Salient Features of Ease of Paying Taxes Act and Revenue Regulations

Discover the key aspects of the Ease of Paying Taxes Act and its implementation through Revenue Regulations, including provisions on publication methods, effectivity dates, and coverage of revenue issuances by the Bureau of Internal Revenue.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

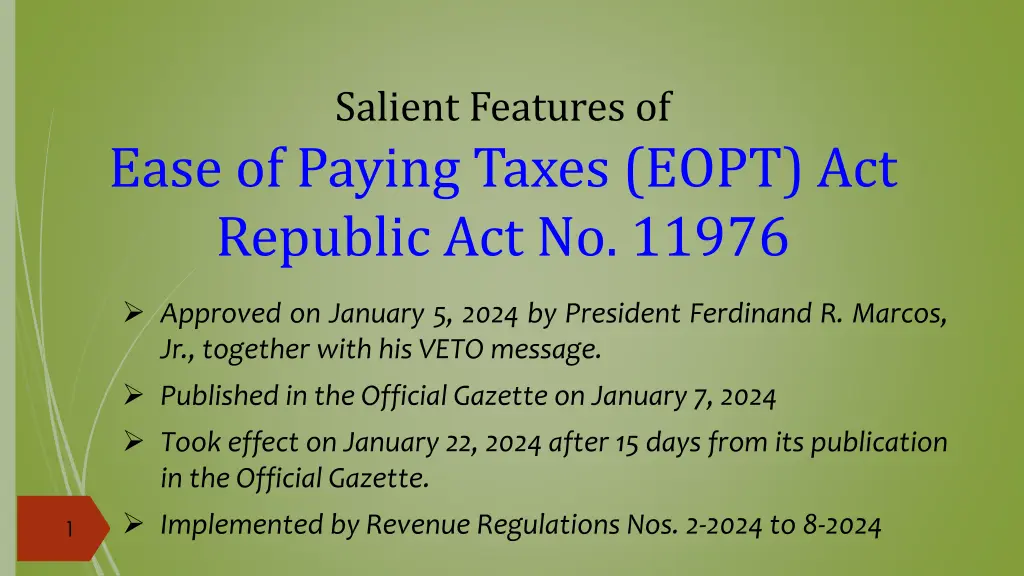

Salient Features of Ease of Paying Taxes (EOPT) Act Republic Act No. 11976 Approved on January 5, 2024 by President Ferdinand R. Marcos, Jr., together with his VETO message. Published in the Official Gazette on January 7, 2024 Took effect on January 22, 2024 after 15 days from its publication in the Official Gazette. Implemented by Revenue Regulations Nos. 2-2024 to 8-2024 1

REVENUE REGULATIONS NO. 2-2024 Re: Publication of Revenue Issuances and other Information Materials of the BIR 2

Salient Features of RR 2-2024 Implements Section 40 of the EOPT Act, specifically the amendment to Section 245(i) of the NIRC The RR itself provides that its effectivity shall be after 15 days from publication in the Official Gazette or in a newspaper of general circulation Published in Manila Bulletin on March 4, 2024 Effective March 19, 2024 3

Effect of the Amendment to Section 245(i) of NIRC The rules and regulations of the Bureau of Internal Revenue should contain provisions specifying, prescribing or defining, among others, the mode of PUBLICATION of INFORMATION REQUIRED TO BE PUBLISHED PURSUANT TO ANY LAWS, RULES, AND REGULATIONS. FOR PURPOSES OF PUBLICATION, THE BUREAU OF INTERNAL REVENUE MAY MAKE USE OF ANY ELECTRONIC MEANS OF PUBLICATION IN THE OFFICIAL GAZETTE, OR ITS OFFICIAL WEBSITE. 4

As provided by RR 2-2024 The BIR may publish (electronically, or otherwise) through the following means: 1. BIR's official website; 2. Official Gazette; or 3. Newspaper of general circulation. Applicable prospectively in accordance with Section 51 of the EOPT Act 5

BIR Revenue Issuances and other information covered by RR 2-2024 1. Revenue Regulations 2. Revenue Memorandum Circulars 3. Revenue Memorandum Orders 4. Other revenue issuances 5. Classification of taxpayers including, but not limited to, top withholding agents 6. Cannot be located (CBL) taxpayers 6

BIR Revenue Issuances and other information covered by RR 2-2024 cont d 7. List of seized, foreclosed and acquired properties for sale 8. Notice of sale of seized, foreclosed and acquired properties 9. Information materials such as, but not limited to, press releases, announcements/advisories and flyers 10.Other similar documents or materials that require publication. 7

REVENUE REGULATIONS NO. 8-2024 Implementing Section 3 of the EOPT Act, on Classification of Taxpayers Amends Section 21 of the NIRC by renumbering Sources of Income as Section 21(a), then adding Section 21(b) on Classification of Taxpayers Posted in BIR Website on April 12, 2024 Effective April 27, 2024 9

Classification of Taxpayers 1. Micro Taxpayers With gross sales for a taxable year of less than P3,000,000. 2. Small Taxpayers With gross sales for a taxable year of P3,000,000 to less than P20,000,000. 3. Medium Taxpayers With gross sales for a taxable year of P 20,000,000 to less than P1,000,000,000 4. Large Taxpayers With Gross Sales for a taxable year of P1,000,000,000 and above 10

Gross Sales shall : 1. Refer to total sales revenue, net of VAT, if applicable, during the taxable year, without any other deductions. 2. Cover only business income, including income from trade or business and exercise of profession, but excluding: compensation income Passive income earned by resident citizens/resident aliens, non-resident aliens, domestic corporations and foreign corporations under Sections 24, 25, 27 and 28, of the NIRC Exclusions from Gross Income under Section 32 (B), NIRC 11

Classification of New and Old taxpayers 1. New registrants for business or practice of profession upon the effectivity of these Regulations: Shall initially be classified based on their declaration in the Registration Forms (1901/1903) starting from the year they registered Shall remain as such, unless reclassified in accordance with the specified threshold values 2. Registered in 2023 or in 2024 but before April 27, 2024 Shall initially be classified as MICRO TAXPAYERS except VAT-registered taxpayers, who shall be classified as SMALL TAXPAYERS 12

Classification of New and Old taxpayers contd 3. Registered in 2022 and prior years Shall be classified on the basis of their gross sales for taxable year 2022 per income tax returns filed for 2022. RMO 37 -2024 4. Registered in 2022 and prior years but who have not filed their ITRs for 2022 RMO 37 -2024 Shall initially be classified as MICRO TAXPAYERS except VAT-registered taxpayers, who shall be classified as SMALL TAXPAYERS 13

NOTIFICATION TO TAXPAYERS Taxpayers shall be duly notified by the BIR of their classification or reclassification, as may be applicable In a manner or procedure to be prescribed in a revenue issuance to be issued separately. 14

REVENUE REGULATIONS NO. 6-2024 Implementing Section 45 of EOPT Act Reduced Interest and Penalty Rates for Micro and Small Taxpayers Posted in BIR Website on April 12, 2024 Effective April 27, 2024 16

Special Concessions to Certain Taxpayers 1. Micro Taxpayer a taxpayer whose gross sales for a taxable year is less than Three Million Pesos (P3,000,000.00). 2. Small Taxpayer a taxpayer whose gross sales for a taxable year is Three Million Pesos (P3,000,000.00) to less than Twenty Million Pesos (P20,000,000.00) 1 7

Reduced Civil Penalty Rate at 10% Instead of 25% per Section 248(A), NIRC, as amended, for: 1. Failure to file any return and pay the tax due thereon as required on the date prescribed. 2. Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment; or 3. Failure to pay the full or part of the amount of tax shown on any return required to be filed, or the full amount of tax due for which no return is required to be filed, on or before the date prescribed for its payment. 1 8 It should be noted that Section 248(A) of the NIRC itself was not amended by the EOPT Act. Only the EOPT Act included a provision regarding the reduced penalties granted to covered taxpayers.

No Reduction of the 50% Civil Penalty The 50% surcharge per Section 248(B), NIRC, as amended, is retained applicable to: 1. Willful neglect to file a return within the period 2. False or fraudulent filing of return A substantial under-declaration of taxable sales or income (more than 30% of the declared in the return); or a substantial overstatement of deductions (more than 30% of the actual deductions)shall shall constitute prima facie evidence of false or fraudulent return. 1 9

Reduced Interest Rate at 6% Imposed on any unpaid amount of tax instead of the usual rate per Section249, NIRC, as amended 1. Section 249 imposes an interest rate at twice the legal interest rate per Bangko Sentral ng Pilipinas 2. Since the legal interest rate per BSP is at 6%, then the usual rate is at 12% 3. Section 45 of the EOPT Act grants a 50% reduction of said rate to covered taxpayers, hence rate applicable to them is only at 6% It should be noted that Section 249 of the NIRC itself was not amended by the EOPT Act. Only the EOPT Act included a provision regarding the reduced penalties granted to covered taxpayers. 2 0

Reduced Penalty Rate at P500 Instead of P1,000 per Section 250, NIRC, as amended for: 1. Failure to file an information return, statement or list 2. Failure to keep any record 3. Failure to supply any information Information is required by the Tax Code or by the CIR Penalty of P500 is for each failure upon notice and demand by the Commissioner of Internal Revenue. Aggregate amount to be imposed during a calendar year should NOT exceed P12,500.00 (usual maximum is at P25,000) 2 1

Reduced Compromise Penalty Rates At 50% of the rates prescribed under RMO 7-2015 and its amendments for violations of the following NIRC provisions: 1. Section 113 - invoicing and accounting requirements for VAT taxpayers 2. Section 237 - issuance of invoices 3. Section 238 - printing of invoices The violations should not involve fraud These are offenses punishable under Section 264 of the NIRC Payment of the reduced compromise penalty shall be in lieu of criminal prosecution 22

REVENUE REGULATIONS NO. 4-2024 Implementing various sections of the EOPT Act Covering Filing of Tax Returns and Payment of Taxes and Other Matters Affecting the Declaration of Taxable Income Effectivity is 15 days from publication in the Official Gazette or the BIR Website, whichever came first Posted on BIR Website on April 12, 2024, effective April 27, 2024

Scope of RR 4-2024 1. Electronic or manual filing of tax returns and payment of taxes, regardless of venue or jurisdiction of the RDO 2. Removal of civil penalty for filing of return at the wrong venue; 3. Non-filing of income tax return by an Overseas Contract Worker (OCW) or Overseas Filipino Worker (OFW) 4. Removal of additional requirements for deductibility of certain payments 5. Withholding of tax at source and declaration of income of recipient 25 RR 4-2024 (Filing and Taxable Income)

Scope 1 Manual or electronic filing and payment, regardless of venue 26 RR 4-2024 (Filing and Taxable Income)

A - Additional Definition of Terms in the NIRC Section 22(KK) - FILING OF RETURN the act of accomplishing and submitting the prescribed tax return, electronically or manually To the BIR, or through any authorized agent bank (AAB) or authorized tax software provider (ATSP) As required in the Tax Code or as prescribed under existing rules and regulations. 27 RR 4-2024 (Filing and Taxable Income)

Definition of Terms - contd Section 22(LL) - Payment of Tax or Remittance of Tax the act of act of delivering the amount of tax due or withheld Either electronically or manually To the BIR, or through any AAB or ATSP Additional provision in RR 4-2024 For ATSP, for specific tax returns as approved by BIR 28 RR 4-2024 (Filing and Taxable Income)

Modes of Filing of Returns and Payment of Taxes A. Electronically when the filing of tax return and payment of tax is done through electronic means using the BIR's electronic platforms, ePayment Channels of AABs and ATSP (for specific returns as certified by BIR). B. Manually when the tax return is accomplished by writing or through the aid of electronic equipment but the act of submission and payment is done through over-the-counter with any AAB or RCO of the BIR. The RCO can accept payment in cash up to P20,000.00, while for check payment, regardless of the amount. Note: BIR Electronic Platforms are the eFPS and eBIRForms System 29 RR 4-2024 (Filing and Taxable Income)

Summary on Mode of Filing of LGUs 1. Local government units have been required to use eBIR Forms since 2014, except barangays per RR 6-2014 2. Barangays became required to use the eBIR Forms starting in 2023 per RR 4-2023 But they may still use the offline eBIR Forms Package, and file the returns manually 3. Per EOPT Law, electronic filing of returns is now required for all Manual filing is allowed only if electronic channels are not available (Section 3 of RR 4-2024) 4. Thus, all LGUs are now required to use Online eBIRForms System 30 RR 4-2024 (Filing and Taxable Income)

NIRC Provisions amended Re: Filing of Returns and Payment of Taxes Section 51(B) Where to File. Except in cases where the Commissioner otherwise permits, the return shall be filed with any authorized agent bank, Revenue District Office through Revenue Collection Officer, or authorized tax software provider. 31 RR 4-2024 (Filing and Taxable Income)

Re: Filing of Returns and Payment of Taxes contd The words electronically or manually were added to pertinent portions of: 1. SEC. 51(D). Income Tax Return of Spouses 2. SEC. 56(A). Payment and Assessment of Income Tax 3. SEC. 58(A). Quarterly Returns and Payments of Taxes Withheld at Source 4. SEC. 77. Quarterly Corporate Income Tax Return 5. SEC. 81. Returns for Withholding Tax on Wages 6. SEC. 90. Estate Tax Returns 32 RR 4-2024 (Filing and Taxable Income)

NIRC Provisions amended contd Re: Filing of Returns and Payment of Taxes The words electronically or manually were added to pertinent portions of: 7. SEC. 91. Estate Tax Payment 8. SEC. 103. Donor s Tax Return and Payment 9. SEC. 114. Value-Added Tax Return and Payment 10.SEC. 116. Percentage Tax on VAT-Exempt Persons per Section 109(CC) 11. SEC. 128. Returns and Payment of Percentage Taxes 12. SEC. 200. Payment of Documentary Stamp Tax 33 RR 4-2024 (Filing and Taxable Income)

Scope 2 - Removal of Civil Penalty for filing of return at the wrong venue Section 248 (A) (2) of the Tax Code, used to impose a 25% civil penalty for filing of a return with an internal revenue officer other than those with whom the return is required to be filed(unless otherwise authorized) This has been repealed by the EOPT Act which is consistent with the policy of filing and payment of returns regardless of venue or jurisdiction 34 RR 4-2024 (Filing and Taxable Income)

Scope 3 Non-filing of income tax return by an OCW or OFW Added by the EOPT Act as Section 51(A)(2)(e) of the NIRC 35 RR 4-2024 (Filing and Taxable Income)

Overseas Filipino Worker Refers to a Filipino who --- Is to be engaged, is engaged, or has been engaged in remunerated activity In a country of which he or she is not an immigrant, citizen or permanent resident or is not awaiting naturalization, recognition or admission whether land-based or sea-based regardless of status 36 RR 4-2024 (Filing and Taxable Income)

The term OFW INCLUDES-- A person who has been contracted for overseas employment but has yet to leave the Philippines, regardless of status. Also includes an "Overseas Contract Worker" SYNONYMOUS -- To the "Migrant Worker" as defined in Department of Migrant Workers Act or RA 11641 DOES NOT INCLUDE -- A Filipino engaged under a government-recognized exchange visitor program for cultural and educational purposes 37 RR 4-2024 (Filing and Taxable Income)

Scope 4 Removal of additional requirement for deductibility of certain payments 38 RR 4-2024 (Filing and Taxable Income)

Repeal of Section 34 (K) of the Tax Code 1. Section 2.58.5 of RR 2-98 as amended, is also repealed This required that for payments to be considered as allowable deductions against gross income, the withholding tax thereon should have been properly withheld and remitted to the BIR. 2. Despite failure of the payor the withhold taxes on the payments, the same may still be considered allowable deductions. 3. Provided, however, that the obligation to withhold tax on certain income payments and remit the same, REMAINS. RMC 60-2024 39 RR 4-2024 (Filing and Taxable Income)

Scope 5 Withholding of Tax at Source and Declaration of Income of Recipient 40 RR 4-2024 (Filing and Taxable Income)

When should the payor withhold the tax? The obligation of the payor to deduct and withhold the tax arises at the time an income has become payable. The term "payable" refers to the date the obligation becomes due, demandable or legally enforceable. It arises at the time an income payment is accrued or recorded as an expense or asset, whichever is applicable, in the payor's books, or-- At the issuance by the seller of the sales invoice or other adequate document to support such payable-- WHICHEVER COMES FIRST. 41 RR 4-2024 (Filing and Taxable Income)

Income of Recipient Income subject to withholding tax shall be included in the return of its recipient The excess of the amount of withholding tax over the tax due on his return (excess tax credits), if any, shall be refunded subject to the provision of Section 204 of the Tax Code. 42 RR 4-2024 (Filing and Taxable Income)

END OF RR 4-2024 43 RR 4-2024 (Filing and Taxable Income)

REVENUE REGULATIONS NO. 7-2024 Pertains to various matters on Registration and Invoicing Effectivity is 15 days from publication in the Official Gazette or the BIR Website, whichever came first Posted on BIR Website on April 12, 2024, effective April 27, 2024 44 RR7-2024 (Registration and Invoicing)

Pertinent NIRC Provisions 1. SEC. 113. Invoicing and Accounting Requirements for VAT-Registered Persons 2. SEC. 235. Preservation of Books of Accounts and Other Accounting Records 3. SEC. 236. Registration Requirements 4. SEC. 237. Issuance of Sales or Commercial Invoices 5. SEC. 238. Printing of Sales or Commercial Invoices 6. SEC. 241. Exhibition of Certificate of Payment at Place of Business 7. SEC. 242. Continuation of Business of Deceased Person 8. SEC. 243. Removal of Business to Other Location 45 RR7-2024 (Registration and Invoicing)

Pertinent Changes on Invoicing Requirements per Sections 113 and 237, NIRC 46 RR7-2024 (Registration and Invoicing)

For VAT-registered persons under Section 113 VAT Invoices shall be issued for the following: 1. For every sale, barter, exchange of goods or properties 2. For every lease of goods or properties 3. For every sale, barter or exchange of services There is no longer any distinction between the sales document to be issued for transactions VAT Invoices shall be issued for all VATable transactions regardless of amount. 47 RR7-2024 (Registration and Invoicing)

Invoicing of VAT-registered persons- contd Key points, re: VAT Invoices 1. Are the basis for output tax of the seller 2. May be issued for cash or credit sales 3. The only valid support for claims for input taxes of the buyer, as long as they should contain the information required under Section 113(B) . 4. For sales to VAT-registered persons amounting to P1,000 or more, business style is no longer required to be indicated in the invoice. 48 RR7-2024 (Registration and Invoicing)

Invoicing of VAT-registered persons- contd Re: VAT Official Receipts a. VAT Official Receipts shall no longer be issued for every lease of goods or properties or sale, barter or exchange of services. b. All references to officialreceipts or receipts are deleted, and only invoices are retained c. Per RR7-2024, official receipts may still be used, but only as a supplementary document. 49 RR7-2024 (Registration and Invoicing)

Issuances of Invoices under Section 237 - contd 1. Mandatory issuance for transactions Valued at P500 or more (previously P100 only), to be adjusted every 3 years based on consumer price index as published by PSA. regardless of amount, when required by the buyer. 2. For transactions less than P500, one invoice will still be issued for the aggregate sales for the day, if total amount is at least P500.00. 50 RR7-2024 (Registration and Invoicing)