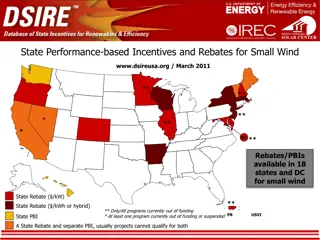

Rural Small Business Incentives in Various States

This content discusses the business climates in different states, highlighting the incentives for small businesses, rankings by various magazines, criteria used for ranking, definitions of small businesses, and Georgia's specific definition. It also mentions states with poor business climates and their challenges.

Uploaded on Feb 16, 2025 | 1 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Rural Small Business Incentives: Other States Blake Doss, House Budget and Research Office

Georgia Georgia consistently ranks in top 10 for the best state to do business. Site Selection Magazine: #1 o Georgia has been ranked #1 four years in a row. Chief Executive Magazine: #8 o Texas was voted #1 for the 13thyear in a row. Forbes: #7 o Utah has secured the #1 ranking three years in a row.

Other Great Business Climates North Carolina: o #2 (Site Selection); #3 (Chief Executive); #2 (Forbes). Texas: o #4 (Site Selection); #1 (Chief Executive); #4 (Forbes). Tennessee: o #4 (Site Selection); #7 (Chief Executive); #17 (Forbes). South Carolina: o #7 (Site Selection); #4 (Chief Executive); #21 (Forbes). Florida: o #11 (Site Selection); #2 (Chief Executive); #12 (Forbes). Utah: o #13 (Site Selection); #12 (Chief Executive); #1 (Forbes).

Ranking Criteria Each of these magazines use polling data of executives and site selectors to rank state business climates. Other criteria include: o Regulatory Environment o Labor Supply o Economic Climate o Quality of Life

Poor Business Climates These states have consistently been ranked poor business climates: o California: N/A (Site Selection); #50 (Chief Executive); #30 (Forbes). o Vermont: N/A (Site Selection); #40 (Chief Executive); #45 (Forbes). These low-ranked states burden their small businesses with excessive family leave mandates, larger energy regulatory burdens, stricter land use regulations, and more expensive workers compensation regulations. Forbes Other states, like Mississippi, rank somewhere in the middle due to poor economic climate, workforce, and quality of life.

Small Business Definitions Federal small business definitions vary by industry, although many default to 500 employees or less. o Logging is 500 employees or less, while gold ore mining is 1,500 employees or less. o Industrial Building Construction is small if its average annual receipts (over three years) make it worth less than $36.5 million.1 Texas: o A microbusiness has no more than 20 employees. o Small business: fewer than 100 employees or $6 million or less in annual gross receipts. 2 Tennessee: o No more than $10 million of total gross receipts averaged over three years or employs no more than 99 people on a full-time basis.3

Georgia Definition Georgia defines a small business as less than 300 employees or less than $30 million in gross receipts per year. o O.C.G.A. 50-5-121. o Based on either of these definitions, over 99% of Georgia businesses are small. o 97% employ fewer than 100. o 94% employ fewer than 50. o 78% employ fewer than 10.

Making Corrections in Poor Business Climates

California California is not a right-to-work state. California Small Business Development Center Network: o Much like UGA s Small Business Development Centers (17 of them). o Direct technical assistance through 35 centers across the state. o Business plan development, start-up basics, procurement and contracting opportunities, money management, gaining access to capital, etc. o Costs nothing to participate. o Study claims clients experienced 6 times sales growth and created 13 times more jobs than average businesses. o In 2014-2015 and 2015-2016, over 20,000 clients were assisted, with over $379 million in capital infusion. o Funding comes from SBA, the Governor s Office of Business and Economic Development, and local providers.8

California The Small Business Finance Center: o Encourages investment in low- to moderate-income communities. o It features a Jump Start Loan Program, Small Business Loan Guarantee Program and a Farm Loan Program. o The Jump Start Program helps low-wealth community businesses start and grow through microloans, technical assistance, and financial literacy training. The loans range from $500 to $10,000 for up to 5 years. o The Loan Guarantee Program covers loans up to $20 million, guaranteeing up to $2.5 million for a maximum of 7 years. o The Farm Loan Program supports direct loans to small farms through participating Financial Development Corporations. The loans are 90% guaranteed by the U.S. Department of Agriculture, Farm Serviced Agency.9

California CA Made: o State-labeling program to promote awareness of substantially-made California products. o $100-$150 annual fee to use the label. o There is a similar program for food and agricultural products, called CA Grown, which is just like our program. o Requires a third-party certification once every three years.10

Vermont SB 34 - The Rural Economic Development Initiative: o Currently awaiting the governor s signature. o Established to promote and facilitate community economic development. o The Initiative would help small businesses located available funding, as well as provide technical assistance, such as grant writing. o Shall also help identify what types of businesses are suitable for small towns, industrial parks, or rural areas. o The Initiative shall coordinate with the Secretary of Commerce and Community Development to avoid duplication of agency services. o The bill also states the Executive Branch will ensure state incentive programs are cross-promoted by different agencies.11

New Mexico HB 205: Vacant Rural Building Act: o Did not make it to the floor. o Allows a building code variance that allows vacant commercial buildings to be occupied by a small business with lower compliance costs. o Cities can adopt a procedure to grant a variance from strict building code requirements as long as they have no impact on the safe use of the building. Property owners or the small business must only fix the life threatening issues if the variance is granted.13

West Virginia The West Virginia Economic Opportunity Tax Credit Act: o Businesses that create at least 20 new jobs and make an investment in a business facility may offset up to 80% of the corporate net income tax. o If the business creates 20 new jobs with an annual median wage above the statewide average, it may offset up to 100% of the corporate net income tax. (Georgia taxes a flat rate of 6% of a corporation s taxable net income) o Small businesses can receive similar tax credits under the Act. For businesses creating less than 20 new jobs within a specified time limit, or a business creating less than 10 new jobs, a $3,000 credit is allowed per each new full-time job for five years. o To qualify, the new job must pay at least $32,000 and provide health insurance benefits. Additionally, the small business must be in manufacturing, information processing, warehousing, non-retail goods distribution, qualified research and development, or destination-oriented recreation and tourism.14

North Carolina Building Reuse Program: o Provides grants to local governments to renovate vacant buildings. Has to be vacant for at least three months. Up to $12,500 per full-time job, with maximum award of $500,000 o Tier 1 or Tier 2 county o New jobs meet county wage standard. o The company will provide health insurance and pay at least 50% of the premiums of participating employees. o Company is part of priority industry list. Up to $10,000 per full-time job, with maximum award of $500,000 for companies not on the priority industry list. Up to $5,00 per full-time job, with maximum award of $250,000 for companies not fulfilling any of the above requirements. 15 o This has some similarities to Rep. Houston s HB 73.

North Carolina The One North Carolina Fund: o Allows the governor to respond quickly to competitive-job creation projects. The North Carolina Department of Commerce administers the fund for the governor. o In order to qualify, the company must create 20 jobs at the county s average wage in Tier 1 projects. Average $3,000 per job. o Tier 2 project parameters: create 20 jobs at the county s average wage. Average $2,000 per job. o Tier 3 project parameters create 40 jobs at an average wage of 110% of the county or state average, whichever is lower. Average $1,000 per job.16

North Carolina Workforce Development programs: o NCWorks Career Centers provide companies with a network of recruiters and recruiting tools for free. Help craft job opportunity announcements and post job openings online at over 100 NCWorks Career Centers. Job seekers can also find area training programs and search job postings through the Center.17 o NCWorks Incumbent Worker Training Grants. The grant reimburses companies for the cost of training their workers. Employers can receive up to $10,000 per grant and up to $60,000 from the program over the course of the company s lifetime. o The grant covers instructional costs, classes for certification exams, online training, computer software for training purposes, and textbook and manuals. This is much like the Georgia Quick Start Program.18

North Carolina HB 896: This bill would establish a grant program within the Rural Economic Development Division of the Department of Commerce to allow local governments or nonprofit corporations located within a Tier 1or Tier 2 county or a rural area to establish or provide broadband services.19 o Still in House committee.

Texas Texas Certified Capital Company Program (CAPCO): o These programs are government-sponsored, private venture capital companies. o They provide investment funds as an alternative to banks. o Funded through certified capital notes purchased by insurance companies. Participating insurance companies receive tax credits equal to 100% of their investment. $400 million program. o The Texas Legislature approved two programs in 2005 and 2007. Total of 19 venture capital companies from the two programs.20 Audits in different states have shown that the money is not always invested in local businesses, though.21

Washington HB 2133: This bill would encourage economic vitality of rural food and forest product businesses by creating an all-encompassing permitting process. o Still in House committee. o Creates a pilot program within the Department of Agriculture to test out the permitting process. o Georgia has had a Licensing Division at the Department of Agriculture since 2013. o The bill would also require the state community economic revitalization board (like the DCA s Redevelopment Fund Program) to consider whether proposed public facilities projects would support long-term sustainability of local agriculture, forestry, and fisheries in rural areas before prioritizing projects.22

Florida HB 1415: This bill deals with regional rural development organizations. o Died in committee. o Would increase the funding available to three regional economic development organizations (much like our Regional Development Centers) serving rural areas so they can increase their professional capacity. Would have given the organizations $250,000 a year instead of $50,000, so more staff could be hired to offer technical assistance, job recruitment, and education/leadership development.23 o In FY18, each RDC in Georgia will receive $164,993 as the floor base, and then an additional supplement based on population. Atlanta and Northwest Georgia both receive $192,493, the highest amounts the DCA gives out.24

Tennessee The Rural Economic Opportunity Act of 2016 establishes the Propelling Rural Economic Progress fund (PREP fund). o Provides grants to rural counties to develop sites and infrastructure. o The goal is to make communities more attractive to prospective companies. o The first appropriation of $135,000 will occur in FY18 and then another appropriation of $270,000 in FY19. Grant sizes will be determined by the Commissioner of Economic and Community Development. o The Act also restructures and extends the county tier system, making it easier for businesses in rural counties to qualify for job tax credits. The restructuring created a Tier 4 county (like ours) to help get more funds/incentives to struggling counties.25

Alabama Small Business and Agribusiness Jobs Act (2016) o Tax credit for employers who create new jobs and hire new employees under certain conditions. o Headquarters of business must be in the state. o Have 75 or fewer employees, not including the new employees to be hired. o One-time credit equal to $1,500 for each new employee earning $40,000 a year. Applicable to the tax year in which the new employee has worked 12 months . It may be carried forward for up to three years. Can only be claimed for employees hired after July 25, 2016. Expires on January 1, 2019.26

South Carolina Job tax credit to businesses with 99 or fewer employees who increase employment by two or more full-time jobs. o Only available if gross wages of the created jobs are a minimum of 120% of the county or state s average per capita income. o It is available for the first 5 years of the new employee s tenure. o The business must be in manufacturing, processing, agricultural packaging, warehousing and distribution, research and development, agribusiness or a qualified technology facility.27

South Carolina SB 407: The South Carolina Agribusiness and Rural Jobs Act o Didn t pass this session. o Creates an agribusiness and rural growth fund. Application fee of $5,000 to be certified by the Department of Revenue. Evidence that the applicant or affiliates have invested at least $100 million in nonpublic companies in rural areas must be included in the application, as well as the estimated jobs created. The application must include a business plan that includes a revenue impact assessment that projects state and local tax revenue to be generated by the applicant's proposed investments. o Has to be prepared by an approved third-party economic forecasting firm. o A taxpayer who makes a credit-eligible capital contribution to an agribusiness and rural growth fund is issued a tax credit certificate.28

Kentucky House Bill 301 (2014) streamlined and revised the process to apply and qualify for the Kentucky Small Business Tax Credit. o Small businesses must create and fill one or more eligible jobs for a year, while investing $5,000 or more in qualifying equipment or technology. o Most businesses with 50 or fewer full-time employees are considered eligible. o The tax credit offers between $3,500 and $25,000 a year. Average of $11,271 per credit. Approximately 1,170 new jobs and $12.4 million in total investment by companies.29

Kansas HB 2357: The Agribusiness Technology and Entrepreneurship District Act: o Still in House committee. o This bill would allow the Secretary of Commerce to establish districts to stimulate agribusiness. Local governments would have to apply with the Department of Commerce to get this designation. Businesses within the district would have to apply to become a qualified business. o Qualified businesses would be allowed to retain 75% of withholding taxes paid for new employees hired up to ten years. Additionally, sales tax exemptions would be given for constructing, enlarging, remodeling, or the purchase of equipment. o Only applies to projects over $50,000 Qualified businesses would also be able to apply for priority consideration of economic development grants offered by the Department of Transportation.30

Common Incentives Narrowing the definition of small business. Placing wage and health insurance requirements on incentives. Encouraging certain types of small business through incentive requirements. Providing an educated and trained workforce for small businesses. Preventing duplication of programs across agencies. Cross-promoting and advertising state and federal programs available to small business owners. Streamlining and simplifying application processes.

Works Cited 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. http://camade.ca.gov/ 11. http://legislature.vermont.gov/bill/status/2018/S.34 12. http://legislature.vermont.gov/bill/status/2018/S.34 13. https://www.nmlegis.gov/Legislation/Legislation?Chamber=H&LegType=B&LegNo=205&year=17 14. Mitchell Gray, Southern Legislative Conference. 15. https://edpnc.com/incentives/building-reuse-program/ 16. https://edpnc.com/incentives/one-north-carolina-fund/ 17. https://www.nccommerce.com/wf/job-seekers 18. https://edpnc.com/incentives/workforce-training-and-development/ 19. http://www.ncleg.net/gascripts/BillLookUp/BillLookUp.pl?Session=2017&BillID=H+896 20. https://comptroller.texas.gov/programs/systems/capco/ 21. http://www.urban.org/research/publication/state-financing-incentives-economic-development 22. http://app.leg.wa.gov/billsummary?BillNumber=2133&Year=2017 23. http://www.myfloridahouse.gov/Sections/Bills/billsdetail.aspx?BillId=59504&SessionId=83 24. Saralyn Stafford, DCA. 25. Mitchell Gray, Southern Legislative Conference. 26. Mitchell Gray, Southern Legislative Conference. 27. Mitchell Gray, Southern Legislative Conference. 28. http://www.scstatehouse.gov/billsearch.php. 29. Mitchell Gray, Southern Legislative Conference. 30. http://kslegislature.org/li/b2017_18/measures/hb2357/. https://www.sba.gov/contracting/getting-started-contractor/make-sure-you-meet-sba-size-standards/table-small-business-size-standards http://www.statutes.legis.state.tx.us/Docs/GV/htm/GV.2006.htm https://www.tn.gov/assets/entities/generalservices/cpo/attachments/Web_site_Small_Business_Guidelines_7-13.pdf http://www.urban.org/research/publication/state-financing-incentives-economic-development http://www.urban.org/research/publication/state-financing-incentives-economic-development http://www.urban.org/research/publication/state-financing-incentives-economic-development http://www.urban.org/research/publication/state-financing-incentives-economic-development http://californiasbdc.org/ http://www.ibank.ca.gov/ibank/programs/what-is-the-sbfc