Setting Up a Company in Ireland - A Guide by Ireland-LSC-Partners

With decades of experience and a trusted local presence, Ireland-LSC-Partners ensures a smooth, compliant, and cost-effective company setup in Ireland. Our dedicated team handles every aspect from formation to administration.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

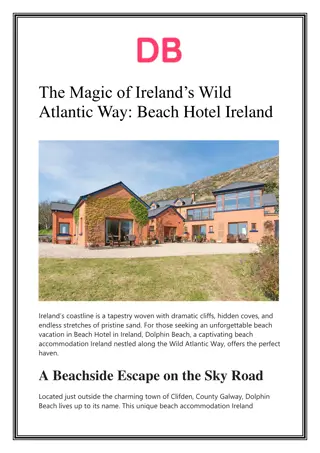

SETTING UP A COMPANY IN IRELAND A Guide by Ireland-LSC-Partners Dublin, Head Offices 77 Lower Camden Street, Suite 7 Dublin, D02 XE80 Ireland +353 1 968 2627 enquiries@ireland-lsc-partners.com

INTRODUCTION Setting up a company in Ireland offers entrepreneurs, startups, and global investors a gateway to the EU market with a business-friendly environment, low corporate tax, and a highly skilled workforce. Ireland- LSC-Partners is here to guide you through the process with clarity and compliance.

WHY CHOOSE IRELAND FOR COMPANY FORMATION? 12.5% Corporate Tax Rate Access to EU Markets English-speaking, Skilled Workforce Robust Legal and Regulatory Framework Double Taxation Treaties with 70+ Countries

TYPES OF BUSINESS STRUCTURES IN IRELAND 1.Private Company Limited by Shares (LTD) Most common structure Limited liability Single director allowed 2. Designated Activity Company (DAC) Suitable for regulated activities Specific purpose defined in constitution 3. Company Limited by Guarantee (CLG) Non-profits and charities No share capital 4. Branch of a Foreign Company Foreign businesses expanding into Ireland

STEPS TO REGISTER A COMPANY IN IRELAND Choose a Company Name Must be unique and compliant with CRO guidelines Prepare Company Constitution Outlines internal governance Appoint Directors and a Company Secretary At least one EEA-resident director or bond required Decide on Shareholders and Share Capital Minimum of one shareholder Registered Office Address in Ireland Can be physical or virtual office Submit Incorporation Documents to CRO Form A1 and constitution submitted electronically Register for Tax Corporation tax, VAT, and employer PAYE registration

POST-INCORPORATION SERVICES OFFERED BY IRELAND-LSC-PARTNERS Company secretarial support Registered office & mail forwarding Annual return filing & compliance Bank account introduction VAT and tax registration Business licensing assistance Virtual office & call answering DOCUMENTS YOU WILL RECEIVE Certificate of Incorporation Company Constitution Share Certificates Company Register Tax Registration Confirmation (if applicable)

WHY CHOOSE IRELAND-LSC- PARTNERS? With decades of experience and a trusted local presence, Ireland-LSC-Partners ensures a smooth, compliant, and cost- effective company setup in Ireland. Our dedicated team handles every aspect from formation to administration. +353 1 968 2627 enquiries@ireland-lsc-partners.com

![USA Swimming and [Insert LSC Here] Starter Clinic Overview](/thumb/162824/usa-swimming-and-insert-lsc-here-starter-clinic-overview.jpg)