Stock Analysis and Recommendations for Microsoft and Apple

Explore detailed stock analysis and recommendations for Microsoft and Apple, including market values, price/share, weights, and future projections. Discover why Microsoft may be a sell and Apple a buy based on insightful data and statistics.

Uploaded on | 1 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Stock Presentation Jason Kotzur, Matthew Leightman, Mitch Maher and Dimitris Siafarikas

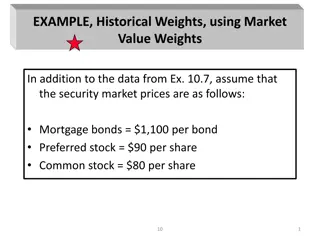

INFO TECH STOCKS IN SIM Company Market Value Price/Share Weight Apple, Inc. 790.13B $150.56 3.69% Cognizant Technology Solutions Corp 40.88B $69.50 4.28% Dell Technologies Inc 12.89B $63.63 2.42% Microsoft 569.85B $68.77 2.31% Vantiv Inc. 12.42B $62.45 4.87% Alphabet Inc. Class A 686.87B $986.95 5.39% 3

MSFT Stock Analysis Ticker MSFT Recommendation Sell Current SIM % 2.31% Microsoft Corp is a technology company. It developes, license, and support a wide range of software products and services. Its business is organized into three segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Recommendation SIM % 1.34% Current Price $68.77 Our Price Target $58.49 Dividend Yield 2.14% Potential Downside -15% ROE 24.65% Forward P/E 22.09 FYE: 30 June 2017 Last Earnings: 27 April 2017 P/S $6.49 5

AAPL Stock Analysis Ticker AAPL Recommendation Buy Current SIM % 3.69% Apple is an American multinational tech company and was incorporated on Jan 3rd company designs, manufactures mobile communication and media devices, personal computers and other consumer electronics. The most profitable product is by far the iPhone. Through the operating system of the products, Apple also sells media content. For example, iTunes Store and App Store offer free and paid applications and subscriptions to various services. 1977. The and markets Recommendation SIM % 3.89% $150.56 Current Price Our Price Target $175.00 Dividend Yield 1.65% Potential Upside 20% ROE 23.00% Forward P/E 14.53 FYE: September 24, 2016 Last Earnings: 2 May 2017 P/S $3.66 10

ALPHABET Stock Analysis Ticker GOOGL Google is an information technology company specialized in internet-related services and products including advertising technologies, search, cloud computing, software, and hardware. Google was founded in 1988 by two Ph.D. students at Stanford University: Larry Page and Sergey Brin. Together, they created an algorithm that determined a website s importance based on the relationships that existed between sites and ranked them from most relevant to least relevant, which eventually turned into the Google search engine. In August of 2015, Google announced plans to restructure the company by creating a new public holding company, Alphabet Inc., which encompasses Google and all of its subsidiaries. In 2016, Alphabet Inc. reported revenues of $90,272 billion and a net income of $19,478 billion, making it the 6thlargest information technology company in the world. Alphabet Inc. now has a market capitalization that exceeds $670 billion. Recommendation HOLD Current SIM % 3.69% Recommendation SIM % 3.69% Current Price $986.95 Our Price Target $1005.27 Dividend Yield 0% Potential Upside 1.9% ROE 15.29% Forward P/E 25.06 P/S $7.51 FYE: June 30, 2017 Last Earnings: April 27, 2017 14

Alphabet Inc. Class A DCF As you can see there is a 1.9% upside to the discounted cash flow model. Because this upside is minimal, we are implementing a HOLD rating for GOOGL stock. 15

Vantiv Stock Review Ticker VNTV Recommendation BUY Current SIM % 4.87% Recommendation SIM % 4.97% Vantiv is a payment-processing provider within the Information Technology sector. Founded in 1970, Vantiv has nine locations across the continental United States with their corporate headquarters located in Symmes Township, Ohio. Vantiv focuses on two exclusive market segments: Merchant Services and Financial Institutions. Current Price $62.45 Our Price Target $76.76 Dividend Yield 0% Potential Upside 22.9% 16

VNTV DCF 17

QUESTIONS? 18