Structuring the Process Key Considerations in Sell-Side M&A

Understand the key considerations in structuring the sell-side M&A process, including timing, buyer types, and auction strategies. Discover how to maximize valuation, ensure confidentiality, and navigate potential challenges effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

M&A and Investment Banking Lecture 6 Sell-Side M&A 1

Sell-Side M&A Structuring the process Best practice Roles and Activities 2

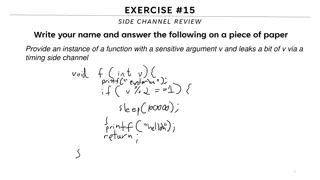

Structuring the Process: Key Considerations Key Considerations Is now the right time to sell? What is the Company s near-term financial outlook? Are there risks to the Company achieving its near term forecasts? Are there any unproven material growth initiatives? Does the Company have any unique considerations regarding the timing (start, duration, deadlines, etc.) of the sale process? What are the current and anticipated financing market conditions? Are there seasonal issues which impact the timing of a process? Will the sale process run into time periods that are traditionally marked by downturns in activity (August vacations, December holidays, etc.)? 1. Timing How large is the field of financially qualified prospective buyers? Have any parties previously expressed interest in acquiring the Company? Are there obvious buyers for the Company? 2. Number of Buyers Broad Buyer Universe Pros and Cons Contacting all viable buyers maximises likelihood of success no stone left unturned Eliminates problem of subsequently broadening and lengthening process if limited list yields insufficient interest Creates maximum competition and therefore increases likelihood of maximum valuation Limits buyers ability to assess negotiating strengths of seller Potentially more disruptive; requires more management of process Targeted or negotiated process more efficient if key prospects identifiable Limits ability to give special attention to small group to accelerate process Some buyers may refuse to participate in a broad auction Broad dissemination of information may lead to competitor gaining access to confidential information May exclude or disadvantage slow movers, particularly foreign buyers Failed auction may create perception of damaged goods Are financial buyers likely to be interested (and competitive in terms of valuation)? Are all logical buyers easily identifiable? 3. Types of Buyers Strategic Buyers Pros and Cons Can generally pay a premium due to synergies and lower cost of financing Have greater knowledge of business allowing for less due diligence time and faster consummation of a deal Means that acquisition for cash or stock reduces possibility of financing contingencies Allows for potential tax deferral if stock is used Eliminate sophisticated financial buyers capable of moving quickly Financial buyers could be attractive to management due to possible equity participation Some financial buyers are quasi-strategic buyers due to existing portfolio companies May participate in the sell-side process in order to gain access to competitive information on the target, without having a real interest in acquiring it 3 Legend Cons Pros

Structuring the process: Key considerations (Contd) Key Considerations Are the Company s operations vulnerable to interruption from a prolonged process (e.g., management focus, employee retention, customer loyalty, etc.)? Does management have the capacity to interact with multiple parties simultaneously? 4. Should a typical two-tier auction process be utilised? A well-run auction creates an atmosphere of competition and can yield the highest price possible Two-step process provides early insight on buyer perspectives on value, structure and issues and limits access to sensitive information to serious buyers Standard auction process needs to be adapted to suit the private market environment at the time of sale Formal process may not be appropriate for story businesses or certain buyer communities Is the Company s story easily understood or does it require more explanation and development (e.g. visibility of growth, logic of strategic fit with prospective buyer(s) and potential synergies, integration challenges, etc.)? Seller s key priorities for an exit, e.g. imminent need for cash, business underperformance, regulatory requirements 5. Length of the Process How would public disclosure that the Company is for sale affect the Company and its employees, customer and / or competitors? How many employees of the Company should ideally be in-the-loop ? 6. Should there be a public/ internal announcement? Maximises likelihood of reaching widest group of prospective buyers Gets the Street to work for you Demonstrates commitment to sale process Disruptive to the organisation Raises questions with employees, customers, suppliers and competitors Risk that unsuccessful process will be public Typically done when value / timing / certainty prove compelling to seller Avoids extended process with risk of non-consummation Can pursue full process (with taint) if transaction falls away Could attract maximum price Allows for faster use of proceeds if price threshold is met Potential loss of leverage and momentum Might extend auction process if bid does not lead to a transaction Can taint the marketplace with information on buyers and price 7. Should pre-emptive bids / exclusivity be considered? Is the Company a potential IPO candidate? 8. Alternatives to a Sale Would going public be detrimental to the Company s competitive advantage(s) due to disclosure requirements? 9. Impact of Failed Process What impact would a failed process have on the Company (financial and competitive position, employee morale, customer retention, etc.)? 4 Legend Cons Pros

Sale Process Options Negotiated Process Controlled Auction Broad Auction Non-auction Auction Initiate negotiations and due diligence with one selected buyer One step negotiation, i.e. price negotiated and agreed shortly after the end of the due diligence In order to increase competitive tension, could provide short window to fast track/pre-empt with threat of broader process Approaching a broader, but still very focused list of potential buyers Phase I: Indicative bids to be submitted on the basis of limited information, primarily the Extended Teaser Phase II: Detailed due diligence for investors selected in Phase I, portioned out depending on sensitivity Contact all potentially interested buyers Broadest possible process Otherwise comparable in form and execution to controlled auction Initiate parallel bilateral discussions with identified buyers Buyers not to be explicitly told they are in a competitive process The existence of additional buyers is to be communicated in the 2nd round Otherwise comparable in form and execution to controlled auction Process Overview Faster execution speed, timing of the transaction between four and six weeks (could sign by the end of November) Higher level of process confidentiality, lower profitability of leaks minimise fall-out from failed process Minimise disruption to the business Generally maximises competition and price Limited information disclosure to Phase I candidates More extensive feed-back about the attractiveness of target from potential buyers Greater assurance that the right buyers have been contacted Broadest possible approach could generate valuation upside no likely potential bidder is excluded Potential to generate even greater competition than controlled auction 1st Round non-binding bids more indicative as no pressure to inflate bids to ensure 2nd round participation Perceived absence of competition could encourage participation of more potential buyers Reduces confidentiality risk Key Advantages Potential Issues Execution risks related to the uncertainty of transaction financing Reduced bargaining power once the process is underway given the involvement of only one buyer No price upside potential given the lack of competition Timing (extra 4+ weeks vs. negotiated process) Impact of failed sale is greater in a broad auction Can be disruptive to the Company s business Lower level of process confidentiality attained Some investors may not be interested in participating in an auction Timing (extra 2+ weeks depending on number of parties contacted and their ability to move quickly / tendency to move slowly) Extent of process and logistical requirements could be highly distracting to management Highest level of confidentiality risk Potential loss of competitive tension Bidders might require exclusivity as pre-requisite to continue process Potential difficulties in synchronising different buyers on same timetable 5 Legend Typical Two Stage Auction Process

Sale Process Best Practice Formal two-phase process is the norm always possible to flex it Danger of stage between binding offers and signing: should aim at minimising it (ideally to less than a week) Frontload due diligence activities as much as possible although some DD issues will likely be left open Pre-negotiate deal documentation (and management packages) before binding offers although it presents risks and will likely leave key issues open Process Quick process ideal (up to four-month process since you pull the trigger, on the basis of previous work done) But must not compromise bullet-proof preparation, which is key Business plan including specific actions and projects: upside to be fully credible and spelt out Timing Committed and unconditional financing package offered at least one week before non-binding offers to maximise impact Buyers encouraged to select their debt providers (staple just sets the right bar) Staple Financing Level playing field between financial and trade buyers, with selected deviations (commercial sensitivity of certain data) Freedom to speak and team up in Phase II should pay off by clearing the air, with limited risks; consortia being formed disclosed in non-binding offers High mortality in recent Phase II s: consider admitting to Phase II a broad number of truly motivated potential buyers (up to seven eight), in spite of increased complexity, with extra-attention and time dedicated to the most proactive ones Treatment of Potential Buyers Management incentives tied to deal value Pre-negotiate management packages with the most serious Phase II bidders before binding offers is possible; related risks could be minimised e.g. by using specialised management s lawyers Significant bidders access to management pays off: standard management presentations and site visits largely insufficient, must allow more interaction VDD and virtual data room improve process efficiency and speed Put pressure, but allow Phase II bidders to complete their exercise in order to achieve truly binding offers with unconditional financing attached and minimise due diligence tail post binding offers Pre-negotiation (first mark-up discussed with seller s lawyers before binding offers) should be targeted although it will leave key issues open By doing so, bidders willingness to accept draconian clauses (e.g. minimum reps and warranties, locked box) can be taken into account when evaluating binding offers although uncertainty on their attitude in the last hour will persist Management Due Diligence Contract 6

Key Ingredients for a Successful Auction Process Competitive Environment Seller Considerations Carefully select bidders Create price tension Minimise exclusivity period (if any) Keep other bidders warm Maintain credible fallback option Minimise disruption to business Protect sensitive commercial information Stay in control of events and restrict unwanted developments (e.g. delays) Ensure clean exit Maximise Value Clear Bidding Rules Provision of Information Potential buyers should bid on the same basis Define clear process Communicate timetable Contact buyers frequently Define form of payment / contract, etc. Present consistent business case Controlled access to management Buyers equally informed Information memorandum Site visits / data room VDD In addition to the factors presented above, preparing fully and in advance is key to a successful disposal 7

Sale Process: Summary of Key Activities 1 2 3 Preparation Phase Phase I Phase II Round One Non-binding Indicative Offers Final Preparation Phase Round Two Binding Final Offers Due Diligence Phase Execution Phase Initiation Phase Agree objectives Determine staffing and appoint advisors Decide sequencing and timing Commission and agree scope for vendor due diligence ( VDD ) report(s) if appropriate Perform due diligence Analyse financial and operating performance Prepare indicative valuation Prepare information memorandum ( IM ) / info pack Develop marketing strategy Prepare prospective buyers list Prepare process documents Finalise IM and prepare teaser Prepare data room and VDD Contact prospective buyers / sign CA Distribute IM and phase 1 letter Prepare management presentation and data room visit Prepare legal agreements Finalise data room and VDD Evaluate offers and select round 2 participants Distribute phase 2 process letter and external due diligence reports Management presentations Data room due diligence / Q&A Pre-negotiation of contracts Evaluate binding offers and select final candidate(s) Finalise negotiations Sign definitive agreements Announce transaction Regulatory approvals and closing 8

Typical Two Stage Auction Process Timeline Weeks from 'green light' 1. Preparation Kick-off meeting Appointment of legal and other advisers Market-testing by the Investment Bank Preparation of potential buyers list Vendor due diligence Identify / resolve tax / legal issues Drafting I M Drafting Phase I process letter Preparation of data room Finalise sales strategy 2. Solicitation and marketing Contact potential buyers Distribute CAs Drafting SPA Distribute I M and Phase I process letter Organise site visit logistics Organise management presentation logistics Drafting management presentation Potential bidders review I M Drafting Phase I I process letter Phase I bids due Select Phase I I parties 3. Due diligence Distribute Phase I I letter Distribute VDD Detailed buyer due diligence (data room) Management presentations Site visits Distribute draft SPA Breakout sessions with management Potential bidder Q&A Phase II bids due 4. Negotiation and completion Select final candidate(s) Negotiation, signing and announcement Approvals and completion conditions(1) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 X X X Prestech X 9 Note: (1) Assuming no need for confirmatory due diligence (on which a binding offer may be conditional), which could delay signing by 10 days to 2 weeks

Roles of Different Parties in a Sale Process Role of the Company Internal Preparation Phase: Role of the Investment Bank Internal Preparation Phase: Design of sale process Due diligence; evaluation of financial and operating performance Preparation of indicative valuation of the company Preparation of process letters / IM / list of prospective buyers and development of marketing strategy 'Assisting' management in preparing extended teaser / management presentations Coordination of all work streams with company and other advisors (e.g. accountants, lawyers) / maintaining detailed timetable and hosting regular team update calls External Execution Phase: Deliver initial marketing / calling effort and facilitate negotiation of CAs Coordination of buyers due diligence schedule and requirements with company and other advisors / maintain calendar and be main point of contact for the process Keeping the management informed and act as 'buffer' Evaluation of indicative and binding offers, respectively First point of contact for negotiations Agreement of approach and views on key transaction issues Preparation and review of business plan Brainstorming on key selling points of the transaction Working with the bankers on preparing teaser / IM / management presentations Assisting lawyers / accountants in data room preparation Providing necessary information in a timely manner Management of internal confidentiality External Execution Phase: Delivery of management presentations and management meetings Rehearsal for, and participation in, detailed Q&A sessions Preparation of answers for written Q&A process Facilitating buyers due diligence visits Participating in key phases of the execution including negotiation, drafting of legal documents and announcement 10

Roles of Different Parties in a Sale Process (Contd) Role of Lawyers Role of Accountants Internal Preparation and External Execution Phases: Internal Preparation and External Execution Phases: Review of historical and forecast financial information Company due diligence; detailed legal review of key documents Assist management in preparation of financial information for the data room Preparation of legal due diligence report (if required) Prepare draft VDD report (if required) Analysis of appropriate transaction structures Analyse tax implications of possible transaction structures and tax regulation changes Draft legal agreements (e.g. SPA, CA) Negotiate CAs with prospective buyers Participate in selected Q&A sessions (e.g. financial, tax) Holding due diligence meetings with potential buyers Assist management and lawyers in preparation of schedules to the SPA (if necessary) Reviewing / drafting of key transaction process documents and data room rules Prepare pre- and post-closing financial statements (if required) Participating in contract negotiations and in potential discussions with regulators Provide final VDD report to ultimate buyer (if applicable) 11

References Bruner, 2004. Applied Mergers and Acquisitions. Wiley Finance: chapters 30, 31 Miller, E.L.J., 2008. Mergers and Acquisitions: A Step-by-Step Legal and Practical Guide. Wiley: chapter 2 12