Reserve Bank of India and Regulations under Foreign Exchange Management Act

The Foreign Exchange Management Act (FEMA) of 1999 aims to facilitate external trade, payments, and the orderly development of India's foreign exchange market. It covers dealing in foreign exchange, holding of foreign assets, current and capital account transactions, and more. The Act empowers the Reserve Bank of India to issue regulations for effective implementation.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

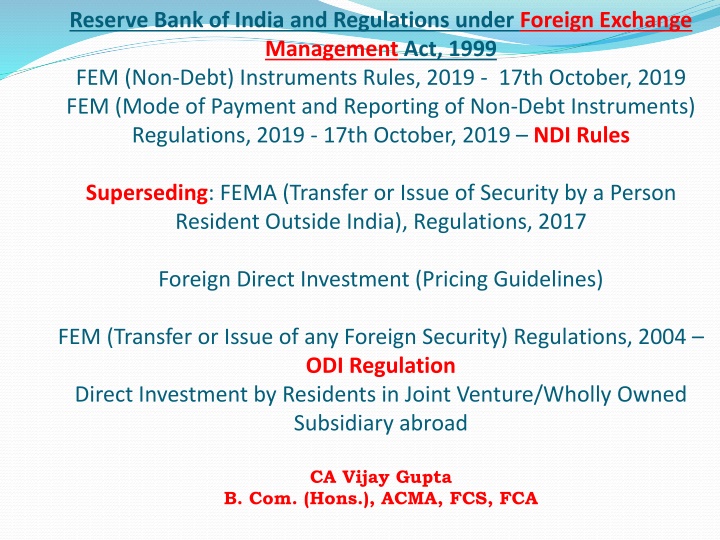

Reserve Bank of India and Regulations under Foreign Exchange Management Act, 1999 FEM (Non-Debt) Instruments Rules, 2019 - 17th October, 2019 FEM (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019 - 17th October, 2019 NDI Rules Superseding: FEMA (Transfer or Issue of Security by a Person Resident Outside India), Regulations, 2017 Foreign Direct Investment (Pricing Guidelines) FEM (Transfer or Issue of any Foreign Security) Regulations, 2004 ODI Regulation Direct Investment by Residents in Joint Venture/Wholly Owned Subsidiary abroad CA Vijay Gupta B. Com. (Hons.), ACMA, FCS, FCA

Foreign Exchange Management Act, 1999 Preamble to FEMA 1999: An Act to consolidate and amend the law relating to foreign exchange with the objective of facilitating external trade and payments and for promoting the orderly development and maintenance of foreign exchange market in India . Extends to the whole of India (including J&K) Extra-territorial jurisdiction (applies to overseas Offices) FEMA came into force w.e.f. June 1, 2000 with over 330+ amendments since then FEMA has 49 sections 2

Foreign Exchange Management Act, 1999 Sec.1-2 Sec. 3-9: 3 4 Short title, Definitions Regulation and management of FOREIGN EXCHANGE: Dealing in foreign exchange Holding of foreign exchange, foreign security or any immovable property situated outside India by a person resident in India Current account transactions Capital account transactions Export of goods and services Realisation and repatriation of foreign exchange Exemption from realisation and repatriation Authorised person Contravention and penalties, power to compound contravention 5 6** 7 8 9 Sec.10-12 Sec. 13-15 Sec. 16-35 Sec. 36-38 Sec. 39-45 46, 47 48, 49 ** Control on non-debt capital flows as equity is exercised by the Government @ Central Government makes Rules; RBI makes Regulations *For a total period of thirty days in one or more successive sessions. *Both Houses must either agree or disagree. Adjudication and appeal Directorate of Enforcement Miscellaneous Power to make Rules; Power to make Regulations @ Rules/Regulations laid before Parliament*; Repeal & Savings 3

What is the mandate of the RBI/ADs? Regulations: RBI is empowered to Notify regulations to give effect the FEMA this constitutes delegated legislation. NDI Rules shall be administered by the Reserve Bank which may interpret and issue such directions, circulars, instructions, clarifications, as it may deem necessary, for effective implementation of the provisions of these rules. A.P. (Dir. Series) Circular: Contains procedural instruction issued by the RBI issued under Section 10(4) and Section 11 of FEMA to Authorized Dealers / Banks ( ADs ) Department of Industrial Policy and Promotion, Ministry of Commerce & Industry, Government of India (DIPP) Circular on Consolidated FDI Policy (last updated on August 28, 2017) Press Notes Authorized Dealer : RBI s gatekeepers Permitted to deal in foreign exchange under FEMA FEMA requires all capital account and current account transactions to be routed through the Authorized Dealers (ADs) ADs are regulated by RBI and must comply with all RBI rules, regulations and instruction including Master Directions. ADs are interface between RBI and the various stake holders. FEMA is regulated through the Rules & the Regulations, AD (Dir Series) Circulars; Master Directions; FAQs; Compounding Orders

Rules under FEMA FEM (Encashment of Draft, Cheque, Instrument and Payment of Interest) Rules, 2000 1. 2. FEM (Authentication of Documents) Rules, 2000 3. FEM (Adjudication Proceedings and Appeals) Rules, 2000 4. FEM (Current Account Transactions) Rules, 2000 5. FEM (Compounding proceedings) Rules, 2000 6. Appellate Tribunal for Foreign Exchange (Recruitment, Salary & Allowances & Other Conditions of Service of Chairperson & Members) Rules, 2000 7. FEM (Non-Debt) Instruments Rules, 2019 Administered by the Reserve Bank. may interpret and issue such directions, circulars, instructions, clarifications, as it may deem necessary, for effective implementation of the provisions of these rules.

Regulations under FEMA FEMA 1/2000 - FEM (Permissible Capital Account Transactions) Regulations, 2000 Permissible Capital Account Transactions + Liberalised Remittance Scheme FEMA 2/2000 - FEM (Issue of Security in India by a branch, office or Agency of a person resident outside India) Regulations, 2000 Transfer or issue of any security or foreign security by any branch, office or agency in India of a person resident outside India FEMA 3(R)/2018 - FEM (Borrowing or Lending) Regulations, 2018 Borrowing and lending between a person resident in India and a person resident outside India 1. 2. 3. 4. FEMA 4/2000 - FEM (Borrowing and Lending in Rupees) Regulations, 2000 Superseded by FEMA 3(R)/2018 Any borrowing or lending in rupees in whatever form or by whatever name called between a person resident in India and a person resident outside India FEMA 5(R)/2016 - FEM (Deposit) Regulations, 2016 Deposits between persons resident in India and persons resident outside India 5. FEMA 6(R)/2015 - FEM (Export & Import of Currency) Regulations, 2015 Export, import or holding of currency or currency notes FEMA 7(R)/2015 - FEM (Acquisition and Transfer of Immovable Property Outside India) Regulations, 2015 Transfer of immovable property outside India, other than a lease not exceeding five years, by a person resident in India 6. 7.

Regulations under FEMA (25) 8. FEMA 8/2000 - FEM (Guarantees) Regulations, 2000 Giving of a guarantee or surety in respect of any debt, obligation or other liability incurred - (i)by a person resident in India and owed to a person resident outside India and (ii) by a person resident outside India FEMA 9(R)/2015 - FEM (Realisation, repatriation and surrender of foreign exchange) Regulations, 2015 Realisation , Repatriation and Surrender of Foreign Exchange FEMA 10(R)/2015 - FEM (Foreign currency accounts by a person resident in India) Regulations, 2015 Foreign Currency Accounts by a Person Resident in India FEMA 10A/2014 - FEM (Crystallization of Inoperative Foreign Currency Deposits) Regulations, 2014 Inoperative foreign currency deposits - inoperative for a period of 3 years FEMA 11(R)/2015 - FEM (Possession and retention of foreign currency) Regulation, 2015 Possession and retention of Foreign Currency FEMA 12(R)/2015 - FEM (Insurance) Regulations, 2015 Holding by a person resident in India of a general or life insurance policy issued by an insurer outside India FEMA 13(R)/2016 - FEM (Remittance of Assets) Regulations, 2016 Remittance outside India by a person whether resident in India or not, of assets in India FEMA 14(R)/2016 - FEM (Manner of Receipt & Payment) Regulations, 2016 Manner of Receipt and Payment FEMA 395/2019 - FEM (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019 9. 10. 11. 12. 13. 14. 15. 16.

Regulations under FEMA (25) 17. FEMA 21(R)/2018 - FEM (Acquisition and Transfer of Immovable Property in India) Regulations, 2018 Superseded by NDI Rules 2109 Acquisition or transfer of immovable property in India, other than a lease not exceeding five years, by a person resident outside India FEMA 22(R)/2016 - FEM (Establishment in India of a Branch Office or a Liaison Office or a Project Office or any Other Place of Business) Regulations, 2016 Establishment in India of a Branch Office or a Liaison Office or a Project Office or any Other Place of Business FEMA 23(R)/2015 - FEM (Export of Goods and Services) Regulations, 2015 Export of Goods and Services FEMA 25/2000 - FEM (Foreign Exchange Derivative Contracts) Regulations, 2000 Foreign Exchange Derivative Contracts FEMA 120/2004 - FEM (Transfer or Issue of any Foreign Security) Regulations, 2004 ODI Regulations Transfer or issue of any Foreign Security FEMA 348/2015-Foreign Exchange Management (Regularization of assets held abroad by a person resident in India) Regulations, 2015 Regularization of assets held abroad by a person resident in India - The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 FEMA 71/2002 - FEM (Offshore Banking Unit) Regulations, 2002 Branch of a bank in India located in the Special Economic Zone FEMA 101/2003 - FEM (Withdrawal of General Permission to Overseas Corporate Bodies (OCBs)) Regulations, 2003 Withdrawal of General Permission to OCBs FEMA 339/2015 FEM (International Financial Services Centre) Regulations, 2015 Financial institutions set up in International Financial Services Centres 18. 19. 20. 21. 22. 23. 24. 25.

Comprehensive Master Directions Master Directions: Until December 2015, the regulatory framework and instructions were compiled in the form of Master Circulars issued on 01 July every year. From 01 January 2016 onwards, Master Directions are being issued. These are regularly updated and simultaneously placed online on the RBI website after any change in rules, regulation or policy. Consequently, Master Circulars stand withdrawn. Instructions to ADs have been compiled in the Master Directions. List of underlying circulars/ notifications which form the basis of this Master Direction furnished in the Appendix to the Master Direction. Master Directions issued on 04 January 2016 - Consolidated relevant A.P (DIR Series) Circulars issued so far All master regulations will be fully updated and placed online. Reserve Bank will issue Master Directions on all regulatory matters. The Master Directions to be issued will consolidate instructions on rules and regulations framed by the Reserve Bank under various Acts including banking issues and foreign exchange transactions. The process of issuing Master Directions involves issuing one Master Direction for each subject matter covering all instructions on that subject. Any change in the rules, regulation or policy will be communicated during the year by way of circulars. The Master Directions will be updated suitably and simultaneously whenever there is a change in the rules/regulations or there is a change in the policy. All the changes will get reflected in the Master Directions available on the RBI website along with the dates on which changes are made. Explanations of rules and regulations will be issued by way of Frequently Asked Questions (FAQs) after issue of the Master Directions in easy to understand language wherever necessary. The existing set of Master Circulars issued on various subjects will stand withdrawn with the issue of the Master Direction on the subject. 9

Master Directions Foreign Investment in India updated 08.03.2019 - FED Master Direction No.11/2017-18 Direct Investment Abroad by Residents in Joint Venture (JV) / Wholly Owned Subsidiary (WOS) updated as on 18.09.2019 - FED Master Direction No.15/2015-16 External Commercial Borrowings, Trade Credit, Borrowing and Lending in Foreign Currency by Authorised Dealers and Persons other than Authorised Dealers updated as on 08.08.2019 - FED Master Direction No.5/2015-16 Borrowing and Lending transactions in Indian Rupee between Persons Resident in India and Non- Resident Indians/ Persons of Indian Origin updated as on 01.01.2016 - FED Master Direction No. 6/2015- 16 Acquisition and Transfer of Immovable Property under Foreign Exchange Management Act, 1999 updated as on 11.04.2018 - FED Master Direction No. 12/2015-16 Establishment of Liaison/ Branch/ Project Offices in India by Foreign Entities updated as on29.03.2019 - FED Master Direction No. 10/2015-16 Compounding of Contraventions under FEMA, 1999 updated as on 04.04.2019 - FED Master Direction No.4/2015-16 Reporting under Foreign Exchange Management Act, 1999 updated as on 18.09.2019 FED Master Direction No.18/2015-16 Deposits and Accounts updated as on 09.01.2020 - FED Master Direction No. 14/2015-16 Remittance of Assets updated as on 28.04.2016 - FED Master Direction No. 13/2015-16 Insurance updated as on 17.11.2016 - FED Master Direction No. 9/2015-16 Other Remittance Facilities updated as on 11.02.2016 - FED Master Direction No. 8/2015-16 Liberalised Remittance Scheme (LRS) updated as on 20.06.2018 - FED Master Direction No. 7/2015-16 Money Changing Activities updated as on 08.12.2017 - FED Master Direction No. 3/2015-16 Miscellaneous updated as on 12.11.2018 - FED Master Direction No.19/2015-16 Opening and Maintenance of Rupee/Foreign Currency Vostro Accounts of Non-resident Exchange Houses updated as on 19.05.2017 - FED Master Direction No. 2/2015-16 Master Circular - Guarantees and Co-acceptances dated 01.07.2015 - DBR. No. Dir. BC.11/ 13.03.00/ 2015-16 Risk Management and Inter-Bank Dealings updated as on 21.03.2017 - FMRD Master Direction No. 1/2016-17 Export of Goods and Services updated as on 12.01.2018 - FED Master Direction No.16/2015-16 Export of Goods and Services Project Exports dated 14.01.2016 A.P. (DIR Series) Circular No.39 dated 14 January 2016 Import of Goods and Services updated as on 27.01.2020 - FED Master Direction No.17/2016-17 10

Frequently Asked questions (FAQs) by RBI Foreign Investments in India - 07.05.2018 Overseas Direct Investments - 19.09.2019 External Commercial Borrowings (ECB) 29.05.2019 Liberalised Remittance Scheme (LRS) for Residents 13.03.2019 Liaison / Branch / Project Offices of foreign entities in India - 26.12.2016 Money Changing Activities - 29.09.2017 Foreign Currency Accounts by Resident Individuals - 01.08.2016 Remittance of Assets - 02.09.2016 Accounts in India by Non-residents - 25.04.2019 Purchase of Immovable Property 07.05.2018 Miscellaneous Forex Facilities - 01.08.2017 Annual Return on Foreign Liabilities and Assets (FLA return) under FEMA 1999 - 18.06.2014 Compounding of Contraventions under FEMA, 1999 - 29.01.2018 Hedging of Price Risk in Commodities - 04.07.2014 Exchange Earner's Foreign Currency (EEFC) Account - 05.07.2016 Issuance of Rupee denominated bonds overseas - 9.10.2017 Remittances [Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangement (RDA)] - 18.01.2017 Asian Clearing Union - 06.04.2017 Swap Window for attracting FCNR (B) Dollar funds - 18.09.2013 11

Dealing in foreign exchange, etc. Sec 3 Save as otherwise provided in this Act, rules or regulations made there under, or with the general or special permission of the Reserve Bank, no person shall- a. Deal in or transfer any foreign exchange or foreign security to any person not being an authorized person; b. Make any payment to or for the credit of any person resident outside India in any manner; c. Receive otherwise through an authorized person, any payment by order or on behalf of any person resident outside India in any manner; Explanation- For the purpose of this clause, where any person in, or resident in, India receives any payment by order or on behalf of any person resident outside India through any other person (including an authorized person) without a corresponding inward remittance from any place outside India, then, such person shall be deemed to have received such payment otherwise than through an authorized person; d. enter into any financial transaction in India as consideration for or in association with acquisition or creation or transfer of a right to acquire, any asset outside India by any person. Explanation - For the purpose of this clause, "financial transaction" means making any payment to, or for the credit of any person, or receiving any payment for, by order or on behalf of any person, or drawing, issuing or negotiating any bill of exchange or promissory note, or transferring any security or acknowledging any debt.

Definitions Foreign Exchange" means foreign currency and includes,- deposits, credits and balances payable in any foreign currency, drafts, travelers cheques, letters of credit or bills of exchange, expressed or drawn in Indian currency but payable in any foreign currency, drafts, travelers cheques, letters of credit or bills of exchange drawn by banks, institutions or persons outside India, but payable in Indian currency Foreign Security" means any security, in the form of shares, stocks, bonds, debentures or any other instrument denominated or expressed in foreign currency and includes securities expressed in foreign currency, but where redemption or any form of return such as interest or dividends is payable in Indian currency Security" means shares, stocks, bonds and debentures, Government securities as defined in the Public Debt Act, 1944 (18 of 1944), savings certificates to which the Government Savings Certificates Act, 1959 (46 of 1959) applies, deposit receipts in respect of deposits of securities and units of the Unit Trust of India established under sub-section (1) of section 3 of the Unit Trust of India Act, 1963 (52 of 1963) or of any mutual fund and includes certificates of title to securities, but does not include bills of exchange or promissory notes other than Government promissory notes or any other instruments which may be notified by the Reserve Bank as security for the purposes of this Act

Definitions Currency" includes all currency notes, postal notes, postal orders, money orders, cheques, drafts, travelers cheques, letters of credit, bills of exchange and promissory notes, credit cards or such other similar instruments, as may be notified by the Reserve Bank Currency Notes" means and includes cash in the form of coins and bank notes. Foreign Currency" means any currency other than Indian currency. Service" means service of any description which is made available to potential users and includes the provision of facilities in connection with banking, financing, insurance, medical assistance, legal assistance, chit fund, real estate, transport, processing, supply of electrical or other energy, boarding or lodging or both, entertainment, amusement or the purveying of news or other information, but does not include the rendering of any service free of charge or under a contract of personal service Transfer includes sale, purchase, exchange, mortgage, pledge, gift, loan or any other form of transfer of right, title, possession or lien [Section 2(ze) of FEMA]. Thus, the definition is very wide. It covers not only transfers of ownership but also simple transfer of possession or even lien.

Capital account transaction & current account transaction S. 2(e) capital account transaction" means a transaction which alters the assets or liabilities, including contingent liabilities, outside India of persons resident in India or assets or liabilities in India of persons resident outside India, and includes transactions referred to in sub- section (3) of section 6 S. 2(j) current account transaction" means a transaction other than a capital account transaction and without prejudice to the generality of the foregoing such transaction includes,- (i) payments due in connection with foreign trade, other current business, services, and short- term banking and credit facilities in the ordinary course of business, (ii) payments due as interest on loans and as net income from investments, (iii) remittances for living expenses of parents, spouse and children residing abroad, and (iv) expenses in connection with foreign travel, education and medical care of parents, spouse and children 15

Definitions Person" includes- individual, a Hindu undivided family, a company, a firm, an association of persons or a body of individuals, whether incorporated or not, every artificial juridical person, not falling within any of the preceding sub-clauses, and any agency, office or branch owned or controlled by such person.

Definition of Person resident in India under FEMA...1/2 A person residing in India for > 182 days during the preceding financial year 1 A person who has gone out of India or who stays outside India, in either case taking up employment outside India, or carrying on outside India a business or vocation outside India, or any other purpose, circumstances as would indicate his intention to stay outside India for an uncertain period A person who has come to or stays in India, in either case, otherwise than taking up employment in India, or carrying on in India a business or vocation in India, or any other purpose, circumstances as would indicate his intention to stay in India for an uncertain period in such in such

If one goes out of India or who stays outside India for circumstances/reasons mentioned in (A) above, he becomes Non-Resident under FEMA immediately. The period of stay in India in current financial year or in the preceding financial year has no bearing in such a case. On the same principle, if an individual returns to India for circumstances/reasons mentioned in (B) above, he becomes Resident in India irrespective of his stay in India in current financial year or in the preceding financial year. For limited purpose of acquiring immovable property in India under FEMA (more particularly by foreign nationals), to be treated as a person Resident in India, a person has not only to satisfy the condition of the period of stay (being more than 182 days during the preceding financial year April to March) but has to also comply with the condition of the purpose/ intention of stay. The intention to stay has to be unambiguously established with supporting documentation including visa. Indian visa granted to him to clearly indicate the intention to stay in India for an uncertain period. Press Release of Government of India, Ministry of Finance dated February 1, 2009 - Government s advice on acquiring land by persons residing outside India - A foreign national who is residing in India for more than 182 days during the course of the preceding financial year for taking up employment or carrying on business / vocation or for any other purpose indicating his intention to stay for an uncertain period can acquire immovable property in India as he would be a person resident in India as per section 2(v) of FEMA, 1999. To be treated as a person resident in India under FEMA, a person has not only to satisfy the condition of the period of stay (being more than 182 days during the course of preceding financial year) but also his purpose of stay as well as the type of Indian visa granted to him to clearly indicate the intention to stay in India for an uncertain period. In this regard, to be eligible, the intention to stay has to be unambiguously established with supporting documentation including visa . 18

Definition of Person resident in India Under FEMA...2/2 Any person or body corporate registered or incorporated in India 2 An office, branch or agency in India owned or controlled by a person resident outside India 3 An office, branch or agency outside India owned or controlled by a person resident in India 4 Person resident outside India means a person who is not resident in India. 19

NRI/OCI Non-Resident Indian (NRI) means an individual resident outside India who is citizen of India; Overseas Citizen of India (OCI) means an individual resident outside India who is registered as an Overseas Citizen of India Cardholder under Section 7(A) of the Citizenship Act, 1955; Resident Indian citizen means an individual who is a person resident in India and is citizen of India by virtue of the Constitution of India or the Citizenship Act, 1955;

Change of residential status....1/2 Section 6(4) of FEMA Person resident outside India Person resident in India Status changed to A person resident in India may hold, own, transfer or invest in foreign currency, foreign security or any immovable property situated outside India if: such currency, security or property was acquired, held or owned by such person when he was resident outside India OR inherited from a person who was resident outside India Section 6(5) of FEMA Person resident in India Person resident outside India Status changed to A person resident outside India may hold, own, transfer or invest in Indian currency, security or any immovable property situated in India if : such currency, security or property was acquired, held or owned by such person when he was resident in India OR inherited from a person who was resident in India

Change of residential status....2/2 Any fresh investments in India in shares or expansion of the activities of the companies in which investment is made would be subject to the prevailing sectoral FDI cap and conditionalities. Further, sale proceedsof the assets would have to be deposited in the NRO Account and disposal thereof would be as per the applicable guidelines. Section 6(4) of FEMA, 1999 covers the following transactions: (i) Foreign currency accounts opened and maintained by such a person when he was resident outside India; (ii) Income earned through employment or business or vocation outside India taken up or commenced while such person was resident outside India, or from investments made while such person was resident outside India, or from gift or inheritance received while such a person was resident outside India; (iii) Foreign exchange including any income arising there from, and conversion or replacement or accrual to the same, held outside India by a person resident in India acquired by way of inheritance from a person resident outside India. (iv) A person resident in India may freely utilise all their eligible assets abroad as well as income on such assets or sale proceeds thereof received after their return to India for making any payments or to make any fresh investments abroad without approval of Reserve Bank, provided the cost of such investments and/or any subsequent payments received there for are met exclusively out of funds forming part of eligible assets held by them and the transaction is not in contravention to extant FEMA provisions.

FEMA Inbound Investment (Non Resident investing into India) Outbound Investment (Resident investing outside India) FDI ODI ECB (Others) (Equity, CCPS & CCDS) (JV/WOS abroad) Approval Route Automatic Route Automatic Route Approval Route 23

Foreign Direct Investment into an Indian company Kinds of Investment Automatic Route No prior approval from the RBI/ Government Approval Route Prior approval of the Central Government required (no separate RBI approval) Mode of Investment Greenfield: Setting up a new JV/ WOS (fresh issue of shares) Brownfield: Relating to existing investments/ business activities: Brownfield Investment Rights/ Bonus issue/ ESOP/ Sweat Equity Share Purchase Gift of shares Share swap Conversion of ECB/ pre-incorp payables/ import payables, royalty, other legitimate dues etc. Merger/Demerger/ Amalgamation/ Reconstruction

Foreign Investment in India Schedule I Equity instruments of an Indian company Foreign Direct Investment Permitted sectors, entry routes and sectoral caps for total foreign investment Schedule II Equity instruments of an Indian company listed or to be listed on a recognised stock exchange in India Limit of 10 percent and 24 percent called individual and aggregate limit Threshold limit of 24% or 49% or 74% Units of domestic mutual funds or Category III Alternative Investment Fund or offshore fund Units of REITs and InVITs NRI or OCI on repatriation basis Equity instruments of a listed Indian company Units of domestic mutual funds Shares in public sector enterprises being disinvested Subscription to National Pension System Equity instruments of an Indian company or units or contribution to the capital of a LLP by NRI or OCI on Non-repatriation basis Units of domestic mutual funds Prohibition on purchase of equity instruments - Nidhi company or a company engaged in agricultural or plantation activities or real estate business or construction of farm houses or dealing in transfer of development rights Investment in a firm or a proprietary concern - not engaged in any agricultural or plantation activity or print media or real estate business Purchase or sell securities other than capital instruments - Sovereign Wealth Funds (SWFs), Multilateral Agencies, Endowment Funds, Insurance Funds, Pension Funds and Foreign Central Banks Schedule III Schedule IV Schedule V

Foreign Investment in India Schedule VI Invest, either by way of capital contribution or by way of acquisition/ transfer of profit shares of an LLP, operating in sectors or activities where foreign investment up to 100 per cent is permitted under automatic route and there are no FDI linked performance conditions Foreign Venture Capital Investor - engaged in specified sectors and whose securities are not listed on a recognised stock exchange at the time of issue of the said securities At a price that is mutually acceptable to the buyer and the seller/ issuer. Invest in units of an Investment Vehicle - InvestmentVehicle means an entity registered and regulated by Securities and Exchange Board of India or any other authority designated for the purpose and shall include Real Estate Investment Trusts (REITs), Infrastructure Investment Trusts (InvIts) and Alternative Investment Funds (AIFs) Depository Receipts (DRs) issued by foreign depositories against eligible securities Foreign Portfolio Investor or Non- Resident Indian or an Overseas Citizen of India may purchase, hold or sell Indian Depository Receipts (IDRs) of companies resident outside India and issued in the Indian capital market Schedule VII Schedule VIII Schedule IX Schedule X

Options For Foreign Entity/Person for business activities in India Company Section 25 companies - Subject to Foreign Contribution Regulation Act, 2010 (Sch. VI of FEMA NDI Rules) Limited Liability Partnership x Venture Capital Fund (VCF)/ AIFs Trusts (other than VCF/ AIFs) x Other Entities e.g. HUF, AOPs Liaison Office/Representative Office/Project Office / Branch Office to undertake specified activities (Body incorporated outside India including a firm or other association of individuals; Other than Individual) Partnership Firm / Proprietary Firm By NRI and OCI: On non-repatriation basis: (Not engaged in any agricultural/ plantation activity or print media or real estate business) x On repatriation basis x Other than NRIs/PIO:

Who can invest under FDI? A person resident outside India or a entity incorporated outside India (including foreign citizens/ Individuals/ NRIs) A citizen of Pakistan or an entity incorporated in Pakistan Under the Government route other than defence, space & atomic energy, other prohibited sectors Under the Government route A citizen of Bangladesh or an entity incorporated in Bangladesh NRIs resident in Nepal and Bhutan as well as citizens of Nepal and Bhutan On repatriation basis, if remittance received in free foreign exchange through normal banking channels Derecognized w.e.f. September 16, 2003 Erstwhile OCBs Not allowed to invest in India Unincorporated entity outside India An entity of a country, which shares land border with India or the beneficial owner of an investment into India who is situated in or is a citizen of any such country, shall invest only with the Government approval. Transfer of ownership of any existing or future FDI in an entity in India, directly or indirectly, resulting in the beneficial ownership falling within the restriction or purview of the above provisos, such subsequent change in beneficial ownership shall also require government approval.

Prohibited Sectors .1/2 Under Schedule 1/ Regulation 15 of FEMA 20(R) - (FDI) FDI is prohibited in: (a) Lottery Business, including Government/private lottery, online lotteries, (b) Gambling and Betting including casinos (c) Chit funds (d) Nidhi company (e) Trading in Transferable Development Rights (TDRs) (f) Real Estate Business** or Construction of Farm Houses (g) Manufacturing of Cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes*** (h) Activities/sectors not open to private sector investment e.g. (I) Atomic Energy and (II) Railway operations (other than permitted activities mentioned in entry 18 of Annex B of FDI Policy). ** Real estate business shall not include development of townships, construction of residential /commercial premises, roads or bridges and Real Estate Investment Trusts (REITs) registered and regulated under the SEBI (REITs) Regulations 2014. Further, for FDI, earning of rent/income on lease of the property, not amounting to transfer, will not amount to real estate business. ***Wholesale cash and carry, retail trading etc. shall be governed by FDI policy Foreign technology collaboration in any form including licensing for franchise, trademark, brand name, management contract is also prohibited for Lottery Business and Gambling and Betting activities

Prohibited Sectors .2/2 Under FEMA 1 Foreign investment in any form is prohibited in a company or a partnership firm or a proprietary concern or any entity, whether incorporated or not (such as, Trusts) which is engaged or proposes to engage in the following activities: (a) Business of chit fund, or (b) Nidhi company, or (c) Agricultural or plantation activities, or (d) Real estate business**, or construction of farm houses, or (e) Trading in Transferable Development Rights (TDRs). ** Real estate business" shall not include development of townships, construction of residential/commercial premises, roads or bridges and Real Estate Investment Trusts (REITs) registered and regulated under the SEBI (REITs) Regulations, 2014.

Equity Instruments EquityInstruments means equity shares, debentures, preference shares and share warrants issued by an Indian company Debentures means fully, compulsorily and mandatorily convertible debentures. Preferenceshares means fully, compulsorily and mandatorily convertible preference shares Capital instruments can contain an optionality clause subject to a minimum lock-in period of one year or as prescribed for the specific sector, whichever is higher, but without any option or right to exit at an assured price Partly paid shares: fully called-up within 12 months of such issue. Twenty five percent of the total consideration amount (including share premium, if any), shall be received upfront. Share warrants for listed company: At least twenty five percent of the consideration shall be received upfront and the balance amount within eighteen months of issuance of share warrants.

Capital Instruments Non-convertible/ preference shares: Treated as debt and shall conform to External Commercial Borrowings guidelines regulated under Foreign Exchange Management (Borrowing and Lending) Regulations, 2000 optionally convertible/partially convertible ConvertibleNote means an instrument issued by a startup company evidencing receipt of money initially as debt, which is repayable at the option of the holder, or which is convertible into such number of equity shares of such startup company, within a period not exceeding five years from the date of issue of the convertible note, upon occurrence of specified events as per the other terms and conditions agreed to and indicated in the instrument. Startup company means a private company incorporated under Companies Act, 2013 and recognised as such in accordance with notification issued by the Department of Industrial Policy and Promotion, Ministry of Commerce and Industry, Government of India and complies with the conditions laid down by it

Foreign Investment/ Foreign Direct Investment Foreign Direct Investment (FDI) means investment through capital instruments by a person resident outside India in an unlisted Indian company; or in 10 percent or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company; Fully diluted basis means the total number of shares that would be outstanding if all possible sources of conversion are exercised ( ForeignInvestment means investment made on a repatriable basis in capital instruments of an Indian company or to capital of an LLP;

Acquisition through a rights issue or a bonus issue (other than share warrants) -Not result in breach of sectoral cap applicable to the company For listed Indian company: At a price determined by the company For unlisted Indian company: Not be at a price less than the price offered to persons resident in India. . s- A person resident outside India who has acquired a right from a person resident in India who has renounced it may acquire equity instruments (other than share warrants) against the said rights as per pricing guidelines. Where original investment has been made on a non-repatriation basis, the amount of consideration may also be paid by debit to the NRO account An individual who is a person resident outside India exercising a right which was issued when he/ she was a person resident in India shall hold the capital instruments (other than share warrants) so acquired on exercising the option on a non-repatriation basis. In case a person resident outside India makes investment in capital instruments (other than share warrants) issued by an Indian company as a rights issue that are renounced by the person to whom it was offered.

Issue of shares under Employees Stock Options Scheme to persons resident outside India An Indian company may issue employees stock option and/ or sweat equity shares to its employees/ directors or employees/ directors of its holding company or joint venture or wholly owned overseas subsidiary/ subsidiaries who are resident outside India Scheme drawn either in terms of regulations issued under the Securities and Exchange Board of India Act, 1992 or the Companies (Share Capital and Debentures) Rules, 2014 notified by the Central Government under the Companies Act 2013 In compliance with the sectoral cap applicable to company under the approval route shall require prior Government approval. To a citizen of Bangladesh/ Pakistan shall require prior Government approval. An individual who is a person resident outside India exercising an option which was issued when he/ she was a person resident in India shall hold the shares so acquired on exercising the option on a non- repatriation basis.

Merger or demerger or amalgamation of Indian companies (1) Where a Scheme of merger or amalgamation of two or more Indian companies or a reconstruction by way of demerger or otherwise of an Indian company, has been approved by National Company Law Tribunal (NCLT)/ Competent Authority, the transferee company or the new company, as the case may be, may issue capital instruments to the existing holders of the transferor company resident outside India Transfer or issue is in compliance with the entry routes, sectoral caps or investment limits (2) Where a Scheme of Arrangement for an Indian company has been approved by National Company Law Tribunal (NCLT)/ Competent Authority , the Indian company may issue non-convertible redeemable preference shares or non-convertible redeemable debentures out of its general reserves by way of distribution as bonus to the shareholders resident outside India, subject to the following conditions, namely: (a) the original investment made in the Indian company by a person resident outside India is in accordance with these Regulations and the conditions specified in the relevant Schedule; (b) the said issue is in accordance with the provisions of the Companies Act, 2013 and the terms and conditions, if any, stipulated in the scheme approved by National Company Law Tribunal (NCLT)/Competent Authority have been complied with; (c) the Indian company shall not engage in any activity/ sector in which investment by a person resident outside India is prohibited.

Startup company Startup company means a private company incorporated under the Companies Act, 2013 and identified under G.S.R. 180(E), dated the 17th February, 2016 issued by the Department of Industrial Policy and Promotion, Ministry of Commerce and Industry; Convertible Note - initially as debt, repayable at the option of the holder, or which is convertible into such number of equity shares of that company, within a period not exceeding five years from the date of issue of the convertible note, upon occurrence of specified events as per other terms and conditions agreed and indicated in the instrument Issue of Convertible Notes by an Indian startup company (1) For an amount of twenty five lakh rupees or more in a single tranche. (2) A startup company, engaged in a sector where investment by a person resident outside India requiresGovernment approval, may issue convertible notes to a person resident outside India only with such approval. Further, issue of equity shares against such convertible notes shall be in compliance with the entry route, sectoral caps, pricing guidelines and other attendant conditions for foreign investment. (3) The mode of payment and other attendant conditions for remittance of sale or maturity proceeds shall be specified by the Reserve Bank. (4) A NRI or an OCI may acquire convertible notes on non-repatriation basis in accordance with Schedule IV of these rules. (5) A person resident outside India may acquire or transfer by way of sale, convertible notes, from or to, a person resident in or outside India, provided the transfer takes place in accordance with the entry routes and pricing guidelines as prescribed for capital instruments. 38

Transaction Pricing Subscription to equity instruments (equity shares, convertible preference shares and debentures) by NR (Issue of equity instruments by Indian company). [R. 6(a). Sch. I] Minimum price i) Listed company - As per SEBI guidelines or Regulations in case of companies going for delisting. [R.21(2)(a)(i)] SEBI Delisting ii) Unlisted company - As per Internationally recognised method by CA, Merchant Banker, practising cost accountant. [R.21(2)(a)(ii)] ---- Subscription to Memorandum of Association [R.21(2)(v)] ---- For convertible instruments, price or conversion formula should be decided upfront. Conversion price cannot be less than the fair value at the time of issue of instruments. ---- Share warrants Pricing and Price conversion formula has to be decided upfront. [R.21(2)(vi)] Downstream investment: Indian entity which has received investment shall comply with pricing guidelines. indirect foreign In case of swap of equity instruments, irrespective of the amount, valuation involved in swap arrangement shall have to be made by a Merchant Banker registered with the Securities and Exchange Board of India or an investment banker outside India registered with the appropriate regulatory authority in the host country Not by CA or CMA. at face value. 39

Purchase of shares Purchase of shares from resident. [R. 9(3). Sch. I] Minimum price i) Listed company - As per SEBI guidelines. [R.21(2)(b)(i)] --- ii) Preferential allotment - As per SEBI guidelines or SEBI Delisting Regulations in case of companies going for delisting. [R.21(2)(b)(ii)] --- iii) Unlisted company - As per Internationally recognised method. [R.21(2)(b)(iii)] Purchase of shares from NR who holds shares on non-repatriable basis. [R.9(1) proviso (ii); R.13(2)] Purchase on stock exchange. [R.6(a), Sch. I, Cl.1(b)] Purchase of shares from NRI who holds shares on repatriable basis. [R.13(1)] No pricing guidelines. However, one should consider S.56(2)(x) and 50CA of ITA. i) Listed company price as decided by company. ii) Unlisted company - not less than the price offered to residents in case of unlisted company. (iii) Acquisition after renunciation of rights.- A person resident outside India who has acquired a right from a person resident in India who has renounced it may acquire equity instruments (other than share warrants) against the said rights as per pricing guidelines specified under rule 21. Rights shares. [R.7] 40

Sale/ Transfer From NR (other than NRI or erstwhile OCB) to NR (including NRI, BUT NOT TO erstwhile OCB). [R.9(1)] No pricing guidelines. However, one should consider S.56(2)(x) and 50CA of ITA. No pricing guidelines. However, one should consider S.56(2)(x) and 50CA of ITA. From NRI to NR (including NRI, BUT NOT TO erstwhile OCB). [R.13(1)] Maximum price i) Listed company - As per SEBI guidelines. [R.21(2)(c)(i)] --- ii) Preferential allotment - As per SEBI guidelines or SEBI Delisting Regulations in case of companies going for delisting. [R.21(2)(c)(ii)] --- iii) Unlisted company - As per Internationally recognised method. [R.21(2)(c)(iii)] --- Guiding principle No assured exit price. [Expln. To R.21(2)(c)] From NR who holds shares on repatriable basis to resident. [R.9(2)] Allowed From NR on stock market. [R.9(2)] From NR who holds shares on repatriable basis to NRI who wants to hold shares on non-repatriable basis. (NRI investment on non-repatriable basis is considered as domestic investment at par with resident. [R.9(2); Sch. IV, A(1)(b)] Not specified. Final consideration should be as per pricing guidelines. [R.9(6), proviso] Deferred consideration. [R.9(6)] Sale through an escrow account. [R.9(7)] Sale of shares with optionality clause. [R.9(5)] Pricing Guidelines apply for Indian company buying back shares in a scheme of merger/ de- merger/ amalgamation of Indian companies approved by NCLT/ competent authority for Buyback of shares/ Reductionof Capital by Indian 41

Gift of shares From NR (other than NRI or erstwhile OCB) to NR (including NRI, BUT NOT TO erstwhile OCB). [R.9(1)] From NRI (other than OCB) to NR (including NRI, BUT NOT TO erstwhile OCB). [R.13(1)] From NR who holds shares on repatriable basis to resident. [R.9(2)] From NR who holds shares on repatriable basis to NRI who wants to hold shares on non-repatriable basis. (NRI investment on non-repatriable considered as domestic investment at par with resident. [R.9(2); Sch. IV, A(1)(b)] basis is Approval required from RBI. Upto 5% of paid up capital / each series of debentures on a cumulative basis from one person to another person. Gift upto US$ 50,000 per year. Gift only to relatives as defined in Companies Act. From resident to NR. [R.9(4)] From non-resident holding shares on non-repatriable basis to NR. [R.13(3)] Approval required from RBI. Upto 5% of paid up capital / each series of debentures on a cumulative basis from one person to another person. Gift upto US$ 50,000 per year. Gift only to relatives as defined in Companies Act. 42

NRI investment on Non-repatriable basis Purchase of shares by NRI subscription or purchase. [R.12(2), Sch. IV] Not applicable. [R.21(2), proviso]. However consider section 56(2)(x) and 56(2)(viib) of ITA. Sale of shares to a NR who wants to hold on repatriable basis. [R.9(1), proviso (ii), R.13(2)] Sale of shares to a NRI who will hold shares on non-repatriable basis. [R.13(2)] Not specified. Not applicable. [R.21(2), proviso]. However consider section 56(2)(x) and 56(2)(viib) of ITA. Approval required from RBI. Upto 5% of paid up capital / each series of debentures on a cumulative basis from one person to another person. Gift upto US$ 50,000 per year. Gift only to relatives as defined in Companies Act. Gift to NR. [R.13(3)] Gift to NRI who will hold shares on non- repatriable basis. [R.13(4)] Not specified. Warrants Subscription warrants by NR (issue of warrants by Indian company) as per SEBI rules. [R. 2(k) expln. (i). 6(a). Sch.I] ---- Warrants cannot be subscribed to in a Rights issue. [R.7] Pricing and price of conversion formula to be decided upfront. --- Pricing not applicable for issue on non-repatriable basis. [R. 21(2) (vi)]. ESOPs and sweat equity Can be issued to non-residents as per SEBI in case of listed companies and company law in caseof unlistedcompanies. [R.8] As per company law or SEBI rules, as the case may be. 43

Investment in a LLP either by way of capital contribution or by way of acquisition or transfer of profit shares, should not be less than the fair price worked out as per any valuation norm which is internationally accepted or adopted as per market practice and a valuation certificate to that effect shall be issued by the Chartered Accountant or by a practising Cost Accountant or by an approved valuer from the panel maintained by the Central Government. In case of transfer of capital contribution or profit share from a person resident in India to a person resident outside India, the transfer shall be for a consideration not less than the fair price of capital contribution or profit share of a LLP. Further, in case of transfer of capital contribution or profit share from a person resident outside India to a person resident in India, the transfer shall be for a consideration which is not more than the fair price of the capital contribution or profit share of an LLP. 44

FEMA & Valuation FDI Issue of shares Transfer of shares from Resident to Non-Resident Transfer of shares from Non-Resident to Resident Price of shares shall not be more than the fair value worked out as per any internationally accepted pricing methodology for valuation of shares on arm s length basis Price of shares shall not be less than the fair value worked out as per any internationally accepted pricing methodology for valuation of shares on arm s length basis Listed Company Unlisted Company Internationally accepted pricing Methodology for valuation of shares on arm s length basis Market Price as per SEBI Preferential Allotment Convertible instruments: Based on conversion formula which has to be determined / fixed upfront. Price at the time of conversion should not be less than the fair value worked out, at the time of issuance of these instruments. Only Certification by SEBI registered Merchant Banker/ Chartered Accountant Valuation & Certification by SEBI registered Merchant Banker/ Chartered Accountant NRIs on non-repatriation basis under Schedule IV of FEMA NDI Rules: No valuation requirement Pricing not applicable for transfers between two Non-Residents Non-residents (including NRIs): Subscription to its Memorandum of Association: Made at face value subject to their eligibility to invest under the FDI scheme SEZs against import of capital goods into equity shares: Committee of Development Commissioner Preferential Allotment Pricing Guideline under SEBI (ICDR) Regulations 2009: Price not less than the higher of Avg. weekly high and low closing price over a trailing six month period, or a trailing two week period, from the "relevant date of transaction. Relevant Date means date thirty days prior to the date of GM of shareholders

Prior permission of the Reserve Bank (ii) A person resident in India, who intends to transfer any security, by way of gift to a person resident outside India. Gift does not exceed 5 per cent of the paid-up capital of the Indian company / each series of debentures / each mutual fund scheme; Sectoral cap limit is not breached; The transferor (donor) and the proposed transferee (donee) are close relatives as defined in Section 6 of the Companies Act, 1956; Value of security to be transferred together with any security already transferred by the transferor, as gift, to any person residing outside India does not exceed the rupee equivalent of USD 50,000 per financial year. Transfer is at a price which falls outside the pricing guidelines specified by the Reserve Bank (iii)

Routing of funds raised abroad to India It has come to our notice that some Indian companies are accessing overseas market for debt funds through overseas holding / associate / subsidiary / group companies. It has also been reported that such borrowings are raised at rates exceeding the ceiling applicable in terms of extant FEMA regulations and that the funds so raised are routed to the Indian companies which accounts for sole/major operations of the group. Different modalities/structures are resorted to for channeling such funds for Indian operations including investment in rupee bonds floated by the Indian company. On a review of the matter in light of the existing regulatory framework, it is clarified as under: i. Indian companies or their AD Category I banks are not allowed to issue any direct or indirect guarantee or create any contingent liability or offer any security in any form for such borrowings by their overseas holding / associate / subsidiary / group companies except for the purposes explicitly permitted in the relevant Regulations. ii. Further, funds raised abroad by overseas holding / associate / subsidiary / group companies of Indian companies with support of the Indian companies or their AD Category I banks as mentioned at (i) above cannot be used in India unless it conforms to the general or specific permission granted under the relevant Regulations. iii. Indian companies or their AD Category I banks using or establishing structures which contravene the above shall render themselves liable for penal action as prescribed under FEMA, 1999. Circular No. 41 dated November 25, 2014

Procedure for Government Approval Proposals for foreign investment would be examined by Competent Authorities as per the Standard Operating Procedure laid down by DIPP (available at http://www.fifp.gov.in/Forms/SOP.pdf). In case of proposals involving total foreign equity inflow of more than Rs 5000 crore, Competent Authority shall place the same for consideration of Cabinet Committee on Economic Affairs (CCEA). Online Filing of Applications for Government Approval Guidelines for e-filing of applications, filing of amendment applications and instructions to applicants are available at the Foreign Investment Facilitation Portal (www.fifp.gov.in).

Downstream Investment Ownership of an Indian company shall mean beneficial holding of more than 50 percent of the capital instruments of such company. Ownership of an LLP shall mean contribution of more than 50 percent in its capital and having majority profit share. Company owned by resident Indian citizens shall mean an Indian company where ownership is vested in resident Indian citizens and/ or Indian companies, which are ultimately owned and controlled by resident Indian citizens. An LLP owned by resident Indian citizens shall mean an LLP where ownership is vested in resident Indian citizens and/ or Indian entities, which are ultimately owned and controlled by resident Indian citizens. Company owned by persons resident outside India shall mean an Indian company that is owned by persons resident outside India. An LLP owned by persons resident outside India shall mean an LLP that is owned by persons resident outside India. Control shall mean the right to appoint majority of the directors or to control the management or policy decisions including by virtue of their shareholding or management rights or shareholders agreement or voting agreement. For the purpose of LLP, Control shall mean the right to appoint majority of the designated partners, where such designated partners, with specific exclusion to others, have control over all the policies of an LLP.

Downstream Investment Companycontrolled by resident Indian citizens means an Indian company, the control of which is vested in resident Indian citizens and/ or Indian companies which are ultimately owned and controlled by resident Indian citizens. An LLP controlled by resident Indian citizens shall mean an LLP, the control of which is vested in resident Indian citizens and/ or Indian entities, which are ultimately owned and controlled by resident Indian citizens. Company controlled by persons resident outside India shall mean an Indian company that is controlled by persons resident outside India. An LLP controlled by persons resident outside India shall mean an LLP that is controlled by persons resident outside India. DownstreamInvestment shall mean investment made by an Indian entity or an Investment Vehicle in the capital instruments or the capital, as the case may be, of another Indian entity: Indirect Foreign Investment means downstream investment received by an Indian entity from: (i) another Indian entity (IE) which has received foreign investment and (i) the IE is not owned and not controlled by resident Indian citizens or (ii) is owned or controlled by persons resident outside India; or (ii) an investment vehicle whose sponsor or manager or investment manager (i) is not owned and not controlled by resident Indian citizens or (ii) is owned or controlled by persons resident outside India Provided no person resident in India other than an Indian entity can receive Indirect Foreign Investment.