Residential Mortgage Financing under the Dodd-Frank Act

Learn about the impact of the Dodd-Frank Act on residential mortgage financing, including key regulations, enforcement actions by the CFPB, and the role of different regulators in Arizona's mortgage industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

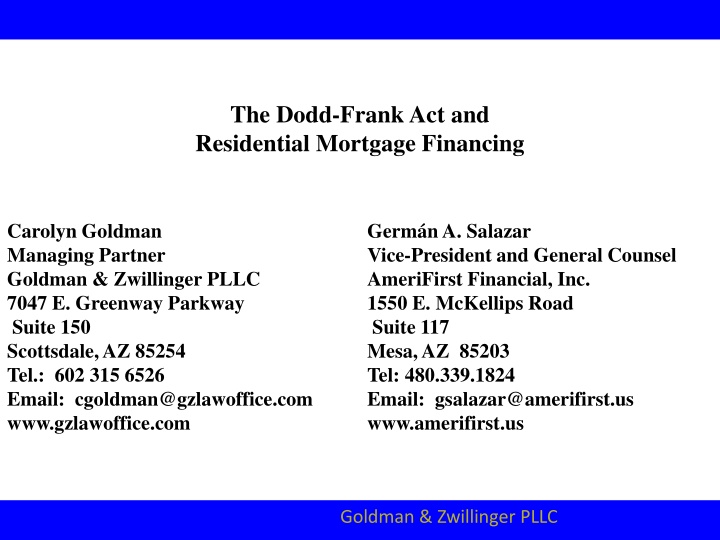

The Dodd-Frank Act and Residential Mortgage Financing Carolyn Goldman Managing Partner Goldman & Zwillinger PLLC 7047 E. Greenway Parkway Suite 150 Scottsdale, AZ 85254 Tel.: 602 315 6526 Email: cgoldman@gzlawoffice.com www.gzlawoffice.com Germ n A. Salazar Vice-President and General Counsel AmeriFirst Financial, Inc. 1550 E. McKellips Road Suite 117 Mesa, AZ 85203 Tel: 480.339.1824 Email: gsalazar@amerifirst.us www.amerifirst.us Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

The Dodd-Frank Act Purpose: To promote the financial stability of the United States by improving accountability and transparency in the financial system, to end "too big to fail," to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and for other purposes. Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Titles of the Dodd-Frank Act Applicable to Residential Mortgage Financing 1. Title X -- Dodd-Frank Act Bureau of Consumer Financial Protection a/k/a the Consumer Financial Protection Act of 2010 2. Title XIV -- Dodd-Frank Act Mortgage Reform and Anti-Predatory Lending Act Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

The New Federal Regulator Creation of the CFPB -- the Consumer Finance Protection Bureau Title X of the Dodd-Frank Act -- Transfer of Enforcement Authority and Rule-Making Authority to the CFBP from other federal agencies such as: - HUD Department of Housing and Urban Development - FRB Federal Reserve Board - FTC Federal Trade Commission Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Enforcement Actions by the CFPB against - Mortgage Lenders - Builders - Title Companies - Law Firms and Attorneys - Real Estate Brokerages - Mortgage Insurers Further Discussion at the Real Property Section Program at the State Bar Convention Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Arizona Mortgage Industry - Two Primary Regulators 1. Arizona Department of Financial Institutions (AZDFI) - Licensing - Examinations - Enforcement Authority 2. Consumer Financial Protection Bureau (CFPB) - Examinations - Enforcement Authority Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Arizona Department of Financial Institutions (AZDFI) Licensing Mortgage Broker Mortgage Banker Commercial Mortgage Broker Commercial Mortgage Banker Loan Originator Escrow Agency Collection Agency A.R.S. 6-901 et seq. A.R.S. 6-941 et seq. A.R.S. 6-901 et seq. A.R.S. 6-971 et seq. A.R.S. 6-991 et seq. A.R.S. 6-801 et seq. A.R.S. 32-1001 et seq. - - - be very careful before concluding an exemption to licensing applies be aware of AZDFI policies the AZDFI and the Arizona Attorney General's Office will issue a cease and desist order for "unlicensed activity" and will impose civil money penalties based in part upon the amount of illegal business conducted -- depending upon the structure of the documents, may be reportable to the Nationwide Mortgage Licensing System & Registry (NMLS) and other states and federal regulators. Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Exemptions from Arizona Mortgage Licensing An Often Misinterpreted and Misapplied Exemption . . . Resulting in a Cease and Desist Order and Civil Money Penalty A.R.S. 6-942(A)(2) A. This article does not apply to: . . . 2. A person who makes a mortgage banking loan or a mortgage loan: (a) With his own monies. (b) For his own investment. (c) Without intent to resell. (d) And is not engaged in the business of making mortgage loans or mortgage banking loans. See R20-4-102(14) (definition of "engaged in the business of making mortgage loans") Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Existing Laws Amended by the Dodd-Frank Act and Regulations Amended as a Result of the Dodd-Frank Act Include -- TILA RESPA Truth in Lending Act (Regulation Z) Real Estate Settlement Procedures Act (Regulation X) ECOA Equal Credit Opportunity Act (Regulation B) HOEPA Home Ownership and Equity Protection Act (Regulation Z) Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Truth in Lending Act (TILA) - 15 U.S.C. 1601 et seq. Regulation Z - 12 C.F.R. 1026.1 et seq. - - - - - - disclosure right of rescission loan officer compensation ability to pay rule - Qualified Mortgage (QM) - point and fees test appraisers - valuation independence special rules for "high cost loans" (Section 32 loans) and "higher-priced mortgage loans Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Truth in Lending Act (TILA) - 15 U.S.C. 1601 et seq. Regulation Z - 12 C.F.R. 1026.1 et seq. Coverage - Reg. Z 1026.1(c)(1)(i) through (iv) Each individual or business that offers or extends credit when four conditions are met: (i) (ii) The offering or extension of credit is done regularly; (iii) The credit is subject to a finance charge or is payable by a written agreement in more than four installments; and (iv) The credit is primarily for personal, family, or household purposes. The credit is offered or extended to consumers; - - this is a general rule regarding coverage each section must be reviewed for applicability, i.e. a dwelling, consumer's principal dwelling, high cost loan (a/k/a "Section 32" loan), higher-cost mortgage loan "done regularly" more than 5 transactions secured by a dwelling past calendar year or prior calendar year special rule for Section 32 loans - Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Real Estate Settlement Procedures Act (RESPA) 12 U.S.C. 2601 et seq. - Regulation X - 12 C.F.R. 1024.1 et seq. - disclosure (currently Good Faith Estimate, Servicing Transfer Disclosure, HUD 1 and 1A Settlement Statements) Section 8 - prohibition against certain kickbacks and referral fees and Affiliated Business Arrangements mortgage servicing rules - loss mitigation procedures, continuity of contact, early intervention requirements, qualified written requests and forced placed insurance - - Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Loan Originator Compensation Rule 1403 of the Dodd Frank Act; 129B(c)(1) of TILA; 15 U.S.C. 1639b(c) Reg. Z 1026.36 Definition of "Loan Originator" SAFE Act and State Licensing Context - individual who takes the loan application TILA - Reg. Z - broader -- includes the entity which originates a loan as well as the individual who takes the loan application Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Loan Originator Compensation Rule 1403 of the Dodd Frank Act; 129B(c)(1) of TILA; 15 U.S.C. 1639b(c) Reg. Z 1026.36 Prior to Dodd-Frank -- Yield Spread Premium - A payment made to a mortgage broker or mortgage banker which originated a loan by a party purchasing the loan. Yield spread premium was higher if the interest rate charged to the borrower was higher. Yield spread premium could be used to pay, and thereby reduce, the borrower's closing costs or could be used to provide compensation to the originating entity and loan officer. After Dodd-Frank -- Yield spread premium is eliminated as loan originator compensation. Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Loan Originator Compensation Rule 1. Prohibition against Payments Based upon a Term of the Transaction Reg. Z 1026.36(d)(1) based upon Prohibits loan originators from receiving, or any person from paying, compensation - the term of a transaction; - the terms of multiple transactions by an individual loan originator; - the terms of multiple transactions by multiple loan originators; or - proxy for a term of the transaction. Example of a transaction term: interest rate Exception: principal amount of the loan Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Loan Originator Compensation Rule 2. Prohibition against Dual Compensation Reg. Z 1026.36(d)(2) A loan originator cannot receive compensation directly from a consumer and also receive compensation from a third party, such as the lender purchasing the loan. Not compensation -- payments for bona fide and reasonable charges for services performed that are not loan origination activities, or similar payments to affiliates. Example -- payment for title insurance Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Loan Originator Compensation Rule 3. Prohibition against Steering Reg. Z 1026.36(e) which will result in greater compensation to the loan originator unless the loan is in the consumer's best interest. Reg. Z 1026.36(e)(1) A loan originator may not direct or "steer" a consumer to a loan transaction Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Loan Originator Compensation Rule 3. Prohibition against Steering Reg. Z 1026.36(e) To avoid violating (e)(1), the loan originator ("LO") is to provide the consumer with options as to each type of transaction in which the consumer expressed an interest and meet the following conditions: regularly does business and for each type of loan must present options that include: - the loan with the lowest interest rate; - the loan with the lowest interest rate without negative amortization, a prepayment penalty, interest-only payments, a balloon payment in the first 7 years of the life of the loan, a demand feature, shared equity, or shared appreciation; or, in the case of a reverse mortgage, a loan without a prepayment penalty, or shared equity or shared appreciation; and - the loan with the lowest total dollar amount of discount points, origination points or origination fees (or, if two or more loans have the same total dollar amount of discount points, origination points or origination fees, the loan with the lowest interest rate that has the lowest total dollar amount of discount points, origination points or origination fees). - the LO must obtain loan options from a significant number of creditors with which it Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Loan Originator Compensation Rule 3. Prohibition against Steering Reg. Z 1026.36(e) In addition -- to the consumer are loans for which the consumer likely qualifies. - the loan originator must have a good faith belief that the options presented more than three loans, the loan originator must highlight the loans that satisfy the criteria specified in this section. - for each type of transaction, if the loan originator presents to the consumer Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Appraisals Valuation Independence Rule Reg. Z 1026.42 Purpose: sellers, and real estate agents to arrive at a particular value - to address pressure appraisers received from loan officers, home buyers, Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Appraisals - Valuation Independence Rule Reg. Z 1026.42 Broad Scope: - loan secured by consumer s principal dwelling Settlement Procedures Act (RESPA), 12 U.S.C. 2602(3), and its implementing regulation, Regulation X at 1024.2 - applies to providers of settlement services as defined in the Real Estate Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Appraisals Valuation Independence Rule Reg. Z 1026.42 Applies to all settlements service providers defined in RESPA Reg. X 1024.2 Settlement service means any service provided in connection with a prospective or actual settlement, including, but not limited to, any one or more of the following: 1)Originationof a federally related mortgage loan (including, but not limited to, the taking of loan applications, loan processing, and the underwriting and funding of such loans); 2) Rendering of servicesby a mortgage broker (including counseling, taking of applications, obtaining verification and appraisals, and other loan processing and origination services, and communicating with the borrower and lender); 3) Provision of any services related to the origination, processing or funding of a federally related mortgage loan; 4)Provision of title services, including title searches, title examinations, abstract preparation, insurability determinations, and the issuance of title commitments and title insurance policies; 5) Rendering of services by an attorney; 6) Preparation of documents, including notarization, delivery, and recordation; 7) Rendering of credit reports and appraisals; 8) Rendering of inspections, including inspections required by applicable law or any inspections required by the sales contract or mortgage documents prior to transfer of title; Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Appraisals Valuation Independence Rule Reg. Z 1026.42 Definition of Provider of Settlement Services (cont.) Ref. X 1024.2 9) Conducting of settlement by a settlement agent and any related services; 10) Provision of services involving mortgage insurance; 11) Provision of services involving hazard, flood, or other casualty insurance or homeowner s warranties; 12) Provision of services involving mortgage life, disability, or similar insurance designed to pay a mortgage loan upon disability or death of a borrower, but only if such insurance is required by the lender as a condition of the loan; 13) Provision of services involving real property taxes or any other assessment of charges on the real property; 14) Rendering of services by a real estate agent or real estate broker; and 15) Provision of any other services for which a settlement service provider requires a borrower or seller to pay. Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Appraisals - Valuation Independence Rule Reg. Z 1026.42(c) Prohibits coercion of the appraiser no covered person shall or shall attempt to directly or indirectly cause the value assigned to the consumer s principal dwelling to be based on any factor other than the independent judgment of a person that prepares valuations Through coercion, extortion, inducement, bribery, or intimidation of, compensation or instruction to, or collusion with a person that prepares valuations or performs valuations management functions Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Appraisals - Valuation Independence Rule Reg. Z 1026.42 Examples of prohibited conduct: (A) Seeking to influence a person that prepares a valuation to report a minimum or maximum value for the consumer s principal dwelling; (B) Withholding or threatening to withhold timely payment to a person that prepares a valuation or performs valuation management functions because the person does not value the consumer s principal dwelling at or above a certain amount; (C) Implying to a person that prepares valuations that current or future retention of the person depends on the amount at which the person estimates the value of the consumer s principal dwelling; (D) Excluding a person that prepares a valuation from consideration for future engagement because the person reports a value for the consumer s principal dwelling that does not meet or exceed a predetermine threshold; and (E)Conditioning the compensation paid to a person that prepares a valuation on consummation of the covered transaction. Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Appraisals - Valuation Independence Rule Reg. Z 1026.42(c)(3) Permitted Actions: (i) Asking a person that prepares a valuation to consider additional, appropriate property information, including information about comparable properties, to make or support a valuation; (ii) Requesting that a person that prepares a valuation provide further detail, substantiation, or explanationfor the person s conclusion about the value of the consumer s principal dwelling; (iii) Asking a person that prepares a valuation to correct errors in the valuation; (iv) Obtaining multiple valuationsfor the consumer s principal dwelling to select the most reliable valuation; (v) Withholding compensation due to breach of contract or substandard performance of services; and (vi) Taking action permitted or required by applicable Federal or state statute, regulation, or agency guidance. Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Appraisals - Valuation Independence Rule Reg. Z 1026.42(g) Mandatory Reporting - officer, inspector, insurance agent, attorney If a covered person i.e. title agent, real estate broker, real estate salesperson, escrow - Professional Appraisal Practice or ethical or professional requirements for appraisers under applicable state or Federal statutes or regulations and that the failure to comply is material reasonably believes an appraiser has not complied with the Uniform Standards of - the covered person must report the matter to the appropriate state agency - consumer s principal dwelling material is defined as "likely to significantly affect the value assigned to the - the reporting must be made within a reasonable time Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Appraisals - Valuation Independence Rule Reg. Z 1026.42(d) Prohibition on Conflicts of Interest - appraisers from those who make loan approval decisions and whose compensation is based upon loans closing rules regarding separation between employees of mortgage companies who select Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Penalties TILA Fines and Imprisonment - 15 U.S.C. 1611 Willful and knowing fine of not more than $5,000 and imprisonment of not more than one year Administrative Enforcement 15 U.S.C. 1607 Adjustments to borrower s account so does not pay more than what was disclosed Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Additional TILA Penalties Specifically for Appraisal Independence Violations TILA 15 U.S.C. 1639e(k) - first violation - $10,000 per day - subsequent violations - $20,000 per day Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Dodd-Frank Act Penalties Imposed by the CFPB - 1055 of Dodd-Frank Act; 12 U.S.C. 5565 Civil Money Penalties - - - $5,000 per day $25,000 per day violations committed recklessly $1,000,000 per day violations committed knowingly Additional Penalties - - - - - - rescission or reformation of contracts refund of moneys or return of real property disgorgement or compensation for unjust enrichment damages or other monetary relief public notification regarding the violation limits on the activates of functions of the persons Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Advertising Model before the Dodd-Frank Act BlueLight Funding, LLC "No Doc" Loans "Stated Income" Loans Adjustable Rate Loans 80/10/10 Available No W-2s No Tax Returns No Financial Statements No Form 4506 required 6 Months Bank Statements Only 1% Low Introductory Rate Qualify Based upon Low Introductory Rate Interest Only Loans Available Negative Amortization Allowed 600 Minimum FICO score Courtesy Refinances Available in Six Months Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

ABILITY TO REPAY RULE AND THE QUALIFIED MORTGAGE (QM) Germ n A. Salazar Vice-President and General Counsel AmeriFirst Financial, Inc. 1550 E. McKellips Road Suite 117 Mesa, AZ 85203 Tel: 480.339.1824 Email: gsalazar@amerifirst.us www.amerifirst.us Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Proposed Mortgage Choice Act Payments to Title Company Affiliates and Whether Included in Points and Fees Test - under current law: yes - Fees Test so that a loan can more easily be considered a Qualified Mortgage the proposed Mortgage Choice Act would take these fees out of the Points and Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Liability of Assignees of Loans 15 U.S.C. 1641 Purchasers of Closed Loans TILA Liability A purchaser of closed loans can have liability under TILA if the violation is apparent on the face of the disclosure statement, including a disclosure which is incomplete or inaccurate or which does not use the required statutory terms. Exemptions for bona fide servicers and assignments for convenience. Purchase Subject to Claims and Defenses The purchaser takes the loan subject to claims and defenses the borrower could assert against the creditor, unless the purchaser demonstrates by a preponderance of the evidence of the evidence that reasonable person exercising ordinary due diligence could not determine the violations of law had occurred. Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Purchasers of Closed Loans Arizona Mortgage Licensing (AZDFI) Purchasers of closed loans are exempt from state licensing. It is important to emphasize, however, that a wholesale lender which is funding loans and receiving an assignment of the loan documents cannot rely upon this exemption. A.R.S. 6-943(A); R20-4-102(11)(d)(ii). Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Risk Retention Rule Dodd-Frank Act 941; Section 15G of the Securities and Exchange Act of 1934; 15 U.S.C. 78o-11 - a/k/a having "skin in the game" - The Dodd-Frank Act required six federal agencies to issue a rule to implement this section (OCC, FRS, FDIC, FHFA, SEC and HUD) - General Rule 5% of the credit risk must be retained by securitzer - Exemptions Qualified Residential Mortgage (QRM) the six federal agencies tasked with defining the QRM defined to be parallel with the Qualified Mortgage (QM) - 20% loan downpayment proposal rejected - Subprime loans and other non-QM loans will be subject to 5% risk retention- Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

TRID TILA/RESPA Integrated Disclosure Rule Effective: August 1, 2015 Forms Replaced: Good Faith Estimate or GFE (HUD/RESPA) Truth in Lending Disclosure Statement (FRB/TILA) HUD 1 and 1A Settlement Statements (HUD/RESPA) New Forms: Loan Estimate or LE (within 3 business days following receipt of loan application) Closing Disclosure or CD (three business days before closing) Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

TRID TILA/RESPA Integrated Disclosure Rule Who will prepare the Closing Disclosure (CD) the title agent or the lender? Before TRID: Typically, the title agent. TRID places two requirements upon the lender regarding the CD: 1. 1026.38(t). Produce the Closing Disclosure and ensure the accuracy of the information. Reg Z. 2. business days before consummation of the transaction. Reg Z. 1026.19(f)(1)(ii). Ensure the Closing Disclosure is received by the consumer at least three (3) After TRID: In light of civil liability, civil money penalties and administrative action by the CFPB, many lenders are deciding to prepare the TRID. Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC

Ben Bernanke ran the Federal Reserve and can't get a new mortgage. Can you? As reported by The Guardian on October 6, 2014 Photograph by Dominick Reuter/Reuters I recently tried to refinance my mortgage and I was unsuccessful in doing so, said Ben Bernanke." Goldman & Zwillinger PLLC Goldman & Zwillinger PLLC