Taxation Laws and Promotion of Religion: Constitutional Insights

The constitutional provisions regarding taxation laws related to the promotion and maintenance of religion, including the distinctions between taxes and fees. Discover the prohibition of religious instruction in state-aided educational institutions as per Article 28. Delve into important legal cases shaping these principles.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

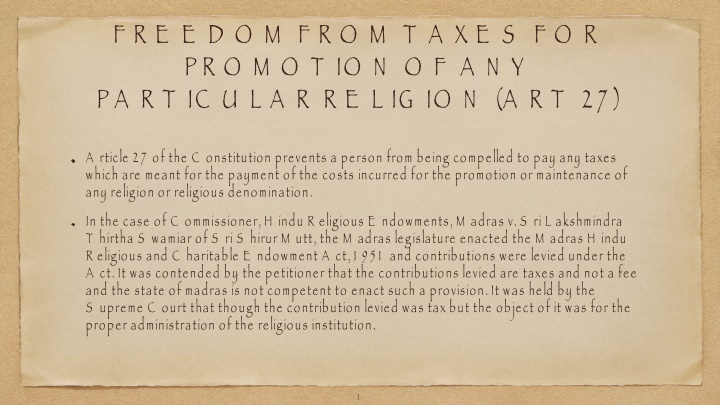

F R E E D O M F R O M T A X E S F O R P R O M O T IO N O F A N Y P A R T IC U L A R R E L IG IO N (A R T 2 7 ) A rticle 2 7 of the C onstitution prevents a person from being compelled to pay any taxes which are meant for the payment of the costs incurred for the promotion or maintenance of any religion or religious denomination. In the case of C ommissioner, H indu R eligious E ndowments, M adras v. S ri L akshmindra T hirtha S wamiar of S ri S hirur M utt, the M adras legislature enacted the M adras H indu R eligious and C haritable E ndowment A ct, 1 9 5 1 and contributions were levied under the A ct. It was contended by the petitioner that the contributions levied are taxes and not a fee and the state of madras is not competent to enact such a provision. It was held by the S upreme C ourt that though the contribution levied was tax but the object of it was for the proper administration of the religious institution. 1

In R ati L al v. S tate of B ombay, the S C held that a tax is in the nature of a compulsory exaction of money by a public authority for public purposes. T he imposition is made for public purposes to meet the general expenses of the state without reference to any special advantage to be conferred upon the taxpayer. T ax is a common burden and the only return which the taxpayer gets is a participation in the common benefits of the state. F ees, on the other hand, are payments primarily in public interest but for some special service rendered or for some special work done for the benefit of those from whom the payments are demanded. O n the basis of distinction between tax and fee the S upreme C ourt in S ri J agannath v. S t of O rissa H eard that the levy under, was in the nature of the fee and no tax. T he payment was demanded only for the purpose of meeting the expenses of the commissioner and his office which was the machinery set up for the A dministration of the affairs of the religious institutions. 2

P R O H IB IT IO N O F R E L IG IO U S IN S T R U C T IO N IN S T A T E -A ID E D IN S T IT U T IO N S (A R T 2 8 ) A rticle 2 8 prohibits: P roviding religious instructions in any educational institutions that are a) M aintained wholly out of the state funds b) R ecognised by the S tate c) R eceiving aid d)A dministered by the states but established under endowment or trust A ny person attending state recognised or state-funded educational institution is not required to take part in religious instruction or attend any workshop conducted in such an institution or premises of such educational institution.

T eaching of G uru-N anak: D .A .V . C ollege v. S tate of P unjab, (1 9 7 1 ) 2 S C C 3 6 8 In this case, S ection 4 of the G uru N anak U niversity (A mritsar) A ct, 1 9 6 9 which provided that the state shall make provisions for the study of life and teachings of G uru N anak D evji was questioned as being violative of A rticle 2 8 of the C onstitution. T he question that arose was that the G uru N anak U niversity is wholly maintained out of state funds and S ection 4 infringes A rticle 2 8 . T he court rejecting this held that S ection 4 provides for the academic study of the life and teachings of G uru N anak and this cannot be considered as religious instruction. E ducation for value development based on all religions: A runa R oy v. U nion of India, (2 002 ) 7 S C C 3 6 8 . In this case, a P IL was filed under A rticle 3 2 wherein it was contended by the petitioner that the N ational C urriculum F ramework for S chool E ducation (N C F S E ) which was published by the N ational C ouncil of E ducational R esearch and T raining is violative of the provisions of the constitution. It was also contended that it was anti-secular and was also without the consultation of the C entral A dvisory B oard of E ducation and hence it should be set aside. N C F S E provided education for value development relating to basic human values, social justice, non-violence, self-discipline, compassion, etc. T he court ruled that there is no violation of A rticle 2 8 and there is also no prohibition to study religious philosophy for having value -based life in a society.