Succession Planning for Family Businesses: Addressing Multiple Issues

Addressing succession planning challenges in family businesses, focusing on confidence, skills, relationships, and finances. Explore key areas like clarity, capability, leadership, and future success, alongside handling communication, timing, financial, and structural issues effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

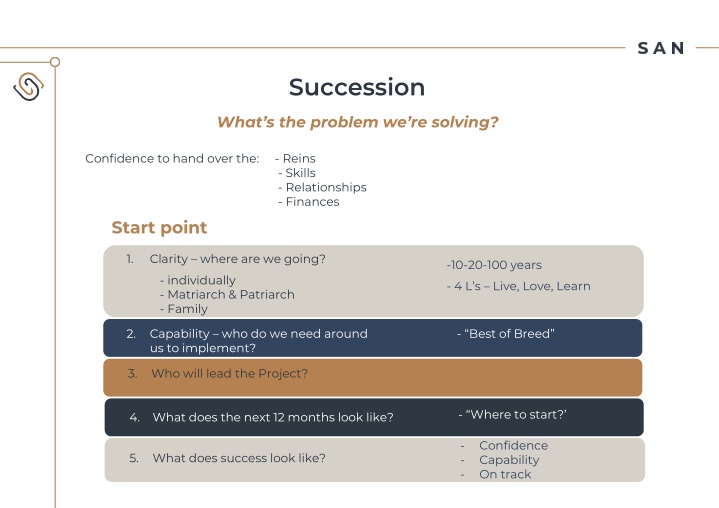

Succession What s the problem we re solving? Confidence to hand over the: - Reins - Skills - Relationships - Finances Start point 1. Clarity where are we going? -10-20-100 years - individually - Matriarch & Patriarch - Family - 4 L s Live, Love, Learn 2. Capability who do we need around us to implement? - Best of Breed 3. Who will lead the Project? - Where to start? 4. What does the next 12 months look like? - - - Confidence Capability On track 5. What does success look like?

Succession Planning Multiple issues Skills & capabilities required to implement 1 Documentation to support Why do you need a Family Board Adviser? Communication issues To who & how? Control issues When to relinquish Timing issues When to start? Why me? Structural issues Are our structures future proof? Timing issues When to start? Financial issues How to untangle? Family issues People issues Planning issues Where to start Family Issues

Capability & Planning Issues How do we engage & communicate? What does success look like? What if the kids don t like it? How do we manage conflict? Are we accountable? Who will help us? Where to start? Where are we going? Ability will articulate our future direction? Are we committed? Our existing advisers competencies? Who will champion the cause? What capabilities do we need? What are our decision trees? How do we make tough decisions? Best of Breed team required across tax, legal and wealth Risk Management Lens 4 RETAIN RETAIN 2 AVOID 1 REDUCE REDUCE 3 TRA Structural People Family Financial Timing Communication 1. We need to get clear first 2. We need our plan sorted first 3.How do I communicate to family How do I communicate to extended family, spouses, partners etc Who owns what Mum & Dad, dreams & aspirations Non alignment How much do Mum & Dad need What s the plan on timing handover for income, equity & control Is our structure fit for purpose Communication Adult children, dreams & aspirations Dollars they might need for the capital required Disinterest or distrust Are we asset protected & tax efficient When are we ready to retire Self-righteousness Relationship issues, divorce Charities Expectance How does structure allow for handing over control Can I retire & still participate on the board Family breakdowns Loans to children Participants don t want to get involved Non interested children Children employed in business V s not employed How do we keep everyone in the loop CGT & tax considerations Financial mismatch - some have money, some don t When does a family member/s take over Interested & can t manage the money Do people/family need to sign a non- disclosure document Are our structures future proof Distribution and income in he future Fair V s Equal How do I know with confidence it s time Divorce Health Issues So they represent our wills & estate planning What happens if I die or lose capacity now Is there a forum for people to discuss concerns & disagreements Control issues Income & capital distribution Staff issues, retaining good people Can we easily report across the group What s the back up plan Reporting of finances Communication issues What happens if family disagree Investment decision making now & in the future Required documentation: Should we have a fire drill Mismatch of values and trust Wills & estate wishes What happens if 1 person is seen to be favoured I need all this in place now All loan documents Investment advice Revised structures Who to seek advice from How long does this take How can we make this robust All other agreements Debts, guaranties, warranties

Succession Plan opportunities 1. Aging parents, first generation, handover of wealth, 10-20-100 year plan Across multiple assets; including business 2. In partnerships, in business People looking to sell the business in the future What s the plan? Use Chaos to Greatness 3. To simplify the assets for the next generation or to simply retire Build their family office Multiple roles: - Build the plan - Build the skill sets required - Form the Advisory Board - Be selected on the board - be the board individually - Be the sense maker

Succession Plan Flow Chart Get clear on next 3 10 100 years (Is it a 3 10 100Yr plan) Implement over 12 months Income what assets to produce retirement income Equity Who owns what in the future Control How do we cede control over a designated period and to whom If not selling who will manage the business? Do we have adult children with capabilities and drive? Passive assets Meet and engage Train Mentor Ease them into the role Family to to family the path forward meeting - Management team - Key Staff - LTI - Merge - Sell - Maintain communicate Insource, outsource Investment expertise mandates, KPI s Balances and checks

Building Succession Plans 1. Get Matriarch/Patriarch or individual clear on direction 10-3-NOW 100-20-10-3-1-NOW Chaos to Greatness for Business 2. Build 1 page plan To Do List Use the 4 L s Live, Love, Learn, Legacy for context 3. Discuss income Dollar amount/capital needed to walk away? What assets/super/property to support Matriarch/Patriarch in retirement? Give them confidence to hand over 4. Discuss kids/adults capabilities 5. Build an agreed 12 month agenda Income Equity Control to who, when, why, how 6. Build the issues list with a risk management framework 7. Discuss skills and capabilities needed to implement and execute (advisory board) 8. Set 12 month program for a 3 year journey

Succession Plan 65+ $30M assets Passive assets Entities Trusts Companies Individual Partnerships Property Residential Commercial Industrial Farming Cash Equity Australian International Private Business Fixed interest Debt Who will control in the future? What will mum & Dad s retirement income be? How to hand over the reins? What are Mum & Dad s future capital requirements? Skill set required now & in the future? What does a 12 month plan look like? Training plan/wheels for the anointed What s the family communication plan? What if no-one wants to commit? Documents required regarding wills, power of attorney, How would you choose an outsource? employment agreements, mandates, risk management, How would you build a family office? reports, succession documents, loan agreements

Sample 12 month agenda Aging Matriarch/Patriarch Passive Assets Q1 Q2 Q3 Q4 Set direction Matriarch & Patriarch are participants in meetings Family clear on direction Scope Matriarch & Patriarch Develop 10-20-100 year plan Issues list identified Training program Income & capital needed Agree with Matriarch & Patriarch direction Engage in family meeting Income sorted Family Rule book being developed Wills & estate documents completed Succession debated and decided Communication plan clear Matriarch & Patriarch wishes & aspirations Equity/structures for succession Release of some control Interview children for future roles Anoint a champion Understand asset & structures Advisory board skills required Monthly meetings Family meeting Live, Love Learn, Legacy for Matriarch & Patriarch Maybe building the family office Roles identified Develop legacy plan Reporting clear and robust Financial reporting Children s Live, Love, Learn, Legacy Family financial meetings underway Understand risks Reporting Understand reporting & decision making Wills and estate documents underway Keep functionality with family office rules Risk management framework in place Family Rule book considered Discuss family office roles

Succession Plan Family in Business Active Asset Decision Tree Sell the business Keep the business Mergers & acquisitions Vision for the business Investor ready Risk Management Key people engaged Key people engaged Advisory board Family employed Risk Management Fair V Equal Systems and Processes Long Term Incentive plan Long Term Incentive Plan External Board members Due diligence ready Updated contracts Q. How are Mum & Dad looked after? Their role in the future? Family member s roles Communication plan Q. What does this mean to the family? What s the communication plan? What next?

Sample 12 month agenda Significant Individual or Family Business Assets Q1 Q2 Q3 Q4 Monthly business meetings Full board working Due diligence ready 4 L s; Live, Love, Learn, Legacy Staff Issues Long term incentive plan Key documents; wills and estates Family rule book Monthly reporting Decide to keep or sell the business Staff engaged Across issues Understand financials Mergers & acquisitions Leadership training Feeling confident Understand risks Risk Management framework for the business Document the strategy Robust reporting Rules & functionality Structures Issues list identified Developing culture Recruit Best of Breed team Board papers commencing Robust financials Risk management overlay Determine skill set required Structure in place Personal: Monthly meeting Personally well organised Wills, estates updated Functionality of roles Financial advisory meeting Succession documents Investor ready Powers of attorney Structure sorted Due diligence ready Long term incentive plan

Sample Board/Business Plan NOW 1 YEAR 3 YEARS Family owned 90 Day Rocks Succession in place 80 staff Get an advisory board Merged or sold Key Person dependant Roles, Functionality Not keyperson 1 family member CEO Review HR Dad retired 1 part-time 1st Board meeting Kids treated equally not fairly Succession needed Good governance framework Key Person Risk Investor ready 90 Days Governance? HR tight Key Staff Engaged Profitable Risk Management known Long term incentive plan for key people Guarantees & warranties unknown Board in place Board meetings Banking not good Double profit CEO reports No HR policy Valuable Strategy Little marketing Options No SWOT Agreements No risk management frameworks Marketing Governance Culture

Risk Management 1 REDUCE 2 AVOID 3 TRANSFER 4 RETAIN ASSET 1 ASSET 2 ASSET 3 ASSET 4 PERSONAL People Reputation Tenancy Business Risk People Conflicts Interest Rates Estate Staff Employment Builder Covenants People Family Business Plan Succession Capital Valuations Public Guarantees Investor base Cash Council Conflicts Licence Opportunities Succession Financials Staff Retention Job Selection Succession Political Key Person Union Sub-Contractor Tax Balance Sheet Key Person

Significant Family Wealth Active and passive assets What s your role? Succession Build and support the family office May require: training adult children, administration, CFO, COO Advisory board reporting Risk Management oversight Develop mandates Communication plan Building the business succession plan To retain: Build the advisory board, keep great staff, governance and risk management To sell: Mergers and acquisitions, advisory board, documentation and investment ready Actions & Documents required: 12 month plan, build Best of Breed team, fortnightly or monthly meetings

Documentation required Wills Personal Properties Security Register (PPSR) Estate wishes updated Power of attorney personal & company Children s loan documented Health directives Family Rule book or constitution Succession documents regarding trusts Updated Register of Covenants, guaranties, and Employment contracts warranties Long term incentive plans Shareholder agreements Inter entity loan documents Relationship agreements New structures The list goes on Deeds updated

Pricing Engagements What s your ideal world/week look like? Number of engagements Type/style of engagements Ideal revenue Dollar Value of Asset = Retainer Their desire for capability and resources Complex Financials + 10-30% Value = Perceived value to client + 10-50% Your Time and Availability Your ideal number of engagement revenues and mix of clients % ASSETS 20m 36K + 10-30% + 10-50% 50m 48K Time Complexity - Desire + Value to them + Your availability 100m+ 60K Are they coachable, advisable?