Smart Tax Planning Strategies for 2021

Discover comprehensive tax planning advice for 2021, covering topics such as income tax, capital gains tax, estate planning, and more. Stay ahead with insights on minimizing tax liabilities and maximizing savings efficiently.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

CPA CULTURE, TAXES & CPA CULTURE, TAXES & 2021 PLANNING 2021 PLANNING CHRIS FEHR, CPA SoarWithFFG.com

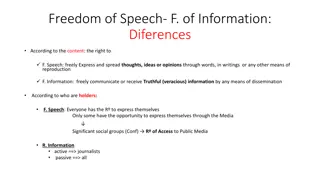

CPA Culture vs CPA Culture vs Massive Tax Massive Tax Savings Savings Traffic Light Tax Code Red Light: Stop and Pay Tax Income Tax Capital Gains Tax Net Investment Income Tax 3.8% Alternative Min. Tax Corporate vs Personal Income Tax

CPA Culture vs CPA Culture vs Massive Tax Massive Tax Savings Savings Green Light: Exception to Paying Tax Alternative Investments Charitable Strategies Change in Business Structure Maximize Tax Credits R&D Tax Credit Cost Segregation

Mindset Shift Red Light/Green Light Tax Savings this year vs Lifelong Tax Minimization Ownership vs Control CPA Culture CPA Culture vs Massive vs Massive Tax Savings Tax Savings

Biden or Sanders Plan Dramatically Lower Exemption Current Exemption - $11.7MM Higher Tax Rates Sanders Lowers Gift Tax Exemption to $1MM Elimination of Step Up in Basis Estate Estate Planning in Planning in 2021 2021

Estate Planning in Estate Planning in 2021 2021 A choice between A choice between Death and Taxes Death and Taxes

Wallet Hub Survey Highest Effective Income Tax 2nd Highest R/E Tax 3rd Highest Gas Tax $4MM Estate Threshold Massive Debt Replacement Tax Planning in Planning in Illinois Illinois

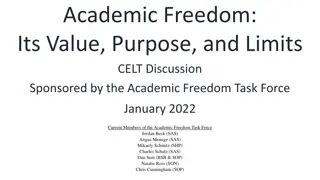

Over 100 Tools, Tactics, and Strategies Custom Combination of 3-7 for Optimum Results Ever Changing Laws Tax Code is only as Permanent as Last Administration Many CPAs and attorneys are a decade behind on tax planning My Financial Coach CFPs are Continuously Current 2021 2021 Solutions Solutions My Financial My Financial Coach Coach

The Free Bridge The Free Bridge I live in Alexandria, Virginia. Near the Supreme Court chambers is a toll bridge across the Potomac. When in a rush, I pay the dollar toll and get home early. However, I usually drive outside the downtown section of the city and cross the Potomac on a free bridge. This bridge was placed outside the downtown Washington, DC area to serve a useful social service, getting drivers to drive the extra miles and help alleviate congestion during the rush hour. If I went over the toll bridge and through the barrier without paying the toll, I would be committing tax evasion ...

The Free Bridge The Free Bridge If, however, I drive the extra mile and drive outside the city of Washington to the free bridge, I am using a legitimate, logical and suitable method of tax avoidance, and am performing a useful social service by doing so. For my tax evasion, I should be punished. For my tax avoidance, I should be commended. The tragedy of life today is that so few people know that the free bridge even exists. ~ Justice Louis Brandeis