Taxpayer Rights in International Tax Cooperation

Explore taxpayer rights in the context of international tax cooperation, including aspects such as audits, confidentiality, data protection, legal remedies, and recent jurisprudence. Learn from Paul Hondius, head of the Harmful Tax Practices Unit at OECD, about the global forum assessment process and the application of data protection laws in cross-border scenarios.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

AUDITS AND TAXPAYER RIGHTS IN AN ENVIRONMENT OF CROSS-BORDER COOPERATION 5th International Conference on Taxpayer Rights 27 May 2021 Paul Hondius Head of the Harmful Tax Practices Unit OECD Centre for Tax Policy and Administration

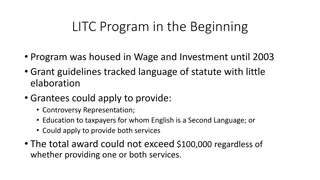

Taxpayer rights in the context of international co-operation in tax matters Foreseeable relevance in the context of exchange of information on request in the context of automatic exchanges of information Confidentiality International legal requirements IT-aspects Global Forum assessment process 2

Taxpayer rights in the context of international co-operation in tax matters Limitations on disclosure and on use Eligible persons and agencies Limits to the appropriate use of information Wider use and on-sharing of information Data protection Cross-border application of data protection laws Public interest and appropriate safeguards Right to information and access Right to correction and erasure Right to redress 3

Taxpayer rights in the context of international co-operation in tax matters Access to legal remedies Administrative and judicial remedies in the sending country Administrative and judicial remedies in the receiving country Recent jurisprudence Shakira Case of the CJEU (C-245/19) French Conseil d Etat re. Accidental Americans (No. 424216) 4

Short CV I head the Harmful Tax Practices Unit with the Organisation for Economic Co- Operation and Development (OECD), In addition, I am a senior advisor on exchange of information policy. Prior to the OECD in 2014, I worked as a Tax Advisor at KPMG Luxembourg from 2007 2010 and as a Tax Attorney with Arendt & Medernach in Luxembourg from 2010 2014. I studied Law and Economics in St. Gallen, Berlin, Washington D.C. and Sydney (lic.iur HSG 2005 and LL.M in 2007). 5