State Government Schemes for Entrepreneurship Development

Entrepreneurs face challenges in underdeveloped areas, prompting governments to offer incentives. Learn about incentives, subsidies, and state schemes like SIP-EIT for entrepreneurs' support and growth.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

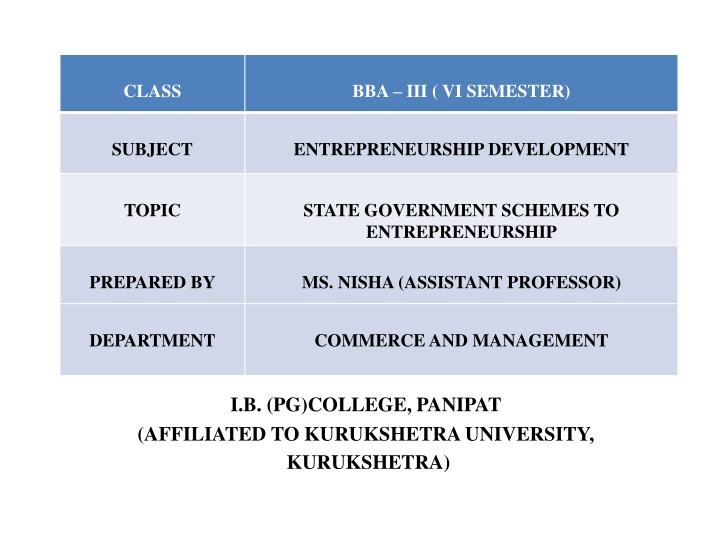

CLASS BBA III ( VI SEMESTER) SUBJECT ENTREPRENEURSHIP DEVELOPMENT TOPIC STATE GOVERNMENT SCHEMES TO ENTREPRENEURSHIP PREPARED BY MS. NISHA (ASSISTANT PROFESSOR) DEPARTMENT COMMERCE AND MANAGEMENT I.B. (PG)COLLEGE, PANIPAT (AFFILIATED TO KURUKSHETRA UNIVERSITY, KURUKSHETRA)

Introduction Entrepreneurs are generally not ready to set up their establishments in underdeveloped areas of the country due infrastructural facilities and lack of supporting facilities like marketing, technical consultancies etc. Therefore different incentives and subsidies are given by government to entrepreneurs for their entrepreneurial activities in these areas. to lack of types of

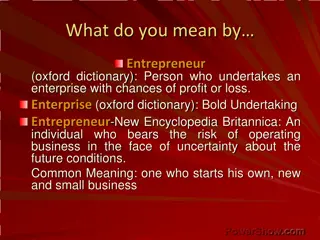

Meaning of Incentive An incentive is a motivational force which induces an entrepre neur to work hard or to do his work more efficiently. Incentives Concessions Bounties Subsidies

Continued Concessions: relaxations in policies and guidelines which mot ivate an entrepreneur to undertake a particular entrepreneurial activity in a given environment. Subsidies: A single lump sum payment which is given by the government to an entrepreneur for national interest to cover th e cost. Bounties: Bonus or Financial aid given by Govt. to an entrepr eneur to help him compete with other units in a nation or a fore ign market. It is given in proportion to its output.

Need For Incentives 1. They act as a motivational force. 2. They encourage the entrepreneurs to start industries in backw ard areas. 3. They provide competitive strength, survival and growth. 4. They bring industrial development uniformity in all regions. 5. They promote entrepreneurship and strengthen the entreprene urial base in the economy. 6. They develop more new entrepreneurs which generate more e mployment.

State Government Schemes For Ent repreneurs 1. Support for International Patent Protection in Ele ctronics & Information Technology (SIP-EIT): The De partment of Electronics and Information Technology (DeiTY) has launched a scheme entitled Support for International Patent Prot ection in E&IT (SIP-EIT) . This scheme provides financial suppo rt to MSMEs and Technology Start-up units for international pate nt filing.

Continued Features and benefits of the SIP-EIT scheme are: Financial support is provided for international filing in Inform ation Communication Technologies and Electronics sector. The Reimbursement limit has been set to the maximum of Rs. 15 Lakhs per invention or 50% of the total charges incurred in filing and processing of a patent application, whichever is less er. SEP-EIT scheme can be applied at any stage of international p atent filing by the applicant.

Continued 2. Multiplier Grants Scheme (MGS): Department of Electronics and Information Technology (DeitY) started the Multiplier Grants Scheme (MGS). The scheme aims to encourage collaborative Research &Develo pment between industry and academics or R&D institutions for d evelopment of products and packages. Under the scheme, if the industry supports R&D for developmen t of products that can be commercialized at institution level, then government will also support them financially which will be up t o twice the amount provided by industry.

Continued MGS promotes and expedites development of aboriginal produ cts and packages. The Government grants would be limited to a maximum amou nt of Rs. 2 Crores per project and the duration of each project c ould considerably be less than 2 years. It would be Rs. 4.0 Cro res and 3 years for industry associations.

Continued 3. Credit Guarantee Scheme for Startups (CGSS): The Credit Guarantee Fund Trust for Micro and Small Enterprise s (CGTMSE ) was set up by the Government of India to provide business loans to micro and small industries, with zero collateral. It allows the new and upcoming startups to avail the loans at hig hly subsidised interest rates without providing any security.

Continued Working along with SIDBI (Small Industries Development Ba nk of India), the government provides a maximum amount of u p to Rs. 100 lakhs under this scheme, for boosting new enterpr ises as well as rehabilitating the existing ones. Primarily for manufacturing units, this loan can be availed in t he form of working capital or term loan.

Continued 4. The Venture CapitalAssistance Scheme (VCA): The Small Farmer s Agri-Business Consortium (SFAC) has laun ched the scheme named Venture Capital Assistance (VCA) Sche me for the welfare of farmer-entrepreneur to develop their agri-bu siness which is approved by the banks, financial institutions regul ated by the RBI. This scheme intends to assist in the form of the term loan to the qualifying projects of the farmers to meet their capital requiremen ts for the implementation of the project. VCApromotes training and visits of agri-entrepreneurs in setting up agribusiness projects.

Continued The quantum of loan will be 26% OR 40%(for hilly region) of the promoter s equity. The maximum amount of loan provided under this scheme will be Rs.50 lakhs.

Continued 5. NewGen Innovation and Entrepreneurship Develo pment Centre (NewGen IEDC): NewGen IEDC is a programme launched by the National Scienc e and Technology Entrepreneurship Development Board under th e Department of Science and Technology, Government of India. This programme aims to inculcate the spirit of innovation and en trepreneurship among the Science and Technology youth, support and encourage the startup creation through proper guidance, ment orship and support. NewGen IEDC directs the energy and the knowledge of the yout h towards the purpose of being active partners in the economic de velopment process.

Continued 6. Single Point Registration Scheme: Single Point Registration Scheme (SPRS) is a startup scheme wh ich was launched in 2003. It is managed by the National Small In dustries Corporation (NSIC). NSIC registers all Micro & Small Enterprises (MSEs) in India u nder this Single Point Registration Scheme to participate in the G overnment Purchases. Enterprises are classified as Micro, Small & Medium based on t he limit of investment for manufacturing or service sector. Eligibl e MSME units are provided with Udyog Aadhar registration ce rtificate

Continued All Central Ministries/Departments /PSUs shall set an annual g oal of minimum 20% of total annual purchases of products pro duced or rendered by MSMEs. For exclusive purchase from M SMEs, about 358 items are reserved.

Continued 7. Modified Special Incentive Package Scheme (M-SI PS): Launched by Department of Electronics and Information Techno logy (DeitY) and supported by Center for Development of Advan ced Computing or CDAC, M-SIPS aims to promote large-scale manufacturing in the Electronic System Design and Manufacturin g (ESDM) sector. Besides infusing the startups with funds for expansion, M-SIPS will also provide subsidy up to 25% in establishing offices, resear ch centers in SEZs, all over the nation.

Continued Applicable Industries: IT Hardware, Medical-tech, Solar Powe r, Automobiles, Healthcare, Semiconductors, Processors/Electr onica, LEDs, LCDs, Avionics, Industrial Electronics, Nano-Ele ctronics, Biotech, Strategic Electronics, Telecom and more

Continued 8. Raw MaterialAssistance: National Small Industries Corporation or NSIC has launched Ra w Material Assistance scheme, which aims to assist manufacturer s and MSMEs with procuring raw materials, both indigenous & i mported. As per the Government Schemes helps the manufacturer s to foc us on the quality of their products, as they can avail low-interest l oans and financial help to get raw materials.

Continued 9. Infrastructure Development Scheme: National Small Industries Corporation (NSIC) has launched this unique scheme to help startups establish their own offices and inf rastructure. However, only those companies which fall under the official defi nition of startups, as highlighted by the Ministry of Micro, Small and Medium Enterprises can avail this grant. Startups which are not registered with Software Technology Par ks Of India Scheme can now get office space ranging from 467 s q.ft. to 8,657 sq.ft. There is no lock-in period, and it is applicable to all industries.

Continued 10. Credit Linked Capital Subsidy for Technology U pgradation: Office of the Development Commissioner (MSME) has launche d this Government scheme to help manufacturers, SMEs, and agri -startups to upgrade their existing machines and technologies. In case any SMEs registered with State Directorate of Industries have upgraded their machines, plants with state of the art technol ogy, then they can apply for this grant, and receive funds to comp ensate their expenses. Applicable Industries: Khadi, Village or Coir industry, Manufact uring, Small Scale Industry, SMEs

Continued 11.Atal Incubation Centres (AIC): Headed by Atal Innovation Mission, AIC aims to promote innov ation and entrepreneurship in India. Approved startups can get fu nding up toRs 10 crore for a maximum period of 5 years, to cover capital and operational expenses. Industries Applicable: AI, AR/VR, Automobiles, Telecom, Healt hcare, Aeronautics, Aviation, Chemicals, Nano-Tech, Pets, Anima ls, IT, Computers, Design, Non-Renewable Energy, Social Impact , Food and more.

Continued 12. Bridge LoanAgainst MNRE Capital Subsidy: Launched by Indian Renewable Energy Development Agency (I REDA), Bridge Loan Against MNRE Capital Subsidy aims to pro mote startups engaged in renewable energy ideas such as biomass power and small hydropower projects. Up to 80% of the project cost will be funded by IREDA, and the minimum funding allocated shall be Rs 20 lakh.

Continued 13. Stand Up India Scheme: Stand Up India Scheme facilitate bank loans between 10 lakh an d 1 crore to atleast one scheduled caste (SC) or Scehduled Tribe, borrower and atleast one women per bank branch for setting up a greenfield enterprise. This enterprise may be in manufacturing, services or the trading sector. In case of non-individual enterprises at least 51% of the sh areholding and controlling stake should be held by either an SC/S T or Woman entrepreneur.

Continued Eligibility for Stand Up India Scheme: SC/ST and/or women entrepreneurs; above 18 years of age . Loans under the scheme is available for only greenfield project. GreenField signifies, in this context, the first time venture of the beneficiary in the manufacturing or services sector. In case of non-individual enterprises, 51% of the shareholding a nd controlling stakes should be held by either SC/ST and/or Wom en Entrepreneur. Borrower should not be in default to any bank or financial institu tio n

Continued How to Avail Stand Up India Scheme: Through stand up India Portal provides information to a potentia l borrower on various kinds of handholding support from differen t agencies and also provides a window to get in touch with banks to avail loans. The applicant first click to "Register" and answer to few short qu estions on the Registration l page of the porta

Continued Based on the response, the Applicant would be classified as th e "Trainee Borrower" or "Ready Borrower". Applicant would a lso be given feedback on his/her eligibility for stand-up India l oan A trainee borrower/ready borrower may then chose to register and login through the portal. Upon logging through the portal, the borrower is taken to a das hboard

Continued 14. Pradhan Mantri Mudra Yojana: Micro Units Development and Refinance Agency Ltd. [MUDRA ] is an NBFC supporting development of micro enterprise sector i n the country. MUDRA provides refinance support to Banks / MF Is for lending to micro units having loan requirement upto 10 lak h. MUDRA provides refinance to micro business under the Scheme of Pradhan Mantri MUDRAYojana. The other products are for de velopment support to the sector. The bouquet of offerings of MUDRA is depicted below. The offe rings are being targeted across the spectrum of beneficiary segme nts.