Technical Meeting Agenda: Key Discussions and Updates for Professionals

Explore the comprehensive agenda of a technical meeting covering topics such as helpline survey feedback, HMRC error submissions, website resources, recent tribunal decisions, disclosure refresh, and year-end updates from Deloitte. Stay informed and engaged with the latest updates in the accounting and finance industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

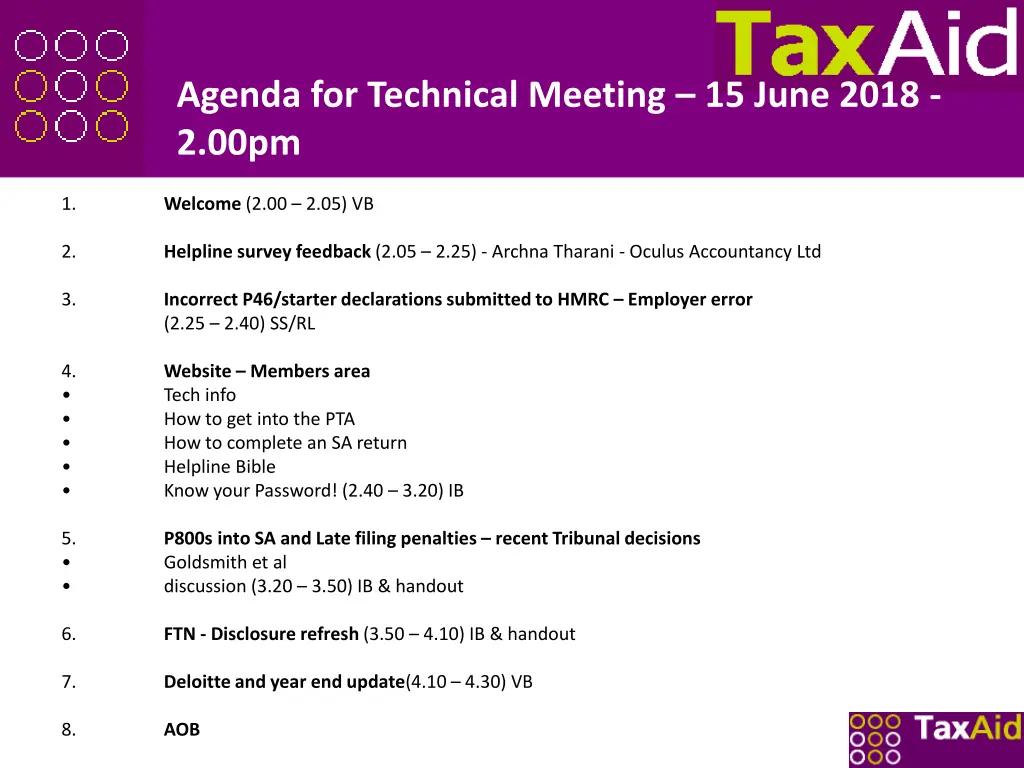

Agenda for Technical Meeting 15 June 2018 - 2.00pm 1. Welcome (2.00 2.05) VB 2. Helpline survey feedback (2.05 2.25) - Archna Tharani - Oculus Accountancy Ltd 3. Incorrect P46/starter declarations submitted to HMRC Employer error (2.25 2.40) SS/RL 4. Website Members area Tech info How to get into the PTA How to complete an SA return Helpline Bible Know your Password! (2.40 3.20) IB 5. P800s into SA and Late filing penalties recent Tribunal decisions Goldsmith et al discussion (3.20 3.50) IB & handout 6. FTN - Disclosure refresh (3.50 4.10) IB & handout 7. Deloitte and year end update(4.10 4.30) VB 8. AOB

Helpline survey feedback Archna Tharani - Oculus Accountancy Ltd

Incorrect P46/starter declarations submitted to HMRC Employer error Richard Leszczynski Champneys Tring Ltd v HMRC TC05685 Regulations Scenarios

Website Members area http://taxaid.org.uk/wp-login.php?redirect_to=%2Fabout%2Fmembers-area Technical info How to get into the PTA How to complete an SA return Helpline Advice Bible Know your Password!

P800s into SA and Late filing penalties recent Tribunal decisions Goldsmith (TC06284) - put into self assessment because HMRC couldn t code out an underpayment. Held that notice to file a tax return was invalid and that HMRC could NOT collect any late filing penalties. Galiara (TC06431) and Lennon (TC06453); similar cases Judge in Lennon referred explicitly to the Goldsmith judgement HMRC DO NOT need SA to collect PAYE underpayments; and They already have assessing powers: TMA s29 assessments and recently-introduced simple assessment procedures. The implications for our clients What do we advise? Round table discussion

Failure to Notify (FTN) - Disclosure refresh Distinction between being registered for SA not being Voluntary disclosure Outside Remit? Within Remit? Property income Links to disclosure facilities: https://www.gov.uk/government/publications/let- property-campaign-your-guide-to-making-a-disclosure https://www.gov.uk/guidance/admitting-tax-fraud-the- contractual-disclosure-facility-cdf https://www.gov.uk/guidance/worldwide-disclosure- facility-make-a-disclosure