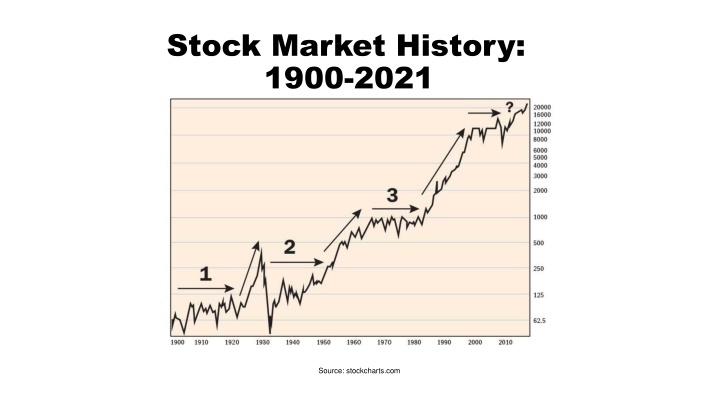

Stock Market History: 1900-2021

Uncover the trends and cycles of the stock market from 1900 to 2021, explore the impact of interest rates on bond funds, and navigate investment strategies for growth and income. Understand the dynamics of borrowing money for stock valuations and delve into the concept of total return through income and growth.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Stock Market History: 1900-2021 Source: stockcharts.com

The Last Secular Bear Market Cycle *Source: StockCharts.com

LONGEVITY RISK LONGEVITY RISK

Mortgage Analogy: Mortgage Analogy: Depleting Assets Depleting Assets

Bond Funds and Interest Rates *Though changes in interest rates are typically considered to be the major factor in determining bond values, many other factors can cause bonds to fluctuate.

Investing for Growth vs. Investing for Growth vs. Investing for Income Investing for Income Growth Income 1. Growth 2. Liquidity 3. Income 4. Safety 1. Income 2. Safety 3. Liquidity 4. Growth

THE TEETER THE TEETER- -TOTTER* TOTTER* Conservative Moderate Aggressive Corporate Bonds CDS Stocks Indexed Annuities Government Bonds Stock funds Conservative Moderate Aggressive Preferred Stocks Municipal Bonds REITs Fixed Annuities *Hypothetical illustration. Not all products are suitable for every investor. Product guarantees are issued by the good faith and credit worthiness of the Issuer. Past performance does not guarantee future results.

The Big Mac Index & Stamps Source: https://seekingalpha.com/article/4119246-big-mac-index-may-be-telling-truth-inflation

TR Total Return= I Income+ G Growth (Capital Growth/Loss) (Interest/Dividends)

Borrow Money Stock Valuations are higher, mathematically speaking cheaper to make major purchases Corporations can borrow money cheaper to buy back stock Investors move up the risk curve because interest- bearing options appear less attractive The result: stocks should should go higher.

PRE-RETIREMENT Accumulation Phase (Principal Growth) RETIREMENT Distribution Phase (Principal Return)

The 4% Cash Flow Rule: You can rely on the Growth ( G ) But what if you retired in the year 2000 and relied on the G? $1,000,000 should be able to withdraw 4% or $40,000 per year for life