Strong Sustainable Future Ahead of Pepperfry

The presentation outlines strategies for Pepperfry to achieve an IPO of INR 132 billion in 2022. It includes analysis of the Indian furniture market, competitors, Pepperfry's capabilities, recommendations for growth, and an implementation plan.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

A STRONG, SUSTAINABLE FUTURE AHEAD OF PEPPERFRY Presented to Mr. Murty & Mr. Shah By Smurfit Consulting Weiran He Geoff O Brien Monika Ghita David Madigan 1

Your challenge Your challenge To achieve IPO of INR132 billion in 2022 2

Our recommendations Grow GMV through House Brands Sales 1 Finance partnership with Bank of Mumbai 2 Expand to 70 studios by 2020 (Franchise 90% - 10% Own) 3 Grow GMV through House Brands Sales Grow GMV through House Brands Sales 3

Agenda Agenda Geoff O Brien External and internal analysis Monika Ghita Alternatives and recommendations David Madigan Implementation plan 4

Geoff O Brien Monika Ghita David Madigan ANALYSIS Geoff O Brien 5

The Indian Furniture Market Furniture Market to grow from $25bn to $35bn Online Furniture Market at $700m will grow Indian Demographics Aspiring post-millennial Modern young market 25m 30m and growing Increasingly organized furniture market Key message Pepperfry must capture the growing online market 6

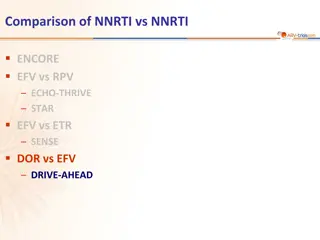

Competitors Online Indian Furniture Pepperfry Pepperfry IKEA IKEA Indian Offline Indian Offline Online Horizontal Online Horizontal Brand Brand Resources Resources Reach Reach Technology Technology Good Good Medium Medium Bad Bad Pepperfry must lead the online furniture marketplace 7

Pepperfry Capabilities and Resources Brand Recognition of Pepperfry 75% organic traffic Excellent Distribution system 2% breakage, 92% 1st time delivery, NPS 60 Supplier system is deep with strong relationships Marketplace is leading furniture portal in India House Brand gives greater profitability and is 50% of GMV Credible investors raised USD$195m Key message Must grow demand on house brands 8

Pepperfry Financial Analysis 2013 341 883 (542) 582 2014 439 801 (362) 642 2015 992 2,247 (1,255) 2,202 2016 2,001 4,993 (2,992) 5,122 2017 2,580 5,066 (2,486) 6,500 CAGR 66% 55% 46% 83% Revenue Costs Profit/Loss GMV INR m INR m INR m INR m Size of Online Furniture Market in India Size of Online Furniture Market in India Pepperfry Share of Online Market USD m INR m 46,667 700 14% Revenue/GMV House Brand Share of GMV House Brand GMV % % 59% 68% 45% 39% 40% 50% 3,250 INR m Funding Funding USD m INR m 13 867 1,000 15 6,667 100 2,000 30 Pepperfry must grow demand to achieve profitability and IPO. 9

Geoff O Brien Monika Ghita David Madigan RECOMMENDATION Monika Ghita 10

Your aim is to achieve INR 50m GMV by 2020. At present this target is not achievable until 2021; Pepperfry will not become profitable until 2027. 11

Strategies Considered 1. 1. Create a Home Buyer Ecosystem Create a Home Buyer Ecosystem Home Design Furniture Purchase Legal Advice House Search Finance Sourcing 2. Pepperfry Rental Platform 2. Pepperfry Rental Platform - Create a new market new customer acquisition - Achieve more GMV - Participate in the shared economy trend 3. Grow GMV through House Brands Sales 3. Grow GMV through House Brands Sales Partner with bank of Mumbai to provide customer financing Grow sales though highly profitable home brand sales Expand studios to promote home brand sales (Franchise 90% - 10% Own) The best option for growth is through option 3 - house brands 12

Alternative strategies Home Buyer Home Buyer Ecosystem Ecosystem Pepperfry Rental Pepperfry Rental Platform Platform Grow House Brand Grow House Brand Sales Sales Consistent with Mission, Consistent with Mission, Vision & values Vision & values Consistent with Core Consistent with Core Capabilities Capabilities Size of the Opportunity Size of the Opportunity Cost of Implementation Cost of Implementation Ease of Feasibility Ease of Feasibility Good Good Medium Medium Bad Bad Leverage core competencies quality furniture and distribution network 13

Recommendation: Grow GMV through House Brands Sales Grow GMV through House Brands Sales Partnership with Bank of Mumbai Provide financing to customers Customer loyalty credit card offering Grow sales though highly profitable house brand sales Digital marketing TV advertising Experience studios Expand to 70 studio by 2020 (Franchise 90% - 10% Own) Franchise 20 out of 27 own studios Establish 26 additional franchise studios by 2020 Introduce augmented reality googles in studios Grow GMV and become profitable in order to IPO in 2022 14

Through this strategy you will achieve profitability and IPO valuation of INR 132billion in 2022. 15

Geoff O Brien Monika Ghita David Madigan IMPLEMENTATION David Madigan 16

1. Implementation: Customer Financing 1. Implementation: Customer Financing Bank of Mumbai (BoM) Bank Partner Embed customer financing tool Commission agreement with BoM paying Pepperfry Balance sheet sits with BoM Typical asset financing rates are 8-10% with net interest margin of 8-10% Create loyalty credit card loyalty credit card which is Pepperfry branded with BoM financing tool on marketplace paid by BoM Deal construct Partnership discussion timeline 1 month head of terms agreement 6 months negotiation 12 months rollout 17

2. Implementation: Driving House Brand Sales 2. Implementation: Driving House Brand Sales Marketing Channels Physical Stores Product Placement Priority on Marketplace Increasing franchise commission to 12% on House Brands from 10% TV advertising focused on House Brands In owned stores prominent product placement Increase Content marketing for better SEO by: Blogging (featured posts) Video posts Social media posts (#Pepperfry) Sponsor Cricket Team 18

3. Implementation: Franchise Studio Expansion 3. Implementation: Franchise Studio Expansion Franchised Studios Owned Studios 70 Total studios by 2020 63 7 Replicate McDonalds franchise model of 90:10 franchise / owner Lower capital expenditure versus owned stores Develop case studies for entrepreneurs Leverage local knowledge advantage Hire head of franchises (costing $140k) Hire 6 employees responsible for each franchise studio (10 studios per employee) Leverage Augmented Reality technology in stores via Microsoft Hololens to drive customer experience 19

IPO Timeframe Appoint Investment Bank to be the main bookrunner Develop IPO prospectus Begin IPO Roadshow IPO at a valuation of INR 132 bn 2022 2019 2020 2021 IPO involves 4 key steps to achieve INR 132bn 20

IPO Timeframe Projections 2016 2,001 4,993 (2,992) 5,122 2017 2,580 5,066 (2,486) 6,500 CAGR 66% 45% 46% 83% 2018 4,753 7,346 (2,593) 11,883 2019 8,689 10,651 (1,962) 21,722 2020 2021 2022 Revenue Costs Profit/Loss GMV 15,884 15,444 39,711 29,038 22,394 6,644 72,595 50,000 32,472 17,528 125,000 440 Size of Online Furniture Market in India Size of Online Furniture Market in India Pepperfry Share of Online Market 46,667 700 46,667 700 50% 1,050 70,000 1,575 105,000 2,363 157,500 3,544 236,250 5,316 354,375 11% 14% 17% 21% 25% 31% 35% Revenue/GMV House Brand Share of GMV House Brand GMV 39% 50% 2,561 40% 50% 3,250 40% 50% 5,941 40% 50% 40% 50% 40% 50% 40% 50% 10,861 19,855 36,297 62,500 Funding Funding 2,000 30 37 13,000 195 2,467 PAT Multiple of 20x on 2021 generates a valuation of INR 132 bn 21

Risks and Contingencies Contingencies Contingencies Risks Risks Tighten requirements on customers (proof of income, extra collateral) Sponsor franchise night courses in local colleges and illustrate benefits via case studies Make sure it is economical and manage quality of people Higher Loss Experience in furniture sales Difficulties finding franchisees Franchise model doesn t work 22

A STRONG, SUSTAINABLE FUTURE AHEAD OF PEPPERFRY By Smurfit Consulting Weiran He Geoff O Brien Monika Ghita David Madigan 23