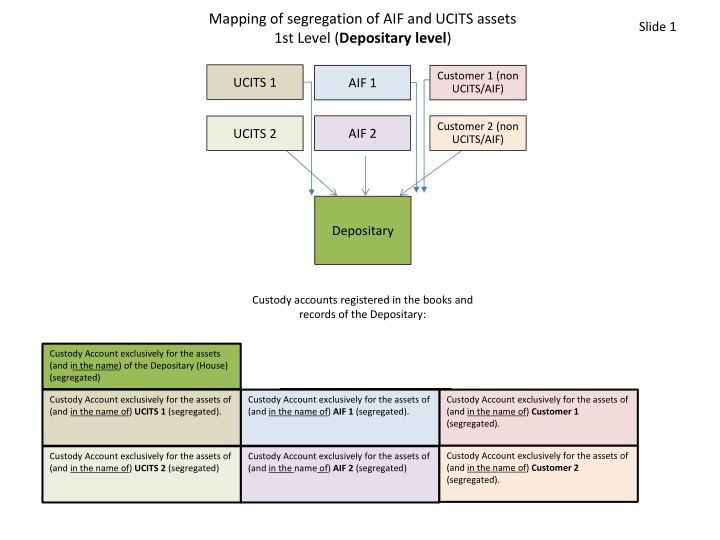

Segregation of AIF and UCITS Assets at Depositary Level

Mapping the segregation of assets at the depositary level for AIF and UCITS funds, including custody accounts for different customers and entities. The segregation ensures clear delineation of ownership and control over assets, providing transparency and protection for investors. The process involves distinct custody accounts for each entity involved, managed by the depositary to maintain accuracy in asset ownership records and control.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Mapping of segregation of AIF and UCITS assets 1st Level (Depositary level) Slide 1 Customer 1 (non UCITS/AIF) UCITS 1 AIF 1 Customer 2 (non UCITS/AIF) AIF 2 UCITS 2 Depositary Custody accounts registeredin the books and records of the Depositary: Custody Account exclusively for the assets (and in the name) of the Depositary (House) (segregated) Custody Account exclusively for and in the name of Customer 1 (one or more) (each a segregated account) Custody Account exclusively for the assets of (and in the name of) UCITS 1 (segregated). Custody Account exclusively for the assets of (and in the name of) AIF 1 (segregated). Custody Account exclusively for the assets of (and in the name of) Customer 1 (segregated). Custody Account exclusively for and in the name of UCITS 1 (one or more) (each a segregated account) Custody Account exclusively for the assets of (and in the name of) Customer 2 (segregated). Custody Account exclusively for the assets of (and in the name of) UCITS 2 (segregated) Custody Account exclusively for the assets of (and in the name of) AIF 2 (segregated)

Mapping of segregation of AIF and UCITS assets 2nd Level (CSD level Danish customers) Slide 2 Danish Customer 1 (non UCITS/AIF) UCITS 1 AIF 1 Danish Customer 2 (non UCITS/AIF) AIF 2 UCITS 2 Depositary Danish CSD (VP Securities) Custody Accounts opened by the Depositary with the Danish CSD: Custody Account exclusively for the assets (and in the name) of the Depositary (House) (segregated) Custody Account exclusively for the assets of (and in the name of) UCITS 1 (segregated). (Reflected in the books and records of the Depositary 1:1, cf. slide 1). Depositary is account controler. Custody Account exclusively for the assets of (and in the name of) AIF 1 (segregated). (Reflected in the books and records of the Depositary 1:1, cf. slide 1). Depositary is account controler. Custody Account exclusively for the assets of (and in the name of) Customer 1 (segregated). (Reflected in the books and records of the Depositary 1:1, cf. slide 1). Depositary is account controler. Custody Account exclusively for the assets of (and in the name of) UCITS 2 (segregated). (Reflected in the books and records of the Depositary 1:1, cf. slide 1). Depositary is account kontroler. Custody Account exclusively for the assets of (and in the name of) AIF 2 (segregated). (Reflected in the books and records of the Depositary 1:1, cf. slide 1). Depositary is account controler. Custody Account exclusively for the assets of (and in the name of) Customer 2 (segregated). (Reflected in the books and records of the Depositary 1:1, cf. slide 1). Depositary is account controler.

Mapping of segregation of AIF and UCITS assets 2nd Level (CSD level Foreign customers (non UCITS/AIF)) Slide 3 Foreign Customer 1 (non UCITS/AIF) UCITS 1* AIF 1* Foreign Customer 2 (non UCITS/AIF) AIF 2* UCITS 2* Depositary Danish CSD (VP Securities) Custody Accounts opened by the Depositary with the Danish CSD: Custody Account exclusively for the assets of (and in the name of) UCITS 1 (segregated). (Reflected in the books and records of the Depositary 1:1, cf. slide 1). Depositary is account controler. Custody Account exclusively for the assets of (and in the name of) AIF 1 (segregated). (Reflected in the books and records of the Depositary 1:1, cf. slide 1). Depositary is account controler. Custody Account (omnibus) for the assets of other customers of the Depositary (Foreign Customer 1 and 2). Account name: [name Depositary ] Foreign customers . Depositary is account controler. Custody Account exclusively for the assets of (and in the name of) UCITS 2 (segregated). (Reflected in the books and records of the Depositary 1:1, cf. slide 1). Depositary is account controler. Custody Account exclusively for the assets of (and in the name of) AIF 2 (segregated). (Reflected in the books and records of the Depositary 1:1, cf. slide 1). Depositary is account controler. Custody Account exclusively for the assets (and in the name) of the Depositary (House) (segregated) *= Not foreign customers

Mapping of segregation of AIF and UCITS assets 2nd Level (Delegate level omnibus market) Slide 4 Customer 1 (non UCITS/AIF) UCITS 1 AIF 1 Customer 2 (non UCITS/AIF) AIF 2 UCITS 2 Depositary Delegate Custody Accounts opened by the Depositary with the Delegate: Custody Account exclusively for the assets (and in the name) of the Depositary (House) (segregated). Account name: [name - Depositary] house . Custody Account (omnibus) for the assets of customers of the Depositary (UCITS 1 & 2, AIF 1 & 2, Customer 1 & 2 etc.) Account name: [name - Depositary] (on behalf of) clients .

Mapping of segregation of AIF and UCITS assets 2nd Level (Delegate level segregated market) Slide 5 Customer 1 (non UCITS/AIF) UCITS 1 AIF 1 Customer 2 (non UCITS/AIF) AIF 2 UCITS 2 Depositary Delegate Custody Accounts opened by the Depositary with the Delegate: Custody Account exclusively for the assets (and in the name) of the Depositary (House) (segregated) Custody Account (omnibus) for the assets of other customers of the Depositary Account name: [name - Depositary ] other clients . UCITS 1 (segregated). Account name: [Depositary name] on behalf of UCITS 1 . Depositary is account controler. Depositary is account controler. Custody Account exclusively for the assets of Custody Account exclusively for the assets of AIF 1 (segregated). Account name: [Depositary name] on behalf of AIF 1 . Custody Account exclusively for the assets of Customer 1 (segregated). Account name: [Depositary name] on behalf of Customer 1 . Depositary is account controler. Custody Account (omnibus) for the assets of the Depositary s UCITS customers (UCITS 1, UCITS 2 etc.). Account name: [name Depositary] UCITS clients . Custody Account exclusively for the assets of UCITS 2 (segregated). Account name: Custody Account exclusively for the assets of AIF 2 (segregated). Account name: [Depositary name] on behalf of AIF 2 . Custody Account (omnibus) for the assets of the Depositary s AIF customers (AIFS 1, AIF 2 etc.). Account name: [name Depositary] AIF clients . [Depositary name] on behalf of UCITS 2 . Depositary is account controler. Depositary is account controler. Custody Account exclusively for the assets of Customer 2 (segregated). Account name: [Depositary name] on behalf of Customer 2 . Depositary is account controler.

Mapping of segregation of AIF and UCITS assets 3rd Level (Sub-delegate level segregated market)* Customer 1 (non UCITS/AIF) UCITS 1 AIF 1 Depositary Delegate Sub-delegate Custody accounts opened by the Delegate with the Sub-delegate: Custody Account exclusively for the assets ( of the depositary (House) (segregated) (name: [Delegate - name] on behalf of [Depositary name] Custody Account exclusively for the assets of UCITS 1 (segregated). Account name: [Delegate name] on behalf of Depositary/UCITS 1 . Custody Account exclusively for the assets of AIF 1 (segregated). Account name: [Delegate name] on behalf of Depositary/AIF 1 .. Custody Account exclusively for the assets of Customer 1 (segregated). Account name: [Delegate name] on behalf of Depositary/Customer 1 . * = Name-convention of the custody accounts with the Sub-delegate not known the reflected is a best guess.