Strengthen Your Financial Institution with Robust Model Risk Governance

Strengthen Your Financial Institution with Robust Model Risk Governance

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

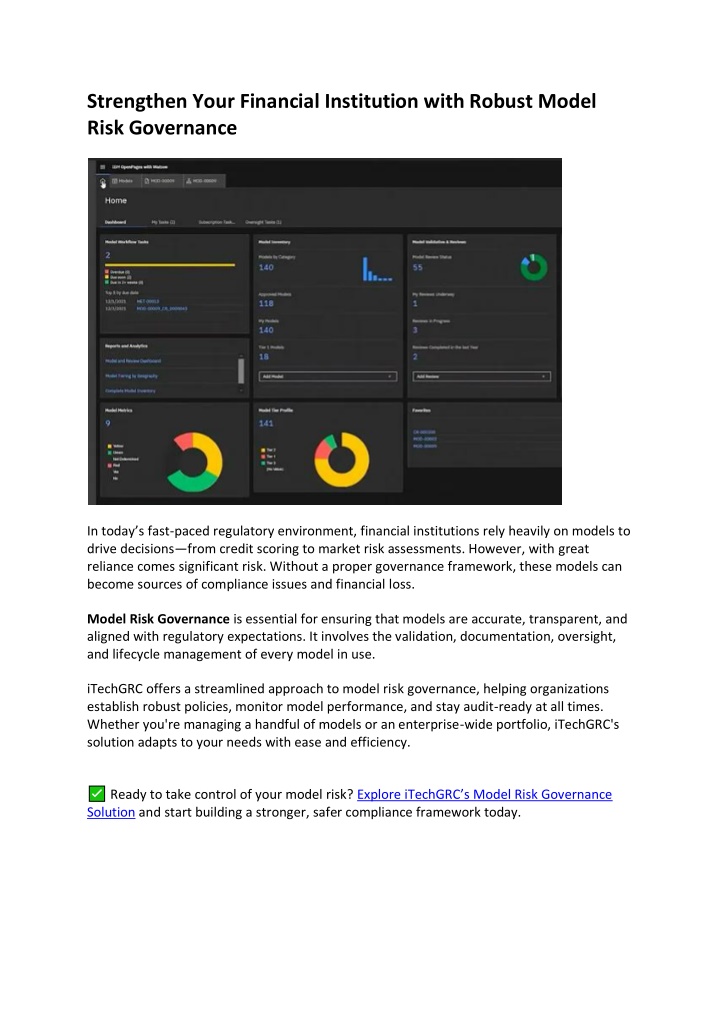

Strengthen Your Financial Institution with Robust Model Risk Governance In today s fast-paced regulatory environment, financial institutions rely heavily on models to drive decisions from credit scoring to market risk assessments. However, with great reliance comes significant risk. Without a proper governance framework, these models can become sources of compliance issues and financial loss. Model Risk Governance is essential for ensuring that models are accurate, transparent, and aligned with regulatory expectations. It involves the validation, documentation, oversight, and lifecycle management of every model in use. iTechGRC offers a streamlined approach to model risk governance, helping organizations establish robust policies, monitor model performance, and stay audit-ready at all times. Whether you're managing a handful of models or an enterprise-wide portfolio, iTechGRC's solution adapts to your needs with ease and efficiency. Ready to take control of your model risk? Explore iTechGRC s Model Risk Governance Solution and start building a stronger, safer compliance framework today.