Securitization and Baseload Transition in Energy Committee

"Explore the financial tool of securitization for managing revenue volatility in utilities, with a focus on transition strategies towards renewable energy. Learn about the challenges, opportunities, and next steps involved in this process, as discussed in the Legislative Energy Committee meeting presented by Julie Pierce, Vice President Strategy and Planning. Discover how Minnesota leads in renewables and the implications for utilities. Dive into the details of securitization terms, sizes, and mitigation structures to facilitate a smooth transition. Gain insights into ALLETE/Minnesota Power's ranking in renewable energy investments compared to total capital expenditures, and the key considerations for the industry."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Securitization and Baseload Transition Legislative Energy Committee 11-13-2020 Julie Pierce Vice President Strategy and Planning 1

Leading Minnesota in Renewables 2021 2005 2019 5% 30% Renewable Renewable 50% Renewable No. 1 in Minnesota No. 2 in the Midwest* 2 *Source: Navigant Consulting

MPs 2020 Baseload Study Boswell Energy Center 3

Financial Tool: Securitization Challenges Opportunities MP revenue volatility is high due to concentrated customer/revenue base May lower customer costs by refinancing utility debt and equity with higher rated, lower cost debt As a small utility achieving the refinancing benefits can be challenging - relative bond size will be important May allow for new utility investment, transition assistance depending on structure of legislation Lower flexibility for regulators in future rate design May reduce future utility earnings Capital recycling can assist but introduces time, type, timing regulatory risk 4

Financial Tool: Securitization Next Steps Evaluate Securitization along with other rate mitigation opportunities Phase 2 Study to accompany Integrated Resource Plan Mitigation Structure securitization terms and sizes carefully Implement regulatory or contractual measures to reduce revenue volatility Allow for utility reinvestment for replacement options 5

Appendix 6

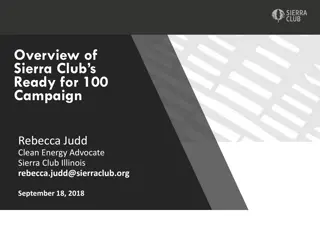

ALLETE/Minnesota Power Ranks Highest in Renewable Energy 49% 47% 42% 36% % of Renewable Cap-X Compared to Total Capital Expenditures 2020-2022 22% 17% 14% 10% 9% 9% 8% 7% 5% 5% 2% 2% 1% 1% ALE OTTR NEE MGEE NJR LNT IDA ED XEL CMS WEC ETR DUK POR ES PEG SRE PNM Source: Company public filings, i.e. Form 10-K, investor slide presentations; S&P Global article, https://www.spglobal.com/marketintelligence/en/news-insights/blog/financial-focus-wind-solar-capex-led-by-nextera-remains-major-component-of-utility-growth