola Mortgage DOT $250,000.00 $1,017.75 $569,818.40 BID at PT Sale $225,000.00 Joe Judgment $16,000.00 $937.68 $820,836.15 Property Sold at PT Sale to THE CASH COW, LLC in the amount of $565,000.00 Overbid Joe Judgment $16,937.68 0 Overbid in the amount of $340,000.00 borrower Signor of Note Overbid $323,062.32 0 8

Allowable Expenses Lien Amount Due Redemption EXAMPLE EXPLAINED Purchaser $565,000.00 $4,818.40 0 Moola Mortgage DOT $250,000.00 $1,017.75 0 BID at PT Sale $225,000.00 $569,818.40 Joe Judgment $16,000.00 $937.68 Property Sold at PT Sale to THE CASH COW, LLC in the Moola Mortgage Joe Judgment $251,017.75 $16,937.68 amount of $565,000.00 Overbid 0 Overbid in the amount of $340,000.00 borrower Signor of Note Overbid $72,044.5 0 9

WHEN PURCHASER (COP HOLDER) IS ALSO A JUNIOR LIENHOLDER & REDEEMS 10

SIR CLOSE-A-LOT gets HOA lien assigned to them and files an Intent to Redeem Debt owed $4,212.50. PURCHASER AT SALE (COP HOLDER) IS A HOLDER OF A JUNIOR LIEN & REDEEMS ***** Per 38-38-302(4)(b)(II) If the redeeming lienor is the same person as the holder of the COP or the prior redeeming lienor as evidenced by the instruments referred to in subsection (1) of this section, regardless of the number of consecutive liens held by the redeeming lienor, the redeeming lienor BID AMOUNT FROM LENDER $460,000.00 SHALL NOT pay to the officer the redemption amount indicated in the certificate of purchase or certificate of redemption held by such person, but SHALL ONLY pay to the officer the unpaid fees and costs required by the redemption and SOLD TO SIR CLOSE-A-LOT AT AUCTION FOR $820,000.00 provide the statement describing in paragraph (f) of subsection (1) of this section. OVERBID $360,000.00 What does this mean? Essentially SIR CLOSE-A-LOT as the COP holder and HOA lienholder pays ONLY the interest and allowable costs due the COP holder pursuant to the acknowledged statement from lienor (f) of subsection (1). 11

WHAT DOES THE PURCHASER PAY PUBLIC TRUSTEE TO REDEEM? SALE AMOUNT $460,000.00 INTEREST PER DIEM 4.75% $60.00 PER DAY = $1,620.00 (27 CAL DAYS) PROPERTY PRESERVATION $150.00 PER DAY = $4,050.00 (27 CAL DAYS) INSURANCE PER DIEM OF $12.00 PER DAY = $324.00 (27 CAL DAYS) ***REMEMBER TO ADD COR FEES & COSTS $78.00 (JULY 1, 2024, CHANGE $60.00 + $18.00) TOTAL DUE $466,145.00 TO NORMAL LIENHOLDER HOWEVER, LIENHOLDER THAT IS ALSO THE PURCHASER (COP HOLDER) ONLY PAYS THE $6,145.00 AMOUNT MUST BE PAID TO PT DURING THE LIENORS 5-DAY REDEMPTION PERIOD TO BE CONSIDERED REDEEMED & INCLUDE THEIR DEBT IN FUTURE JUNIOR LIENHOLDER FIGURES. 12

2 JUNIOR DEED OF TRUSTS BOTH HELD BY SAME LENDER & BOTH REDEEM MERRYMINT MORTGAGE HAS 2 JUNIOR DEEDS OF TRUST AND FILES 2 INTENTS TO REDEEM (1 FOR EACH LOAN) DEBT OWED MERRYMINT MTG 2ND DOT $100.000.00 REDEMPTION PERIOD 20-24 BUSINESS DAYS AFTER SALE (34 CALENDAR DAYS) + 7 REDEMPTION FIGURES DUE TO 2NDLIENHOLDER (MERRYMINT) BY END OF 19THBUSINESS DAY FROM REDEEMING PARTY (SIR CLOSE-A-LOT) AND IF NOT RECEIVED PT CALCULATES AND PROVIDES BY THE START OF THE 20THBUSINESS DAY DEBT OWED MERRYMINT MTG 3RD DOT $50,000.00 REDEMPTION PERIOD 25-29 BUSINESS DAYS AFTER SALE (41 CALENDAR DAYS) + 7 REDEMPTION FIGURES DUE TO 3RD LIENHOLDER (MERRYMINT) BY END OF 25THBUSINESS DAY FROM REDEEMING PARTY (MERRYMINT MTG) AND IF NOT RECEIVED PT CALCULATES AND PROVIDES BY THE START OF THE 25THBUSINESS DAY 13

2ND LIENHOLDER PAYS TO REDEEM SIR CLOSE-A-LOT GETS PAID TOTAL REDEMPTION AMOUNT OF 1STLIENOR (HOA) $466,145.00 PLUS DEBT OWED 1STLIENHOLDER - HOA DEBT $4,212.50 INTEREST PER DIEM 8% ON HOA LOAN $0.92 PER DAY = $11.96 PROPERTY PRESERVATION $150.00 PER DAY = $1,300.00 INSURANCE PER DIEM OF $12.00 PER DAY = $156.00 ***REMEMBER TO ADD COR FEES AND COSTS $78.00 TOTAL DUE $471,903.46 14

3RD LIENHOLDER PAYS TO REDEEM MERRYMINT MORTGAGE REDEMPTION AMOUNT $471,903.46 PLUS DEBT OWED 2ND DOT HOLDER $100,000.00 INTEREST PER DIEM 5% ON DOT $13.70 = $95.90 INSURANCE PER DIEM OF $17.00 PER DAY = $119.00 ***REMEMBER YOUR COR FEES AND COSTS $78.00 TOTAL DUE $572,196.36 HOWEVER, PER STATUTE THEY ONLY PAY THE DIFFERENCE SINCE THEY ALSO REDEEMED 2ND LIEN HOLDER POSITION. $100,292.90 DUE TO PT TO BE CONSIDERED REDEEMED. 15

4TH LIENHOLDER PAYS TO REDEEM MERRYMINT MORTGAGE REDEMPTION AMOUNT $572,196.36 DEBT OWED 3RD DOT HOLDER $50,000.00 INTEREST PER DIEM 11% ON DOT $13.70 = $95.90 INSURANCE PER DIEM OF $17.00 PER DAY = $119.00 ***REMEMBER YOUR COR FEES AND COSTS $78.00 TOTAL DUE $622,489.26 16

OVERBID FUNDS OVERBID FUNDS C.R.S C.R.S 38 38- -38 38- -111 111

WHO GETS OVERBID FUNDS 38-38-111(2) ANY REMAINING OVERBID ANY REMAINING OVERBID SHALL PAID IN ORDER OF RECORDING PAID IN ORDER OF RECORDING PRIORITY TO THE JUNIOR LIENORS PRIORITY TO THE JUNIOR LIENORS WHO HAVE DULY FILED A NOTICE OF WHO HAVE DULY FILED A NOTICE OF INTENT TO REDEEM AND INTENT TO REDEEM AND WHOSE LIENS HAVE NOT BEEN REDEEMED LIENS HAVE NOT BEEN REDEEMED IN EACH CASE UP TO THE UNPAID IN EACH CASE UP TO THE UNPAID AMOUNT OF EACH SUCH LIENOR S AMOUNT OF EACH SUCH LIENOR S LIEN LIEN PLUS PLUS FEES AND COSTS. FEES AND COSTS. SHALL BE BE WHOSE 18

WHO GETS WHAT? CONFUSED YET? SIR CLOSE-A-LOT was redeemed by MOOLA MORTGAGE - $0.00 overbid Joe Judgment was NOT redeemed so gets overbid funds in the amount of lien $16,937.68 MOOLA MORTGAGE (1st DOT) was redeemed by MOOLA MORTGAGE - $0.00 overbid borrower party that signed the NOTE gets remaining overbid in the amount of $323,062.32. MOOLA MORTGAGE (2nd DOT) as redeemed by Joe Judgment - $0.00 overbid. 19

VARIATIONS OF REDEMPTIONS WHO GETS OVERBID OF $360,000.00 LIENHOLDER AMOUNT DUE REDEEMED OVERBID SIR CLOSE-A-LOT $4,212.50* x 0.00 MOOLA MORTGAGE 2ND $100,000.00* $100,292.90 MOOLA MORTGAGE 3RD $50,000.00* X 0.00 JOE JUDGMENT $16,000* $16,937.68 BORROWER(S) $242,769.42 20 *Plus, allowable fees and costs

VARIATIONS OF REDEMPTIONS WHO GETS OVERBID OF $360,000.00 LIENHOLDER AMOUNT DUE REDEEMED OVERBID SIR CLOSE-A-LOT $4,212.50* x 0.00 MOOLA MORTGAGE 2ND $100,000.00* $100,429.80 MOOLA MORTGAGE 3RD $50,000.00* $50,214.00 JOE JUDGMENT $16,000* X $16,937.68 BORROWER(S) $167,581.48 21 *Plus, allowable fees and costs remove COR fees and costs.

Q&A Holly Ryan, Esq. Chief Deputy Public Trustee 303-814-4320 Hryan@douglas.co.us