Smoked Salmon Market Trends, Size, Share, and Growth Forecast to 2030

The global smoked salmon market was valued at USD 12.59 billion in 2024 and is expected to grow to USD 13.23 billion in 2025. By 2030, the industry is projected to reach USD 17.28 billion, reflecting a CAGR of 5.48% during the forecast period.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

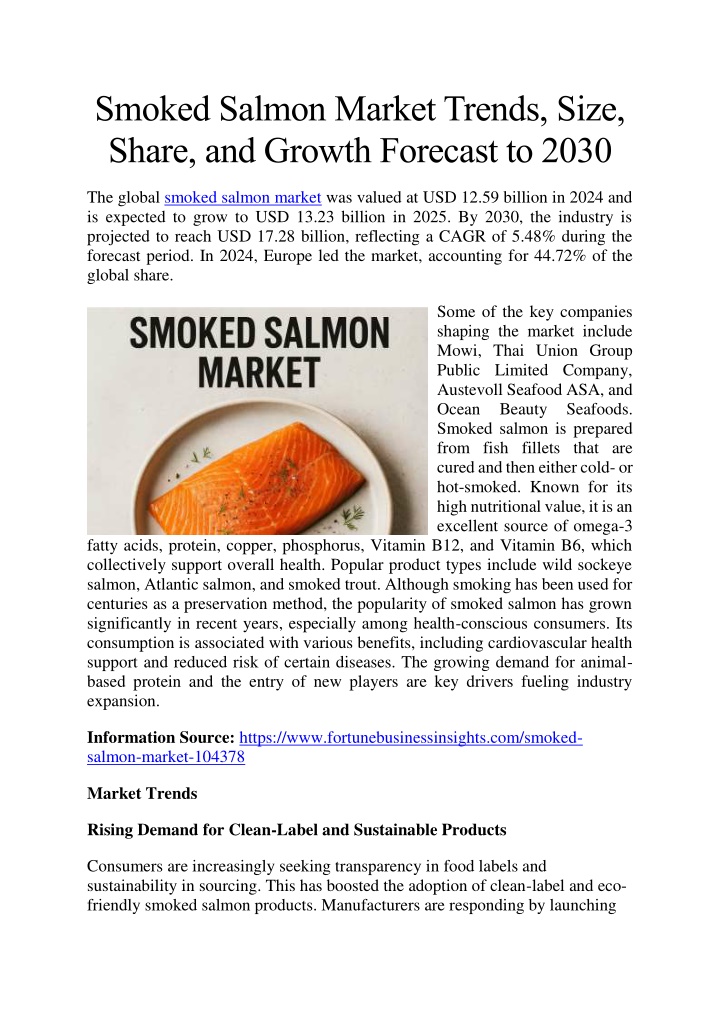

Smoked Salmon Market Trends, Size, Share, and Growth Forecast to 2030 The global smoked salmon market was valued at USD 12.59 billion in 2024 and is expected to grow to USD 13.23 billion in 2025. By 2030, the industry is projected to reach USD 17.28 billion, reflecting a CAGR of 5.48% during the forecast period. In 2024, Europe led the market, accounting for 44.72% of the global share. Some of the key companies shaping the market include Mowi, Thai Union Group Public Limited Company, Austevoll Seafood ASA, and Ocean Beauty Seafoods. Smoked salmon is prepared from fish fillets that are cured and then either cold- or hot-smoked. Known for its high nutritional value, it is an excellent source of omega-3 fatty acids, protein, copper, phosphorus, Vitamin B12, and Vitamin B6, which collectively support overall health. Popular product types include wild sockeye salmon, Atlantic salmon, and smoked trout. Although smoking has been used for centuries as a preservation method, the popularity of smoked salmon has grown significantly in recent years, especially among health-conscious consumers. Its consumption is associated with various benefits, including cardiovascular health support and reduced risk of certain diseases. The growing demand for animal- based protein and the entry of new players are key drivers fueling industry expansion. Information Source: https://www.fortunebusinessinsights.com/smoked- salmon-market-104378 Market Trends Rising Demand for Clean-Label and Sustainable Products Consumers are increasingly seeking transparency in food labels and sustainability in sourcing. This has boosted the adoption of clean-label and eco- friendly smoked salmon products. Manufacturers are responding by launching

product lines that align with these preferences. Moreover, many consumers are willing to pay a premium for products with clean-label certifications, further accelerating growth. Segmentation Insights In 2024, cold-smoked salmon dominated the market due to its stronger nutritional value compared to hot-smoked options. By application, the household segment held the largest share, highlighting its popularity at the consumer level. Regional Analysis The smoked salmon market is divided into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Europe retained its dominant position in 2024, supported by high import volumes and strong demand for sustainable seafood, especially Atlantic salmon, which is the most widely consumed type in the region. North America ranked third globally, with rising demand driven by greater health awareness and recognition of omega-3 health benefits. Competitive Landscape In 2024, leading companies such as Mowi, Austevoll Seafood ASA, Thai Union Group, Labeyrie Fine Foods, and Ocean Beauty Seafoods accounted for nearly 40% of the total market share. These players are actively expanding their global presence to strengthen their competitive positioning across key regions. Report Scope This research provides both qualitative and quantitative insights, covering market size, forecast growth, segmentation performance, and regional dynamics to deliver a comprehensive outlook on the smoked salmon industry. Key Companies Profiled Mowi (Norway) Labeyrie Fine Foods (France) Ocean Beauty Seafoods (U.S.) Austevoll Seafood ASA (Norway) Suempol (Poland) Milarex (Norway) SalMar ASA (Norway) Thai Union Group PCL (Thailand)

ACME Smoked Fish (U.S.) Cooke, Inc. (Canada) Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample- pdf/smoked-salmon-market-104378 Recent Industry Development In March 2024, Mowi launched its 7 Origins of Salmon campaign at the Seafood Expo North America. The initiative showcased a diverse range of products including smoked, frozen, and fresh salmon targeting both retail and food service markets.

![[✔PDF✔⚡] ✔DOWNLOAD✔ Ancestral Knowledge Of Smoking Salmon: The Ultimate Gui](/thumb/68084/pdf-download-ancestral-knowledge-of-smoking-salmon-the-ultimate-gui.jpg)