Revolutionizing Our View of Longevity Through Healthy Life Expectancy

Discover how modeling healthy life expectancy is transforming our understanding of longevity, addressing modern challenges, and offering new solutions. Explore motivations, engineering principles, applications, and implications in this insightful research presentation featuring key insights and innovative approaches by Pei Wang and Nicholas Frei.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Modeling Healthy Life Expectancy Revolutionizing Our View of Longevity Pei Wang, Research Assistant at Goldenson Center Nicholas Frei, Actuarial Analyst at Sun Life Financial

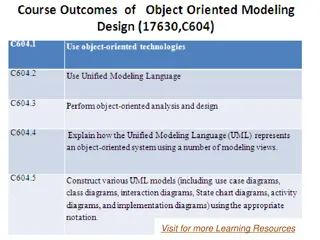

Table of Contents 1. Motivation 2. Engineering 3. Applications 4. Conclusion 2

1. Motivation Longevity Modern Challenges Healthy Life Expectancy 3

Longevity Fascination with immortality, death and everything in between What is the upper limit? 4

Modern Challenges Health care 2.7% of Americans have a healthy lifestyle consisting of exercise, nutrition, healthy BMI Financial Security and not smoking. Cognitive Disabilities 70% of Americans are worried about Long-Term Care retirement. 5

Healthy Life Expectancy Life Expectancy HLE ULE 6

A New Solution Healthy Life Expectancy is a positive new spin on looking at longevity The HLE Toolkit Modeling the healthy and unhealthy portions of someone s life equips us to tackle the modern challenges we ve mentioned Alternative methods to approaching healthy living, financial advice, and underwriting 7

2. Engineering Definitions Assumptions HLE Model Example calculations 8

Definitions Some definitions from the HLE model: Termination from a healthy state occurs by death or disability Disability uses a long term care definition, which is the inability to perform some of the activities of daily living The only exit from disability is death Cognitive Adjusted ULE (Conditional on the disability being cognitive in nature) 9

Assumptions Healthy attained age mortality rates Uses first year select SOA mortality rates Incidence rates of disability Based on SOA long term care incidence rates Attained age mortality rates for Non-cognitive disabled lives Based on SOA RP 2014 mortality rates for disabled lives Attained age mortality rates for Cognitive disabled lives Based on regular SOA annuity mortality rates Personal information gender, age, smoker status, exercise and dietary habits, body mass index, income, education level, marital status, sleep habits 10

HLE Model Flow Chart Year 1 Year 2 Year 3 Healthy Healthy Healthy Y2 Year 2 Y1 Unhealthy Year 1 Y3 Dead Dead Dead 11

HLE Model Formulas ( )= P(Healthy life (x) stays healthy and dies in the coming year) ?? ?? =P(Healthy life (x) gets disabled at the start of the year) (?)= P(Disabled life (x) dies in the coming year) ?? (?) = P(Healthy life (x) dies between x+k and x+k+1) = Then ??+? ( )(1 - ??+?) ??+? ( ) + ?=0 ( )??+? [k-t|??+? (?)] ? ??? ??? 12

HLE Model Validation of Formulas Independently evaluated HLE, ULE and LE with separate formulas and one test was to ensure LE = HLE + ULE Additional validation using Monte Carlo simulations with actuarial assumption inputs to reproduce the analytically developed calculations Monte Carlo simulations had the added benefit of providing a distribution of realized HLE s Quantiles of HLE distribution used to develop adjustment factors for input actuarial assumptions based on personal data 13

Example Calculations Male 60, non-smoker, 5 ft 10in, 180 lbs Exercises 3 - 4 days per week; > 8 hours sleep; 2 to 3 drinks per week Graduate and annual earnings > $100,000 Diet and state of health very good Output HLE = 27.4 years ULE = 2.3 years Cognitive adjusted ULE = 4.2 years Relative HLE = 112.8% Male 60, non-smoker, 5 ft 10in, 230 lbs Rarely exercises; < 5 hours sleep; 3-7 drinks per week Graduate and annual earnings > $100,000 Diet and state of health fair Output HLE = 19.2 years ULE = 2.7 years Cognitive adjusted ULE = 6.4 years Relative HLE = 79.1% VS 15

3. Applications Wellness Tool Individual Financial Planning Underwriting Health Care Cost Estimation Long Term Care Design and Pricing 16

Wellness Tool HLE is not carved in stone for an individual Proactive lifestyle changes (exercise, diet, sleep, etc.) can have a significant impact on HLE (and ULE) Easy to understand and communicate that increasing HLE increases an individual s quality of life The new step-counter app 17

Individual Financial Planning Annual retirement spending should not be level across the expected lifetime of an individual During the HLE period, retirement spending can be maximized subject to a given level of annual basic expenses During ULE period, basic expenses are expected to increase but discretionary expenses will be significantly reduced Incorporating HLE and ULE in a financial planning model will significantly change optimal spending patterns The HLE framework can provide guidance on what type of product (annuity, long-term care etc.) makes the most sense 18

Financial Planning - Illustrative Example Assume initial assets of $1.5M, i = 6%, HLE = 22 years and ULE = 8 years Assume p.v. of basic expenses = 20% of initial assets Assume basic expenses are double over ULE period and there are no discretionary expenses 19

Financial Planning - Illustrative Example Financial planning not based on HLE: Annual spending over LE of 30 years approximately $103,000 Financial planning model based on HLE: Annual spending over HLE approximately $112,000 Annual spending over ULE approximately $41,000 Additional annual discretionary spending is $9,000 or approximately $750 of additional monthly spending 20

Underwriting The creation of a model which can explicitly measure HLE and demonstrate the impact of lifestyle practices on HLE can add more rigor to current simplified underwriting practices: Model results can be obtained in real time HLE relative index can be used to differentiate between high and low risk individuals 21

Health Care Cost Estimation The HLE model can be enhanced to incorporate more detailed lifestyle and dietary details and serve as a patient screening tool for medical providers The enhanced HLE relative index could be used to develop risk classes for patients and be incorporated into a health care cost predictive model 22

Long Term Care Design and Pricing An HLE deferred life annuity for a limited duration of ULE years could be used as a substitute or to complement a long term care policy purchase LTC policies could be designed as a deferred limited duration coverage product based on HLE and ULE estimates at underwriting The cognitive-adjusted ULE could be used to estimate the additional costs incurred arising from a cognitive disability in LTC 23

4. Conclusion The HLE perspective Limitations Next Steps Acknowledgements 24

The HLE Perspective Quantifying quality of life Emphasis on a healthy lifestyle Applications in health, financial planning, long term care and underwriting 25

Limitations Underlying mortality rates Possible recovery from disabilities Current factors and assumptions can be refined More factors can be included 26

Next Steps Many open research questions are available on how to incorporate more rigor on explicitly measuring lifestyle changes on HLE Nutritional and medical professional input Immediate next step by the Goldenson Center is to develop a web- based application that will be available to the public to measure individual HLE 27

Acknowledgements Advisor: Jay Vadiveloo Team Members: Nicholas Frei Jay Krutiak Cory Wang Pei Wang Yanhan Wang John Potter 28