Revolutionizing Business Models for the Real World

In today's business landscape, the traditional 20th-century capitalism model is evolving into a more sustainable and impactful 21st-century capitalism approach. This shift emphasizes maximizing stakeholder wellbeing and creating long-term value while acknowledging nested interdependencies with society and the environment. The 21st-century business model focuses on making visible the impacts of businesses on various stakeholders, tracking non-financial ESG performance, and addressing new global risks. It also highlights the interconnected flow of resources and emphasizes accountability, transparency, and sustainable practices.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

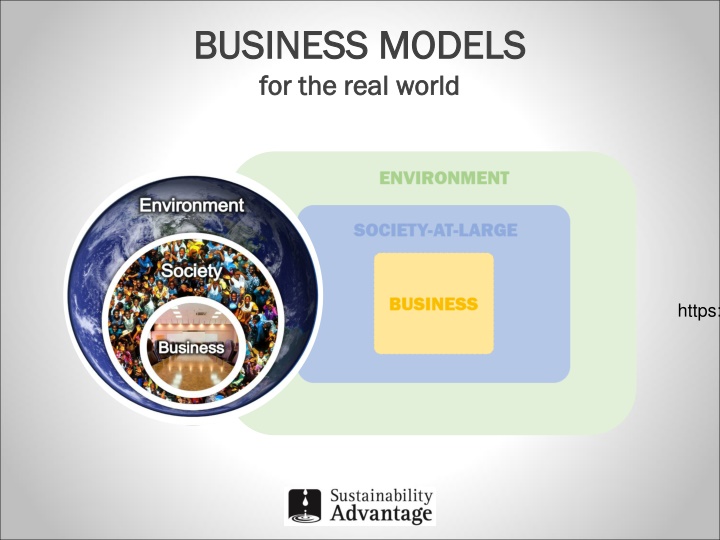

BUSINESS MODELS BUSINESS MODELS for the real world for the real world https://www.americangreetings.com/

TRADITIONAL 20 TRADITIONAL 20th th CENTURY BUSINESS MODEL CENTURY BUSINESS MODEL BUSINESS Governance Governance Purpose / Vision / Mission / Values / Strategies Human Resources Human Resources People Reputation Customers Products & Services Activities & Processes Channels Supplies $ Revenue Financial Assets, Facilities, Financial Assets, Facilities, Equipment, Intellectual Equipment, Intellectual Propoerty Lenders & Investors Propoerty $ Returns

Characteristic 20th Century Capitalism 21st Century Capitalism Purpose of the firm Maximize shareholder wealth Invisible, limitless Environment and Society Short-term profit Financial Profit For direct operational impacts Maximize stakeholderwellbeing, including Environment and Society-at-large Visible Environment-Society-Business nested interdependencies Long-term value creation Natural, Social, Human, Financial Planet, People, Prosperity For direct and indirect impacts across the value chain Business model Strategic focus Capital focus Bottom lines Accountability Negative ESG impacts Externalized; unmanaged Internalized; managed Mandatory financial reporting; optional non- financial / ESG reporting Traditional institutional lenders and investors Fossil fuels Mandatory integrated reporting on financial and non-financial / ESG performance Institutional and private impact investors; crowd-sourcing; co-operatives Low-impact renewable energy Reporting / Disclosure Sources of financial capital Powered by Aggressive tax avoidance (tax havens, etc.) Proudly pay intended right taxes in the right place at the right time Taxes paid

21st CENT 21st CENTUR URY BUSINESS MODEL Y BUSINESS MODEL - - Design Criteria Design Criteria Acknowledge nested interdependencies: Acknowledge nested interdependencies: Make visible how business is nested in Society, which is nested in the Environment on a finite planet. Show impact points: Show impact points: Make visible where and how business impacts Environment, Society and other stakeholders, to facilitate tracking, managing and reporting of non-financial ESG performance. Include new risks: Include new risks: Make visible how new global environmental, social, technological, economic and geopolitical risks are threatening businesses. Connect the dots: Connect the dots: Make visible the sources of reputation, savings and income that flow back into the business, enabling it to flourish. Show traditional flows: Show traditional flows: Show the overall input process output flow between the business, Environment, Society and other stakeholders. Include traditional business elements: Include traditional business elements: Show traditional, value- creating business model components, to the desired level of detail. The 2st Century Business Model Template satisfies these criteria

21st CENTURY BUSINESS MODEL TEMPLATE 21st CENTURY BUSINESS MODEL TEMPLATE ENVIRONMENT 21st century environmental risks SOCIETY- AT-LARGE BUSINESS Community Impacts Governance Governance Purpose / Vision / Mission / Values / Strategies Other Reputation Stakeholders Social licence $ Other income Human Resources Human Resources People Reputation Customers Reputation $ Revenue Usage & end-of-life impacts Products & Services Activities & Processes Impacts Channels Supplies Reputation $ Savings Reputation $ Savings Operational impacts Lenders & Investors Financial Assets, Facilities, Financial Assets, Facilities, Equipment, Intellectual Property Equipment, Intellectual Property Reputation $ Savings Reputation & $ Returns

NON NON- -FINANCIAL ESG PERFORMANCE FINANCIAL ESG PERFORMANCE Generic Example Generic Example xx% xx% elimination of harm to employees employees yy yy% of harm to customers, customers, communities communities and society society- -at at- -large % elimination large + + positive impacts* + + positive impacts* zz zz% % elimination of harm to the environment Impacts of obtaining supplies Impacts of operations Impacts of product usage Impacts of end-of-life-disposition environment over products life cycles from: + + positive impacts* * Positive impacts are described by the scale, depth, duration and significance of the initiatives outcomes.

NON NON- -FINANCIAL ESG PERFORMANCE FINANCIAL ESG PERFORMANCE Future- -Fit Business Benchmark (FFBB) Goals Example Fit Business Benchmark (FFBB) Goals Example Future 75% 75% elimination of harm to employees employees 68% 68% elimination of harm to customers, communities, customers, communities, andsociety society- -at at- -large large Employee health (70%) Living wage (82%) Employment terms (73%) No discrimination (66%) Concerns addressed (85%) Product comm s (63%} Product concerns (71%) Products harm (82%) Community health (70%) Business ethics (88%) Right taxes (58%) Lobbying (67%) Financial assets (48%) + + positive pursuits* E.g. Create / foster positive employee impacts E.g. Help / amplify others positive employee impacts E.g. Help others reduce their negative employee impacts + + positive pursuits* E.g. Create / foster positive social impacts E.g. Help / amplify others positive social impacts E.g. Help others reduce their negative social impacts 62% 62% elimination of harm to the environment obtaining supplies, operations, product usage and end-of-life product disposition environment over products life cycles from + + positive pursuits* E.g. Create / foster positive, restorative environmental impacts E.g. Help / amplify others positive, restorative environmental impacts E.g. Help others reduce their negative, degrading environmental impacts Supply impacts Renewable energy (76%) Water (90%) Natural resources (57%) Procurement (30%) Operations impacts Operational emissions (65%) Operations GHGs (72%) Operational waste (40%) Encroachment (87%) Product usage impacts Product GHGs (45%) Product disposition impacts Product repurposing (60%) * Positive pursuits are described by the scale, depth, duration and significance of their outcomes.

NON NON- -FINANCIAL ESG PERFORMANCE FINANCIAL ESG PERFORMANCE Sustainable Development Goals (SDGs) Example Sustainable Development Goals (SDGs) Example 75% 75% elimination of negative impacts on employee employee- -related SDGs 68% 68% elimination of negative impacts on community community- - and society at at- -large large- -related SDGs and society- - 82% 85% 68% 68% 72% 70% 68% 68% 61% 82% 68% + + positive contributions* + + positive contributions* 62% 62% elimination of negative impacts on environment obtaining supplies, operations, product usage and end-of-life-product disposition environment-related SDGs from 36% 70% 61% 60% 72% 74% + + positive contributions* * Positive contributions are described by the scale, depth, duration and significance of their outcomes.

NON NON- -FINANCIAL ESG PERFORMANCE FINANCIAL ESG PERFORMANCE B Corp Business Impact Assessment (BIA) Example B Corp Business Impact Assessment (BIA) Example Score on worker BIA Qs worker-related Score on customer customer- --and community community-related BIA Qs + + Score on associated Impact Business Model BIA Qs* + + Scores on associated Impact Business Model BIA Qs* Score on environment environment- -related BIAs about impacts from: obtaining supplies, operations, product usage and end-of-life product disposition + + Score on associated Impact Business Model BIA Qs* * Impact Business Models are described by the scale, depth, duration and significance of their outcomes.

21st CENTURY BUSINESS MODEL TEMPLATE 21st CENTURY BUSINESS MODEL TEMPLATE Capitals Version Capitals Version NATURAL CAPITAL 21st century environmental risks SOCIAL & RELATIONSHIP CAPITAL BUSINESS Community Impacts Governance Governance Purpose / Vision / Mission / Values / Strategies Other Reputation Stakeholders Social licence $ Other income Human Capital Human Capital People Reputation Customers Reputation $ Revenue Usage & end-of-life impacts Products & Services Activities & Processes Impacts Channels Supplies Reputation $ Savings Reputation $ Savings Operational impacts Lenders & Investors Financial, Manufactured and Financial, Manufactured and Intellectual Capitals Intellectual Capitals Reputation $ Savings Reputation & $ Returns

NON NON- -FINANCIAL ESG PERFORMANCE FINANCIAL ESG PERFORMANCE Integrated Reporting <IR> Capitals Example Integrated Reporting <IR> Capitals Example 75% 75% elimination of destruction of human capital capital 68% 68% elimination of destruction of social and relationship capital relationship capital human social and SOCIAL AND SOCIAL AND RELATIONSHIP RELATIONSHIP CAPITAL CAPITAL HUMAN CAPITAL HUMAN CAPITAL 75% 68% + creation of human capital* + creation of social and relationship capital* 62% 62% elimination of destruction of natural capital obtaining supplies, operations, product usage and end-of-life-product disposition natural capital over products life cycles from: NATURAL CAPITAL NATURAL CAPITAL 62% + creation of natural capital* * Value creating initiatives are described by the scale, depth, duration and significance of their outcomes.